A Hole Rally: FIIs Take Large Earnings as Retail Chases a Harmful Brief Squeeze

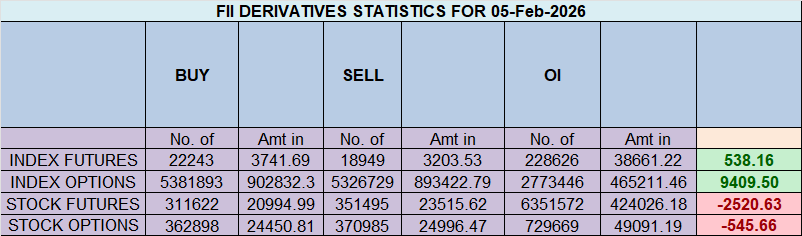

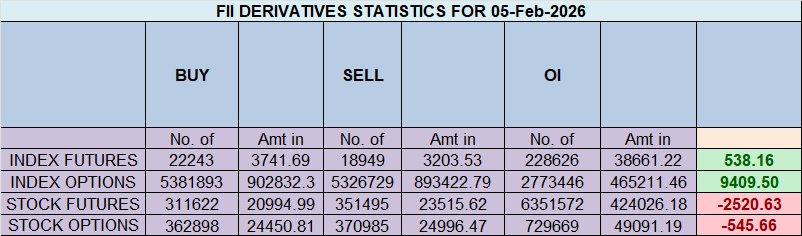

On February 5, 2026, the Nifty Index Futures market offered a spectacular, but deeply misleading, image of institutional confidence. Whereas the headline confirmed a powerful web purchase of 3,988 contracts by International Institutional Traders (FIIs), a deeper dive into the information reveals this was not a brand new bullish endorsement. As an alternative, it was a masterful execution of a large profit-taking operation carried out throughout a violent, retail-fueled quick squeeze.

The day’s most crucial and revealing occasion was the colossal collapse in web Open Curiosity (OI), which plummeted by 5,794 contracts. That is the definitive signature of an unhealthy, unsustainable rally constructed not on a powerful basis of recent consumers, however on the weak basis of outdated gamers exiting en masse.

Decoding the Information: The Anatomy of a Misleading Rally

1. The FIIs’ “Bullish” Disguise: Cashing in Their Profitable Bets

The FII granular information unmasks their true, good technique. Their “purchase” quantity was nearly completely pushed by the protecting of a colossal 4,884 quick contracts.

-

This isn’t a brand new bull wager; it’s the strategic closing of an immensely worthwhile bear marketing campaign. After efficiently driving the development down, they’re utilizing the market’s upward panic and retail’s aggressive shopping for as the proper exit liquidity.

-

The definitive proof is of their closing positioning: they continue to be profoundly bearish at 19% lengthy versus 81% quick (ratio 0.22). They haven’t flipped their view; they’ve merely realized huge earnings.

2. The Major Occasion: The Retail Chase and the OI Collapse

The retail shoppers had been the first gasoline for this squeeze. Their actions reveal basic late-stage, emotional buying and selling:

-

They aggressively added 5,341 new lengthy contracts, chasing the rally and offering the purchase orders the FIIs wanted to promote their shorts into.

-

Concurrently, they lined 1,989 quick contracts, eradicating their hedges and draw back safety at a possible market high.

-

All this exercise befell in a market that was “hollowing out,” as confirmed by the large OI collapse. This proves the rally had no broad-based assist.

Key Implications for the Market

-

A Textbook Brief Squeeze: The rally is being fueled by the compelled, panicked shopping for of trapped short-sellers and the euphoric chasing of retail longs, not by new, assured institutional capital.

-

Profound Pattern Exhaustion: A rally on collapsing OI is the weakest and most harmful form. The first members are exiting the market, signaling the top of a serious cycle.

-

A Brittle and Extraordinarily Fragile Market: As soon as the compelled short-covering is full, the first supply of shopping for stress will evaporate immediately. This leaves the market exceptionally weak to a sudden and violent reversal, usually known as a “rug pull.”

-

The Danger has Inverted: The first danger is now not being left behind by the rally. The first danger is now getting trapped in a euphoric rally on the precise second the “good cash” is cashing out.

Conclusion

Disregard the headline FII “purchase” determine. The dominant and simple story is of a large quick squeeze and a masterful profit-taking operation by the FIIs, enabled by the euphoric and ill-timed chasing of retail shoppers. The outdated bear development is over, however the brand new rally is constructed on essentially the most fragile basis attainable. The chance of a pointy reversal is now extraordinarily excessive.

Final Evaluation might be learn right here

The Nifty is in a state of profound and suspenseful consolidation, having shaped a basic “Inside Bar” sample forward of at this time’s essential RBI coverage resolution. This technical signature of a narrowing vary is a transparent signal of a market holding its breath, constructing immense potential power earlier than a serious, catalyst-driven transfer.

