From my perspective, what we’re seeing proper now is just not a market that’s making ready for the subsequent main leg increased throughout the board, however one that’s quietly flashing late-cycle alerts. When a number of topping indicators start to align, momentum begins to stall, and sentiment turns into one-sided, historical past reveals that threat is rising, not falling. That is typically the part the place capital begins rotating aggressively between property fairly than lifting all the pieces collectively, which is why volatility tends to extend, and surprises catch traders off guard.

In environments like this, defending capital and respecting exit alerts turns into way more vital than chasing power. Belongings resembling gold, silver, miners, and even Bitcoin can nonetheless present spectacular momentum bursts, however these strikes incessantly happen close to the later levels of a cycle and are sometimes adopted by sharp corrections. Bond yields and leveraged merchandise are additionally sending vital alerts, suggesting that the market could also be nearer to a reset than most headlines suggest. As at all times, the purpose is to not predict the long run, however to remain aligned with what worth, development, and capital flows are telling us proper now.

Join my free Investing publication right here

The matters David and I mentioned embrace:

- 0:00 – Intro.

- 1:15 – Topping indicators

- 3:02 – Metals and a correction

- 5:35 – Rotation

- 10:23 – Gold and silver momentum

- 14:09 – Bitcoin and Gold

- 17:44 – Miners and exit technique

- 21:53 – Convention sentiment examine and leveraged merchandise

- 24:16 – Bond yields pointing towards 8.3% and asset rotation technique

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

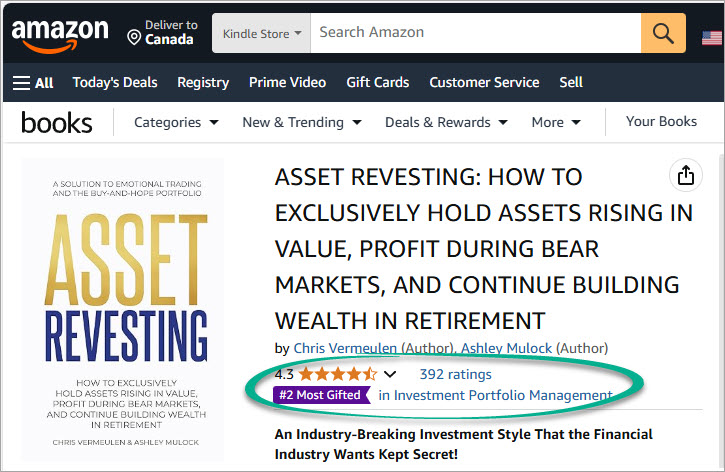

MY FREE INDICATORS IN MY BOOKS

Disclaimer: This electronic mail is meant solely for informational and academic functions and shouldn’t be construed as customized funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Change Fee or any state regulator. The content material supplied doesn’t represent a advice to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to alter with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions might change at any time with out discover. Readers are solely answerable for their very own funding selections. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding selections. Efficiency outcomes referenced might embrace each stay buying and selling information and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t replicate precise buying and selling. No illustration is being made that any account will or is more likely to obtain earnings or losses much like these proven. Testimonials and endorsements included on this communication will not be consultant of all customers’ experiences and usually are not ensures of future efficiency or success. We might obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material supplied is common market commentary and never tailor-made to any particular person’s monetary scenario. Previous efficiency is just not indicative of future outcomes. Investing entails threat, together with the potential lack of capital.