Introduction To The Lengthy Put Technique

Choices are utilized by buyers to make the most of a variety of projections on the state of the market.

Not like inventory investing, the place solely an increase makes cash, choices can revenue from falls out there, and a spread of different market actions reminiscent of adjustments in a safety’s volatility.

One such easy technique used within the lengthy put, detailed right here.

Description of the Lengthy Put Technique

The technique includes the acquisition of a put choice.

Places give the customer the fitting however not the duty to promote the underlying safety anytime* between now and the expiry date of the choice.

That is for ‘American’ fashion choices – as in comparison with European choices which may solely be exercised on the expiry date, not earlier than. Most choices traded on the CBOE that we’ll cowl are American choices.

For instance suppose a put choice was bought with a strike worth of 140 and three months of time remaining till expiry. Anytime over the following 3 months we might train the choice and promote inventory for $140/share.

(If we didn’t personal inventory we might purchase some instantly earlier than exercising the choice – brokers would simply pay the distinction to us).

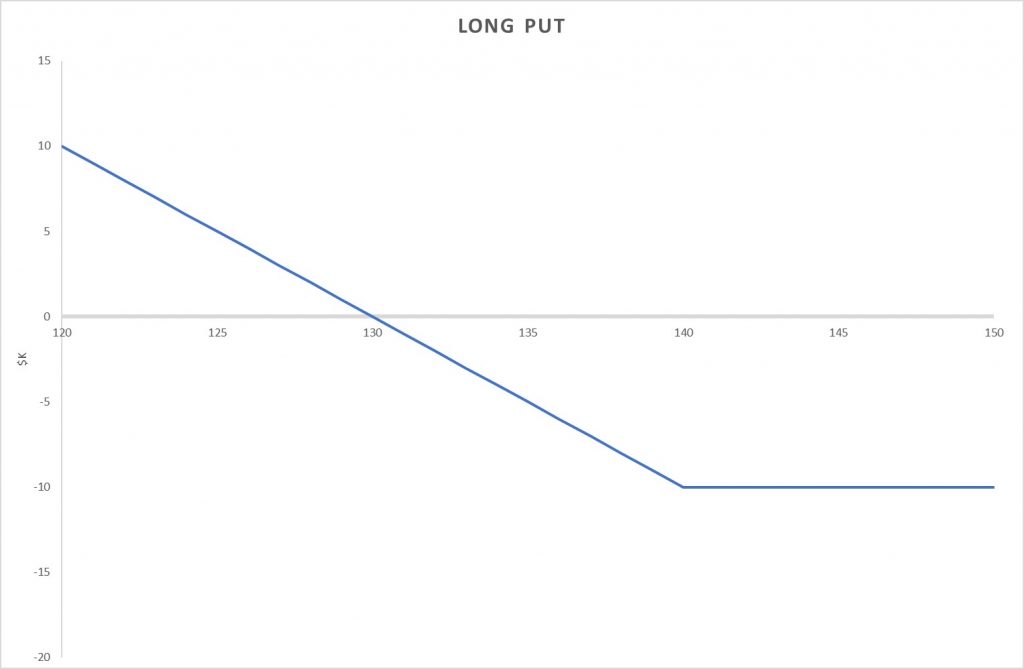

Most Acquire and Lack of the Lengthy Put

The utmost achieve is important, however is theoretically restricted to the strike worth minus the price of the choice, if the inventory drops to $0.

Your most loss is the quantity paid for the choice. If the inventory is anyplace above strike A, you’ll lose the identical amount of cash.

When and find out how to put a Lengthy Placed on

A protracted put can be positioned if we believed the underlying inventory was to fall, and fall fairly quickly (as we’ll see the put loses time worth).

A protracted put place is initiated when a purchaser purchases a put choice contract. Places are listed in an choice chain and supply related data for each strike worth and expiration out there, together with the bid-ask worth. The price to enter the commerce is known as the premium. Market members think about a number of elements to evaluate the worth of an choice’s premium, together with the strike worth relative to the inventory worth, time till expiration, and volatility.

Sometimes, put choices are costlier than their name choice counterparts. This pricing skew exists as a result of buyers are keen to pay the next premium to guard in opposition to draw back danger when hedging positions.

Lengthy Put market outlook

A protracted put is bought when the customer believes the value of the underlying asset will decline by a minimum of the price of the premium on or earlier than the expiration date. Additional out-of-the-money strike costs can be cheaper however have a decrease chance of success. The additional out-of-the-money the strike worth, the extra bearish the sentiment for the outlook of the underlying asset.

Execs of Lengthy Put Technique

Lengthy places are a capital environment friendly place – solely the price of the choice which is prone to be a fraction of the value of the inventory is required.

They’re additionally one of many few methods retail buyers can revenue from falls in inventory costs. The alternate options reminiscent of shorting a inventory are sometimes unavailable or too capital intensive to non wholesale dealer purchasers.

The place can be fairly easy in comparison with different methods and choices spreads we cowl.

Cons of Lengthy Put Technique

Lengthy places are theta constructive. Over time they lose worth, all issues being equal, and so any transfer down must be fairly speedy to counteract this.

Care with the technique must be taken if the inventory has taken a big fall just lately. out of the cash places specifically are prone to be in demand, push up implied volatility and choice worth.

Ought to the inventory rise again in worth the places will probably lose twofold: from the adverse delta of the place and in addition the implied volatility falling again to regular ranges. The put worth is prone to collapse on this situation.

Danger Administration

As we’ve acknowledged above, making certain an extended put place doesn’t have an elevated implied volatility on entry is the primary danger administration resolution to make.

You must also think about fairly lengthy dated choices – 30-90 days plus – to reduce the lack of time worth. Theta on longer dated choices is decrease therefore minimizing the impact of time decay.

One other various is to promote an out of the cash put to cut back the online value of the technique, and decrease time decay danger. This may flip the technique right into a bear put unfold.

Lengthy Put Technique vs. Shorting Inventory

A protracted put could also be a good technique for bearish buyers, reasonably than shorting shares. A brief inventory place theoretically has limitless danger for the reason that inventory worth has no capped upside. A brief inventory place additionally has restricted revenue potential, since a inventory can’t fall beneath $0 per share. A protracted put choice is just like a brief inventory place as a result of the revenue potentials are restricted. A put choice will solely enhance in worth as much as the underlying inventory reaching zero. The advantage of the put choice is that danger is restricted to the premium paid for the choice.

The downside to the put choice is that the value of the underlying should fall earlier than the expiration date of the choice, in any other case, the quantity paid for the choice is misplaced.

To revenue from a brief inventory commerce a dealer sells a inventory at a sure worth hoping to have the ability to purchase it again at a cheaper price. Put choices are comparable in that if the underlying inventory falls then the put choice will enhance in worth and may be offered for a revenue. If the choice is exercised, it’s going to put the dealer brief within the underlying inventory, and the dealer will then want to purchase the underlying inventory to appreciate the revenue from the commerce.

Time decay influence on a Lengthy Put

Time remaining till expiration and implied volatility make up an choice’s extrinsic worth and influence the premium worth. All else being equal, choices contracts with extra time till expiration could have greater costs as a result of there’s extra time for the underlying asset to expertise worth motion. As time till expiration decreases, the choice worth goes down. Due to this fact, time decay, or theta, works in opposition to choices patrons.

Implied volatility influence on a Lengthy Put

Implied volatility displays the potential of future worth actions. Greater implied volatility leads to greater priced choices as a result of there’s an expectation the value might transfer greater than anticipated sooner or later. As implied volatility decreases, the choice worth goes down. Choices patrons profit when implied volatility will increase earlier than expiration.

Conclusion

- A protracted put is a place when any individual buys a put choice. It’s in and of itself, nonetheless, a bearish place out there.

- Traders go lengthy put choices in the event that they suppose a safety’s worth will fall.

- Traders might go lengthy put choices to invest on worth drops or to hedge a portfolio in opposition to draw back losses.

- Draw back danger is thus restricted utilizing an extended put choices technique.

The Lengthy Put technique is nice for having the ability to merely and simply revenue on the autumn of an underlying safety. Nonetheless extra refined merchants could also be extra interested in extra advanced methods such because the bear name unfold to equally revenue, however as lowered value and theta danger.

Subscribe to SteadyOptions now and expertise the total energy of choices buying and selling at your fingertips. Click on the button beneath to get began!

Associated articles