Again in 1990, I used to be simply out of faculty and pretty broke. I used to be dwelling in a basement residence with two roommates. It was a dump.

On the finish of every month, my meager paycheck was principally gone. I made a decision I wanted to be taught in regards to the inventory market to make some cash.

I learn every little thing I may get my palms on. I spent many Saturdays on the New York Public Library absorbing as a lot as I may. (This was earlier than the entire world was obtainable on the web.)

Quickly I began buying and selling and investing in shares. After which my thoughts was blown once I found choices.

The place I Began: Shopping for Places and Calls to Speculate

Like most individuals, at first, I noticed choices as a shortcut to fast riches. Fortuitously, I knew that I didn’t know what I didn’t know (ya know?), so I didn’t begin buying and selling choices till I had a greater understanding of them.

However even then, I used to be solely shopping for places and calls as speculations.

A put is a wager {that a} inventory will go down. A name is a wager that it’ll rise. These choice contracts will let you management 100 shares of inventory for pennies on the greenback for a particular period of time.

For instance, when you thought Financial institution of America (NYSE: BAC) was going larger within the brief time period, you possibly can purchase 100 shares for about $5,250. If the inventory rose 10 factors, you’d make about $1,000.

Or you possibly can pay simply $325 to purchase a name that expires in March with a strike value of $52.50. Meaning if the inventory is beneath $52.50 at expiration, your name expires nugatory. If it’s above $52.50, the decision may have worth, relying on how excessive the inventory rises and the way a lot time is left till expiration.

If Financial institution of America shoots larger subsequent week and is buying and selling at $62.50, 10 factors larger than it’s at this time, your name would most likely be price round $1,100. So that you’d be up $775 on a $325 wager.

In the event you’d purchased the inventory, you’d have risked $5,250 and made 19%. By shopping for the calls, you risked solely $325 and made 238%.

You may see why folks speculate with choices. You threat much less and may make a a lot larger proportion return.

My Large Revelation: Promoting Choices

However as I dug deeper into choices, I discovered one thing beautiful: The true cash in choices is in promoting them, not speculating with them. When a speculator buys a put or a name, somebody has to promote them that choice – they usually receives a commission to take action.

Large monetary establishments usually aren’t making an attempt to hit dwelling runs shopping for calls on Nvidia (Nasdaq: NVDA) and taking over that threat, however they’ll be comfortable to promote you some.

The extra I understood this, the extra I needed to promote choices to generate earnings straight away.

Now that I’m older, whereas I nonetheless wish to swing for the fences on occasion, my precedence for my investments is producing earnings.

However over the previous decade, I’ve more and more used choices to generate earnings with varied methods, together with (however not restricted to) coated calls and bare places.

Lined Calls and Bare Places 101

A coated name is once you personal a inventory and promote a name on it. In different phrases, somebody is betting that the inventory will go larger. While you promote the decision to them, you receives a commission instantly. If the inventory goes larger, you could have to promote your inventory on the larger strike value, however you retain the cash you bought from promoting the decision.

If the inventory pays a dividend, you may also proceed to gather these dividends when you wait, which additional boosts your return.

Then there are bare places. When somebody is anxious about their inventory taking place – or speculating on a fall – they’ll purchase a put. In the event you promote them a unadorned put, you’re agreeing to purchase that inventory from them if it reaches the strike value. (In choices buying and selling, “bare” merely means you don’t personal the inventory already. “Lined,” as in coated calls, means you do personal the underlying inventory.)

Let’s say you’re considering shopping for a inventory, however provided that you will get it at a ten% low cost.

You may promote places on that inventory with a strike value 10% beneath the present value. Meaning if the inventory drops by 10%, you’ll probably get to purchase 100 shares of the inventory at your goal value. You additionally bought paid for promoting the put, which lowers your efficient value much more.

If the inventory by no means drops to your goal value, you continue to hold the cash you acquired upfront once you offered the places.

![]()

YOUR ACTION PLAN

I’ve come a great distance since spending my weekends within the library. The time was properly spent, as I now have various methods to place further money in my pocket. Had I offered choices 35 years in the past, I may have gotten out of that dumpy residence so much faster – and eaten so much much less ramen.

Good investing,

Marc

FUN FACT FRIDAY

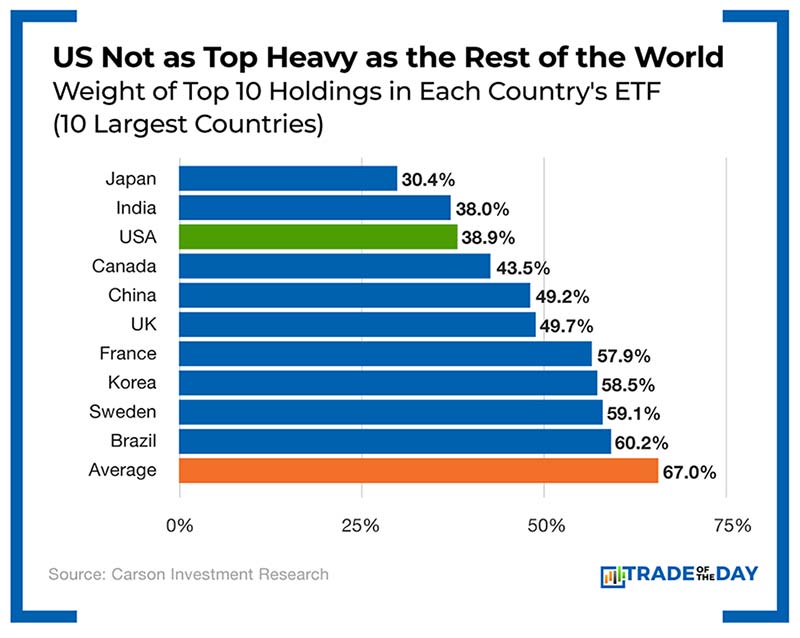

Not as bubbly as folks assume: With tech big Nvidia lately crushing earnings once more, there’s plenty of discuss that we’re in an “AI bubble,” much like the dot-com bubble again within the late Nineties. However the knowledge reveals the market isn’t as high heavy as we predict.

Earlier than the dot-com crash in 1999, the S&P 500 index gained greater than 20%, however solely 20% of shares had been above their shifting common. This signaled a really high heavy market.

However as of at this time, greater than half of the S&P 500 is in an uptrend along with AI. The truth is, in accordance with Carson Funding Analysis, the U.S. truly has one of many least concentrated inventory markets among the many 25 largest nations on this planet. So whereas some tech shares are crushing, most different sectors are additionally rising – albeit slower.