Shares are buying and selling decrease immediately after Oracle’s miss that despatched its inventory worth tumbling 12%. That has created a bit of concern and promoting, however general, nothing out of the norm, and we now have been anticipating some shakeup to cleanse the market.

Gold and silver are buying and selling increased, which is thrilling to see.

MARKET OVERVIEW

- S&P 500 and Nasdaq: traded sideways most of Wednesday, then spiked on the Fed information and closed constructive.

- In a single day: Oracle’s poor outcomes sparked a pointy pre-market selloff, triggering cease runs and panic dips throughout main indices.

- Nasdaq fell –1.6% in a single day, however has since recovered greater than half of these losses.

- This fast flush could have been the “shakeout” markets wanted earlier than the following leg increased.

As we famous earlier this week, the market had a number of clustered cease ranges beneath latest lows. These had been cleared in a single day — precisely the kind of short-term washout that always precedes one other advance.

In the meantime, concern continues to rise. The VIX has been climbing steadily whilst costs maintain agency — a setup that always ends with a rally “wall of fear” as soon as merchants lastly hand over ready for the pullback.

SECTOR & ASSET FLOWS

- Small Caps & Dow: rebounded strongly this morning, exhibiting resilience outdoors tech as cash seems to be for alternatives past the AI commerce.

- Bonds: up +0.3%, however nonetheless locked in a long-term basing sample with little path.

- Charges & Greenback: each drifting decrease in latest periods, however longer-term, the information nonetheless helps the concept inflation and yields might rise once more — a setup that might strain actual property and bonds whereas supporting commodities.

PRECIOUS METALS: STRENGTH BROADENING

The treasured metallic area stays the intense spot on this market:

- Gold: up +0.3%, quietly constructing a tight bull flag inside a bigger uptrend.

- Silver: up +2.5%, the clear chief, now extending after its breakout earlier this week.

- Platinum +2.3%, Palladium +1.6%: rebounding sharply after heavy promoting Wednesday.

- GDX (Gold Miners): sample tasks +8–9% potential upside near-term.

- SILJ (Silver Miners): nonetheless coiled for a doable +15–16% breakout transfer towards $30+.

Rising metals alongside rising concern alerts traders are quietly hedging for instability — confirming the “one thing massive is brewing” theme our long-term cycle fashions have warned about.

ENERGY & COMMODITIES

- Oil: down –1% and flirting with a technical breakdown close to $55–56. A decisive transfer decrease might speed up towards the mid-$40s.

- Pure Gasoline: down –3.6%, now off 20% in 5 periods — residing as much as its “widowmaker” nickname.

- Each markets stay extremely unstable and news-sensitive; merchants ought to keep defensive.

BIG PICTURE & LONG-TERM CYCLE

The Benner Cycle, which traditionally marks main turning factors, continues to line up with our personal stage evaluation. It suggests 2025–2026 might mark a cyclical excessive, adopted by a number of troublesome years for equities and actual property.

That doesn’t imply panic — it means put together.

Intervals like this have a tendency to reshape wealth, transferring it from emotional traders to disciplined ones who comply with worth, not prediction.

BITCOIN & TECH

- Bitcoin: down –2.7%, forming a bear flag that warns of potential decrease lows towards $70K if assist breaks.

- Oracle: down –13% in a single day after a +40% rally earlier this quarter.

- NVIDIA: holding surprisingly nicely, exhibiting that concern is stock-specific, not systemic — but.

KEY TAKEAWAYS

- Oracle’s miss triggered a wholesome market shakeout, clearing stops and calming speculative extra.

- Worry rising whereas costs maintain = constructive backdrop for a rally.

- Treasured metals stay the strongest sector — silver main, miners coiled.

- Oil and gasoline weak; Bitcoin susceptible; tech shaken however not damaged.

- Lengthy-term cycles level to 2025–2026 as a possible turning level — the time to guard capital and keep tactical.

BOTTOM LINE:

The shakeout could also be over. With stops cleared and sentiment stretched, we might quickly see the subsequent rally leg — led by treasured metals and choose equities, not hypothesis.

Get My Precise ETF Trades and Portfolio Trades

Respectfully,

Chris Vermeulen

Founder, The Technical Merchants

✔ PREMIUM ETF SIGNALS: https://thetechnicaltraders.com/investment-solutions/

✔ OPTIONS TRADING SIGNALS: https://thetechnicaltraders.com/ots/

✔ FREE ANALYSIS NEWSLETTER: https://TheTechnicalTraders.com/publication/

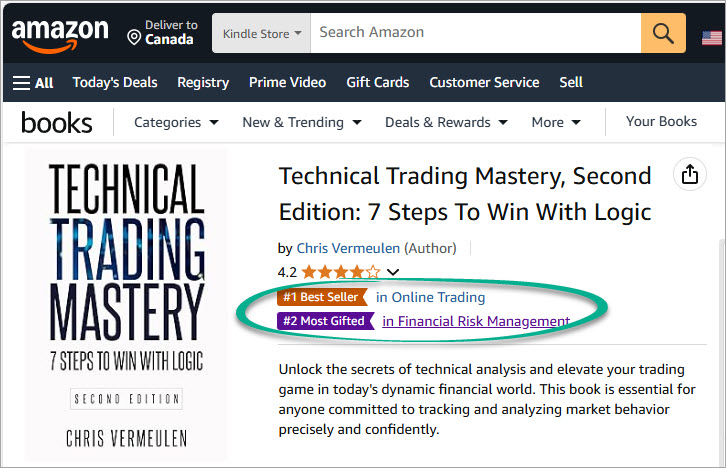

MY FREE INDICATORS IN MY BOOKS

Disclaimer:

The content material revealed on this web site, together with weblog posts, movies, analysis articles, and commentary, is meant solely for informational and academic functions and shouldn’t be construed as funding recommendation. Technical Merchants Ltd. and its associates are not registered as funding advisers with the U.S. Securities and Alternate Fee or any state securities authority. The knowledge supplied is basic in nature and is not tailor-made to the funding wants of any particular particular person. Nothing revealed on this web site constitutes a suggestion to purchase, promote, or maintain any specific safety, commodity, or monetary instrument. The views expressed symbolize the opinions of the authors and are topic to vary at any time with out discover. Efficiency outcomes mentioned could embrace stay buying and selling outcomes and/or backtested or hypothetical information. Hypothetical outcomes are inherently restricted and don’t mirror precise buying and selling efficiency. No illustration is made that any account will or is prone to obtain earnings or losses just like these mentioned. Previous efficiency is just not indicative of future outcomes. All investments contain threat, together with the potential lack of principal. Testimonials and person experiences introduced might not be consultant of others and don’t assure future success. Some content material could comprise affiliate hyperlinks or promotional materials, from which we could earn compensation. This doesn’t affect our content material or editorial independence. By accessing this web site or consuming its content material, you acknowledge that you’re solely answerable for your personal monetary choices and conform to seek the advice of a licensed monetary skilled earlier than performing on any info supplied.