Ever opened a information web site or scrolled by means of social media, solely to search out the markets “crashing,” “surging,” or “on the point of collapse”?

Every single day, merchants are hit with a tidal wave of headlines, skilled opinions, breaking alerts, and scorching takes. It might probably all really feel pressing, emotional, and necessary.

Should you’re not cautious, it might utterly hijack your decision-making and, in flip, your buying and selling outcomes.

The reality is, monetary media isn’t there to make you a greater dealer.

It’s designed to maintain your consideration.

And whereas that doesn’t imply it’s best to ignore the information altogether, it is advisable perceive the way it works and what results it might have on you.

Apparently, most merchants assume they’re reacting to info after they hear or see information.

However in actuality, they’re merely reacting to how that info is framed.

Worry-based headlines. Overconfident predictions. Skilled noise.

All of it chips away at your potential to stay to your plan.

I’m going to point out you the way media in buying and selling mislead merchants, and methods to overcome it.

Particularly, on this article, you’ll be taught:

● How monetary media works, and why it’s constructed to amplify emotion, not accuracy

● The delicate methods merchants get misled by headlines, narratives, and consultants

● The psychology behind information, why your mind is drawn to noise and tales, even after they damage your edge

● Actual examples of media-driven panic… and the way the sensible cash normally strikes the opposite method

● Most significantly, methods to construct a system that filters the noise and retains you in management

Let’s get into it.

The Function of Media in Buying and selling

Headlines are constructed for emotion, not accuracy.

Most monetary media isn’t there to coach you.

It’s there to seize your consideration by utilizing headlines that set off emotion: worry, greed, and urgency.

Phrases like “crashes,” “skyrockets,” or “meltdown” aren’t simply dramatic, they’re deliberate. They’re chosen to make you’re feeling one thing, reasonably than allow you to make higher buying and selling choices.

The consequence? Merchants begin reacting emotionally. Chasing inexperienced candles. Panic-selling into purple ones.

You may assume you’re responding to new, invaluable info… however actually, you’re reacting to how that info was framed.

It’s a key distinction.

So subsequent time you see a headline that will get your coronary heart fee up, take a second and ask your self:

Is that this informing me? Or simply attempting to impress a click on?

The media is reactive, not predictive.

You’ve most likely heard the phrase: commerce the information.

However right here’s the issue: by the point the information hits your display, the market has already priced it in.

Massive gamers, like establishments, hedge funds, and algorithms? They’re method forward of you. They don’t anticipate headlines, and by the point retail merchants react, the transfer is usually over.

The media doesn’t inform you what’s about to occur, however what has already occurred. By wrapping the knowledge in a assured story that sounds prefer it’s predictive.

That’s why attempting to commerce based mostly on information articles is like attempting to drive utilizing your rearview mirror.

It would present you the place you’ve been… nevertheless it gained’t allow you to see what’s coming.

The phantasm of certainty

One of many greatest risks in media is how confidently it presents guesses as information.

“The market dropped due to X.” “Consultants say Y is subsequent.”

It sounds sure. Nevertheless it’s not actuality.

The reality? No one is aware of what’s going to occur subsequent. Not the speaking heads, not the analysts, not the influencers.

Markets are messy. They transfer due to hundreds of various inputs, sentiment, macro knowledge, large gamers shifting positions, technical ranges… the record goes on.

So when somebody confidently tells you “why” one thing occurred, at all times take it with a grain of salt. It’s greater than doubtless a narrative they’ve fitted, or at most a greatest guess. It’s not gospel.

As a dealer, it is advisable be okay with uncertainty. This sport isn’t about predicting, however about managing danger and making choices based mostly on chances, not headlines.

Should you begin anchoring your choices to what somebody on the web stated “triggered” a transfer, you’ll rapidly end up reacting emotionally, and your edge will vanish.

Media in Buying and selling: How Merchants Fall Into Traps

Chasing Headlines With out Context

This is likely one of the commonest errors: merchants reacting immediately to a dramatic headline with out stopping to assume.

You see one thing like “Markets Crash on Recession Fears,” and the intuition kicks in:

Promote now! Get out!

However right here’s the catch: the market may’ve already reacted.

That information is likely to be baked into the value already. And what seemed like a crash may simply be a pullback inside a much bigger development.

That is how individuals find yourself panic-selling on the backside or FOMO-buying on the high.

The smarter transfer?

Pause. Zoom out. Ask your self:

- Has the market construction truly modified?

- Has the extent you commerce from damaged or held?

- Is that this headline confirming what you already noticed, or attempting to scare you into motion?

Bear in mind, value is at all times the reality

Let the chart information your considering.

Overvaluing Skilled Opinions

Let’s be trustworthy, it’s tempting to belief somebody who sounds assured.

Whether or not it’s a big-name analyst, a finance influencer, or a YouTube guru with one million views, it’s simple to imagine they know one thing you don’t.

However even professionals get it fallacious.

So much!

And extra importantly, their outlook could not match your system, your timeframe, or your danger tolerance. They is likely to be buying and selling 5-minute breakouts when you’re holding swing trades for weeks.

So for those who begin inserting trades based mostly on their conviction reasonably than your personal course of, you lose extra than simply your edge; you lose your potential to develop.

That’s not buying and selling – that’s outsourcing your choices.

And it virtually at all times ends badly.

Complicated Narrative With Causation

This can be a delicate one, nevertheless it messes with merchants on a regular basis.

Monetary media is good at creating tales after value strikes.

“The greenback dropped due to X.”

“Markets surged because of Y.”

Sounds neat. Feels logical. Nevertheless it’s typically simply guesswork wrapped in confidence.

The reality is that value can fluctuate for 100 totally different causes. Making an attempt to tie it to a single, clear trigger typically results in deceptive conclusions.

And if you begin believing each transfer will need to have a narrative behind it, you find yourself buying and selling narratives, not setups.

You hesitate when the story doesn’t match your bias, doubting your plan as a result of somebody on TV sounds convincing…

Otherwise you get caught in evaluation paralysis, second-guessing each commerce as an alternative of simply executing based mostly on construction and logic…

That’s the way you lose momentum and begin drifting out of your edge.

So now that you just’ve seen what number of traps are on the market, let’s break down why human brains are wired to fall for them within the first place.

The Psychology Behind Media in Buying and selling

Your Mind Loves Tales, Even When They Mislead You

People are hardwired to make sense of the world by means of tales.

Everyone desires clear explanations… to know why one thing occurred.

So when the market strikes and the media jumps in with “The Fed stated X, so the market did Y,” it feels satisfying. It offers you closure… even when it’s utterly made up!

The actual hazard? These explanations sound logical, in order that they really feel true. They provide you false emotional certainty.

And that feeling can override your logic. As a substitute of asking “Does this align with my edge?” You begin considering, “What in the event that they’re proper?”

Worse nonetheless, when sufficient individuals consider the identical story, it might quickly drive value… even when the story is nonsense. So it’s important to watch out, not simply of what the media says, however of how your mind processes it.

“Breaking Information” Triggers Dopamine, Not Self-discipline

Breaking information feels thrilling, doesn’t it? It offers you that very same hit of power as a social media like or a slot machine win.

That surge is dopamine. It’s your mind’s chemical reward for stimulation and novelty.

The issue?

Dopamine isn’t designed for considerate decision-making. It’s designed for chasing fast rewards.

And good buying and selling isn’t about chasing. It’s about management, routine, endurance, and following your course of.

So for those who’re leaping into trades on a information excessive, whether or not it’s pleasure, panic, or urgency, you’re not buying and selling from self-discipline. You’re playing on emotion.

That’s why construction and routines matter. You want a system that holds up even when the information is loud and your feelings are louder.

Affirmation Bias: The Entice You Don’t See Coming

When you kind a bias, bullish or bearish, your mind begins filtering out every part that doesn’t assist it. It does all this subconsciously; you gained’t even know you’re doing it.

It’s known as affirmation bias.

Should you’re lengthy, you’ll zero in on bullish headlines. Should you’re brief, you’ll dismiss something that challenges your view.

The media makes this even simpler, as for each opinion, there’s an “skilled” backing it. It doesn’t matter what your bias is, you’ll discover somebody to validate it.

That’s the place it will get harmful. Although it might really feel such as you’re doing analysis, you’re actually simply reinforcing your perception.

This doesn’t simply cloud your considering… It blinds you to danger.

Recognizing the bias is a crucial first step to defeating it. Nonetheless, a sturdy buying and selling system ought to be capable to catch it earlier than issues get out of hand.

Guidelines. Logs. Journals. They’re your guardrails.

Let’s carry this all along with some real-world examples of media-driven chaos and the way it performs out on the charts.

Actual Examples of Affect in Media in Buying and selling

When Headlines Scream, Sensible Cash Whispers

Let’s rewind to March 2020 — the peak of the COVID crash.

The headlines had been apocalyptic:

“Markets in freefall.”

“International recession imminent.”

“Get out when you nonetheless can.”

And actually, who may blame anybody for panicking? It was an unprecedented world disaster, and the media made it really feel like the tip of monetary markets.

Retail merchants rushed to promote. Not as a result of they had been irrational, however as a result of every part round them screamed: “Escape now!”

However whereas the general public panicked, establishments had been quietly shopping for. They weren’t reacting to the headlines. They had been planning past them.

And simply months later, markets not solely recovered, they printed new all-time highs.

This isn’t a one-off.

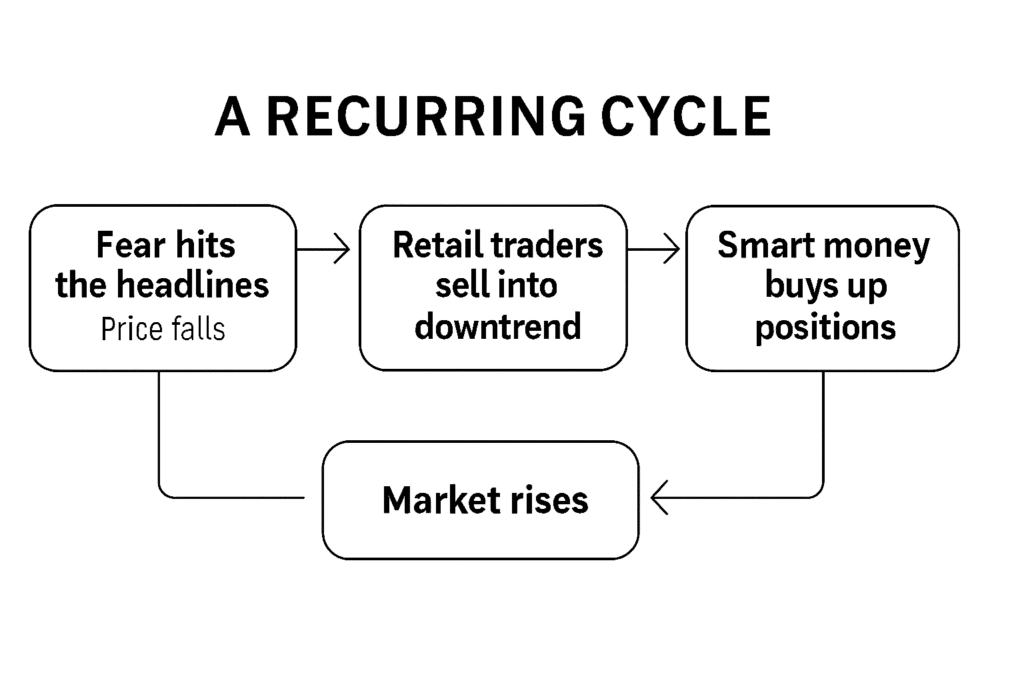

It’s a recurring cycle:

The takeaway? Should you’re reacting to the information, you’re most likely too late. Anybody listening to the gang is probably going on the fallacious aspect of the commerce.

The Fed Frenzy Entice

Each time the Federal Reserve makes a press release, the information explodes.

“Fee hikes may crush the market! Pivot incoming!”

All of the sudden, merchants scramble to reposition.

However right here’s what’s actually taking place: Most often, the market already knew.

Establishments have already got entry to financial forecasts and consensus expectations, and crucially, they act on that earlier than the announcement ever goes public.

Except the Fed’s resolution wildly deviates from the anticipated final result, most value motion is both already priced in or a fast knee-jerk response that fades quick.

The sensible play isn’t to react to the headline. It’s to look at how the value behaves after the information.

Did the construction break? Is the development intact?

That tells you greater than any headline about what the Fed did or didn’t say.

Conflict headlines and false panic

Geopolitical rigidity at all times units the media on fireplace, with invasions, battle, and nuclear threats. And when it hits, merchants typically really feel stress to do one thing.

However the knowledge typically tells a extra measured story.

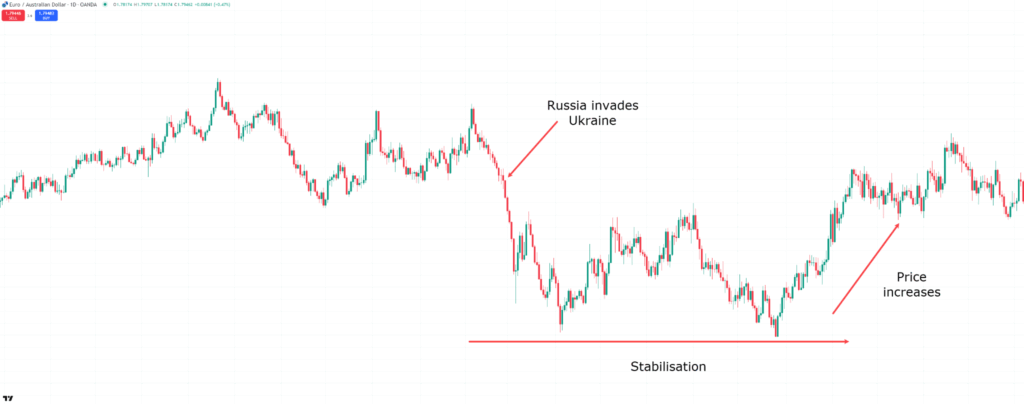

Let’s take the Russia-Ukraine battle in early 2022, when headlines had been intense…

Each day EUR/AUD Chart – Russia/Ukraine Conflict:

The EUR/AUD bought off quick… solely to get well simply weeks later.

Why?

As a result of by the point the occasion was front-page information, the market had already adjusted.

Merchants who reacted to worry missed the rebound. However those that waited, watched the value, and adopted the construction? They stayed grounded, and lots of caught the restoration.

This doesn’t imply geopolitical danger must be ignored. It simply means reacting emotionally is never the sting.

Use the information as context, however commerce your system, not your emotions.

Media in Buying and selling: The best way to Defend Your self as a Dealer

Use Information as Background, Not a Sign

So how do you keep sharp with out getting sucked into the noise?

Begin by reframing the position of reports. It’s not a sign, it’s background context. The media’s job is to seize consideration, not allow you to make good trades. That’s your job!

Is there a giant fee resolution or financial launch developing? Good, mark it in your calendar. Concentrate on it.

However don’t place a commerce simply because somebody stated “it’s going to maneuver.” As a substitute, ask: Is the chart exhibiting me one thing actual?

Issues like:

- Is a degree breaking?

- Is a development shifting?

- Is a setup forming inside my plan?

Let value motion affirm the story, by no means the opposite method round.

Construct Your Course of Round Construction, Not Emotion

That is the place most merchants go fallacious. They react to what they really feel, worry, pleasure, and urgency, as an alternative of what they see.

The answer? Construct construction.

You want a system that’s constructed on course of, and that you may comply with on good days and unhealthy.

A guidelines that doesn’t care what the information says.

Nevertheless it’s precisely the place journaling turns into invaluable.

Ask your self after each commerce: Was this resolution pushed by my plan or my feelings?

Over time, this sort of self-review builds confidence, and that confidence is price greater than any “skilled take” on TV.

Zoom Out and Keep Grounded

Right here’s a trick sensible merchants use: when the headlines zoom in, you zoom out.

Information shops love drama: “Bitcoin plunges 5%!”

However is it a plunge… or only a pullback on a weekly uptrend?

The one technique to know is to step again and take a look at the larger image. Is the value holding construction? Was that 5% pullback simply the brand new increased low? Is it simply ranging inside a bigger transfer?

That is the way you keep grounded.

Not by attempting to foretell what is going to occur subsequent, however by understanding what’s taking place now.

Once you construct that behavior, the media stops being a supply of stress… and turns into simply one other layer of context in your buying and selling toolbox.

Conclusion

If there’s one factor this text ought to depart you with, it’s this:

Monetary media isn’t designed that will help you commerce higher; it’s designed to maintain you watching, clicking, and reacting.

Whereas the information may be helpful context, it turns into harmful the second you let it override your course of.

Headlines amplify worry. Consultants communicate with confidence they haven’t earned. And your mind, hardwired to chase certainty and fast solutions, is greater than prepared to consider all of it, particularly within the warmth of the second.

That’s how some merchants get shaken out… and why disciplined ones handle to remain in.

On this article, you’ve seen how media is reactive, not predictive, typically reporting what’s already occurred.

You’ve discovered how tales set off emotion, how dopamine overrides logic, and the way even stable merchants can fall into traps like affirmation bias or herd mentality.

However most significantly, you now know methods to shield your self from all of it.

On the finish of the day, your edge doesn’t come from reacting quicker, however from considering clearly.

Worth tells the reality. Your system retains you grounded. And your job isn’t to foretell the following headline… It’s to remain calm when everybody else is panicking.

That’s how execs commerce!

So, now I need to understand how you commerce the information.

Have you ever fallen into the entice of being overwhelmed by the headlines?

Or have you ever additionally seen how value reacts initially to information occasions, solely to stabilize later?

Let me know within the feedback under!