We’re there going to go what they’re, the place they got here from, how they’re used and a few of the principle (sure, sorry) that you could know to know them.

Additionally there’s extra data on Choices Greeks.

Within the meantime let’s begin with precisely what choices are…

What Are Choices?

Choices of their present kind are latest innovations, however the primary choices kind has a protracted historical past. We’ll outline precisely what an choice is in a minute, however first let’s attempt a little bit of a thought experiment.

Think about an oil firm about to spend money on a brand new oil discipline. They’ve a good suggestion how a lot oil there may be, how a lot it is going to value to extract it and so on, however sadly they don’t have certainty on the longer term worth of the oil produced. It is a downside as a result of they know they should receive no less than $80/barrel for no less than the subsequent 3 years for the brand new discipline to be worthwhile.

How can this firm mitigate the danger of a drop within the worth of oil? Properly, they may exit into the futures market and contract to promote oil at a pre-set worth sooner or later. Nonetheless they must enter a number of contracts spaced over the three years. And so they must take no matter worth was on provide now; which might show pricey ought to the oil worth truly rise over the subsequent few years. So that is unlikely to be a good selection.

However what if the corporate was in a position to buy a $2/barrel insurance coverage coverage giving it the appropriate to promote its oil at $80/barrel anytime within the subsequent 3 years? Ought to the oil worth rise they’ve solely ‘misplaced’ the $2 premium on the, unused, insurance coverage. Ought to worth fall the corporate would realize it might get the minimal worth it must be worthwhile (much less the insurance coverage value in fact).

Properly the above coverage is definitely an instance of an choice; it offers the appropriate however not the duty to promote at a predetermined worth ($80) inside a set interval (3 years).

Inventory choices

Let’s focus now, and for remainder of this course, on choices on shares. For a worth (the ‘premium’) they offer the appropriate however not the duty to purchase/promote 100 shares at a predetermined worth (the ‘strike’ worth) inside a set interval (till ‘expiry’).

Choices to purchase inventory are name choices; choices to promote are put choices.

Right here’s an instance utilizing Apple(AAPL): a Mar13 500 Name @ $40. For $4000 ($40×100) a dealer might give themselves the choice (pun supposed) to purchase 100 Apple shares for $500/share (ie $50,000) anytime between now and 20 March 2013.

Now, let’s say AAPL rises to $600 in March. Unbelievable. The dealer can ‘train’ their choice, purchase the shares for $50,000 and promote them again instantly for $60,000. A revenue of $10,000 (much less the unique $4,000 premium). Discover right here that the one upfront outlay was $4,000 to ‘management’ $50,000 value of inventory. Discover too that this $4,000 might all be misplaced, however no extra – if AAPL falls under $5,000.

(We now have a extra detailed clarification of put and name choices right here).

That is an instance of the ‘leverage’ obtainable from choices: they can be utilized to make enormous earnings on minimal outlay. However a dealer can lose all their cash.

Possibility promoting

We now have concentrated to date on the dealer who buys an choice (both put or name). However for each purchaser there’s a vendor; which (topic to dealer approval) might be you. Why would you wish to do that? To obtain the choices premium. An choices vendor acts similar to an insurance coverage firm. In our AAPL instance they obtain the $4,000 premium which they get to maintain ought to AAPL be under $500 in March.

The danger is, in fact, that it’s larger whereby the choice they’ve offered is more likely to be exercised, requiring the sale of 100 AAPL shares for $500 (i.e. lower than the market worth) to the choice purchaser (like our dealer within the above instance).

Both you’ve the shares already, and now have to provide them up for a decrease than market worth, otherwise you don’t, and have to purchase them within the open marketplace for greater than the $500 you’d get on their sale to the proprietor of your offered name. There’s subsequently limitless danger: your loss is the market worth (which, theoretically, might be infinitely excessive) much less the $500 strike worth (x100).

Components of an Possibility

As now we have seen, for each inventory choice, there are the next parts which have to be outlined for every contract:

Underlying

That is the inventory the choices relate to (AAPL within the above instance) Name/Put Does the contact give the appropriate to purchase or promote shares?

Strike Worth

At what worth can an choice be purchased/offered

Expiry

When do the choice proprietor’s rights expire?

Monthlies/Weeklys

Most choices, till lately anyway, had been obtainable in month-to-month sequence. There would, for instance, be an Apple January sequence of calls/places at totally different strike costs, after which one other sequence for February, March and so on. All choices would expire on the identical date within the month and so, ought to somebody speak about January AAPL choices, we’d know they expired on 25 January (as per the CBOE’s choices timetable).

This modified a couple of years in the past. Month-to-month choices nonetheless exist, and are nonetheless common, however they’ve been joined by weekly choices.

Extremely traded shares now have weekly choices obtainable with, because the title would counsel, shorter expiry instances. Choices expiring each week for the subsequent 4 weeks are subsequently now obtainable for these common shares.

Subsequently, along with the Jan/Feb/Mar and so on sequence, AAPL has choices expiring on the finish of the week, and for the three weeks following. This has enabled a number of shorter time period methods, which will probably be lined in additional superior classes. A lot of the examples in these classes will probably be utilizing the month-to-month choices, for readability.

Utilizing An Choices Dealer

Choices are available for purchase and promote at a number of choices exchanges, comparable to CBOE (the biggest), by way of choices brokers. These choices brokers, comparable to thinkorswim, tradeking and etrade, permit retail buyers to purchase and promote similar to the professionals.

Should you haven’t but arrange an account but google them, select your favorite, and enroll. Most of them are very straightforward to make use of and used to rookies in addition to extra skilled merchants.

A few ideas:

Join a paper buying and selling or digital account permitting you to commerce with out cash altering palms. A great way to study.

Don’t be postpone by all the flamboyant instruments brokers present, they’re for extra skilled merchants and are sometimes not too helpful anyway.

Choices Chains

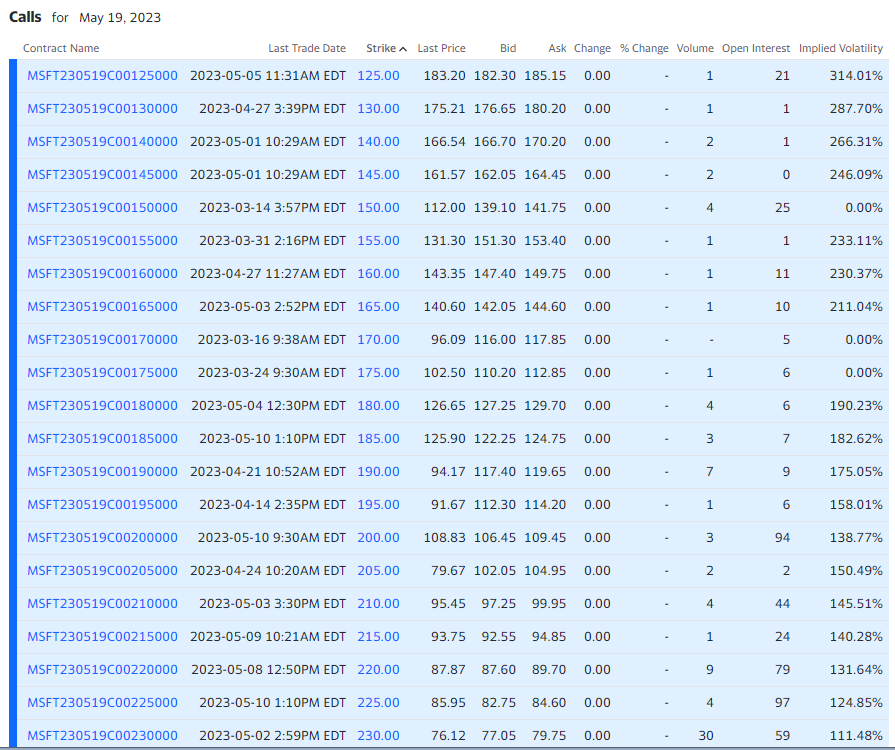

All brokers show choices costs in a so-called options-chain. Let’s take a look at an instance (from the yahoo web site):choices chainYahoo.com choices dealer chain

That is Microsoft (MSFT)’s name choices chain for Might 2023 (comparable ones can be found for different expiry dates too). Choices chains normally embody the final commerce for every choice, the bid and ask unfold (ie the quoted promote/purchase costs), quantity and open curiosity. Some brokers additionally embody the choices Greeks.

Different knowledge comparable to this feature’s open curiosity is there too. The precise course of of shopping for and promoting choices is dealer particular however so long as you may learn an choices chain you may, with the dealer’s assist, study fairly rapidly learn how to purchase and promote choices contracts.

Choices Pricing Fashions

Market Pricing

The costs for choices are solely pushed by provide and demand: what somebody is keen to purchase and promote them for.

Merchants enter the value they’re keen to promote (the ‘bid’) or purchase (the ‘ask’) the choice. The perfect costs on the trade are then displayed because the bid-ask unfold; the bid at all times being decrease than ask.

In our choices chain above, we will see that the Oct13 108 BA put’s bid-ask unfold is 0.62-0.67. In different phrases a dealer might promote this feature for 62c or purchase one for 67c.

Black Scholes Mannequin

Though costs are set by the market, merchants have at all times been fascinated about figuring out what they need to pay for an choice. And specifically how do numerous components, comparable to actions in inventory worth and the size of time left on an choice, affect this resolution.

Up till comparatively lately, the Nineteen Seventies in truth, this was nonetheless largely an unknown query. Then work performed by Fischer Black, Myrton Scholes and Robert Merton got here up with a comparatively easy methodology to provide you with an choice’s worth. And right here it’s for a name choice:

See, informed you it was easy. OK, so we’re in all probability not that within the math.

Right here’s a web based calculator that makes use of the maths to provide you with an choice valuation. Choices brokers have them too. For our functions at this stage I simply need spotlight the important thing inputs:

That’s, an inexpensive estimate of the honest worth of an choice might be decided by simply the next components: the inventory worth, strike worth, numbers of days to expiry, volatility, rates of interest and dividend yield. That’s it.

Maybe the one difficult variable there may be volatility; however for now simply see this as a measure of how a lot the inventory strikes round.

Makes use of of an Possibility

So now that we all know what an choice is, what are its makes use of? Why would we wish to purchase and promote these items? Listed here are the principle ones:

Insurance coverage

The primary use for choices, initially, was as insurance coverage. In case you are uncovered not directly to cost of a inventory or (extra probably up to now) commodity, choices can be utilized to insure partially, or totally, towards this consequence.

We’ve already seen an instance of this above.

The oil firm used a purchased put choice – giving the appropriate to promote oil at a pre-determined worth – to make sure towards a big drop within the oil worth.

Alternatively, an airline might insure towards its rise by shopping for a name choice – giving the appropriate to purchase oil at a selected worth – to guard towards its rise.

Comparable examples might be constructed for different commodity producers/customers; choices can scale back and even get rid of the value danger of a key output/enter (for the price of the premium).

However what about inventory choices? What insurance coverage makes use of have they got?

Their essential use is to insure, by way of a put choice, the worth of a inventory portfolio. Say you had 500 IBM shares at $200/share ($100,000), had been approaching retirement however involved about your publicity to the IBM share worth earlier than then.

You might, fairly cheaply buy 5 three month $180 put choices, say, guaranteeing that no matter occurred within the subsequent 3 months, your shares couldn’t fall under this $180.

Leverage

Choices can be utilized to cut back the capital required to placed on a commerce.

Let’s say you imagine Google (GOOG), at $750, will rise over the subsequent month. You might purchase 100 shares for $75,000 which, utilizing margin, would require $37,500 of capital.

Or you could possibly purchase a 1 month name choice, giving the appropriate to purchase the 100 shares at $750 anytime within the month for about $20/share.

This could require a lot much less capital: $2,000. Now there are different execs and cons to this which we’ll cowl later within the course – the $2,000 is totally misplaced ought to GOOG fall; however that is essentially the most that may be misplaced even when GOOG fell closely and so on; the choice’s worth decays over time – however it’s a good way to ‘management’ 100 shares for a small outlay. Finance professions name this ‘leverage’.

The proportion return, or loss, on capital is rather more delicate to the share worth. A $50 rise in share worth would end in $5,000 achieve; a 13% improve on the $37,500 share funding.

However an identical rise represents an enormous 150% achieve on our $2,000 choices outlay. