A Market on a Collision Course: FIIs Unleash a Bearish Barrage as Battle Escalates to a Climax

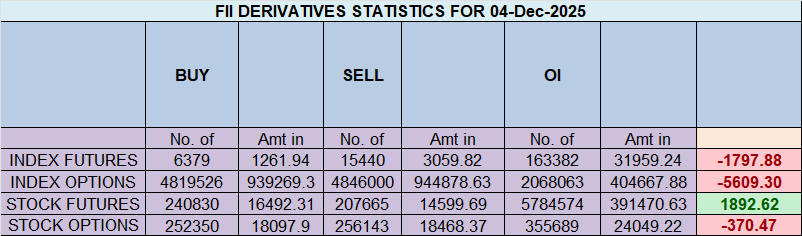

On December 4, 2025, the Nifty Index Futures market remodeled right into a high-stakes battlefield, witnessing an enormous and aggressive assault by International Institutional Traders (FIIs). They unleashed a torrent of promoting, offloading a internet 5,725 contracts price ₹1,104.98 crore.

The headline, whereas vital, solely tells half the story. The session’s most crucial and revealing knowledge level was the colossal surge in internet Open Curiosity (OI) of 5,635 contracts. It is a profoundly necessary sign. It confirms that the FIIs’ huge bearish bets have been met by a contemporary wave of bullish capital, which means the market will not be breaking down however is actively loading a powder keg of opposing positions for a serious, decisive confrontation.

Decoding the Knowledge: An Unambiguous Declaration of Conflict

The granular knowledge reveals the anatomy of this institutional assault and the intense polarization it has created.

1. The FIIs: A Two-Pronged “All-In” Assault

The FIIs’ actions have been a masterclass in high-conviction, aggressive positioning. They didn’t simply promote; they strategically escalated their bearish footprint with a brutal, two-pronged assault:

-

They liquidated 1,775 lengthy contracts, fully abandoning any notion of an upside.

-

Concurrently, they initiated an unlimited 7,286 brand-new quick contracts, actively and massively betting on a big market decline.

This has pushed their positioning to an excessive 14% lengthy versus 86% quick (ratio 0.14). This isn’t a hedge. It is a strategic, all-in declaration of conflict towards the present market degree.

2. The Shopper Knowledge and the Divergence

(Observe: There seems to be a contradiction within the granular consumer exercise knowledge versus the Open Curiosity surge. Nonetheless, the ultimate consumer positioning is crystal clear.)

The consumer section stays the unyielding opposing power. Regardless of the institutional onslaught, their general positioning stays staunchly bullish at 69% lengthy versus 31% quick (ratio 2.20). They symbolize the huge wall of bullish conviction that’s absorbing the FIIs’ unprecedented wave of promoting.

Key Implications for the Market

-

A Market at its Breaking Level: The divergence between the “Sensible Cash” (FIIs) and the “Retail Cash” (Purchasers) has now reached an excessive and unsustainable degree. A market this polarized can not stay steady.

-

An Imminent Volatility Explosion: The huge surge in Open Curiosity is the market’s definitive stamp that it is a constructing battle, not a waning development. Vitality is being packed into the system, and its eventual launch might be swift and violent.

-

The Final Contrarian Pink Flag: A setup this excessive is a basic, high-alert contrarian indicator. Historical past overwhelmingly reveals that when institutional and retail positioning turns into this polarized, the eventual decision is brutally in favor of the establishments.

-

A Large Reservoir of “Gasoline”: The 69% of consumer positions which can be nonetheless lengthy now symbolize a colossal reservoir of potential “gasoline” for a market decline. A break of key help ranges would doubtless set off a catastrophic wave of panic promoting from this big, uncovered group.

Conclusion

The Nifty is not only trending; it’s getting ready for battle. The FIIs have made certainly one of their most aggressive bearish strikes in latest reminiscence, and an enormous quantity of latest capital has entered the market to take the opposite aspect. A interval of quiet consolidation is now the least doubtless consequence. Put together for a serious, trend-defining occasion that may resolve this monumental battle, proving one aspect spectacularly proper and the opposite spectacularly incorrect.

Final Evaluation may be learn right here

The Nifty is presently in a state of good, high-stakes equilibrium. A unstable sideways grind has culminated within the formation of a Doji candlestick, a robust and unambiguous signal of a market at a degree of absolute indecision. This monument to a drawn battle between bulls and bears will not be a state of calm, however a “coiled spring,” storing immense power that’s about to be unleashed by a uncommon and highly effective trifecta of catalysts.

At this time’s session is not only one other buying and selling day; it’s a level of immense confluence the place the market might be compelled to make a decisive, trend-defining alternative.

1. The Trifecta of Volatility Catalysts

The market’s present state of indecision is about to be violently disrupted by three distinct and highly effective forces converging on the similar time:

-

The Lunar Peak (The Full Moon): A Full Moon represents a peak in emotional power and sometimes coincides with a end result occasion—both a ultimate, exhaustive prime or a second of peak worry marking a backside. It ensures that sentiment might be operating excessive.

