A Market at Most Rigidity: FIIs Unleash Bearish Assault Towards Peak Retail Bullishness

The Nifty Index Futures knowledge from November 11, 2025, paints a dramatic image of a market on the point of battle. International Institutional Traders (FIIs) escalated their bearish marketing campaign, shorting a internet 3,115 contracts value ₹602 crore. Nevertheless, the headline quantity solely hints at the true story. The session’s true significance lies within the underlying dynamics: an enormous, head-on collision of conviction between institutional bears and retail bulls, confirmed by a big surge in Open Curiosity (OI) of 1,491 contracts.

This isn’t a market that’s drifting. This can be a market that’s actively loading a weapon. The rising OI is proof that new, high-conviction capital is flooding in to take sides in a monumental standoff.

Decoding the Information: Two Armies Constructing Opposing Fortresses

This can be a basic and excessive divergence between “Good Cash” and “Retail Cash,” with each side digging in for a significant battle.

1. The FII Bears: A Declaration of Warfare

The FIIs’ actions weren’t merely bearish; they had been a declaration of whole disbelief available in the market’s power. Their two-pronged assault was brutal and unambiguous:

-

They added 2,695 new brief contracts, aggressively constructing their bearish fortress.

-

They concurrently liquidated their remaining lengthy positions (overlaying 428 contracts), signaling a whole abandonment of any upside potential.

Their ensuing positioning has reached an nearly unprecedented excessive: 13% lengthy versus 87% brief. An extended-short ratio of 0.14 is at rock-bottom, representing a state of most bearish conviction. That is an all-in wager on a market decline.

2. The Consumer Bulls: Unwavering Optimism within the Face of the Onslaught

On the opposite facet of this institutional wall of promoting stood the unflinching retail consumer. Their actions had been an ideal mirror picture of bullish religion:

-

They defiantly added 3,051 new lengthy contracts, absorbing the FII promoting after which some.

-

In a transfer of supreme confidence, they lined 2,026 brief contracts, eradicating their hedges and draw back safety.

This has pushed their positioning to a degree of peak optimism. At 67% lengthy versus 33% brief, their long-short ratio has hit a particularly bullish 2.30. They’re totally invested within the perception that the market goes larger.

Key Implications for Merchants

-

Impending Volatility Explosion: The market is now a coiled spring. This stage of utmost, opposing conviction, backed by new cash (rising OI), is basically unstable. The decision of this battle is not going to be quiet; it is going to be a pointy, violent, and directional transfer.

-

A Historic Divergence: We’re witnessing probably the most excessive divergences between institutional (“Good Cash”) and retail positioning. Traditionally, such standoffs are nearly at all times resolved in favor of the establishments. The present setup is an immense crimson flag for the bulls.

-

The Ache Commerce is Clear: A transfer down will set off an enormous wave of panic promoting from the big and extremely uncovered base of retail longs. A transfer up would trigger a historic brief squeeze towards the closely entrenched FIIs.

-

A Excessive-Conviction Development: The rising open curiosity is the market’s affirmation that this isn’t a interval of indecision. This can be a interval of constructing power for a significant pattern.

Conclusion

Don’t be deceived by any short-term, range-bound worth motion. The underlying flows reveal a market at a breaking level. The FIIs have drawn their line within the sand with most bearish drive, and the retail purchasers have met them with most bullish religion. The battlefield is about, the armies are in place, and the strain is at its peak. That is the setup that precedes main market turning factors and high-velocity developments. Put together for a significant enlargement in volatility.

Final Evaluation could be learn right here

The market is unfolding with the chaotic and risky power that was forecast. The earlier session’s wild swings—a 150-point fall erased by a 250-point restoration—had been a basic signature of the Jupiter Retrograde interval. This violent worth motion has solid a second consecutive “Outdoors Bar,” a strong technical signal of a market in deep battle, constructing immense power for a significant directional breakout.

At the moment, this coiled spring is about to be triggered by a gap-up opening, making a basic setup for a possible bull entice.

1. The Catalyst: The Bihar Exit Ballot Hole-Up

The market is about to open robust, gapping up over the vital provide zone of 25,705-25,711 on the again of constructive information from the Bihar election exit polls. It will give the bulls rapid management on the opening bell. Nevertheless, as your evaluation expertly notes, this information comes with a big warning. Exit polls are notoriously unreliable, and the likelihood of a good, contested remaining result’s excessive. This creates a textbook “purchase the rumor, promote the information” state of affairs, the place the market’s preliminary optimism might shortly fade and result in a pointy reversal.

2. The Astrological Spark: Mercury Conjunct Mars – A Turning Level

Fueling this risky setup is at this time’s aggressive and highly effective Mercury-Mars conjunction. This astrological facet is thought for bringing decisive motion, battle, sharp arguments, and, critically, Key Turning Factors. This isn’t a passive power; it’s an assertive, forceful one that can empower each bulls attempting to push for a brand new excessive and bears attempting to defend and reverse the pattern. The chance of a quiet, drifting session is close to zero. Count on a fierce, high-conviction battle to be fought on the day’s key ranges.

3. The Definitive Battle Strains: The Breakout vs. The Reversal

The mix of the gap-up and the underlying volatility has created a transparent and high-stakes set of aims for each bulls and bears.

-

The Bullish Breakout Goal (Shut > 25,830-25,850): The bulls’ mission is not only to hole up, however to show their power. They need to take up the early profit-taking and push for a decisive weekly shut above the 25,830-25,850 resistance zone. An in depth above this space would validate the breakout, entice the bears, and sign the beginning of a brand new, sustainable uptrend.

-

The Bearish Ambush Goal (Hole-Fill and Shut < 25,700): The bears’ technique is to view the morning gap-up as a present. Their plan might be to soak up the preliminary wave of optimistic shopping for after which launch a strong counter-attack. A failure to carry the highs would put a gap-fill squarely of their sights, with the final word goal of erasing all of the morning’s features and securing a weak shut again under the vital 25,700 stage.

4. The Intraday Recreation Plan: Capturing the Development

For a day with such excessive potential for a morning spike and a subsequent reversal, the primary quarter-hour might be essential to tell apart the true pattern from the preliminary noise.

-

Mark the Preliminary Excessive and Low: The primary quarter-hour of buying and selling will set up the preliminary emotional excessive. This vary is vital.

-

Commerce the Failure or the Observe-By:

-

A transfer above the 15-minute excessive would sign that the breakout has actual momentum.

-

A decisive break under the 15-minute low is probably the most vital sign of the day. It will point out the bullish pleasure has failed, the bears have seized management, and the gap-fill state of affairs is underway.

-

Conclusion

This can be a setup for a basic showdown. A news-driven gap-up will problem main resistance below a risky and aggressive astrological signature. The bulls can have their probability to show themselves on the open, however any signal of weak point might be brutally punished by bears trying to engineer an enormous reversal. Self-discipline might be paramount; watch the important thing ranges and use the 15-minute vary to substantiate which facet is profitable this high-stakes battle.

Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 25795 for a transfer in direction of 25875/25954. Bears will get lively under 25716 for a transfer in direction of 25636/25557

Merchants might be careful for potential intraday reversals at 10:26,11:33,01:07,02:59 Tips on how to Discover and Commerce Intraday Reversal Occasions

Nifty Oct Futures Open Curiosity Quantity stood at 1.85 lakh cr , witnessing liquidation of 0.6 Lakh contracts. Moreover, the rise in Price of Carry implies that there was closuer of SHORT positions at this time.

Nifty Advance Decline Ratio at 40:10 and Nifty Rollover Price is @26104 closed under it.

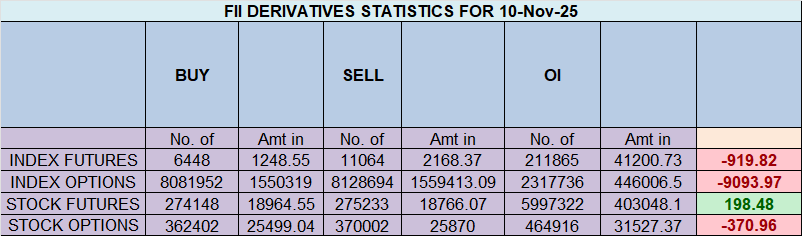

Within the money phase, International Institutional Traders (FII) offered 3115 cr , whereas Home Institutional Traders (DII) purchased 602 cr.

For Positional Merchants, The Nifty Futures’ Development Change Stage is At 25861 . Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Similar Facet As Establishments, With A Increased Danger-reward Ratio. Intraday Merchants Can Hold An Eye On 25694 , Which Acts As An Intraday Development Change Stage.

Nifty Intraday Buying and selling Ranges

Purchase Above 25795 Tgt 25848, 25888 and 25936 ( Nifty Spot Ranges)

Promote Under 25711 Tgt 25666, 25620 and 25585 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to intently monitor market actions and make knowledgeable selections primarily based on a well-thought-out buying and selling plan and danger administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators

Associated