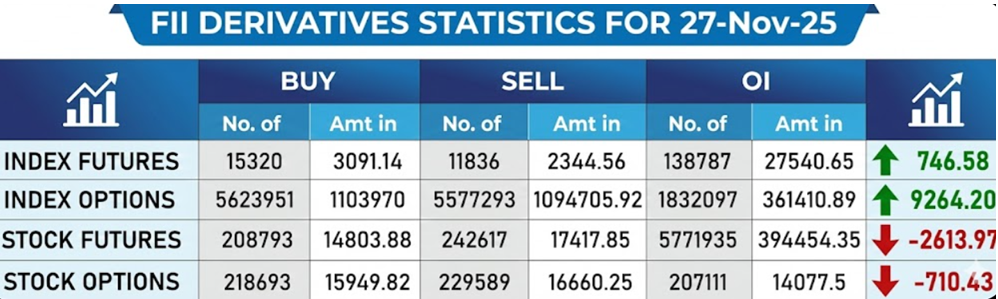

Beneath the Floor: FIIs Quietly Accumulate Longs Amid Retail Confusion

On the floor, the buying and selling session of November 27, 2025, seemed to be a day of quiet indecision. The headline knowledge confirmed a near-neutral occasion from Overseas Institutional Buyers (FIIs), with web promoting of simply 396 contracts. Nonetheless, to take this at face worth could be to fully miss the seismic shift occurring beneath the market’s floor. The true story is advised by the important enhance in web open curiosity (OI) of 1,166 contracts and, most significantly, the highly effective underlying actions of each FIIs and retail merchants.

(Notice: There’s a discrepancy between the FII headline determine and their exercise breakdown. We are going to analyze the extra detailed and highly effective sign from the breakdown knowledge.)

The FII’s Strategic Pivot: Accumulation, Not Neutrality

Ignoring the deceptive headline, the FII breakdown reveals a strong and bullishly strategic transfer. The FIIs executed a basic two-pronged offensive:

-

They ADDED 2,000 new lengthy contracts: This isn’t profit-taking. That is the initiation of recent bullish bets, signaling a rising conviction that the market is poised for an up-move.

-

They COVERED 1,484 brief contracts: This motion signifies the capitulation of their previous bearish view. They’re actively de-risking from the brief aspect and decreasing their bearish publicity.

Mixed, that is an unequivocally bullish circulation of funds. The FIIs are concurrently constructing a brand new bullish basis whereas dismantling their previous bearish one. That is the clearest sign of accumulation and a constructive sentiment shift now we have seen from the “sensible cash.” Their total legacy positioning stays closely brief (19:81), however their actions as we speak are a much more highly effective and forward-looking indicator of their future intentions.

The Retail Confusion: A Market Paralyzed by Indecision

In stark distinction, the Consumer (retail) phase is an image of profound and whole confusion. They added hundreds of positions on each side of the market: +2,636 lengthy contracts and +2,739 brief contracts.

That is the signature of a market participant that has been fully whipsawed. Retail is now hedging frantically, anticipating a serious transfer however having zero conviction on the route. They’re concurrently shopping for the dip and shorting the rip, a low-conviction technique that always precedes being caught on the incorrect aspect of a serious development.

The Highly effective Divergence: Conviction vs. Confusion

This creates a basic and highly effective market divergence that savvy merchants search for:

-

FIIs (The Good Cash): Are displaying clear directional conviction (upside) by including longs and overlaying shorts.

-

Purchasers (The Crowd): Are displaying most confusion by including each longs and shorts in nearly equal measure.

Historical past has repeatedly proven that when institutional conviction clashes with retail confusion, the market nearly all the time resolves within the route of the conviction. The FIIs are quietly accumulating, and the confused retail positioning is creating the proper atmosphere for a possible squeeze.

Conclusion:

Ignore the impartial headline determine. The true story of the day is the highly effective, bullish accumulation by the FIIs, hidden beneath the floor of a seemingly quiet market. Their twin motion of including longs and overlaying shorts is a high-conviction sign that shouldn’t be ignored. As retail merchants stay paralyzed by indecision, the institutional tide is popping constructive. The chance is now constructing for a pointy transfer greater, which might catch the newly added retail shorts fully off guard. The sensible cash has positioned its wager.

Final Evaluation will be learn right here

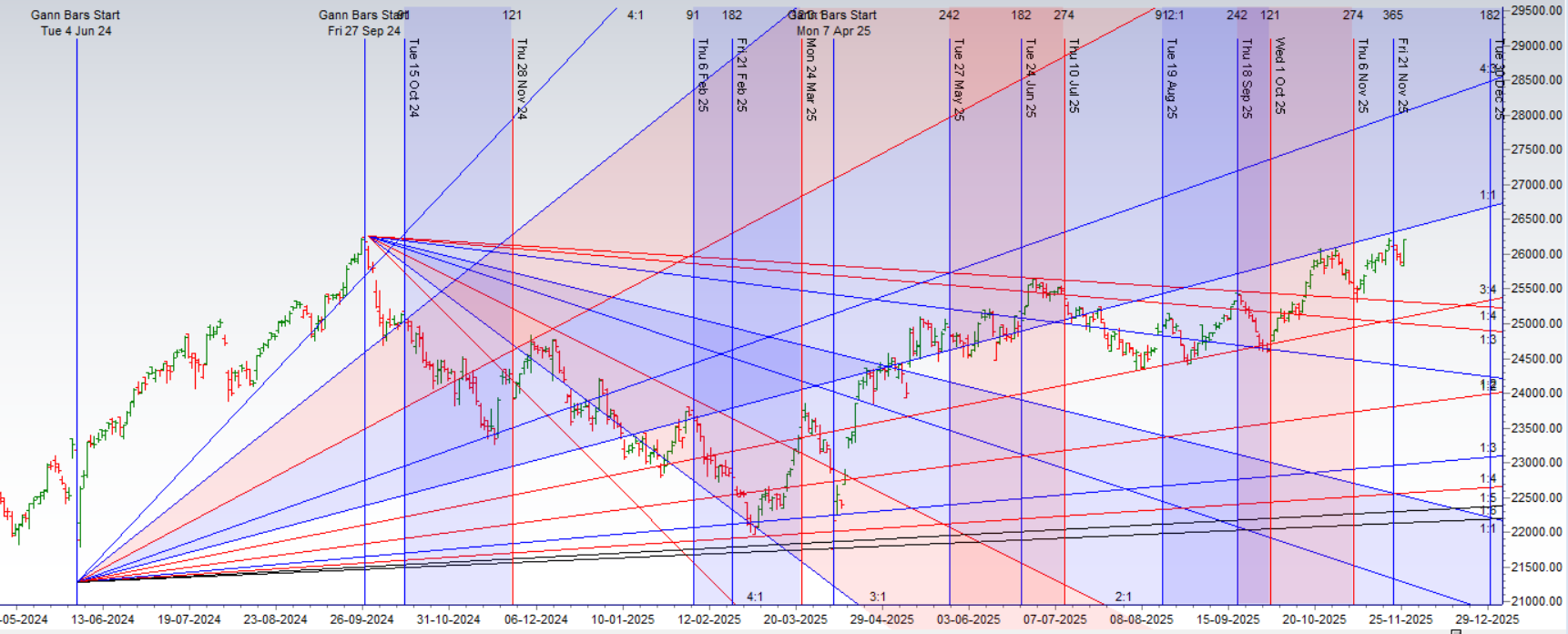

Nifty’s Hole Crown: A Fragile New Excessive as Main Astro Cycles Warn of a Reversal

In the present day, the Nifty 50 etched a brand new all-time excessive within the historical past books, a second that on the floor seems to be a crowning achievement for the bulls. The earlier peak of 26277, made on September 27, 2024, was lastly surpassed. Nonetheless, for a overwhelming majority of merchants and traders, it is a hole and painful victory. The celebratory headlines are masking a deep and troubling divergence that indicators profound weak point beneath the market’s floor.

This isn’t a wholesome, broad-based rally. It is a slim, index-management-driven phantasm, and a strong confluence of main astrological and cyclical occasions is now warning that this phantasm is about to be shattered.

The Nice Divergence: An Echo of the 2018-2019 Grind

Probably the most important statement of the present market is the stark distinction between the index’s efficiency and the well being of the common portfolio. Whereas a handful of heavyweight shares have propelled the Nifty to its new peak, the truth is that the broader market has been in a silent bear market. Most portfolios are displaying drawdowns of 20% to 50%.

This isn’t a brand new phenomenon. We’re seeing a direct echo of the treacherous 2018-2019 interval, the place the index repeatedly floor out new highs whereas the vast majority of mid-cap and small-cap shares have been in a state of relentless decline. It is a harmful atmosphere, because the headline quantity creates a false sense of safety, luring in unsuspecting capital simply because the underlying market construction is decaying.