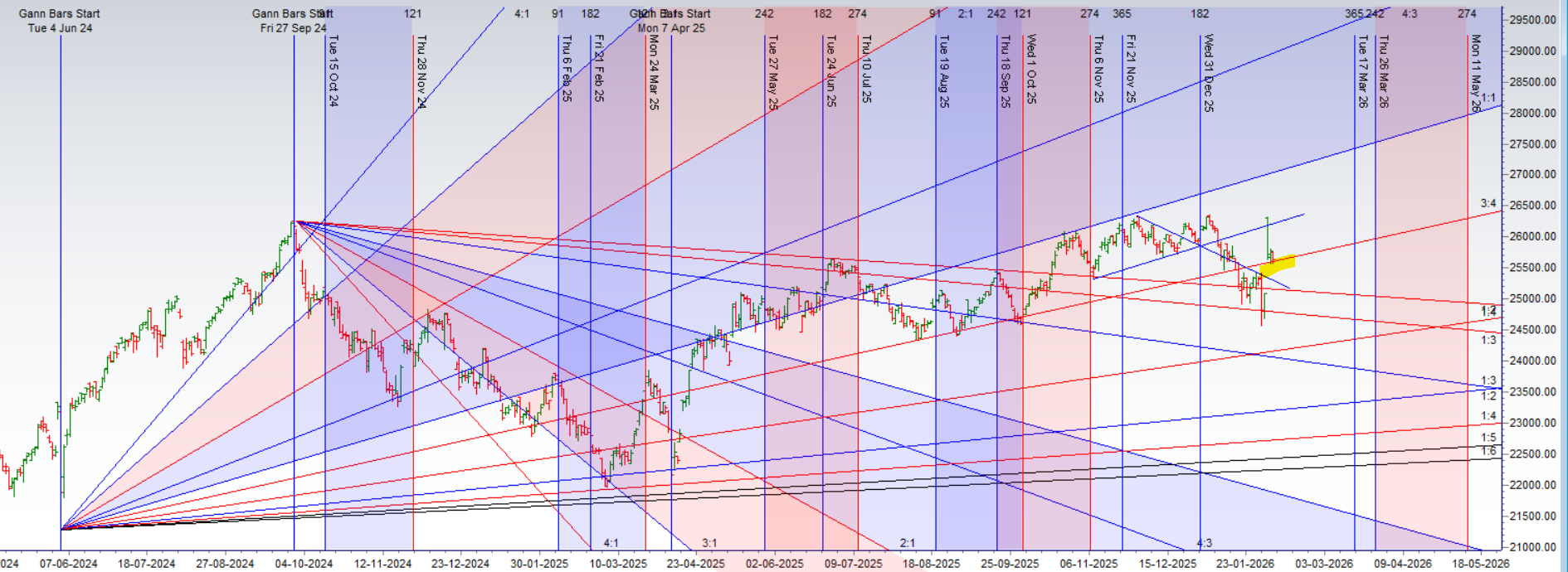

This state of technical indecision is about to be violently resolved. A gap-down opening, pushed by weak point from Wall Road, is about to check the market’s resolve from the very first second. Nevertheless, this gap-down just isn’t random; it’s guiding the value on to its most crucial technical assist: the 3×4 Gann angle. This creates a high-stakes “make-or-break” situation on the open. Moreover, a brand new astrological occasion—a Mercury signal change—is about to inject a recent wave of risky, communicative power into the session, amplifying the market’s response to the coverage information.

The Bullish Protection: A Restoration from the Gann Line

The bulls have one vital mission: defend the Gann angle assist and take up the preliminary promoting stress. The battle for management will likely be fought on this key zone.

-

The Bullish Fortress: 25,555 – 25,610.

-

The Situation: If the bulls can efficiently maintain this vary after the RBI coverage announcement, it’s going to sign that the gap-down was a profitable take a look at of assist, not a breakdown.

-

The End result: A profitable protection is anticipated to set off a fast and highly effective restoration rally in the direction of the following resistance ranges of 25,729 and 25,800.

The Bearish Assault: Breaking the Last Help

The bears will view the gap-down as their alternative to grab management and provoke the following main leg down. Their path is evident.

-

The Breakdown Set off: 25,450.

-

The Situation: The bears will solely achieve the definitive higher hand if they’ll drive a sustained break under this stage, confirming that the Gann angle assist has failed.

-

The End result: A breach of 25,450 could be a serious technical breakdown, possible unleashing a wave of aggressive promoting.

The Intraday Compass for a Unstable Day

Given the potent mixture of the RBI coverage and the Mercury signal change, a transparent tactical plan is important to navigate the anticipated chaos. The first quarter-hour’ excessive and low would be the final information. It’ll minimize via the preliminary, emotional, news-driven noise and reveal the true, dominant intraday development that emerges as soon as the mud has settled.

Conclusion

The Nifty is a coiled spring at a vital assist juncture, ready to be unleashed by two highly effective catalysts. The preliminary gap-down will take a look at the three×4 Gann angle instantly. The market’s capacity to carry the 25,555-25,610 assist post-policy will decide if a pointy restoration is within the playing cards. A failure to take action, breaking under 25,450, will sign a brand new and highly effective wave of promoting. Use the 15-minute rule to commerce what the market does, not what it would possibly do. Put together for a session of utmost volatility.

