Good night, merchants and buyers.

Equities kicked off the week on a powerful observe. The Nasdaq led the cost, rising +1.5%, whereas the S&P 500 and Dow additionally superior. The Russell 2000 (small caps) and micro caps (IWC) bounced, however stay mid-range after final week’s swings.

Momentum continues to oscillate between concern and FOMO, with merchants chasing the market larger someday and bailing out the subsequent. The Magnificent Seven carried a lot of at present’s upside, driving the Nasdaq again towards all-time highs and reigniting optimism—but additionally creating one other short-term overbought situation.

Market Insights, Information & Economic system

Inventory Market Pattern

Right now’s gap-up open fueled broad pleasure, however our indicators present the transfer was pushed largely by emotion, not dedication.

- The FOMO indicator turned purple all through a lot of the session—signaling overbought circumstances as merchants piled in “hand over fist.”

- Regardless of robust positive aspects, market internals stay weak; a number of sentiment and quantity research present large cash rotating out as retail inflows dominate.

- On the S&P 500, at present’s bars nonetheless sit inside final week’s giant purple candle, holding the general construction technically bearish.

For now, the development stays up, however the setup mirrors previous topping phases, the place establishments distribute shares whereas public enthusiasm peaks.

System Standing & Positioning

Our ACS and BAN methods each executed exits this morning close to the open, locking in stable positive aspects as volatility will increase.

- We’re on the sidelines, defending earnings whereas ready for clear affirmation of the subsequent directional transfer.

- SPY and QQQ each exited close to morning energy.

- The market is now in what I name “no man’s land”—neither a confirmed breakout nor a confirmed breakdown.

Till recent development indicators type, our focus stays on capital preservation.

Sizzling Checklist & Sector Rotation

Our proprietary Sizzling Checklist—which blends cash move, sentiment, and quantity metrics—confirmed principally “risk-off” readings at present.

Whilst costs climbed, the information suggests this was an emotional bounce, not a well-funded rally.

Roughly half of sectors stay in short-term uptrends, half in downtrends.

The long-term stage evaluation nonetheless reads bullish, however short-term indicators stay indecisive.

Overbought & Oversold Psychology

Latest value swings completely illustrate how markets oscillate between panic promoting and FOMO shopping for.

- Final week’s tariff panic flushed out weak fingers.

- The following day, those self same merchants piled again in, creating back-to-back extremes.

We’re presently on the higher finish of that emotional cycle once more, suggesting a attainable short-term pause or pullback throughout the subsequent session or two.

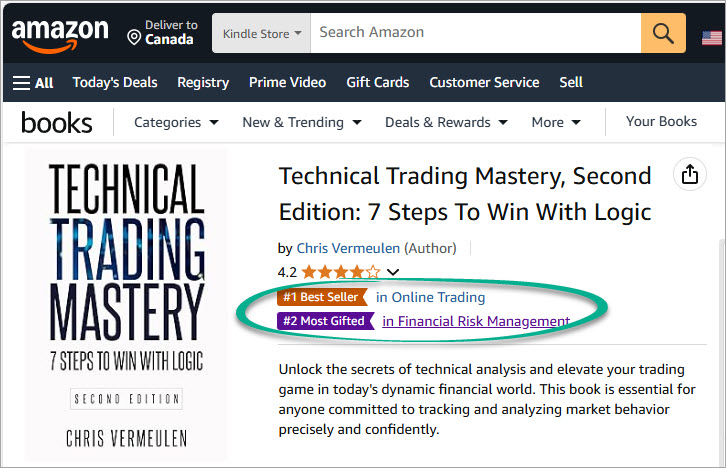

As proven in my ebook Technical Buying and selling Mastery (Chapters 10–12), combining development, panic, and FOMO indicators offers highly effective perception into the place feelings sit inside every cycle.

Market Momentum Bar Chart Instrument

I shared a brand new short-term momentum instrument with members just lately—a bar chart oscillator based mostly on a number of high-volume shares.

Right here’s the way it works:

- Readings above 101 = short-term overbought (probably pause/pullback).

- Readings under 99 = short-term oversold (probably bounce).

Right now’s studying sits nicely above 101, implying the market may see a quick exhaustion hole larger tomorrow, adopted by potential intraday promoting as profit-takers step in.

In plain phrases: at present’s patrons are tomorrow’s sellers.

Member Questions & Insights

1. Oil & Information-Pushed Strikes

One member requested why we “ignored” a previous oil spike however reacted to the latest inventory market drop.

The reply lies in context and construction.

- The oil spike was a one-off, news-driven occasion inside a gradual downtrend.

- The latest fairness drop occurred amid multi-sector cash move adjustments, signaling deeper structural shifts.

Briefly, oil’s transfer was noise; the inventory market’s transfer is a part of a broader rotation.

2. Uranium’s Parabolic Part

Uranium stays a crowded commerce—quantity close to data, volatility excessive.

The rally has reached measured transfer targets, gapped above Fibonacci extensions, and instantly reversed—a traditional exhaustion transfer.

At this stage, uranium’s path is a coin toss, with potential for each blow-off spikes and sharp purple bars.

3. Gold & Volatility

Gold continues to surge, with 4–5% every day swings changing into the brand new regular.

Measured strikes have accomplished, leaving us in “no man’s land” for brand spanking new setups.

Brief-term goal extensions level towards $4,625, however momentum may fade anytime.

For now, gold stays bullish however prolonged and unstable.

4. Sizzling Checklist: GDX, COPX, and Lithium

- GDX: Danger-off studying. Brief-term uptrend and long-term bullish, +47% since its final set off 54 days in the past.

- COPX: Momentum pullback ended its prior set off; nonetheless holding a bullish chart construction.

- Lithium: Misplaced its set off on final week’s volatility however retains robust moving-average alignment—value merely resetting.

Total, these sectors stay constructive so long as the broad market development doesn’t roll over.

Key Takeaways

- Equities: Robust day, however internals stay weak; rally pushed by emotion.

- Pattern: Nonetheless long-term bullish, however in a Stage 3 topping part.

- FOMO: Elevated; short-term overbought circumstances returning.

- Gold/Uranium: Prolonged; volatility excessive—shield positive aspects.

- Oil: Nonetheless weak; ignore short-term information spikes.

- Sizzling Checklist: Danger-off bias regardless of value positive aspects; endurance warranted.

Backside Line

Right now’s energy feels good, but it surely’s constructed on shaky floor.

We’re in a topping part, the place retail enthusiasm and emotional buying and selling dominate whereas good cash quietly steps apart.

Count on attainable gap-up exhaustion tomorrow, adopted by uneven motion as merchants flip from greed to concern once more.

We’re sitting ready of energy—earnings locked, capital protected, and able to re-engage when a clear development re-emerges.

Speak quickly, and commerce protected.

Chris Vermeulen

✔ PREMIUM ETF SIGNALS: https://thetechnicaltraders.com/investment-solutions/

✔ OPTIONS TRADING SIGNALS: https://thetechnicaltraders.com/ots/

✔ FREE ANALYSIS NEWSLETTER: https://TheTechnicalTraders.com/e-newsletter/

MY FREE INDICATORS IN MY BOOKS

Disclaimer:

The content material printed on this web site, together with weblog posts, movies, analysis articles, and commentary, is meant solely for informational and academic functions and shouldn’t be construed as funding recommendation. Technical Merchants Ltd. and its associates are not registered as funding advisers with the U.S. Securities and Trade Fee or any state securities authority. The data supplied is common in nature and is not tailor-made to the funding wants of any particular particular person. Nothing printed on this web site constitutes a suggestion to purchase, promote, or maintain any specific safety, commodity, or monetary instrument. The views expressed signify the opinions of the authors and are topic to vary at any time with out discover. Efficiency outcomes mentioned could embody reside buying and selling outcomes and/or backtested or hypothetical information. Hypothetical outcomes are inherently restricted and don’t replicate precise buying and selling efficiency. No illustration is made that any account will or is more likely to obtain earnings or losses just like these mentioned. Previous efficiency will not be indicative of future outcomes. All investments contain danger, together with the potential lack of principal. Testimonials and person experiences offered is probably not consultant of others and don’t assure future success. Some content material could include affiliate hyperlinks or promotional materials, from which we could earn compensation. This doesn’t affect our content material or editorial independence. By accessing this web site or consuming its content material, you acknowledge that you’re solely accountable for your personal monetary choices and comply with seek the advice of a licensed monetary skilled earlier than appearing on any info supplied.