Good night, merchants and traders.

After Friday’s sharp tariff-induced selloff, Monday delivered a strong rebound. The markets gapped sharply larger on the open and held features all through the session, producing a robust aid rally that erased a great portion of final week’s harm.

Friday’s panic promoting and heavy quantity drove the short-term indicators into excessive oversold territory, which frequently alerts a near-term backside. At the moment’s surge displays that emotional pendulum swinging again from concern to FOMO—an indicator of short-term buying and selling psychology.

Market Insights, Information & Financial system

Inventory Market Development

The S&P 500 and Nasdaq bounced laborious off Friday’s lows. We went from panic promoting to full-blown FOMO in only one buying and selling day, with traders bailing on Friday and piling again in hand over fist on Monday.

- The 30-minute chart now reveals a basic FOMO bounce sample — robust upside follow-through that usually precedes one other fast dip because the market digests the transfer.

- Primarily based on Fibonacci projections, the S&P 500 might simply retest the 6,440 zone (roughly 3.6% decrease) if this rebound rolls over right into a second leg down.

Whereas the longer-term pattern stays technically inexperienced, short-term momentum is fragile, and several other indicators recommend the market is near a possible pattern shift if weak point returns later this week.

Sentiment: Sensible Cash vs. Public Cash

The tape continues to indicate divergence between insider flows and retail conduct.

- Huge cash has been quietly rotating out of equities whereas the normal public drives costs larger.

- This mirrors prior late-stage conduct when establishments distribute shares into retail enthusiasm earlier than a pullback.

For now, the uptrend holds, however we’re watching intently for affirmation of a pattern reversal sign throughout the S&P and QQQ. If triggered, we’ll exit our SPY (ACS) and SSO (BAN) positions whereas persevering with to carry QQQ and XLC till their respective alerts full.

Leverage & Inverse Trades

Various members famous they entered inverse ETFs or 3x shorts into Friday’s weak point. As mentioned final week, that’s a high-risk, counter-trend transfer.

- The key pattern continues to be up, and shorting into an oversold situation is actually playing that the pattern is ending.

- Friday’s transfer was news-driven, not a confirmed pattern break, and right now’s rally left these inverse positions deep underwater.

In a rising pattern, we maintain or purchase dips, not brief them. Momentum and pattern alignment all the time override emotion and information.

Sector & Movement Evaluation

- Small caps (IWM) led right now’s rally, signaling renewed danger urge for food.

- Retail rebounded sharply, absolutely recovering Friday’s tariff losses. This “V-shaped” transfer suggests both fast hypothesis or foreknowledge of the information cycle — insider positioning stays a robust risk.

- Greenback (DXY) rose +0.3%, constructing one other potential launch pad.

- Gold surged +3.25%, whereas silver additionally gained — confirming continued safe-haven demand whilst equities bounced.

Gold Replace & Technique Clarification

Our current gold commerce (PHYS) was a discretionary bonus commerce, not a part of the core long-term place.

- We hit our measured transfer goal completely, locking in income earlier than the market’s fast pullback.

- Lengthy-term, I stay bullish on gold, nonetheless holding all bodily positions established in 2019 for the continued secular bull run.

Brief-term trades and long-term investments serve totally different timeframes — a crucial distinction for members following each the ACS system and my bonus discretionary trades.

Whereas the current gold swing was short-term, I proceed to anticipate potential blow-off highs forward, presumably reaching $4,500–$5,000 if market stress expands.

Development Methods & Portfolio Alerts

We’re approaching doable trend-exit ranges on the S&P 500 inside each ACS and BAN.

If triggered:

- The ACS SPY place and BAN SSO commerce will shut.

- We’ll proceed working QQQ and XLC till Nasdaq and sector alerts verify pattern exhaustion.

There are no new gold entries deliberate; the earlier 15% achieve captured within the bonus commerce was tactical and full.

Broader Market Conduct

The speculative sectors stay extraordinarily lively: silver, uranium, clear tech, lithium, copper, blockchain, and marijuana proceed to dominate the scorching listing.

We’re seeing 6–7% each day swings, heavy quantity, and extensive intraday gaps — all clear indicators of late-stage volatility and emotional money-chasing.

One of these surroundings typically precedes topping motion, with rotations accelerating between speculative themes earlier than an eventual consolidation or correction.

Outlook

- Brief-term: After right now’s FOMO surge, markets might roll again over midweek towards the 6,440 S&P goal zone.

- Medium-term: We stay in an uptrend, although momentum is weakening and a pattern sign reversal might set off quickly.

- Gold & Silver: Protected havens stay agency — power right here typically hints at fairness stress forward.

- Greenback: Rising quietly — one other early warning signal of potential danger aversion.

Key Takeaways

- Equities: Sharp rebound from Friday’s selloff; pattern intact however fragile.

- Sentiment: FOMO changed panic; insiders nonetheless distributing.

- Inverse ETFs: Excessive-risk countertrend performs — keep away from guessing tops.

- Gold: Brief-term commerce accomplished; long-term bullish view unchanged.

- Volatility: Scorching cash chasing speculative sectors — basic late-stage conduct and offers merchants FOMO.

- Watchlist: 6,440 S&P zone for potential retest; gold for breakout continuation.

Backside Line

Markets did what they do finest — flip feelings in a single day. From Friday’s concern to Monday’s euphoria, we’re seeing merchants chase headlines and momentum.

The pattern stays up however susceptible, with insider promoting and defensive flows signaling that this rally might quickly stall.

Gold continues to guide, greenback power is constructing quietly, and speculative sectors are flashing basic late-cycle volatility.

Keep disciplined, observe the system alerts, and let value—not feelings—dictate each transfer.

✔ PREMIUM ETF SIGNALS: https://thetechnicaltraders.com/investment-solutions/

✔ OPTIONS TRADING SIGNALS: https://thetechnicaltraders.com/ots/

✔ FREE ANALYSIS NEWSLETTER: https://TheTechnicalTraders.com/e-newsletter/

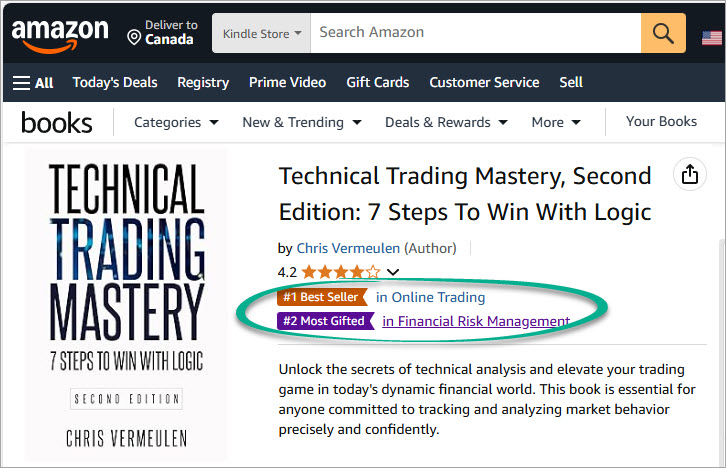

MY FREE INDICATORS IN MY BOOKS

Disclaimer:

The content material revealed on this web site, together with weblog posts, movies, analysis articles, and commentary, is meant solely for informational and academic functions and shouldn’t be construed as funding recommendation. Technical Merchants Ltd. and its associates are not registered as funding advisers with the U.S. Securities and Change Fee or any state securities authority. The knowledge supplied is normal in nature and is not tailor-made to the funding wants of any particular particular person. Nothing revealed on this web site constitutes a advice to purchase, promote, or maintain any explicit safety, commodity, or monetary instrument. The views expressed characterize the opinions of the authors and are topic to vary at any time with out discover. Efficiency outcomes mentioned might embody stay buying and selling outcomes and/or backtested or hypothetical knowledge. Hypothetical outcomes are inherently restricted and don’t replicate precise buying and selling efficiency. No illustration is made that any account will or is prone to obtain income or losses just like these mentioned. Previous efficiency isn’t indicative of future outcomes. All investments contain danger, together with the potential lack of principal. Testimonials and consumer experiences offered will not be consultant of others and don’t assure future success. Some content material might include affiliate hyperlinks or promotional materials, from which we might earn compensation. This doesn’t affect our content material or editorial independence. By accessing this web site or consuming its content material, you acknowledge that you’re solely liable for your individual monetary selections and comply with seek the advice of a licensed monetary skilled earlier than performing on any info supplied.