Beneath we’ll construct up this payoff diagram – for each lengthy and brief name choices – by contemplating the behaviour of a name possibility worth at expiry with respect to its strike worth.

Lengthy Name Possibility Payoff

Let’s think about the best instance: an extended name possibility with, say, a strike worth of 100 which expires in 3 months time. Suppose additionally that the inventory worth is at 90 at current. We hope that the inventory will rise above 100 at expiry enabling us to train or promote the decision as it’ll have worth.

To buy the decision, an possibility premium have to be paid which, all issues being equal (particularly implied volatility), will depend on the time to expiry: 3 month on this case. Let’s say that this premium is 10.

At expiry one in all these situations will happen:

The inventory worth is under the 100 train worth (ie the choice is out of the cash)

On this case the commerce has not labored as deliberate and the decision possibility will expire nugatory. The revenue/loss is subsequently:

- Premium Paid: -$10

- Revenue from name possibility: $0

-

Loss on commerce: -10

The inventory worth is between 100 and 110

The decision possibility is within the cash which is sweet information. Its worth will likely be its extrinsic worth – the inventory worth much less the strike worth – as there is no such thing as a intrinsic worth (possibility worth from time remaining on the choice).

Nonetheless this quantity will likely be small – between 0 and 10 – and better the nearer to 110 the inventory worth is.

Nonetheless it is not going to be sufficient to recoup the ten paid for the decision possibility premium and therefore a loss remains to be made.

Our revenue/loss – assuming, say, a inventory worth of $105 is under:

- Premium Paid: -$10

- Revenue from name possibility: $5

- Loss on commerce: -5

The inventory worth is 110

That is the choice’s breakeven level.

At 110 the choice will likely be value $10 at expiry, recouping all of the $10 possibility premium paid.

No revenue or loss is made; the dealer will break even:

- Premium Paid: -$10

- Revenue from name possibility: $10

- Revenue/Loss on commerce: $0

The inventory worth is over 110

That is the place the dealer begins to make a revenue.

The expired possibility is now value greater than $10, thus greater than recouping the $10 possibility paid.

So if, say, the inventory worth is 115:

- Premium Paid: -$10

- Revenue from name possibility: $15

- Revenue/Loss on commerce: $5

This revenue will likely be bigger the additional the inventory worth is from the 110 strike worth. It’s probably infinite (because the potential inventory worth is infinite, though that is unlikely).

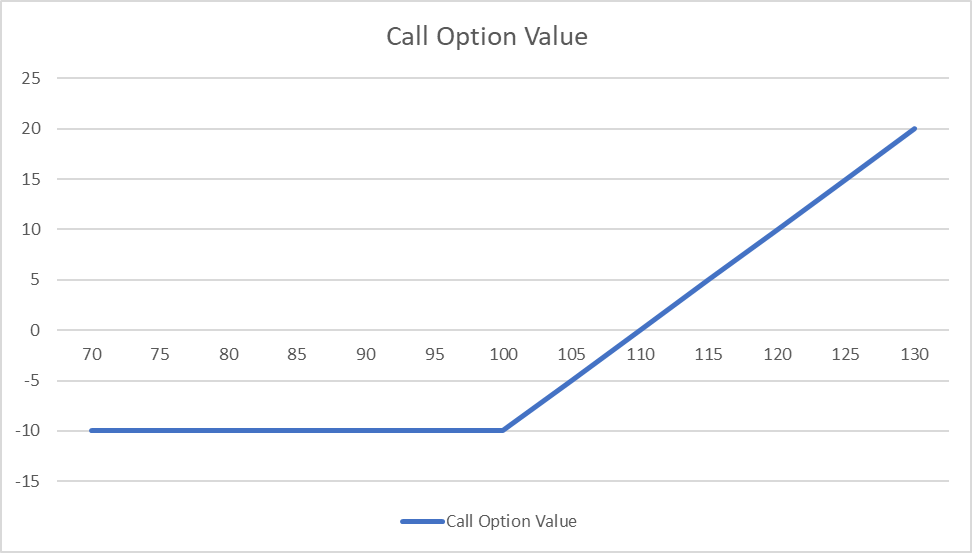

Placing all this collectively for all doable inventory costs offers the next payoff graph:

The horizontal x-axis is the inventory worth at expiry.

Brief Name Possibility Payoff

What if the dealer had offered the decision possibility slightly than purchased it, hoping that the inventory wouldn’t rise above 100 and therefore maintain the ten premium with no price.

Let’s have a look at the situations once more:

The inventory worth is under the 100 train worth (ie the choice is out of the cash)

On this case the commerce has labored as deliberate and the decision possibility will expire nugatory. The revenue/loss is subsequently:

- Premium Obtained: $10

- Loss from name possibility: $0

-

Revenue on commerce: $10

The inventory worth is between 100 and 110

The decision possibility is within the cash which is unhealthy information. Its worth will likely be its extrinsic worth – the inventory worth much less the strike worth – as there is no such thing as a intrinsic worth (possibility worth from time remaining on the choice).

Nonetheless this quantity will likely be small – between 0 and 10 – and better the nearer to 110 the inventory worth is.

Nonetheless it is not going to be sufficient to extinguish all the ten name possibility premium obtained and therefore a revenue remains to be made.

Our revenue/loss – assuming, say, a inventory worth of $105 is under:

- Premium Obtained: $10

- Loss from name possibility: -$5

- Revenue on commerce: $5

The inventory worth is 110

That is the choice’s breakeven level.

At 110 the choice will likely be value $10 at expiry, eradicating all of the $10 possibility premium obtained.

No revenue or loss is made; the dealer will break even:

- Premium Obtained: $10

- Loss from name possibility: -$10

-

Revenue/Loss on commerce: 0

The inventory worth is over 110

That is the place the dealer begins to make a (probably infinite) loss.

The expired possibility is now value greater than $10, thus greater than recouping the $10 possibility paid.

So if, say, the inventory worth is 115:

- Premium Obtained: $10

- Loss from name possibility: -$15

- Loss on commerce: $5

Breakeven Level Calculation

As we have now seen the breakeven level of both an extended or brief name possibility place is the expiry worth at which neither a revenue nor loss is made.

It may be calculated utilizing the system:

Conclusion

A name possibility payoff is a perform of the underlying inventory’s worth at expiration.

For an extended/brief place, a revenue is made if this worth is larger/decrease than the breakeven level, calculated because the sum of the strike worth and the choice premium paid/obtained.

Concerning the Creator: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and currently in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Occasions (of London). He determined to carry this data to a wider viewers and based Epsilon Choices in 2012.