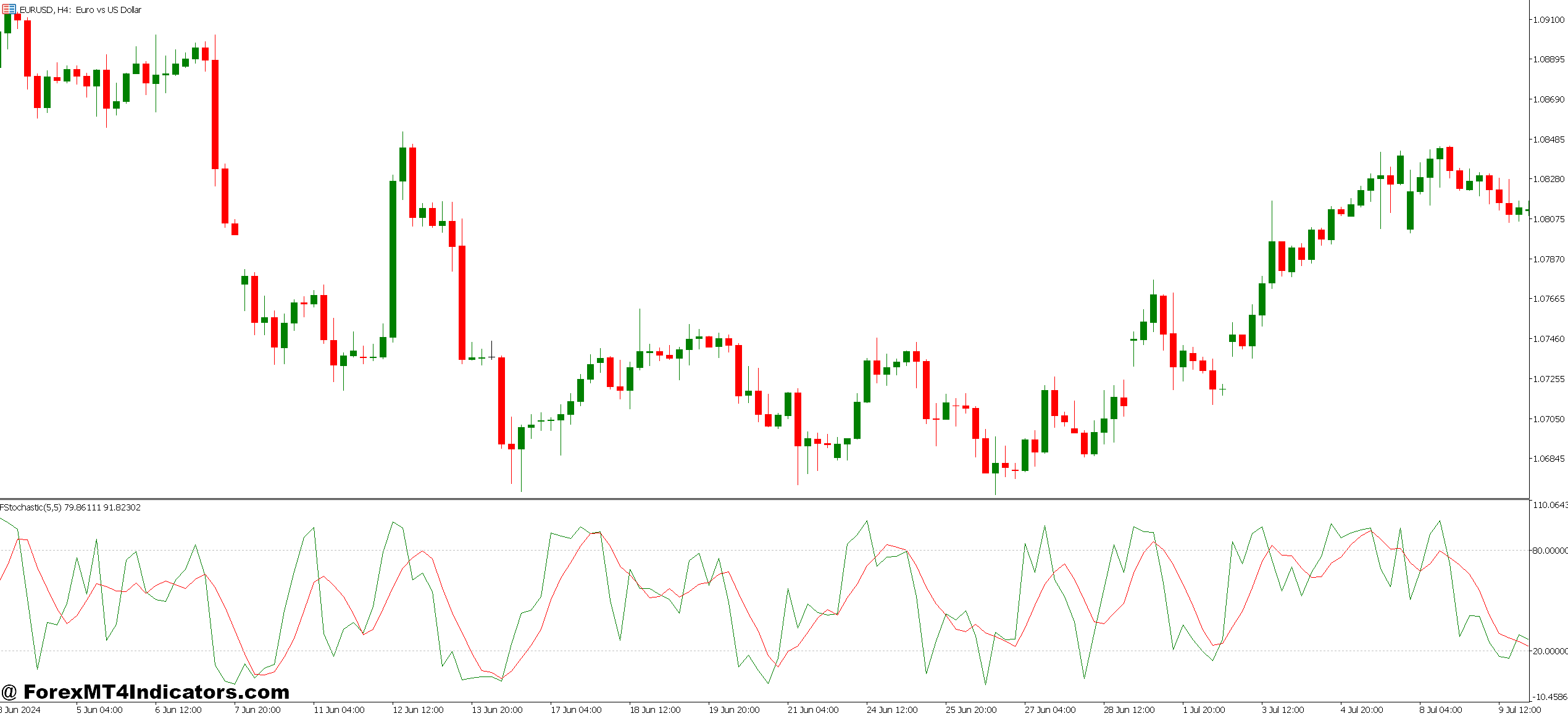

The stochastic oscillator tracks momentum by evaluating the newest closing value to the value vary over a selected lookback interval. It’s displayed as two strains %Ok (the quick line) and %D (the gradual sign line) that fluctuate between 0 and 100.

Right here’s what it’s actually telling you: When the stochastic reads 80 or above, the present value is close to the highest of its latest vary. When it drops under 20, value is buying and selling close to the underside of that vary. Consider it as a snapshot of whether or not bulls or bears have been profitable the latest battle.

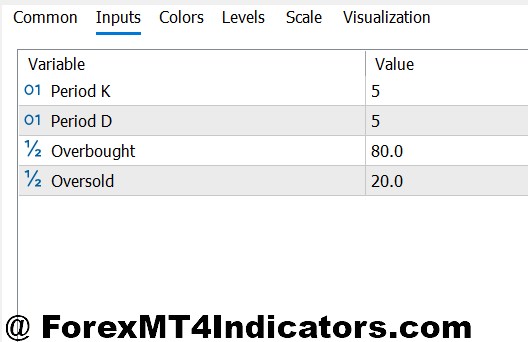

The usual MT5 setup makes use of a 5-3-3 configuration (5-period %Ok, 3-period %D, 3-period smoothing), although many merchants modify these primarily based on their timeframe. George Lane, who developed this indicator within the Fifties, believed that momentum modifications path earlier than value does which is why merchants look ahead to stochastic divergence and crossovers.

How the Calculation Works

The maths behind the stochastic isn’t difficult, however understanding it helps you grasp why the indicator behaves the way in which it does.

The %Ok line calculation appears like this: Take the present shut, subtract the bottom low out of your lookback interval, then divide by the vary (highest excessive minus lowest low) over that very same interval. Multiply by 100. That proportion tells you the place value at the moment sits throughout the latest vary.

The %D line is solely a shifting common of %Ok normally a 3-period easy shifting common. This smoothing creates the sign line that helps filter out noise and cut back false alerts.

When merchants discuss “quick” versus “gradual” stochastic, they’re referring to how a lot smoothing will get utilized. The quick model is extra responsive however generates extra false alerts. The gradual model (default on MT5) applies further smoothing to each strains, making it extra dependable however barely delayed.

Buying and selling the Stochastic in Actual Market Situations

Let’s get sensible. The textbook method says purchase when stochastic crosses above 20 from oversold territory, and promote when it crosses under 80 from overbought. However anybody who’s tried this on a stay account is aware of it’s not that easy.

I’ve discovered the stochastic works finest in two particular eventualities. First, throughout range-bound markets the place value lacks clear directional bias. On GBP/JPY’s 4-hour chart final month, value chopped between 188.50 and 191.20 for 2 weeks. Merchants who purchased close to the help zone when stochastic dipped under 20 and bought close to resistance when it climbed above 80 had a number of high-probability setups.

Second, use it to identify divergence throughout traits. When USD/JPY was trending up in December, value made larger highs round 157.80, however the stochastic fashioned decrease highs. That bearish divergence signaled weakening momentum earlier than value reversed giving alert merchants a heads-up to tighten stops or take earnings.

The largest mistake? Shorting simply because stochastic hits overbought throughout a powerful uptrend. Throughout trending markets, the indicator can keep pegged in excessive territory for dozens of candles whereas value continues operating. That’s the place you want affirmation from value motion look forward to a decrease excessive or rejection at resistance earlier than appearing on stochastic alerts.

Customizing Settings for Completely different Buying and selling Kinds

Default settings don’t match each dealer or market situation. Day merchants on the 5-minute or 15-minute charts usually discover the usual 5-3-3 too gradual. Bumping it to 8-3-3 and even 10-3-3 reduces whipsaw alerts in the course of the London and New York classes.

Swing merchants working off day by day or weekly charts may do the alternative utilizing a sooner 3-2-2 setup to catch momentum shifts earlier. The tradeoff is all the time the identical: sooner settings provide you with earlier alerts however extra false positives, whereas slower settings lag however filter noise higher.

Some merchants modify the overbought/oversold ranges too. As an alternative of the normal 80/20, they use 70/30 for extra alerts or 85/15 for higher-quality setups. Take a look at what works along with your most well-liked forex pairs and timeframe. Risky pairs like GBP/NZD may want wider bands, whereas secure pairs like EUR/CHF work effective with customary ranges.

One trick I’ve seen skilled merchants use: mix two stochastic indicators with completely different intervals on the identical chart. When each align say a 5-3-3 and a 14-3-3 each exhibiting oversold situations it confirms momentum is shifting throughout a number of timeframes.

Strengths, Weaknesses, and When It Fails

The stochastic excels at figuring out potential reversal factors in ranging or corrective markets. It’s additionally wonderful for divergence buying and selling, usually recognizing momentum shifts earlier than they’re apparent on value charts. The clear visible alerts (crossovers, excessive readings) make it beginner-friendly too.

However right here’s the place it struggles. Throughout sturdy traits, the indicator turns into almost ineffective as a standalone device it’ll scream “overbought” whereas value continues climbing for hours. You’ll additionally get chopped up throughout consolidation intervals when value whipsaws backwards and forwards, triggering false alerts on each side.

The stochastic doesn’t let you know something about pattern path or energy. It solely measures the place value sits inside its latest vary. Which means you want context from different instruments shifting averages, help and resistance ranges, or pattern strains to know whether or not you’re buying and selling with or towards the dominant pattern.

Threat administration issues much more with oscillator-based entries. Simply because stochastic reveals oversold doesn’t imply value can’t drop one other 50 pips earlier than reversing. Set your stops primarily based on value construction, not indicator ranges.

How It Compares to RSI and Different Oscillators

Merchants usually evaluate the stochastic to the Relative Energy Index (RSI), they usually’re each momentum oscillators with overbought/oversold readings. The important thing distinction? RSI measures the magnitude of latest value modifications, whereas stochastic measures place throughout the latest vary.

In uneven markets, stochastic tends to be extra responsive as a result of it reacts to the value vary immediately. RSI may keep extra impartial throughout the identical situations. That mentioned, RSI tends to work higher throughout traits as a result of its calculation doesn’t get pinned to extremes as simply.

Another choice is the Stochastic RSI, which applies stochastic calculations to RSI values. It’s extra delicate than both indicator alone, producing alerts sooner but additionally producing extra false readings. It’s overkill for many merchants.

What works? Many profitable merchants use stochastic alongside trend-following indicators. Mix it with a 50-period or 200-period shifting common to filter alerts solely take oversold purchase alerts when value is above the MA, and solely take overbought promote alerts when value is under it.

Methods to Commerce with MT5 Stochastic Indicator

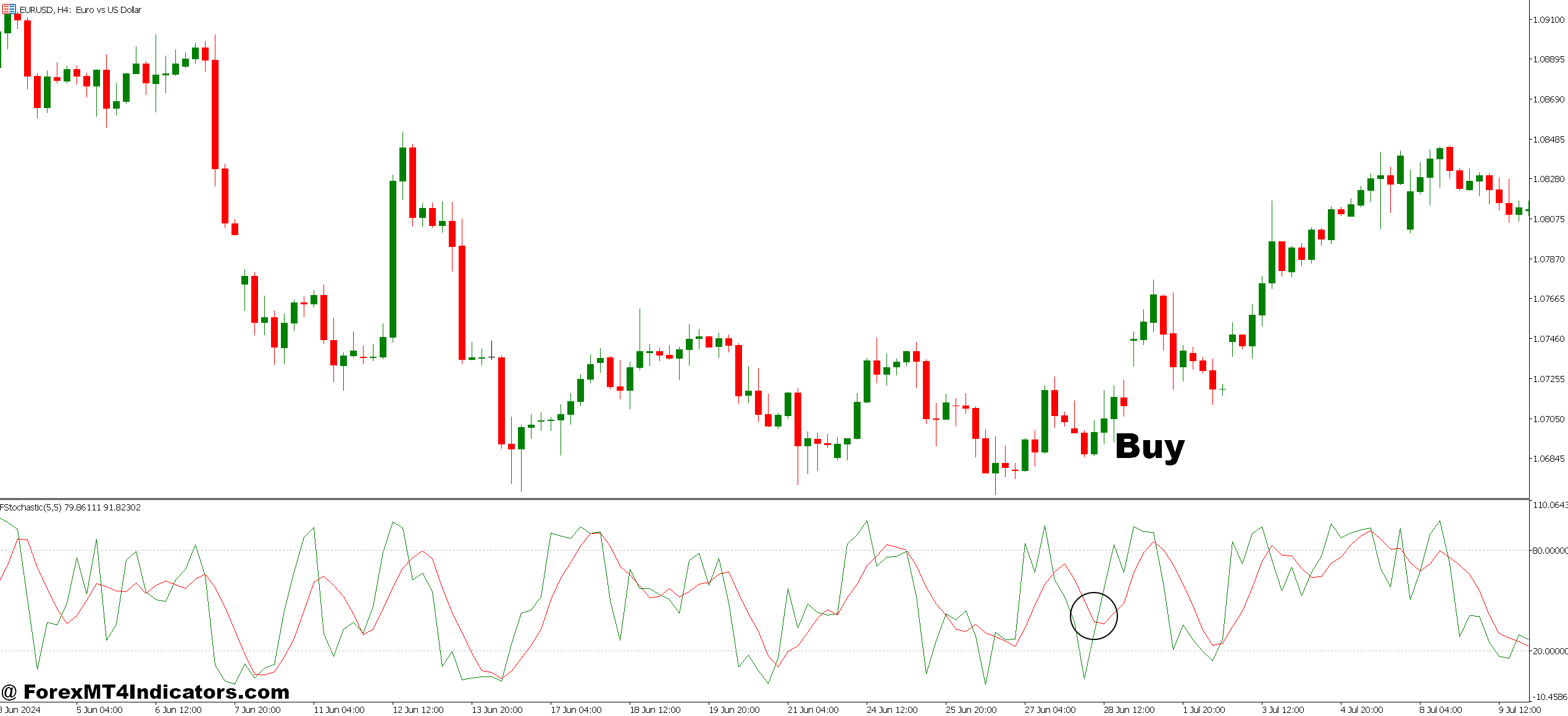

Purchase Entry

- Oversold crossover under 20 – Watch for %Ok line to cross above %D line whereas each are underneath 20 on EUR/USD 1-hour chart, then enter on the subsequent candle open with 20-30 pip cease loss.

- Bullish divergence affirmation – When value makes decrease lows however stochastic kinds larger lows on 4-hour GBP/USD, enter after stochastic crosses above 30 with cease under latest swing low.

- Vary help bounce – Purchase when stochastic hits 15-20 close to established help on day by day timeframe, however skip this sign if value breaks help by greater than 10 pips.

- Double-dip setup – Enter when stochastic drops under 20 twice inside 8-12 candles with out breaking help, signaling sturdy shopping for strain constructing beneath.

- Pattern pullback entry – On uptrending pairs above 200 EMA, purchase when stochastic touches 40-50 (not ready for 20), catching the dip early with tighter 15-pip stops.

- Keep away from throughout sturdy downtrends – Don’t purchase oversold readings when value is under 50-period MA on 4-hour charts, as stochastic can keep oversold whereas value retains dropping.

- Watch for candle affirmation – By no means enter mid-candle on stochastic alerts; look forward to the candle to shut above entry stage to keep away from false breakouts that reverse shortly.

- Threat solely 1-2% per commerce – Even with excellent stochastic alerts, restrict place measurement so your cease loss equals 1-2% of account steadiness most.

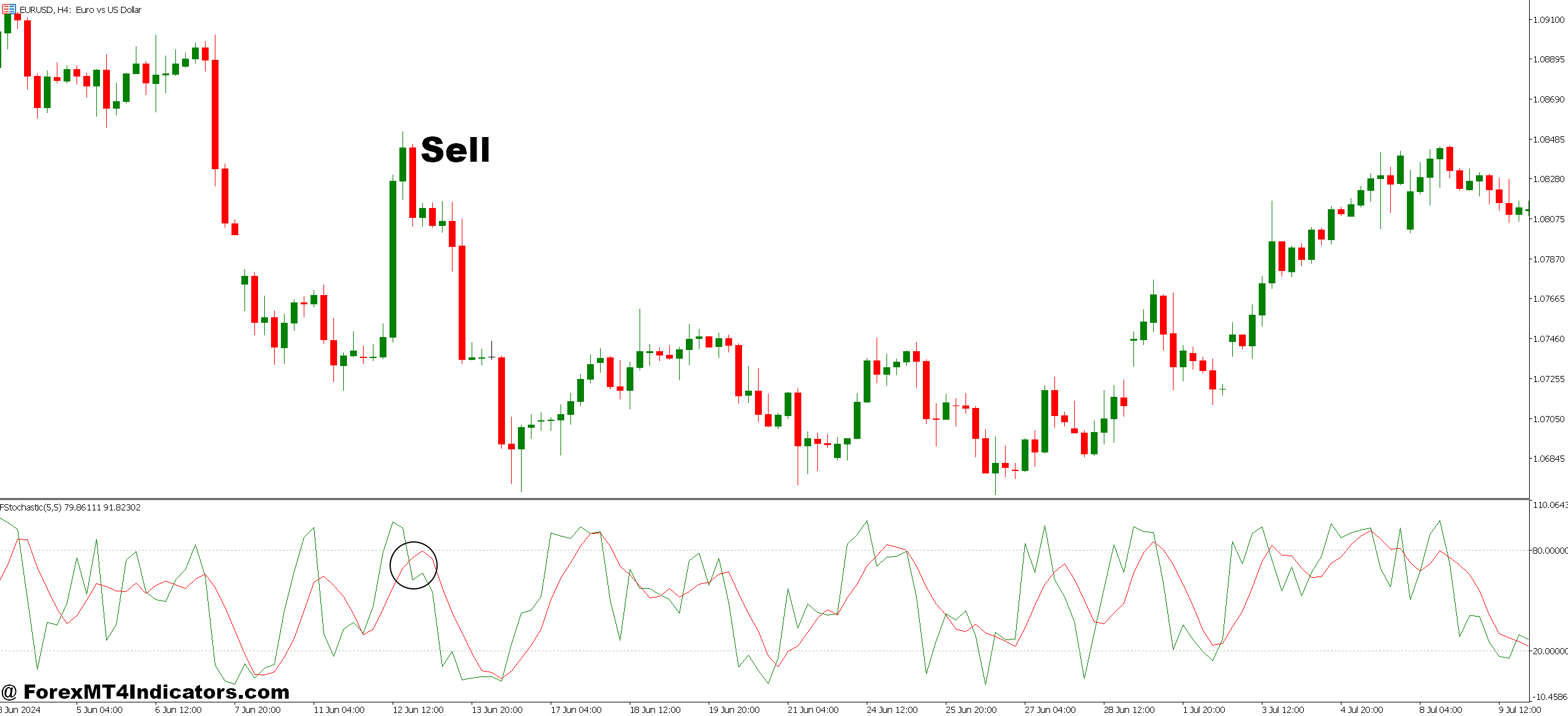

Promote Entry

- Overbought crossover above 80 – Promote when %Ok crosses under %D whereas each strains are above 80 on EUR/USD 4-hour chart, putting stops 25-35 pips above latest swing excessive.

- Bearish divergence play – When value makes larger highs however stochastic kinds decrease highs on day by day GBP/USD, quick after stochastic drops under 70 with affirmation candle.

- Vary resistance rejection – Promote when stochastic reaches 80-85 at confirmed resistance on 1-hour charts, however cancel if value breaks resistance cleanly with quantity.

- Failed breakout sign – Quick when stochastic hits overbought (80+), value touches resistance, then reverses with bearish engulfing candle inside 2-3 intervals.

- Pattern retest entry – In downtrends under 200 EMA, promote when stochastic bounces to 50-60 zone throughout pullbacks, coming into sooner than ready for full 80 studying.

- Skip in sturdy uptrends – Ignore overbought alerts when value is 100+ pips above 50 MA on 4-hour charts, as trending markets keep overbought for prolonged intervals.

- Information occasion warning – Don’t commerce stochastic alerts half-hour earlier than or after main information (NFP, FOMC, CPI), as volatility creates false alerts and huge spreads.

- Path stops after 30+ pips – As soon as your quick runs 30-40 pips in revenue, transfer cease to breakeven and let stochastic staying oversold information your exit timing.

Making the Stochastic Work for Your Buying and selling

The MT5 Stochastic Indicator received’t rework your buying and selling in a single day, however it might probably present actual worth when used intelligently. It really works finest for timing entries in ranging markets, recognizing divergence throughout traits, and confirming momentum shifts alongside different evaluation strategies.

Hold your expectations practical. No indicator catches each transfer or avoids each shedding commerce. The merchants who revenue persistently with stochastic use it as one piece of a broader technique combining it with value motion, help and resistance, and stable danger administration. In addition they know when to disregard it fully, like when markets are trending onerous or throughout high-impact information occasions.

Buying and selling foreign exchange carries substantial danger, and indicators are instruments, not ensures. Take a look at any setup on a demo account first, preserve your place sizes manageable, and by no means danger capital you’ll be able to’t afford to lose. The stochastic might help you learn momentum however the choices, and the accountability, stay yours.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90