Including a layer of cyclical significance to this, the brand new excessive has arrived precisely 14 months after the earlier one—a interval of exact time symmetry that always marks a serious end result level slightly than the beginning of a brand new, sustainable development.

An Imminent Storm: A Uncommon Confluence of Main Astro Occasions

The market is now strolling straight into an ideal storm of astrological catalysts. The convergence of a number of, highly effective, and sometimes conflicting celestial occasions on a single day dramatically will increase the likelihood of a serious pivot and a major enlargement in volatility. Here’s what is on the fast horizon for Monday:

-

Saturn Stations Direct in Pisces: That is the heavyweight occasion. Saturn is the planet of actuality, karma, construction, and penalties. A planet stationing (showing to face nonetheless earlier than altering route) is when its vitality is at its absolute most depth. Saturn turning direct is a serious “actuality examine” second. It typically brings an finish to durations of phantasm and forces the market to confront the underlying, arduous truths.

-

Bayer Rule 2 – A “Large Transfer” Down Sign: We’ve a direct and traditionally potent bearish sign coming into play:

“Bayer Rule 2: Pattern goes down inside 3 days when the pace distinction between Mars and Mercury is 59 minutes. Results in Large Transfer.”

This isn’t an ambiguous sign. It explicitly warns of a downward development and a “Large Transfer.” This arriving simply because the market prints a fragile new excessive is an ominous warning. -

Mercury Conjunct Jupiter (Helio): This facet typically brings a wave of optimism, information, and a possible for a big transfer. On this context, it may present the gas for a remaining, misleading gap-up opening on Monday, sucking within the final of the bulls earlier than the heavier, extra highly effective energies of Saturn and Bayer Rule 2 take management.

The Strategic Outlook: Hedge or Face the Penalties

This highly effective confluence makes a major hole opening on Monday a really excessive likelihood. Nonetheless, merchants should not be lured into chasing it. The underlying astro-currents are signaling a serious potential reversal.

The battle line for the market is now drawn with absolute readability at 26110. This degree is the “line within the sand.”

-

The Bullish Case (Tenuous): So long as the bulls can defend 26110 on a closing foundation, they keep a tenuous higher hand. This could be their solely saving grace towards the tide of bearish indicators.

-

The Bearish Case (Excessive Likelihood): A decisive break and shut beneath 26110 would be the affirmation that the astro-signals have been triggered, the bull lure has been sprung, and the “Large Transfer” down is underway.

Conclusion:

We’re witnessing a fragile, unhealthy, and slim peak available in the market, made on a exact long-term time cycle. A cluster of among the strongest astrological reversal signatures of the quarter is scheduled to hit the market on Monday. This isn’t a time for complacency or chasing new highs. It is a time for warning, danger administration, and energetic hedging. The chance of a pointy, sudden, and punishing reversal is now exceptionally excessive. Watch the 26110 degree with excessive vigilance; it’s the key that can unlock the market’s subsequent main development.

Nifty Commerce Plan for Positional Commerce ,Bulls will get energetic above 26258 for a transfer in direction of 26338/26419. Bears will get energetic beneath 26177 for a transfer in direction of 26097/26017

Merchants could be careful for potential intraday reversals at 09:21,11:24,12:58,02:45 Easy methods to Discover and Commerce Intraday Reversal Occasions

Nifty Dec Futures Open Curiosity Quantity stood at 1.38 lakh cr , witnessing liquidation of 1.8 Lakh contracts. Moreover, the rise in Price of Carry implies that there was closuer of SHORT positions as we speak.

Nifty Advance Decline Ratio at 22:28 and Nifty Rollover Price is @26320 closed above it.

Within the money phase, Overseas Institutional Buyers (FII) offered 1996 cr , whereas Home Institutional Buyers (DII) purchased 3551 cr.

