Final Evaluation might be learn right here

Feb 10 2026 NIFTY Expiry Forecast: Key Assist & Resistance Ranges for Weekly Choices

Merchants might be careful for potential intraday reversals at 10:29,11:28,12:22,01:11,02:11 Discover and Commerce Intraday Reversal Occasions

Nifty Dec Futures Open Curiosity Quantity stood at 1.52 lakh cr , witnessing liquidation of 6.7 Lakh contracts. Moreover, the rise in Value of Carry implies that there was closuere of SHORT positions immediately.

Nifty Advance Decline Ratio at 36:14 and Nifty Rollover Value is @25405 closed above it.

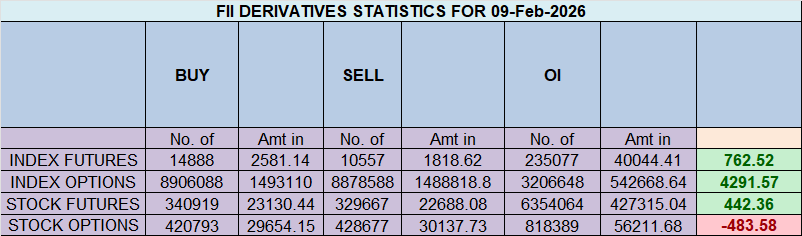

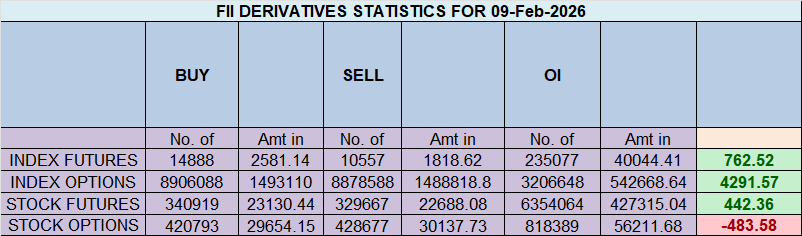

Within the money section, Overseas Institutional Buyers (FII) purchased 2254.64 cr , whereas Home Institutional Buyers (DII) purchased 4.15 cr

The Nifty choices market is radiating a powerful and assured bullish sentiment, signaling that bulls have decisively taken management. A powerfully optimistic Put-Name Ratio (PCR) of 1.05 confirms this shift, indicating that whole put open curiosity has surpassed name open curiosity. It is a basic signal of a market that has shed its worry, pushed by aggressive put writers who’re confidently promoting draw back safety and thereby constructing a formidable help construction beneath the index.

This bullish confidence has anchored the market across the Max Ache level of 25,800. With the present value buying and selling barely above this at 25,867, the market is able of power, holding its floor above its monetary middle of gravity.

A deep dive into participant exercise reveals the engine behind this rally:

-

Overseas Institutional Buyers (FIIs) are the first architects of this bullish construction. Their most vital motion was being large internet sellers of put choices. By promoting places on a big scale, they’re constructing a robust help flooring, expressing excessive confidence that any market dips can be shallow and short-lived.

-

Retail seems to be on the opposite facet of this commerce, appearing as important patrons of those put choices, indicating a continued sense of worry or a want for hedging that’s fueling the institutional premium assortment.

This setup has cast a transparent and formidable battlefield:

-

Resistance: An enormous “Nice Wall of Calls” is situated on the 26,000 psychological strike, which serves as the last word ceiling.

-

Assist: A strong help flooring, strengthened by FII put promoting, has been constructed on the 25,700 strike. The 25,800 Max Ache degree will even act as an important pivot.

In conclusion, the Nifty is in a powerful, institutionally-backed “purchase on dips” setting. The trail of least resistance is upwards, with the bulls now set to problem the ultimate fortress at 26,000.

For Positional Merchants, The Nifty Futures’ Development Change Stage is At 25515. Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Identical Aspect As Establishments, With A Greater Danger-reward Ratio. Intraday Merchants Can Hold An Eye On 25900 , Which Acts As An Intraday Development Change Stage.

Nifty Spot – Intraday Chart Commentary

Technical Setup: The index is approaching important breakout ranges. Watch these zones for value motion affirmation:

-

Power (Upside): Momentum is anticipated to select up if Nifty sustains above 25900. On this situation, the speedy resistance ranges are 25945, 25972 and 26016.

-

Weak spot (Draw back): The pattern technically weakens if the index slips under 25850 This might open the trail in direction of help ranges at 25816, 25777 and 25729.

Nifty Expiry Vary

Higher Finish of Expiry : 26028

Decrease Finish of Expiry : 25697

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable selections primarily based on a well-thought-out buying and selling plan and danger administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators