Whereas the market concluded the week on a robust be aware on all entrance, satirically inventory choice can change into more and more difficult as a result of pullbacks all the time appear imminent. Opening new positions on shares which are rising from long-term bases within the upcoming weeks may be thought-about as buying and selling on severely lagging shares, notably when the market continues to distance itself from its shifting averages, resembling an expanded rubber band.

It could be extra prudent to prioritize shares which have already clinched their YTD highs as early as Could and have skilled slight pullbacks to their 10/20 shifting averages for previous weeks.

Thanks for studying.

PS: In case you benefit from the above curated article, you could comply with me on twitter (@jfsrevg) to get day by day market diary, buying and selling concepts and intermittent reflection on life as a dealer.

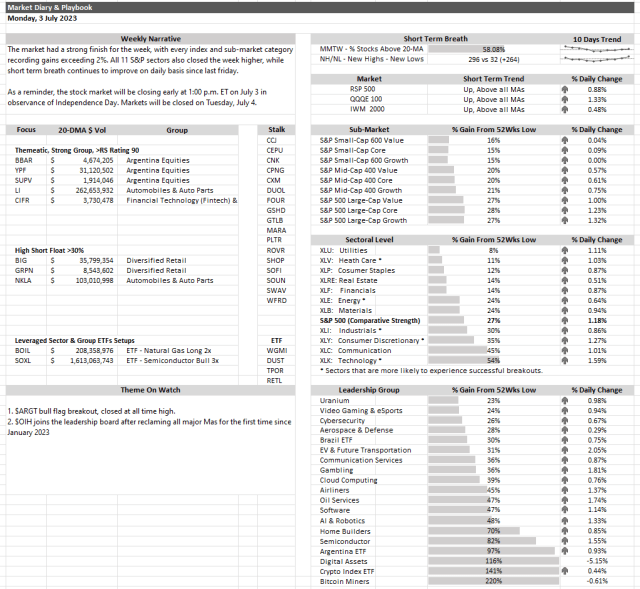

Week of three/7/2023 Market Diary,

Whereas the market concluded the week on a robust be aware on all entrance, satirically inventory choice can change into more and more difficult as a result of pullbacks all the time appear imminent. Opening new positions on shares which are rising from long-term bases within the… pic.twitter.com/YKOX0czkHK

— Jeff Solar, CFTe (@jfsrevg) July 2, 2023

The put up Market Diary & Playbook ($BBAR, $YPF, $LI, $CIFR and extra) first appeared on .