You might be studying MultiCharts VS MetaTrader 5: Which Buying and selling Software program is the Greatest? by Enlightened Inventory Buying and selling initially posted on the Enlightened Inventory Buying and selling weblog.

Which Backtesting Software program is Greatest for Systematic Merchants?

MultiCharts vs MetaTrader 5: Evaluating Backtesting Software program for Systematic Buying and selling

MetaTrader 5 (MT5) is free and extensively used for foreign exchange and CFD buying and selling. MultiCharts, then again, is a extra superior charting and backtesting platform for critical systematic merchants. In case you’re centered on constructing rule-based methods with realism, pace, and portfolio-level evaluation, MultiCharts is the extra succesful selection. However each platforms have strengths, relying on the way you commerce.

Let’s evaluate them feature-by-feature so you can also make the suitable name.

MultiCharts vs MetaTrader 5 at a Look:

Quick on time? Right here’s how MultiCharts vs MetaTrader 5 evaluate aspect by aspect.

|

Function |

MultiCharts |

MetaTrader 5 |

|

Yr Launched |

1999 (Crew origin) |

2010 |

|

OS Compatibility |

Home windows solely |

Home windows, Mac (through Wine), Internet |

|

Dealer Integration |

Multi-broker (IB, OANDA, CQG) |

Dealer-specific (MetaQuotes brokers) |

|

Language |

PowerLanguage (EasyLanguage-compatible) |

MQL5 (proprietary, C-like) |

|

Backtesting |

Portfolio-level, event-based engine |

Single-instrument, tick-based |

|

Optimization |

Genetic, Stroll-Ahead, Exhaustive |

Genetic, exhaustive, restricted robustness testing |

|

Charting |

Institutional-grade, multi-timeframe |

Clear, however geared towards foreign exchange scalping |

|

Value |

Paid (Trial, Subscription, Lifetime) |

Free through brokers |

Platform Overview, Value & Compatibility

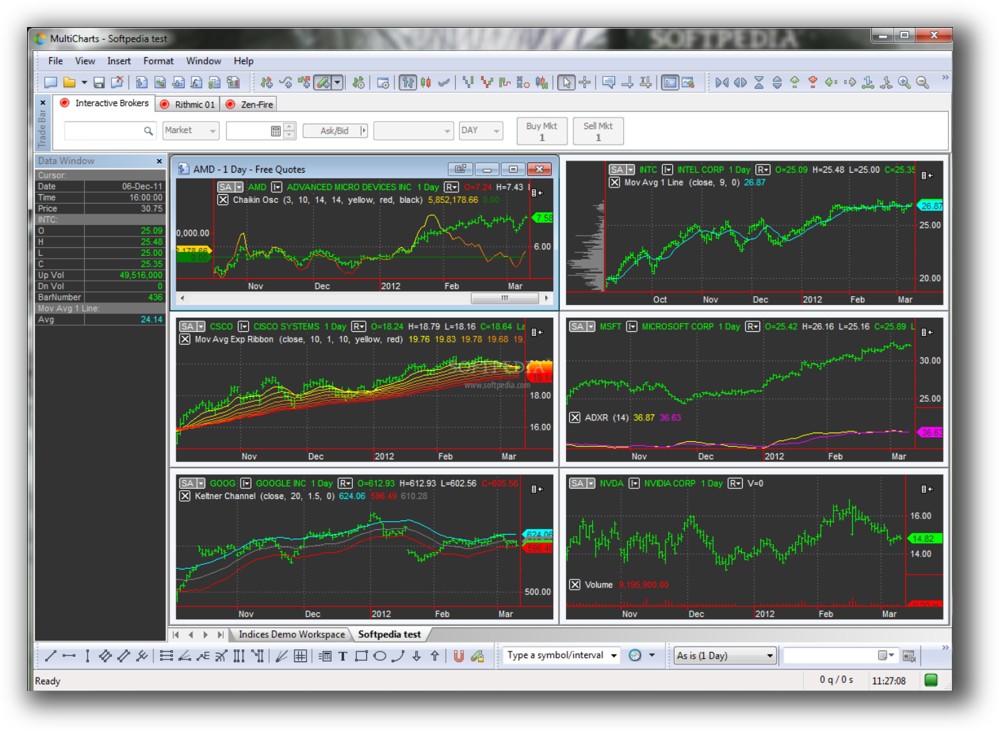

MultiCharts is a industrial backtesting and execution platform recognized for its deep technique growth and charting capabilities. It’s Home windows-based and helps dealer connections like Interactive Brokers, OANDA, and CQG. It’s a paid device (subscription or lifetime license) however is geared towards skilled and semi-professional merchants who need sturdy system testing and deployment.

MetaTrader 5, in distinction, is free by your dealer. It’s extensively utilized in foreign exchange and CFD markets and works on Home windows, macOS (through Wine or emulation), and the net. Whereas simpler to entry, it has extra limitations for multi-strategy or multi-asset merchants.

MetaTrader 5 Major View:

Market Entry & Knowledge Help in MultiCharts vs MetaTrader 5

MultiCharts helps equities, futures, foreign exchange, and crypto through a number of brokers and knowledge suppliers. You should use real-time and historic knowledge from Interactive Brokers, IQFeed, eSignal, and others. This makes it a greater match for international systematic inventory and futures buying and selling.

MT5 is tied to your dealer’s choices. Most brokers supply foreign exchange and CFDs, not shares or futures. Historic knowledge availability additionally relies on the dealer, and long-term bar knowledge could also be restricted or low high quality.

In case you’re critical about buying and selling throughout a number of markets and wish management over your knowledge, MultiCharts is superior.

MetaTrader 5 Backtesting Interface:

Constructing & Customizing Buying and selling Methods

MultiCharts makes use of PowerLanguage, which is appropriate with EasyLanguage (utilized in TradeStation). It’s readable, extensively supported, and good for merchants who need to code their very own methods or modify present ones. You can too import third-party scripts or use built-in methods.

MetaTrader 5 makes use of MQL5, a robust however proprietary C-like language. It helps complicated logic, however the studying curve is steeper when you’re not already conversant in C-style syntax. Its developer ecosystem is huge, however extra retail/indicator-focused than systematic.

If you would like readability and a decrease barrier to writing and adapting rule-based methods, MultiCharts has the sting.

Examine Out: Buying and selling System Improvement

MetaTrader 5 Code Editor (Meta Editor):

Backtesting Efficiency, Velocity & Realism

That is a very powerful part for systematic merchants.

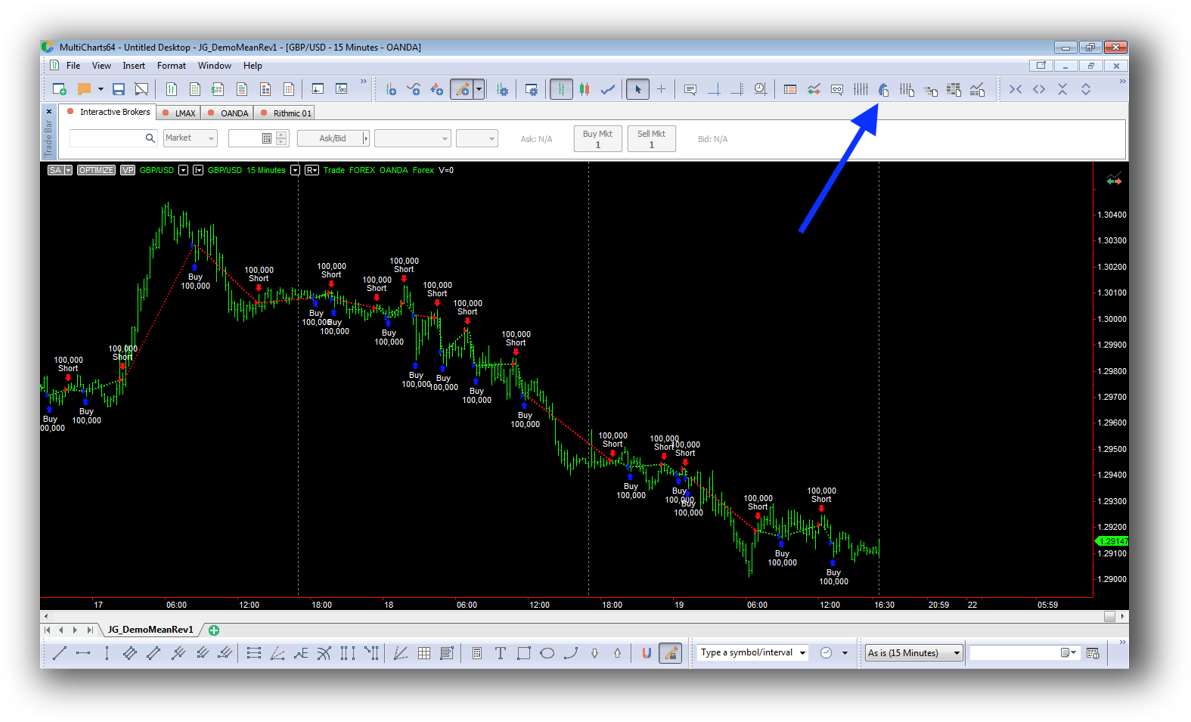

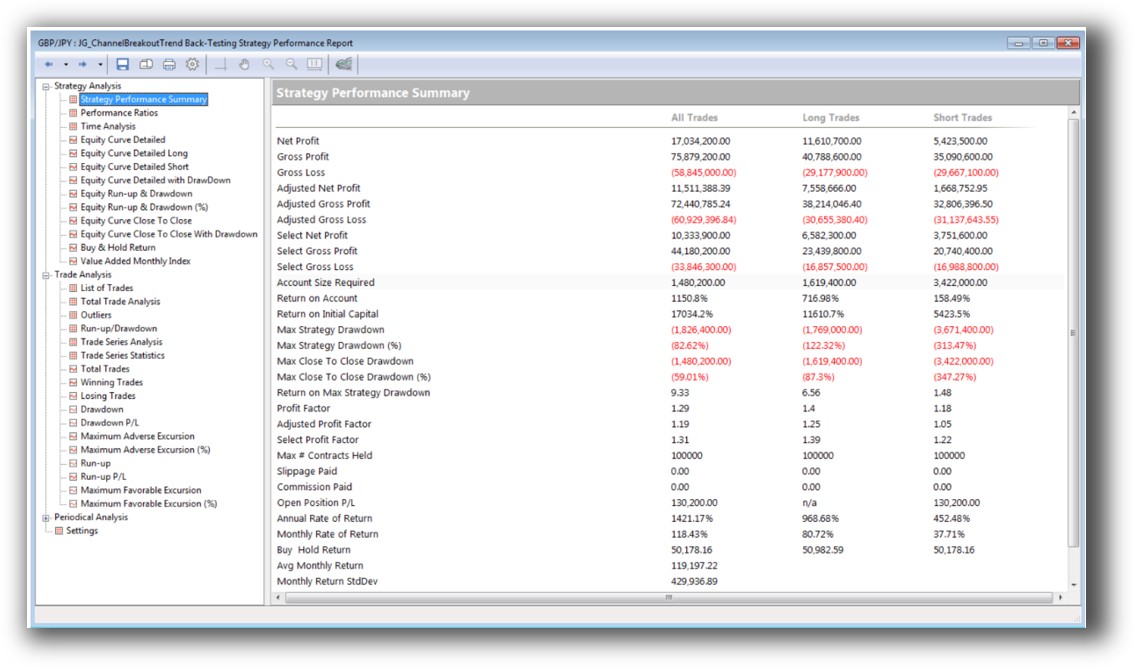

MultiCharts has a portfolio-level, event-driven backtesting engine. This implies you possibly can take a look at methods throughout a number of symbols and simulate reasonable buying and selling eventualities (like capital allocation, slippage, and execution order). You possibly can apply place sizing, take a look at portfolio-wide metrics, and mannequin correlated methods. This can be a massive deal.

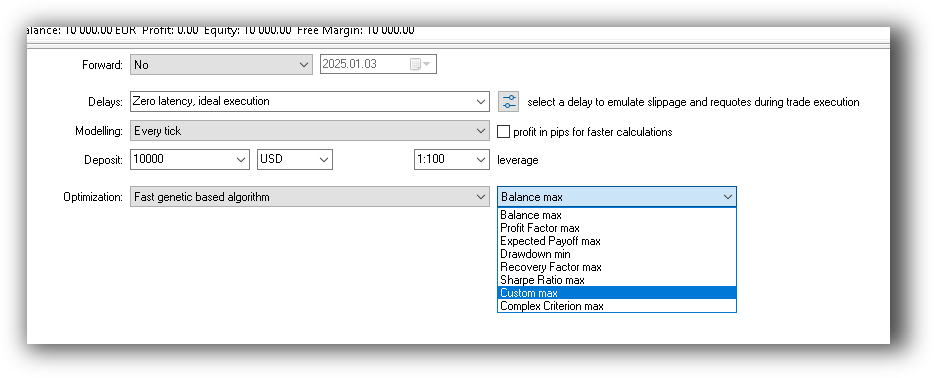

MT5 is single-instrument centered. Its backtesting is tick-based and may simulate order execution, however it lacks native portfolio-level simulation. It’s nice for testing Professional Advisors (EAs) on a single foreign exchange pair or CFD, however if you wish to construct multi-system, multi-market fashions with reasonable capital deployment, MT5 will fall quick.

Take a look at: Backtesting | Drawdown

MetaTrader 5 Backtest Report:

Technique Optimization & Stress Testing Instruments

Each platforms supply genetic and exhaustive optimization. However MultiCharts additionally helps Stroll-Ahead Evaluation (WFA) and parameter stability testing, vital for avoiding curve becoming and constructing sturdy methods.

MT5 lacks walk-forward testing by default. You possibly can run optimizations, however robustness testing and parameter validation require third-party plugins or exterior instruments.

MultiCharts helps you construct methods that stand as much as actual markets, not simply the previous.

Examine Out: Buying and selling System Optimization

MetaTrader 5 Genetic Optimization:

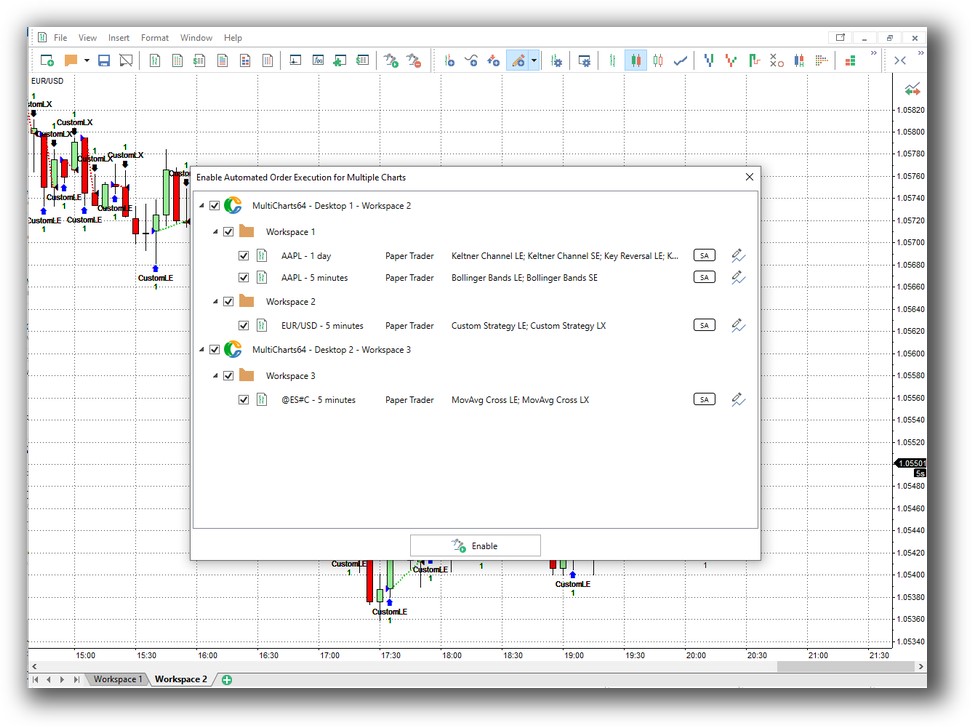

Charting Options, Sign Exploration & Reside Execution

Charting is the place MultiCharts actually shines. It provides institutional-quality multi-timeframe charts, superior drawing instruments, indicator layering, and straightforward navigation throughout symbols.

Scanning: MultiCharts contains highly effective scanner and sign era options throughout a number of devices.

Execution: MultiCharts helps reside buying and selling by brokers like IB and CQG. It additionally contains technique auto-execution with full management over sign timing, order routing, and slippage modeling.

MT5 charting is clear however simplified. It’s optimized for foreign exchange scalping. Whereas it contains indicator overlays, drawing instruments, and timeframes, it’s not designed for deep evaluation throughout portfolios. Scanner performance is fundamental.

Execution in MT5 is extremely dependent in your dealer. You possibly can automate buying and selling by EAs, however execution management is proscribed to what your dealer permits.

Examine Out Order Sorts | Automated Buying and selling Programs

MetaTrader 5 Automation Set Up (Professional Advisor):

Help, Documentation & Studying Sources

MultiCharts provides a complete information base, an energetic consumer discussion board, and clear documentation. It’s technical, however well-organized. There’s additionally respectable third-party assist and group dialogue for PowerLanguage.

MT5 has in depth documentation, however loads of it’s fragmented throughout dealer websites, MetaQuotes boards, and YouTube. It’s simple to get misplaced, particularly for merchants searching for structured system growth.

Each have energetic communities, however MultiCharts is healthier geared to the systematic mindset.

MultiCharts Discussion board Entrance Web page is illustrated down under:

MetaTrader 5 Discussion board Entrance Web page is illustrated down under:

MultiCharts vs MetaTrader 5: Which One Ought to You Use?

In case you commerce foreign exchange solely, don’t want portfolio-level backtesting, and desire a free device that comes together with your dealer, MetaTrader 5 is ok.

However when you’re constructing rule-based buying and selling methods throughout a number of markets, care about realism, need to mannequin portfolio results, and take a look at methods with confidence, MultiCharts is a much better device.

It’s not even shut with regards to:

- Portfolio backtesting

- Execution realism

- Optimization and robustness testing

- Scalability for a number of methods

Our Suggestion

In case your buying and selling targets embrace consistency, automation, and assured execution, MultiCharts is the stronger platform for long-term success.

Nevertheless, when you’re nonetheless in search of probably the most environment friendly method to construct your buying and selling system from scratch or need to keep away from losing time caught in software program setup hell – there’s a greater means.

Begin with a confirmed roadmap.

Need The Remainder of the Puzzle?

Backtesting software program is only one piece. The actual transformation occurs once you align your instruments, your methods, and your psychology together with your targets.

In case you’re uninterested in chasing suggestions and need to construct wealth systematically, the following step is evident: The Dealer Success System.

Inside, you’ll uncover:

- Confirmed buying and selling methods

- A step-by-step backtesting framework

- Place sizing instruments

- Automation methods that allow you to commerce in half-hour or much less

Buying and selling and Backtesting Software program Evaluate Listing

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Past Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Past Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Past Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Past Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Past Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Past Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Past Charts VS Optuma

- Past Charts VS TradingView

- Past Charts VS MetaTrader 4 (MT4)

- Past Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)

The submit MultiCharts VS MetaTrader 5: Which Buying and selling Software program is the Greatest? first appeared on Enlightened Inventory Buying and selling.