5 A+ squeezes simply appeared on my favourite chart.

Right here’s what occurs subsequent.

I’ve been watching Lemonade for weeks, and yesterday one thing modified. The place we used to have common squeezes scattered throughout timeframes, now now we have 5 A+ squeezes lighting up the display screen like a Christmas tree.

That is what I stay for as a swing dealer.

However Lemonade isn’t the one setup catching my consideration as we head into the vacation week. Whereas most merchants try for Christmas, the market usually delivers a few of its finest strikes throughout these quiet intervals when no one’s paying consideration.

Listed below are the 5 charts I’ll be monitoring over the vacations.

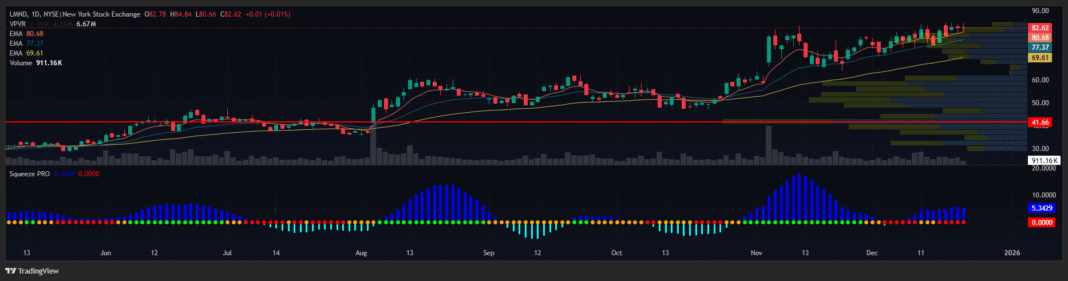

1. Lemonade (LMND) – The Setup That Has Me Most Excited

Present Value: ~$84 Swing Goal: $89-100 Why I Love It: 5 A+ squeezes throughout a number of timeframes

That is my favourite chart proper now, and I’m not being shy about it. I’ve acquired three completely different positions operating – short-term requires this week and swing requires subsequent week.

The technical story is easy: we’ve acquired resistance clustered round $85. If we are able to take out that stage, there’s nearly no resistance till $89. And that $89 goal? It’s not just a few random quantity – it’s the 1.272 Fibonacci extension from the latest excessive to low.

However right here’s what actually has me excited: Lemonade carries a 22% quick float. When this factor breaks $85 and begins squeezing shorts, it might transfer quick.

My sincere opinion? I believe Lemonade begins working its manner towards $100. When precisely? I don’t know. However the setup is there, and setups like this don’t come round day by day.

2. Carvana (CVNA) – The False Breakdown Play

Present Value: ~$240 Swing Goal: $450+ Why It’s Attention-grabbing: Traditional false breakdown sample growing

I nonetheless assume Carvana goes to $500, and right here’s why this latest weak spot is perhaps precisely what we wish to see.

Look, this acquired sloppy into Friday’s OpEx and continued Monday. However robust shares typically shake folks out earlier than they do their factor. What I believe we’re seeing here’s a false breakdown – the type that finally resolves within the path of the principle pattern.

The sample I’m watching is easy: preliminary spike up, pullback, then secondary transfer. As a substitute of constructing that secondary transfer from the pullback, CVNA rolled over and took out the lows. But when that is actually a false breakdown, we must always see it reclaim and begin making that transfer quickly.

Vacation weeks may be good for these sorts of strikes when quantity is gentle and shorts get caught off guard.

3. Roku (ROKU) – The Weekly Squeeze Particular

Present Value: ~$65 Swing Goal: $75+ (hole fill potential to $15-17) Why I Like It: Weekly squeeze with momentum shift

Roku and I’ve historical past – we used to commerce this factor on a regular basis collectively, and for good purpose. This weekly squeeze with a momentum shift appears precisely like what we wish to see.

It’s slightly prolonged for a longer-term swing entry proper right here, however the larger image story is compelling. If Roku can get above $75, there’s an enormous hole to refill round $15-17. That’s not a typo – this factor has room to run if it will get going.

The setup isn’t fairly as clear as Lemonade, but it surely’s undoubtedly on my vacation radar. Typically the marginally messier setups are those that actually shock you.

4. B. Riley (RILY) – The Earnings Shock Bounce

Present Value: ~$5.50 Swing Goal: $7.50+ (hole fill to $15-17) Why It’s Price Watching: Put up-earnings momentum shift on the weekly

Right here’s one which stunned introduced earnings final week and had an enormous transfer on huge quantity. It got here again fairly far, however now it’s bouncing, and we’re beginning to see momentum shift on the weekly chart.

I do know it’s a good distance percentage-wise – a couple of 40% transfer to recover from $7.50. But when Riley can clear that stage, there’s huge room as much as $15-17 to shut the hole from its earlier highs.

Vacation buying and selling may be good for these sorts of restoration performs when institutional promoting strain lightens up.

5. EchoStar (SATS) – The 130-Minute Magnificence

Present Value: ~$109 Entry Goal: Dip to $104 Swing Goal: TBD (following the sample) Why It’s Tempting: 130-minute chart appears phenomenal

This one appears superior, but it surely’s up about $5 since I first observed it, so I’m not chasing. The 130-minute chart is totally stunning – the form of setup that makes you wish to do one thing instantly.

I’ve acquired an alert set for a dip again to $104. If we get that pullback over the vacation week, this turns into a severe consideration. Typically the perfect swing trades are those the place you wait to your value as an alternative of chasing the transfer.

Your Motion Plan

Right here’s the factor about vacation weeks: whereas most merchants are testing, a number of the 12 months’s finest strikes occur when no one’s paying consideration. Decrease quantity can amplify strikes, and institutional promoting strain usually lightens up.

That’s why I’ll be watching these charts even whereas everybody else is concentrated on Christmas dinner and household time.

Not saying I’ll be glued to screens – however these setups are too good to disregard utterly.

The secret’s persistence. Wait to your ranges, wait to your setups, and after they align, be able to act. These 5 charts symbolize several types of swing alternatives that might develop over the quiet buying and selling interval.

Not all will work. Some may fail spectacularly. However whenever you discover setups with this a lot technical alignment, the percentages begin tilting in your favor.

By the best way, if you happen to like several of those concepts, you’ll wish to verify this out.