On this technical weblog, we’ll have a look at the previous efficiency of the 1-hour Elliott Wave Charts of NVDA. Wherein, the rally from 07 April 2025 low is unfolding as an impulse construction. Exhibiting a better excessive sequence favored extra upside extension to happen. Due to this fact, we suggested members to not promote the inventory & purchase the dips in 3, 7, or 11 swings on the blue field areas. We’ll clarify the construction & forecast beneath:

NVDA 1-Hour Elliott Wave Chart From 11.07.2025

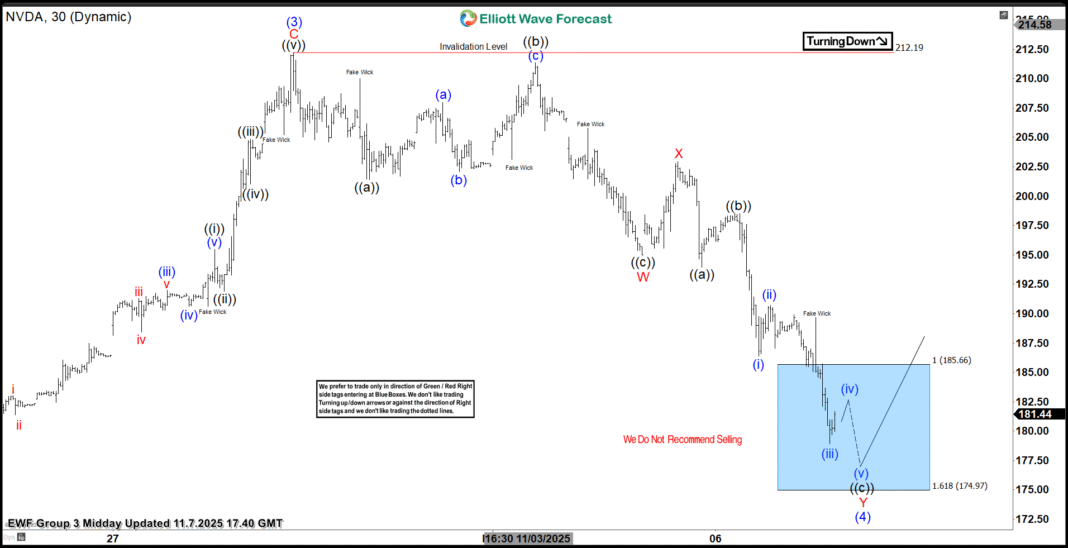

Right here’s the 1-hour Elliott wave chart from the 11.07.2025 Noon replace. Wherein, the cycle from the 21 April 2025 low led to wave (3) at $212.19 excessive. Down from there, the inventory made a pullback in wave (4) to appropriate that cycle. The internals of that pullback unfolded as Elliott wave double three construction the place wave W ended at $195 low. Wave X bounce ended at $202.92 excessive & wave Y managed to succeed in the blue field space at $185.66- $174.97. From there, consumers had been anticipated to seem on the lookout for the following leg increased or for a 3 wave bounce minimal.

NVDA Newest 1-Hour Elliott Wave Chart From

That is the newest 1-hour Elliott wave Chart from the 11.10.2025 Submit-Market replace. Wherein the NVDA is displaying a response increased going down, proper after ending the double correction inside the blue field space. Allowed members to create a risk-free place shortly after taking the lengthy place on the blue field space. Nonetheless, a break above $212.19 excessive continues to be wanted to substantiate the following extension increased in the direction of $220.01- $232.72 space minimal & keep away from a double correction decrease.

Supply: https://elliottwave-forecast.com/bluebox-wins/nvda-delivers-risk-free-setup-blue-box/