-

The Astrological Signature (Mercury-Venus Facet): As your evaluation accurately identifies, this side is essential for short-term buying and selling. Venus (governing finance and worth) in side with Mercury (governing information, communication, and buying and selling) creates a direct hyperlink between market-moving information and its monetary influence, promising a pointy and vital response.

-

The Basic Set off (The RBI Coverage): The “identified unknown” of the RBI’s coverage resolution is the proper elementary catalyst to behave upon the pre-existing celestial stress. The information itself is necessary, however its influence might be dramatically amplified by the astro-cyclical atmosphere.

2. The Definitive Battle for the Weekly Shut

With right this moment being the essential weekly shut, all the session turns into a high-stakes battle to regulate the market’s narrative heading into the weekend. The battle strains have been drawn with army precision.

-

The Bullish Goal (A Weekly Shut > 26,110): The bulls’ mission is to harness the day’s volatility, take up any promoting stress, and safe a decisive shut above 26,110. An in depth above this degree would invalidate the bearish potential of the Doji, turning it right into a easy consolidation earlier than the subsequent leg up.

-

The Bearish Goal (A Weekly Shut < 25,920): The bears will view the Doji as an indication of bullish exhaustion. Their purpose is to make use of the catalysts to engineer a reversal, forcing a weak weekly shut under 25,920. This is able to verify the Doji as a basic topping sample and sign a serious shift within the short-term development.

3. The Unwavering Sport Plan: The 15-Minute Compass

In a market atmosphere this charged with unpredictable potential, a disciplined technique is paramount. The first 15-minute excessive and low would be the final information by means of the approaching chaos.

-

This vary will take up the preliminary knee-jerk response to the RBI coverage.

-

A break of the excessive alerts the bulls are in management.

-

A break of the low alerts the bears have seized the day.

Conclusion

The market is completely poised for a serious, high-velocity transfer. A technical sample of supreme indecision (the Doji) is about to be shattered by a robust alignment of lunar, planetary, and elementary catalysts. The battle for the weekly shut between 26,110 and 25,920 will outline the development. By ready for the opening 15-minute vary to kind, merchants can let the market present its hand earlier than committing to the day’s confirmed route. Put together for a session of maximum volatility and conviction.

Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 26082 for a transfer in the direction of 26163/26244. Bears will get lively under 25995 for a transfer in the direction of 25920/25839

Merchants might be careful for potential intraday reversals at 09:15,10:07,11:09,12:26,01:39 The right way to Discover and Commerce Intraday Reversal Occasions

Nifty Dec Futures Open Curiosity Quantity stood at 1.50 lakh cr , witnessing addition of 4.9 Lakh contracts. Moreover, the rise in Value of Carry implies that there was addition of SHORT positions right this moment.

Nifty Advance Decline Ratio at 24:26 and Nifty Rollover Value is @26320 closed under it.

Within the money section, International Institutional Traders (FII) offered 1944 cr , whereas Home Institutional Traders (DII) purchased 3661 cr.

The Nifty choices market is flashing clear warning alerts, with sentiment taking a decisive flip in the direction of the bears. That is captured by a Put-Name Ratio (PCR) that has dropped to a cautious 0.80, indicating that aggressive name writing has tilted the steadiness of energy. This surge in name promoting demonstrates a powerful conviction amongst merchants that the market’s upside is now restricted and that main resistance ranges will maintain.

This cautious sentiment is anchored across the market’s new monetary middle of gravity: the Max Ache level is firmly established on the crucial psychological degree of 26,000. With the spot value at 26,033, the market is pinned on to this fulcrum of most monetary stress for choice patrons, suggesting institutional sellers are actively defending this zone.

An evaluation of participant exercise reveals that International Institutional Traders (FIIs) are the first architects of this bearish construction. As vital internet sellers of name choices (-26K contracts), they’re actively setting up the resistance ceiling that’s capping the rally. In distinction, retail merchants seem confused and lack conviction, being minor internet sellers of each calls and places.

The choices chain clearly maps out this high-stakes battlefield:

-

Resistance: A formidable wall of Name OI has been constructed, with instant resistance at 26,150 and the last word ceiling on the 26,500 strike.

-

Assist: The 26,000 degree is now essentially the most crucial pivot, performing as each the Max Ache level and the first help ground with the best Put OI. Ought to it fail, the subsequent main help is at 25,800.

In conclusion, the market’s upward momentum has been decisively checked. Led by institutional name promoting, a robust resistance wall has been erected, pinning the Nifty across the 26,000 mark. The trail of least resistance is now sideways to down.

For Positional Merchants, The Nifty Futures’ Pattern Change Stage is At 26259. Going Lengthy Or Brief Above Or Under This Stage Can Assist Them Keep On The Similar Aspect As Establishments, With A Larger Danger-reward Ratio. Intraday Merchants Can Preserve An Eye On 26163 , Which Acts As An Intraday Pattern Change Stage.

Nifty Intraday Buying and selling Ranges

Purchase Above 26025 Tgt 26066, 26120 and 26175 ( Nifty Spot Ranges)

Promote Under 25995 Tgt 25955, 25914 and 25866 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable choices based mostly on a well-thought-out buying and selling plan and threat administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators