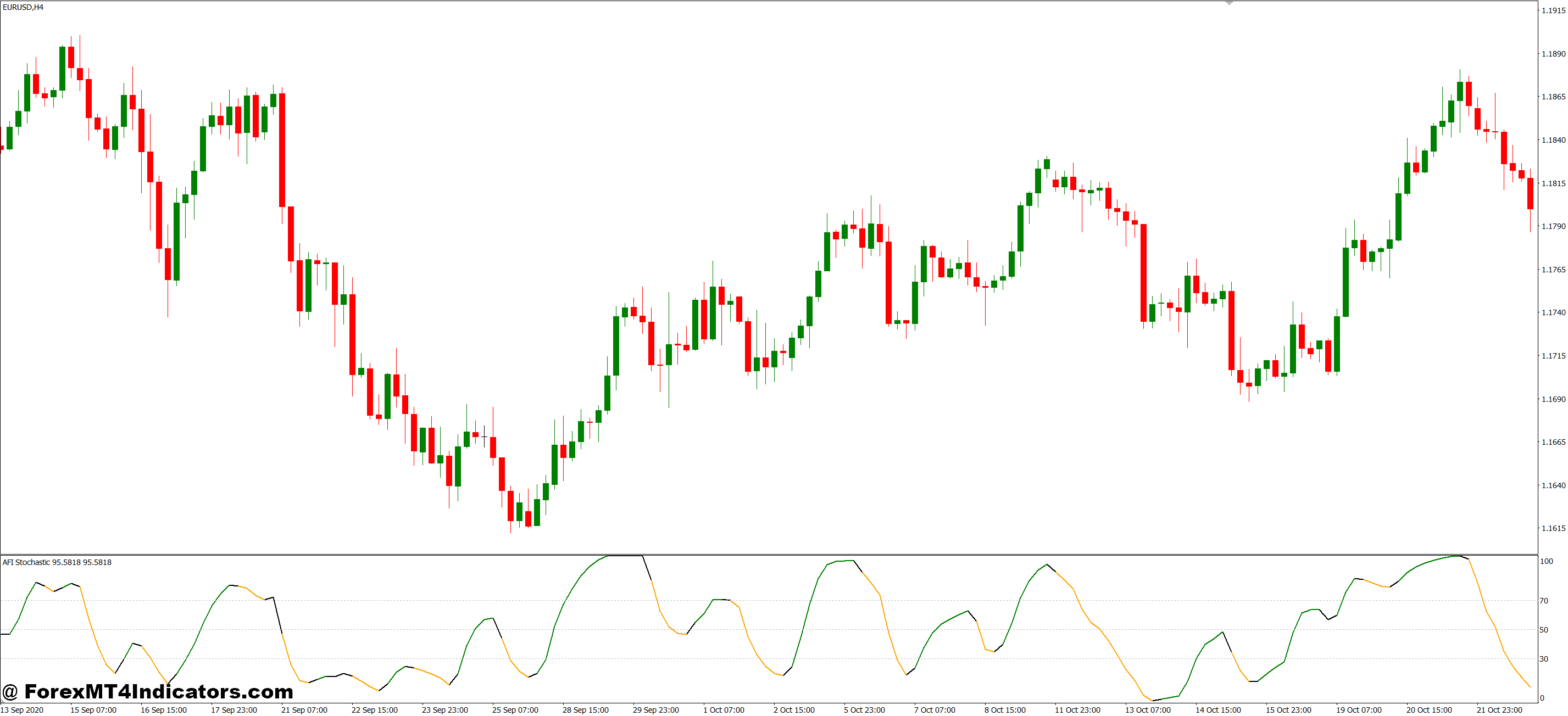

The Stochastic indicator compares a foreign money pair’s closing value to its value vary over a set variety of durations. George Lane developed it within the Nineteen Fifties on a easy commentary: in an uptrend, costs have a tendency to shut close to the highs, whereas downtrends see closes close to the lows.

The indicator produces two strains—%Ok and %D—that oscillate between 0 and 100. The %Ok line is the sooner, extra reactive line. The %D line smooths out %Ok, appearing like a sign line. When %Ok crosses above %D close to the oversold zone (beneath 20), it suggests shopping for strain is constructing. A cross beneath %D close to overbought ranges (above 80) warns that sellers may take management.

Right here’s what makes it completely different from easy transferring averages or development indicators: Stochastic doesn’t care whether or not value is at 1.0850 or 1.0950. It solely cares the place the present shut sits inside the latest vary. This relative positioning reveals momentum shifts that absolute value ranges miss.

The Math Behind the Sign

The usual calculation makes use of a 14-period lookback. The system divides the distinction between the present shut and the 14-period low by the full 14-period vary, then multiplies by 100.

So if GBP/USD closes at 1.2650, and over the previous 14 hours (on a 1-hour chart) the low was 1.2600 and the excessive was 1.2700, you’d calculate: (1.2650 – 1.2600) / (1.2700 – 1.2600) × 100 = 50. A studying of fifty means value is closing proper in the course of its latest vary—no momentum edge both means.

When readings climb above 80, value has been closing close to the highest of its vary repeatedly. That’s robust bullish momentum, nevertheless it additionally means the transfer is perhaps overextended. Under 20 alerts the alternative—constant closes close to the lows, suggesting both robust bearish momentum or an oversold bounce alternative.

The %D line applies a 3-period transferring common to %Ok, which is why crossovers between these strains generate buying and selling alerts.

Actual Buying and selling Situations: The place Stochastic Shines

Let’s get particular. On July 18, 2024, EUR/USD spent the Asian and early London classes grinding larger on the 15-minute chart. By 9:00 AM GMT, Stochastic had pushed above 80 and stayed there for 3 consecutive candles. Value regarded robust, however momentum was stalling.

At 9:15 AM, %Ok crossed beneath %D on the 83 stage. Inside two candles, EUR/USD reversed 25 pips. Merchants utilizing Stochastic prevented chasing that top and both stayed flat or positioned for the pullback.

However right here’s the factor—Stochastic additionally generated a false sign earlier that morning. At 7:30 AM, it dipped to 25 and crossed upward, suggesting a purchase. Value did bounce 10 pips earlier than rolling over into new lows. That’s the trade-off: you get early alerts, however not all of them play out.

Vary-bound markets are the place Stochastic actually earns its preserve. When USD/JPY trades between 149.50 and 150.20 for a whole session, conventional development indicators give uneven, conflicting alerts. Stochastic, nonetheless, helps pinpoint the vary extremes. Readings above 80 close to 150.20 recommend shorting towards the vary backside. Under 20 close to 149.50 alerts a possible bounce.

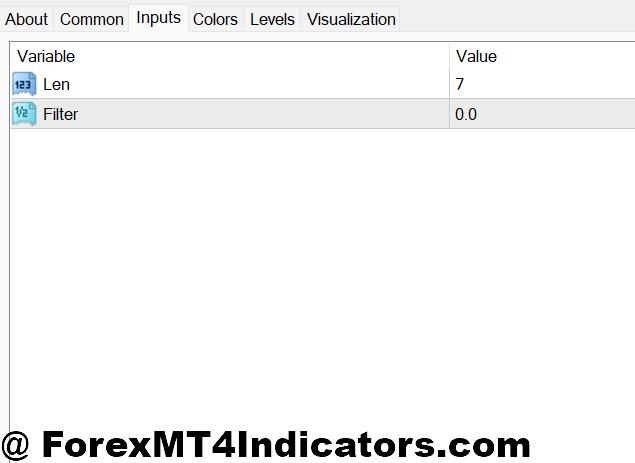

Customizing Settings for Completely different Fashion

The default 14-period setting works properly for swing buying and selling on 4-hour or each day charts. However scalpers and day merchants usually want sooner alerts.

For the 5-minute chart, some merchants drop the %Ok interval to eight or 9. This makes the indicator extra responsive, catching fast momentum shifts throughout London or New York classes. The draw back? Extra whipsaws. You’ll see overbought and oversold readings continually, many main nowhere.

On the flip aspect, place merchants utilizing each day or weekly charts may lengthen the interval to 21 and even 25. This filters out noise however means fewer alerts. You gained’t catch each swing, however the ones you do catch are usually larger high quality.

The smoothing interval (sometimes 3 for each %Ok and %D) may also be adjusted. Growing it to five creates smoother strains with fewer crossovers. Fewer alerts, much less noise, however probably slower entries. Day merchants typically follow 3, whereas swing merchants experiment with 4 or 5.

Foreign money pair volatility issues too. GBP/JPY swings more durable than EUR/CHF, so similar settings produce completely different outcomes. Testing in your particular pairs and timeframes beats blindly accepting defaults.

Strengths, Weaknesses, and What Merchants Get Improper

Stochastic excels at figuring out potential reversals earlier than they occur. That’s highly effective in range-bound markets or when buying and selling counter-trend pullbacks in robust traits. It additionally helps keep away from the basic mistake of shopping for breakouts proper as momentum dies.

The limitation? Sturdy traits break Stochastic. Throughout a robust directional transfer, the indicator can keep pegged above 80 or beneath 20 for hours and even days. Merchants who brief just because readings hit 85 get steamrolled when momentum persists.

That’s why skilled merchants mix it with development filters. If the 200-period transferring common slopes upward and value trades above it, ignore oversold Stochastic readings—they’re simply pullbacks in a wholesome uptrend. Solely take overbought alerts towards the development or search for divergences.

Divergence is the place Stochastic exhibits its experience. When EUR/GBP makes the next excessive however Stochastic makes a decrease excessive, momentum is weakening regardless of rising costs. This divergence usually precedes reversals. Recognizing it requires expertise, nevertheless it’s one of the dependable Stochastic setups.

Stochastic vs. RSI: Choosing the Proper Instrument

Merchants usually confuse Stochastic with RSI since each oscillate between 0 and 100 and determine overbought/oversold situations. The important thing distinction: RSI measures the magnitude of latest value modifications, whereas Stochastic measures the place the shut sits inside the latest vary.

In trending markets, RSI tends to carry out higher. It doesn’t keep pinned at extremes so long as Stochastic does, so that you get fewer false reversal alerts throughout robust runs.

Stochastic wins in ranging markets and for timing particular entries. The twin-line crossover system offers clearer entry alerts than RSI’s single line. Many merchants run each—RSI for development context, Stochastic for entry timing.

Methods to Commerce with MT4 Stochastic Indicator

Purchase Entry

- %Ok crosses above %D beneath 20 – Await each strains to drop below the 20 stage on EUR/USD 1-hour chart, then enter when %Ok crosses upward by %D, focusing on 20-30 pip strikes.

- Bullish divergence at assist – When GBP/USD makes a decrease low however Stochastic makes the next low close to the 15-25 zone, value momentum is shifting; enter on the following bullish candle shut with a 25-pip cease.

- Double-bottom in oversold zone – If Stochastic touches beneath 20 twice inside 10-15 candles on the 4-hour chart with out breaking decrease, purchase the second bounce as promoting strain exhausts.

- Exit oversold throughout uptrend – On each day charts with value above the 200 EMA, purchase when Stochastic climbs again above 20 after an oversold dip; don’t look ahead to it to achieve 50—momentum is already turning.

- Confirmed by value motion – By no means purchase on Stochastic sign alone; look ahead to a bullish engulfing candle or pin bar rejection on the oversold stage to verify purchaser curiosity.

- Threat 1.5% most per commerce – Even with good Stochastic alignment, restrict place measurement so a 30-pip cease equals not more than 1.5% of your account; indicators fail, threat administration saves you.

- Keep away from throughout robust downtrends – Skip all purchase alerts when value is beneath the 50 and 200 EMA on the 4-hour chart; Stochastic can keep oversold for 20+ candles in highly effective selloffs.

- Set real looking revenue targets – Ebook 50-70% of the place at 2:1 risk-reward (40-60 pips if risking 20); let the rest run with a trailing cease as Stochastic approaches 80.

Promote Entry

- %Ok crosses beneath %D above 80 – Enter brief on EUR/USD 1-hour chart when %Ok drops by %D after each strains exceed 80, putting stops 5 pips above the latest swing excessive.

- Bearish divergence at resistance – When value makes the next excessive however Stochastic peaks decrease on the 4-hour GBP/USD chart above 75, momentum is fading; brief the following bearish candle with 30-pip cease.

- Rejection from excessive overbought – If Stochastic hits 95+ and instantly reverses on the 15-minute chart throughout London open, promote aggressively for fast 15-20 pip scalps earlier than the pullback completes.

- Failed breakout above 80 – When %Ok pushes above 80 however can’t pull %D with it and as an alternative crosses again down, it alerts weak shopping for; brief with conviction on the crossover.

- Overbought in ranging markets – Between 8 AM-12 PM GMT when USD/JPY trades in a 40-pip vary, promote each Stochastic studying above 85 towards the vary midpoint with tight 15-pip stops.

- Don’t struggle prolonged rallies – Ignore overbought alerts above 80 if the each day chart exhibits value climbing with robust bullish candles; look ahead to precise development construction breaks or decrease timeframe divergence first.

- Path stops as Stochastic drops – As soon as brief and worthwhile with Stochastic declining from 80 towards 50, transfer your cease to breakeven at 10 pips revenue, then path it 15 pips behind value.

- Exit earlier than oversold extremes – Shut 75% of your brief place when Stochastic reaches 25-30 on the 1-hour chart; attempting to squeeze out the final 10 pips usually leads to giving again 20.

Placing It All Collectively

The Stochastic oscillator provides merchants a window into momentum shifts that value alone doesn’t reveal. It really works greatest in ranging markets, for timing pullback entries in traits, and for recognizing divergences that sign exhaustion. The twin-line crossover system offers particular entry alerts, whereas overbought/oversold zones determine potential reversal areas.

However it’s not good. Sturdy traits render it ineffective except you’re filtering alerts with the broader context. False alerts occur, particularly on decrease timeframes or with aggressive settings. And like several technical software, it requires follow to learn appropriately.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and previous efficiency doesn’t predict future outcomes. Stochastic can enhance your timing and decision-making, however solely when mixed with stable threat administration and real looking expectations.

Begin by including it to your charts and easily observing. Watch how readings behave throughout completely different market situations. Notice when crossovers result in precise value motion and after they fail. That hands-on expertise will educate you greater than any article can. The indicator is only a software—your judgment about when to make use of it makes all of the distinction.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90