A Declaration of Conflict: FIIs Launch an All-Out Bearish Assault on the Market

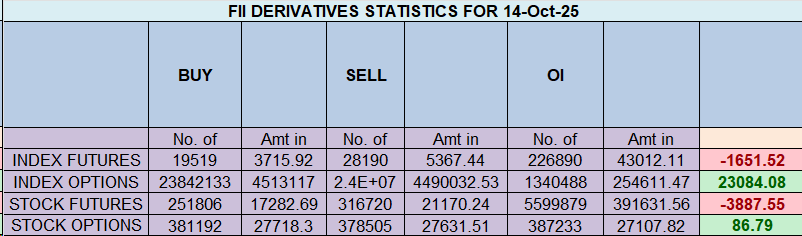

The buying and selling session of October 14, 2025, was not simply one other day of promoting; it was a transparent and unequivocal declaration of conflict by the International Institutional Traders (FIIs). The info reveals an aggressive, high-conviction offensive that has created some of the harmful and structurally unstable market environments in latest reminiscence. The headline quantity is staggering: FIIs web shorted 6,960 contracts, value a colossal ₹1,322 crores.

Nevertheless, the really earth-shattering sign is that this huge promoting was accompanied by a gargantuan web open curiosity (OI) improve of 9,558 contracts. This isn’t profit-taking. This isn’t hedging. That is the irrefutable signature of a large, coordinated, and aggressive new short-selling marketing campaign.

The FIIs’ All-In Bearish Offensive

The breakdown of FII exercise leaves no room for doubt. They added a negligible 362 lengthy contracts, however concurrently unleashed a tidal wave of latest shorts, including a monumental 9,033 brief contracts. They don’t seem to be simply bearish; they’re actively urgent their bets with overwhelming power. This surge in open curiosity confirms that new institutional capital is flooding into the market to provoke contemporary bearish positions, signaling an especially sturdy perception {that a} vital and imminent decline is coming.

This aggressive motion has pushed their positioning to a historic excessive. The FII Lengthy/Quick ratio is frozen at a deeply pessimistic 0.07. This implies their strategic stance is now 93% brief. This isn’t a cautious lean; it’s an all-in wager on a market decline.

Retail Takes the Bait, Turning into the Counterparty

In a traditional and profoundly harmful market dynamic, the Consumer (retail) section willingly stepped as much as take the opposite facet of this institutional assault. Whereas the FIIs had been aggressively shorting, retail merchants had been vital web patrons, including 4,970 new lengthy contracts.

It is a textbook case of retail “catching a falling knife,” absorbing the huge provide from the institutional sellers. This has pushed their positioning to a dangerously optimistic Lengthy/Quick ratio of 3.23, which interprets to a 70% lengthy place.

A Market at its Breaking Level

This has created some of the perilous and unsustainable market constructions conceivable. Now we have a historic standoff:

-

FIIs (Good Cash): At a document 93% brief, and aggressively including extra.

-

Shoppers (The Crowd): At a extremely optimistic 70% lengthy, willingly shopping for what the establishments are dumping.

It is a powder keg. The huge and susceptible pool of retail lengthy positions now represents the “gasoline” for the very fireplace the FIIs are positioned for. Any breach of key technical assist might set off a devastating cascade of stop-losses and compelled promoting from these retail accounts, resulting in a swift and extreme market crash.

Conclusion:

The info from October 14th is likely one of the strongest and unambiguous bearish indicators a dealer can obtain. FIIs have launched an all-out bearish offensive, and retail merchants have walked instantly into the lure. The chance is now overwhelmingly and decisively skewed to the draw back. Any minor bounce needs to be seen with excessive suspicion, as it’s probably a bull lure designed to create extra liquidity for institutional shorts. Train excessive warning.

Final Evaluation could be learn right here

After a interval of coiled indecision, the Nifty has lastly rendered its verdict with a robust and unambiguous value motion sign. Right now’s session noticed the formation of a traditional Exterior Bar, a sample of immense significance that has shattered the market’s latest equilibrium.

What elevates this from a easy technical occasion to a high-probability forecast is its timing. This violent enlargement of volatility has occurred exactly on a key astrological timing date: the Venus Ingress (Venus altering indicators). When a robust value sign and a pre-identified time catalyst converge, as they’ve at this time, it’s a textbook indication {that a} main transfer is across the nook, and a brand new, sturdy pattern is about to start.

The Worth Verdict: The Energy of the Exterior Bar

An Exterior Bar is the antithesis of an Inside Bar. The place an Inside Bar indicators consolidation and a contraction of volatility, an Exterior Bar represents a violent enlargement of volatility. It’s fashioned when the excessive of the day is larger than yesterday’s excessive, and the low of the day is decrease than yesterday’s low.

Basically, at this time’s value motion has utterly engulfed the complete buying and selling vary of the earlier session. That is the signature of a decisive battle between bulls and bears the place a transparent winner has emerged by the tip of the day. The prior pattern’s indecision has been resolved with power. An Exterior Bar is usually a trend-initiating sample; it washes out weak palms on each side of the market earlier than embarking on a brand new directional path.

The Time Catalyst: The Significance of the Venus Ingress

This highly effective value sample didn’t happen in a vacuum. It has aligned completely with the Venus Ingress, a recognized astrological occasion that marks a “change of home” for the planet Venus. In monetary astrology, such ingresses are traditional timing indicators for a shift in market psychology, worth notion, and, finally, pattern.

It is a good instance of value and time assembly. The market’s inside construction (value motion) has confirmed the exterior timing sign (astro-cycle). When these two impartial types of evaluation align, the ensuing sign is exponentially extra highly effective and dependable. The Venus Ingress offered the “why” and the “when” for a possible pattern change, and the Exterior Bar offered the definitive “how” with its highly effective value affirmation.

The Strategic Implication: A New Development is Beginning Now

This confluence of occasions has established a brand new and decisive set of technical parameters. The interval of consolidation is over. The excessive and low of at this time’s Exterior Bar at the moment are crucial ranges on the chart. They’re the brand new battle traces, and the follow-through from right here will verify the course of the brand new pattern.

-

A transfer and shut above the excessive of the Exterior Bar would verify a robust bullish pattern is underway.

-

A transfer and shut under the low of the Exterior Bar would verify a brand new bearish leg has begun.

Conclusion:

That is now not a market of consolidation; it’s a market on the verge of a serious directional pattern. The highly effective Exterior Bar has delivered a decisive verdict on the value entrance, and its good alignment with the Venus Ingress supplies the temporal affirmation. An enormous transfer is now not simply “across the nook”; the beginning gun has been fired. Merchants ought to watch the excessive and low of at this time’s session with excessive vigilance, as they are going to outline the market’s new path.

Nifty Commerce Plan for Positional Commerce ,Bulls will get energetic above 25140 for a transfer in the direction of 25219/25298. Bears will get energetic under 25062 for a transfer in the direction of 24983/24904.

Merchants might be careful for potential intraday reversals at 09:28,11:07,01:05,02:27 Find out how to Discover and Commerce Intraday Reversal Instances

Nifty Oct Futures Open Curiosity Quantity stood at 1.77 lakh cr , witnessing addition of 5.2 Lakh contracts. Moreover, the rise in Price of Carry implies that there was addition of SHORT positions at this time.

Nifty Advance Decline Ratio at 15:35 and Nifty Rollover Price is @24980 closed above it.

Nifty Gann Month-to-month Development Change stage 24731 closed above it.

Nifty has closed above its 21 SMA @ 25067 Development is Purchase on Dips until above 25067

Within the money section, International Institutional Traders (FII) offered 1440 cr , whereas Home Institutional Traders (DII) purchased 452 cr.

Merchants who observe the musical octave buying and selling path might discover helpful insights in predicting Nifty’s actions. Based on this path, Nifty might observe a path of 23037-23722-24408-25134-25860 Which means merchants can take a place and probably journey the transfer as Nifty strikes via these ranges.In fact, it’s vital to remember that buying and selling is inherently dangerous and market actions could be unpredictable.

For Positional Merchants, The Nifty Futures’ Development Change Degree is At 25133. Going Lengthy Or Quick Above Or Under This Degree Can Assist Them Keep On The Similar Facet As Establishments, With A Greater Threat-reward Ratio. Intraday Merchants Can Hold An Eye On 25234, Which Acts As An Intraday Development Change Degree.

Nifty Intraday Buying and selling Ranges

Purchase Above 25185 Tgt 25225, 25260 and 25308 ( Nifty Spot Ranges)

Promote Under 25144 Tgt 25108, 25075 and 25025 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to intently monitor market actions and make knowledgeable selections primarily based on a well-thought-out buying and selling plan and danger administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be a part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators

Associated