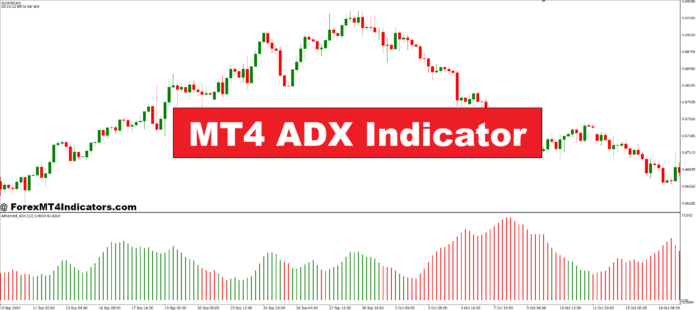

The Common Directional Index (ADX) is a momentum oscillator that quantifies development power on a scale from 0 to 100. Developed by J. Welles Wilder in 1978, it’s one of many few indicators that doesn’t care whether or not the market’s going up or down—it solely cares how forcefully it’s shifting.

Right here’s what makes it completely different: Whereas RSI tells you if one thing’s overbought and MACD alerts momentum shifts, ADX solutions an easier query: “Is that this development value buying and selling?” A studying beneath 20 suggests weak, uneven value motion. Above 25 signifies a creating development. Something north of fifty alerts a robust development that usually continues.

The indicator seems as a single line on MT4, normally plotted beneath your value chart. Two companion traces—+DI (optimistic directional indicator) and -DI (unfavourable directional indicator)—usually accompany it, although many merchants focus solely on the ADX line itself.

How ADX Calculates Pattern Power

Understanding the mathematics helps you belief what you’re seeing. ADX derives from the connection between two directional indicators. Wilder’s components compares the distinction between consecutive highs and lows, then smooths these values over a specified interval (usually 14).

The calculation includes three steps. First, it measures the directional motion—each optimistic (present excessive minus earlier excessive) and unfavourable (earlier low minus present low). Second, it determines which directional motion is dominant. Third, it averages these values to provide the ADX line. The result’s a smoothed indicator that responds to development adjustments however filters out minor value fluctuations.

What issues for sensible buying and selling: ADX rising means development power is constructing. ADX falling alerts weakening momentum, even when value continues trending. This lag is intentional—it prevents false alerts throughout transient consolidations.

Buying and selling the ADX: Actual-World Software

The candy spot for ADX entries sits between 25 and 50. When ADX crosses above 25 with value breaking a key degree, you’ve obtained affirmation that the transfer has legs.

Take a latest instance on USD/JPY. The pair broke above 150.00 with ADX at 18—barely shifting. Early patrons obtained stopped out as value chopped round for 2 days. However when value retested 150.00 and ADX climbed to twenty-eight, that breakout had actual momentum. The following 200-pip rally to 152.00 lasted 5 days.

Right here’s the place merchants mess up: They enter when ADX already reads 60 or 70. That’s late. Robust ADX readings above 50 usually precede exhaustion. The most effective risk-reward comes from catching developments as ADX transitions from weak (beneath 20) to reasonable (25-40).

For vary buying and selling, flip the script. ADX beneath 20 alerts uneven situations—excellent for purchasing help and promoting resistance. On EUR/GBP’s 4-hour chart, ADX spent three weeks below 18 whereas value bounced between 0.8300 and 0.8360. Merchants who acknowledged this sideways market made constant earnings fading the extremes.

The directional indicators (+DI and -DI) add one other layer. When +DI crosses above -DI with ADX rising, that’s a bullish affirmation. The reverse alerts bearish momentum. However don’t obsess over these crossovers—the ADX line itself tells you what issues most.

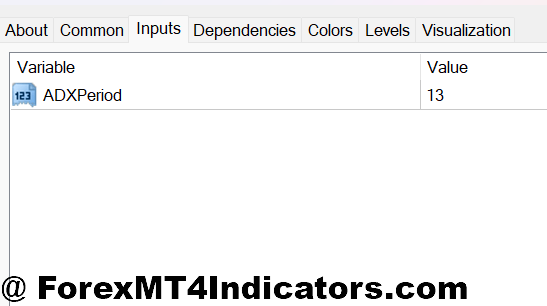

Optimizing ADX Settings for Completely different Buying and selling Types

The default 14-period setting works nicely for every day charts, but it surely’s not gospel. Scalpers want quicker suggestions. Dropping ADX to 7 or 9 intervals on a 5-minute chart supplies earlier development alerts, although you’ll catch extra false strikes. Day merchants usually stick to 14 intervals on hourly charts—it strikes a stability between responsiveness and reliability.

Swing merchants weekly charts may lengthen ADX to twenty or 25 intervals. This smooths out noise and focuses on main development shifts. One foreign exchange supervisor I do know makes use of 21-period ADX on every day charts for place trades, coming into solely when ADX crosses 30. His hit price improved noticeably after making this adjustment.

Risky pairs like GBP/JPY profit from barely longer ADX intervals (16-18) to keep away from getting whipsawed throughout regular value fluctuations. In the meantime, slower-moving pairs like EUR/CHF can use normal settings since they don’t expertise the identical intraday chaos.

The ADX threshold issues too. Aggressive merchants may enter at 20, accepting extra marginal setups for earlier entries. Conservative merchants await 30, sacrificing some revenue potential for higher-probability trades. Take a look at each approaches in your most popular pairs and timeframes—what works on AUD/USD may fail on USD/CAD.

Strengths, Weaknesses, and What ADX Can’t Do

ADX excels at preserving you out of unhealthy trades. When it’s beneath 20, the market’s going nowhere quick. This alone saves merchants from numerous shedding positions throughout consolidation intervals. It additionally helps maintain successful trades longer—rising ADX confirms you must let earnings run.

However ADX received’t let you know when to enter or exit. It measures power, not route. You want value motion, help and resistance, or one other indicator to time your precise trades. Some merchants pair ADX with shifting common crossovers or trendlines to resolve this downside.

The lag is actual. ADX responds to development adjustments after they’ve already began. You’ll not often catch absolutely the starting of a transfer. That’s the tradeoff for fewer false alerts. Throughout sudden reversals, ADX may nonetheless learn 40 or 50 whereas value has already turned—it wants time to acknowledge the shift.

In comparison with Bollinger Bands or ATR, ADX focuses purely on development persistence moderately than volatility. It received’t widen throughout uneven markets the way in which Bollinger Bands do. Towards indicators like Ichimoku or Supertrend, ADX is less complicated however much less complete. You get one clear studying as an alternative of a number of alerts—which is both limiting or refreshing, relying in your model.

Buying and selling foreign exchange carries substantial threat. No indicator ensures earnings, and ADX can hold you in shedding trades should you ignore different market elements. It’s a software, not a crystal ball. Threat administration and correct place sizing matter greater than any technical indicator.

Tips on how to Commerce with MT4 ADX Indicator

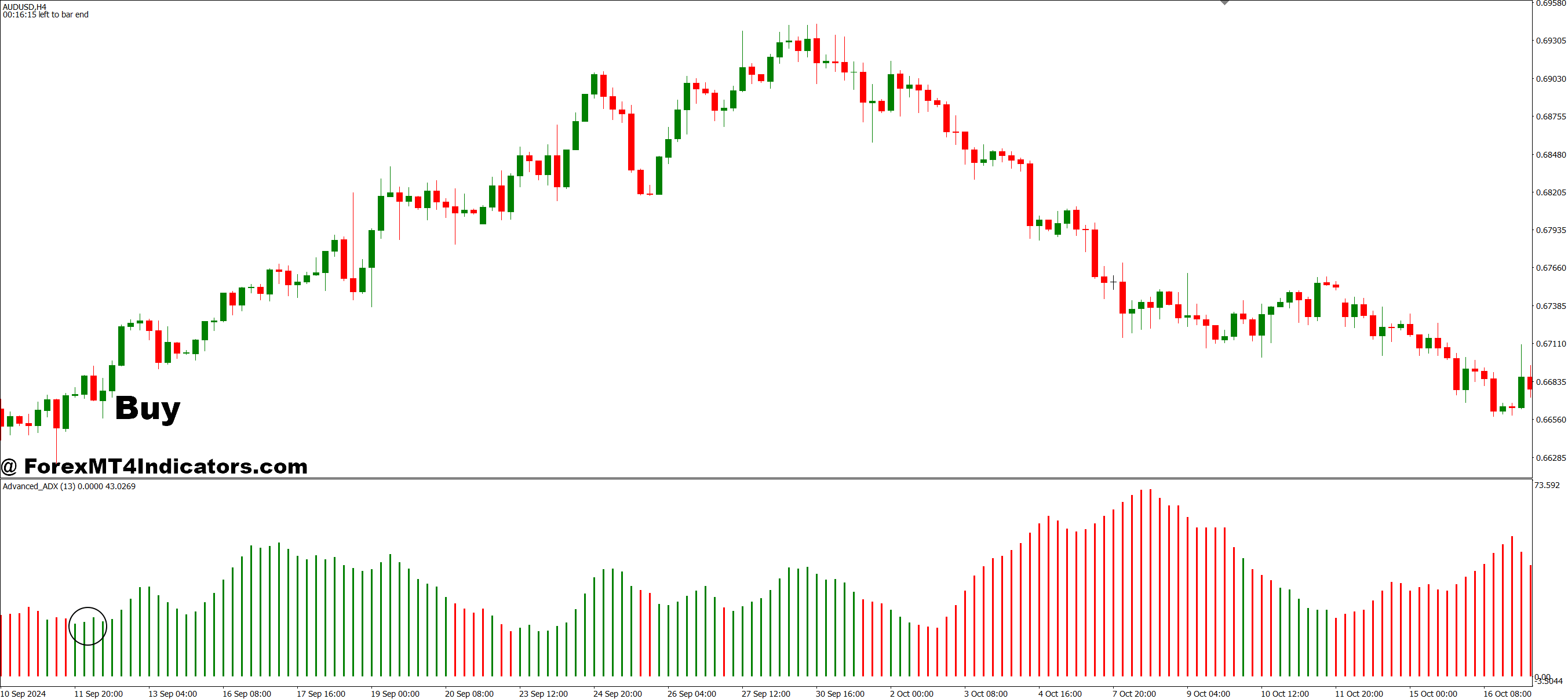

Purchase Entry

- ADX crosses above 25 with rising momentum – Enter lengthy when ADX breaks 25 whereas trending upward and value is above the 20-period EMA on EUR/USD 4-hour charts; this confirms strengthening bullish momentum value buying and selling.

- +DI crosses above -DI with ADX above 20 – Take purchase positions when the optimistic directional indicator overtakes the unfavourable one and ADX reads not less than 20, signaling bulls are taking management with measurable power.

- Look forward to ADX between 25-40 on breakouts – Don’t chase when ADX already exceeds 50; enter GBP/USD breakouts solely when ADX is constructing (25-40 vary) to catch the development early with 30-50 pip cease losses.

- Worth retests help with ADX rising from beneath 20 – Purchase the retest when ADX climbs from weak readings (below 20) to 23-25, indicating the market is transitioning from chop to development on 1-hour timeframes.

- Keep away from entries when ADX is falling – Skip purchase alerts if ADX is declining even with greater costs; falling ADX above 40 usually precedes reversals, so await ADX to stabilize or rise once more.

- Mix with key psychological ranges – Solely take ADX purchase alerts close to spherical numbers like 1.1000 on EUR/USD or after breaking earlier swing highs; ADX confirms power however wants value construction for timing.

- Set stops beneath latest swing low minus 20 pips – Place cease losses beneath the newest low with buffer room; if ADX reads 28-35, your development has momentum however wants correct threat administration with 1:2 minimal risk-reward.

- Exit if ADX peaks above 60 then drops 5 factors – Shut lengthy positions when extraordinarily excessive ADX (60+) begins declining, even when value hasn’t reversed but; this alerts momentum exhaustion on every day charts earlier than the precise prime types.

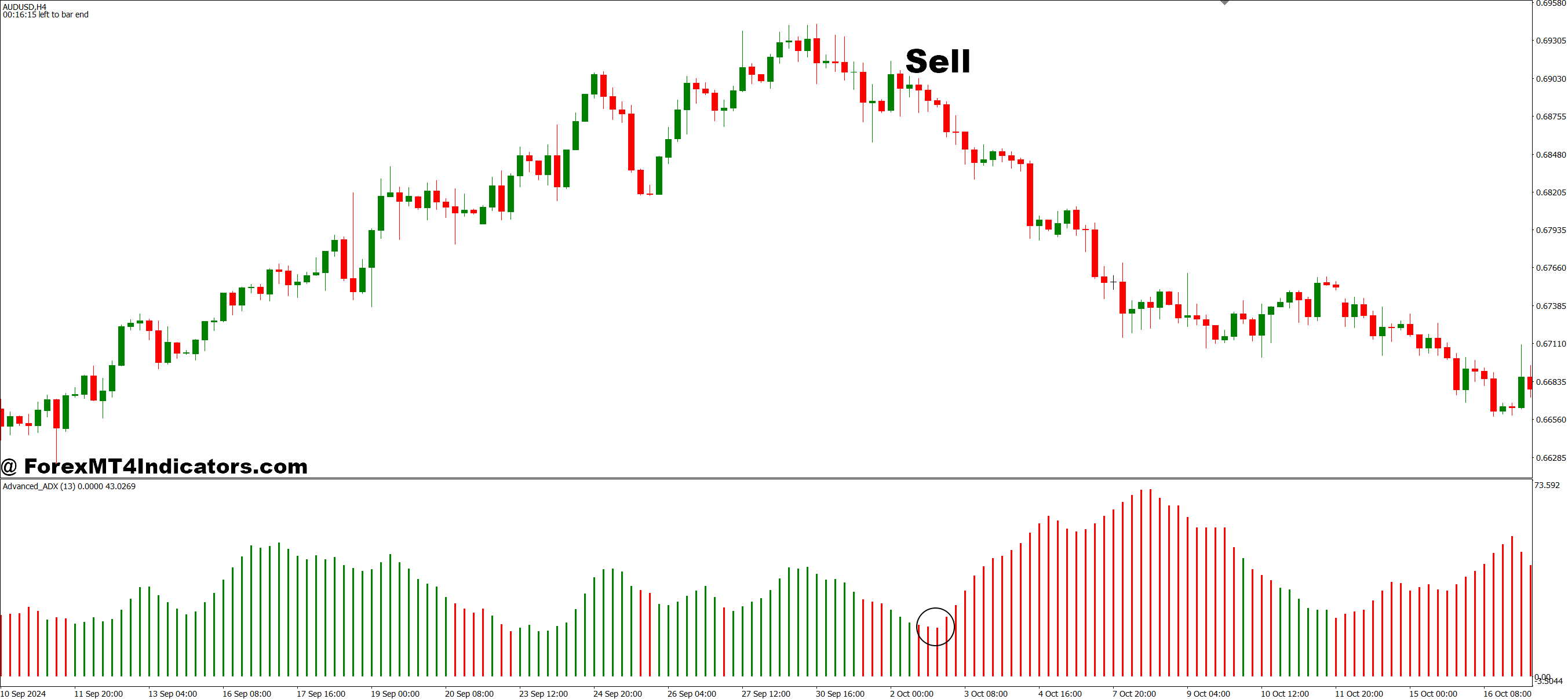

Promote Entry

- ADX crosses above 25 with value beneath key shifting common – Enter quick when ADX breaks 25 whereas value trades below the 50-period EMA on GBP/USD every day charts; robust downtrend affirmation with measurable momentum behind the transfer.

- -DI crosses above +DI with ADX rising previous 20 – Take promote positions when unfavourable directional indicator dominates and ADX climbs from weak readings, exhibiting bears are constructing management with growing stress on 4-hour timeframes.

- Brief failed rallies with ADX 30-45 – Promote when value makes an attempt to rally however stalls at resistance whereas ADX reads 30-45 in downtrend; this means robust bearish momentum will doubtless resume after transient consolidation.

- ADX rises from consolidation beneath 20 – Enter shorts when ADX breaks above 20-23 after extended sideways motion below 18; markets transitioning from vary to development provide cleanest entries with 40-60 pip stops on EUR/USD.

- By no means quick when ADX is beneath 20 – Keep away from promote alerts throughout low ADX readings (below 20); weak developments reverse regularly, and shorting uneven markets results in whipsaw losses even with excellent value motion setups.

- Use earlier swing excessive plus 20 pips for stops – Place cease losses above the latest excessive with buffer; if ADX confirms downtrend at 30+, shield capital with stops and goal 1:3 risk-reward towards subsequent help degree.

- Fade power when ADX exceeds 55-60 – Take into account taking earnings or avoiding new shorts when ADX climbs above 55; excessive readings usually precede exhaustion strikes, particularly on unstable pairs like GBP/JPY throughout information occasions.

- Exit when ADX falls beneath 25 in downtrend – Shut quick positions if ADX drops below 25 even with decrease costs; declining ADX alerts momentum is fading and the downtrend could stall or reverse quickly on 1-hour charts.

Making ADX Work in Your Buying and selling Plan

The ADX indicator earned its place in MT4 for good cause—it solutions a query most merchants overlook till they’ve already entered a nasty commerce. Robust developments don’t seem out of nowhere; they construct momentum steadily. ADX quantifies that buildup, supplying you with goal knowledge as an alternative of intestine emotions.

Sensible merchants use ADX as a filter, not a standalone system. It confirms whether or not your setup is value taking or should you’re higher off ready. That EUR/USD breakout, GBP/JPY vary, or USD/CAD development—ADX tells you which of them market situation you’re really dealing with.

Don’t anticipate perfection. Count on readability on one essential variable: Is that this transfer robust sufficient to commerce? When you cease forcing trades throughout weak-ADX environments, your win price usually improves. The chance value of missed trades is actual, however the precise value of unhealthy trades is way greater.

Begin by observing ADX in your charts for every week with out buying and selling. Watch the way it behaves throughout developments versus ranges. Discover when it spikes and when it stays flat. That sample recognition builds the instinct that turns ADX from simply one other line in your chart into a real edge.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90