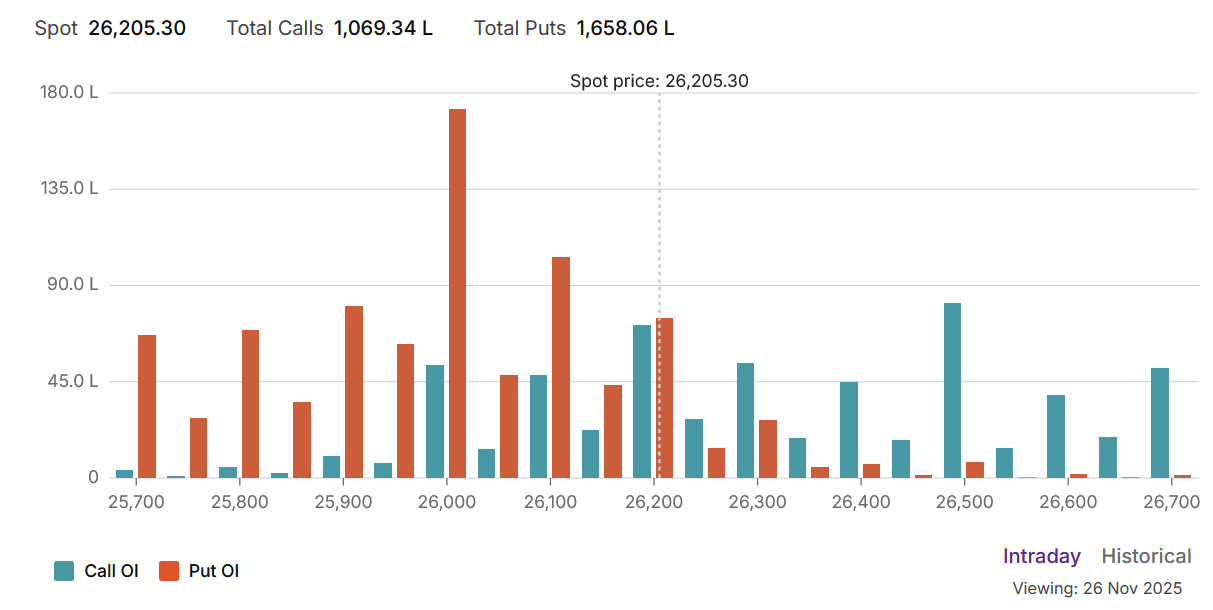

Market on a Knife’s Edge: Warning Prevails as FIIs Exit Bullish Bets

The choices market is flashing clear indicators of warning and underlying anxiousness, at the same time as costs stay at elevated ranges. The Put-Name Ratio (PCR) stands at a cautious 1.14, indicating that extra Places are being traded than Calls—a basic signal of hedging and worry. The Max Ache degree at 26200 is performing as a strong magnet for the market, representing the purpose of most monetary ache for possibility patrons and a key degree that possibility sellers will vigorously defend.

A deeper look reveals a important divergence in technique between institutional and retail gamers. Retail merchants are enjoying a basic range-bound recreation, performing as important web sellers of each Name choices (betting the upside is capped) and Put choices (betting the draw back is protected). They’re confidently promoting volatility to gather premium, a method that earnings from a market that goes nowhere.

In stark distinction, the “sensible cash” is sending a delicate however highly effective warning. Whereas FIIs have been impartial on Calls, their most important and telling motion was within the Put choices. They have been main web patrons of Places, primarily by overlaying a large 42,000 of their current brief Put contracts.

It is a profoundly bearish sign. By shopping for again the Places they beforehand offered, FIIs are exiting their “we’ll purchase the dip” positions. They’re now not comfy being the insurance coverage sellers and are paying to shut these trades, a transparent signal they see an growing danger of a major draw back break.

Choice Chain Help and Resistance:

-

Resistance: A formidable provide wall has been constructed by the heavy Name writing, with main resistance now at 26300 and 26400.

-

Help: The Max Ache degree at 26200 acts as the primary line of protection. Beneath that, the subsequent important Put wall is at 26100.

Conclusion: Whereas retail is betting on stability, the FIIs are actively eradicating their draw back help. It is a main crimson flag, suggesting the market is much extra weak than it seems. The chance is closely skewed to the draw back.

For Positional Merchants, The Nifty Futures’ Pattern Change Degree is At 26409 . Going Lengthy Or Quick Above Or Beneath This Degree Can Assist Them Keep On The Identical Facet As Establishments, With A Larger Threat-reward Ratio. Intraday Merchants Can Hold An Eye On 26265 , Which Acts As An Intraday Pattern Change Degree.

Nifty Intraday Buying and selling Ranges

Purchase Above 26225 Tgt 26270, 26300 and 26350 ( Nifty Spot Ranges)

Promote Beneath 26185 Tgt 26144, 26108 and 26066 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to intently monitor market actions and make knowledgeable selections based mostly on a well-thought-out buying and selling plan and danger administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators