Union Funds 2026: Market Expectations & Financial institution Nifty Insights

Date: February 1, 2026

️ Offered by: Honorable Finance Minister Shri Nirmala Sitharaman Ji

Market Sentiment Forward of the Funds

- Regardless of a 4-day rally in Nifty, the general market temper stays weak.

- Low expectations heading into the Funds, with no main leaks to the media, retaining uncertainty excessive.

Historic Insights: How Financial institution Nifty Reacts to the Funds

- The Union Funds is without doubt one of the greatest market-moving occasions, influencing Financial institution Nifty and broader indices.

- Analyzing previous 23 Budgets gives helpful patterns for merchants to anticipate volatility and development shifts.

⚡ Nifty Funds Day Volatility (2006-2025)

- Most intraday vary recorded: 2525 factors

- Anticipate a giant risky transfer this 12 months as nicely, making danger administration vital.

Buying and selling Technique for Funds Day

✅ Commerce cautiously & use strict stop-losses

✅ Put together for sharp swings in each instructions

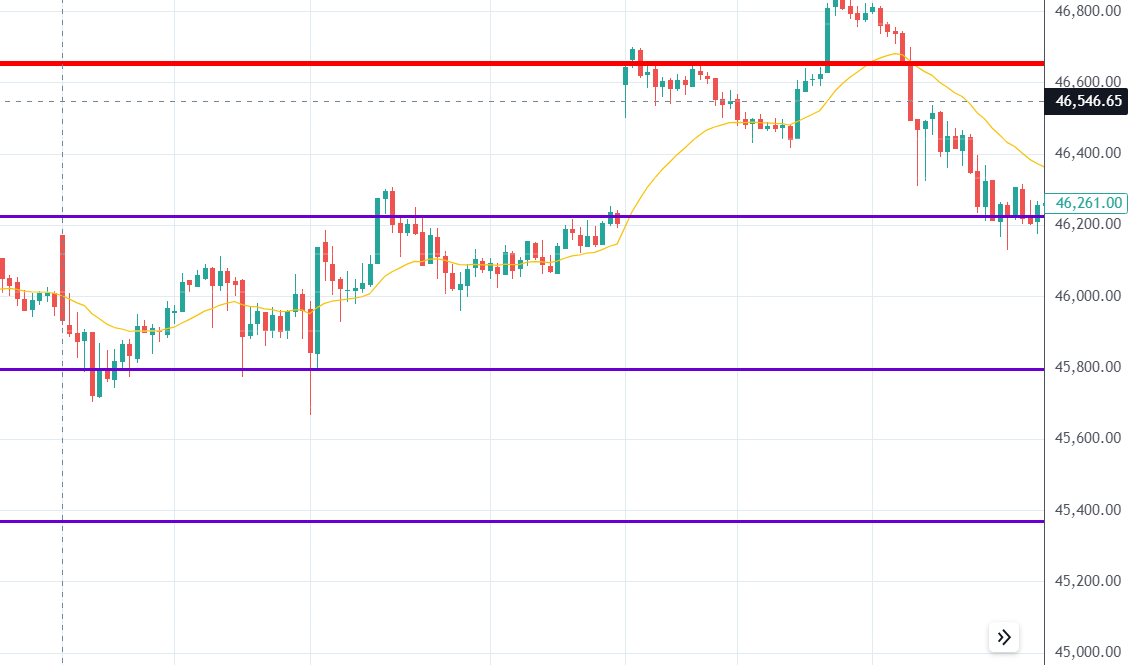

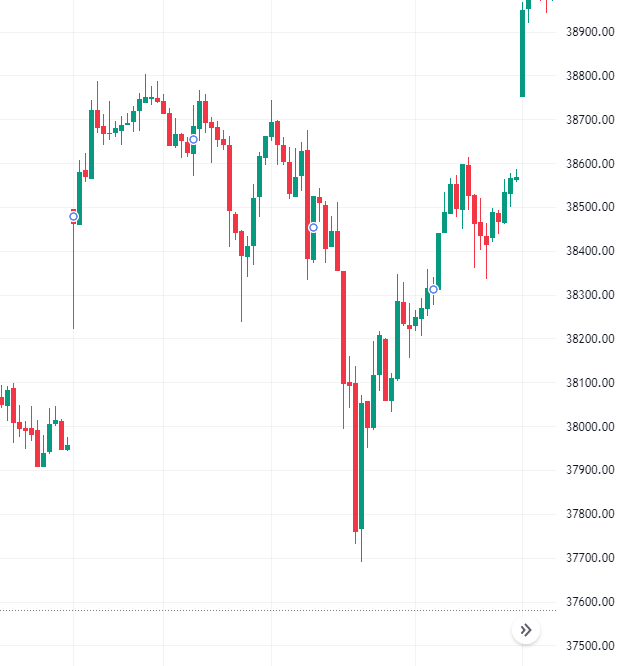

✅ Give attention to key assist & resistance ranges

Under are the Financial institution Nifty vary from 2006-2025. Most Vary on Funds day is 2525 factors so massive risky transfer on playing cards, so commerce cautiously.

Out of 23 Funds Offered When Financial institution Nifty began Buying and selling we’ve 10 Funds the place we had Optimistic Shut and 13 Budgets we had damaging shut.

- 01-Feb-2025 Intraday Chart

- 01-Feb-2024 Intraday Chart

01-Feb-2023 Intraday Chart

01-Feb-2022 Intraday Chart

01-Feb-2021 Intraday Chart

Learn how to Commerce Safely on Funds Day: Key Insights & Methods

Why Most Merchants Lose Cash on Funds Day

Many merchants battle on Funds Day resulting from an absence of technical and psychological preparedness for the wild market swings. If you happen to’re buying and selling with lower than ₹5 lakhs in capital, it’s greatest to keep on the sidelines and observe quite than danger pointless losses. Capital safety ought to all the time be the #1 precedence for merchants.

We might be sharing key market ranges on Twitter that can assist you navigate Funds Day profitably!

Understanding these historic patterns helps merchants make higher choices earlier than, throughout, and after the Funds announcement.

Conclusion: Keep Ready, Keep Worthwhile

Historical past reveals that BANK Nifty’s motion is intently tied to insurance policies affecting banking, infrastructure, and financial development.

- A supportive, growth-oriented finances might set off a rally.

- A restrictive or high-deficit finances would possibly weigh on market sentiment.

Sensible merchants analyze tendencies, handle dangers, and commerce with self-discipline. Keep tuned for reside updates and key ranges that can assist you commerce profitably on Funds Day!