Turning Buying and selling Regrets into Tuition: Find out how to Be taught from Your Worst Choices

Merchants could be careful for potential intraday reversals at 09:51,10:42,12:24,01:33,02:34 Find out how to Discover and Commerce Intraday Reversal Instances

Nifty Dec Futures Open Curiosity Quantity stood at 1.55 lakh cr , witnessing addition of 1 Lakh contracts. Moreover, the rise in Value of Carry implies that there was addition of SHORT positions at this time.

Nifty Advance Decline Ratio at 19:31 and Nifty Rollover Value is @25405 closed above it.

Within the money section, International Institutional Traders (FII) bought 2150.51 , whereas Home Institutional Traders (DII) purchased 1129.82 cr.

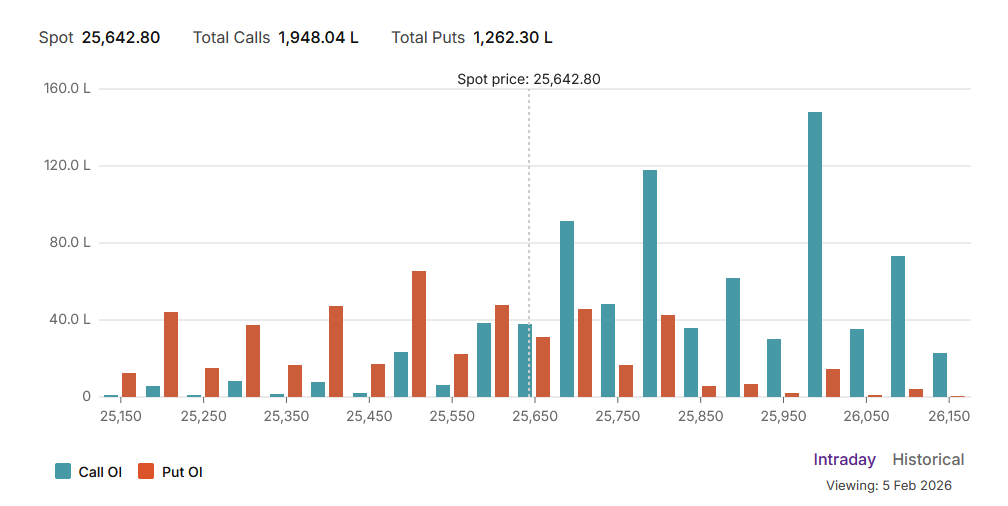

The Nifty choices market is screaming a message of intense bearish stress and a major lack of bullish confidence. A deeply unfavourable Put-Name Ratio (PCR) of 0.64 signifies a market that has fallen firmly below the management of sellers. This extraordinarily low studying confirms that the open curiosity in name choices has overwhelmingly surpassed that of places, a direct results of aggressive name writing from members who’re assured that the market’s upside potential has been severely and definitively capped.

This bearish atmosphere has pinned the index in a decent gravitational orbit across the Max Ache level of 25,650. With the spot value buying and selling nearly precisely at this stage (25,642.80), the market is completely anchored on the level of most monetary ache for choice consumers. This can be a basic signature of a market being managed by massive institutional choice sellers who’re dictating the phrases of engagement.

The participant information, whereas ambiguous in its uncooked kind, helps the structural view of establishments possible promoting calls to a retail viewers shopping for them with hope. This dynamic has solid a transparent and formidable battlefield:

-

Resistance: An enormous, multi-layered “Nice Wall of Calls” stands on the 25,800 and, extra importantly, the 26,000 strikes, serving as the final word ceiling for any potential rally.

-

Help: On the draw back, a major assist ground has been constructed by put writers on the 25,500 strike, which acts as the first line of protection for the bulls.

In conclusion, the Nifty is firmly in a bear grip, dominated by unfavourable sentiment and overwhelming overhead provide. The trail of least resistance is sideways to down, with any rally prone to be bought into aggressively. A significant catalyst is required to interrupt the stalemate outlined by the assist at 25,500 and the immense resistance at 25,800.

For Positional Merchants, The Nifty Futures’ Pattern Change Stage is At 25456. Going Lengthy Or Brief Above Or Beneath This Stage Can Assist Them Keep On The Identical Aspect As Establishments, With A Increased Danger-reward Ratio. Intraday Merchants Can Hold An Eye On 25729 , Which Acts As An Intraday Pattern Change Stage.

Nifty Spot – Intraday Chart Remark

Technical Setup: The index is approaching vital breakout ranges. Watch these zones for value motion affirmation:

-

Energy (Upside): Momentum is anticipated to choose up if Nifty sustains above 25610 . On this situation, the rapid resistance ranges are 25651, 25700, and 25743.

-

Weak point (Draw back): The development technically weakens if the index slips under 25555. This might open the trail in the direction of assist ranges at 25512, 25470, and 25416.

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable choices primarily based on a well-thought-out buying and selling plan and danger administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators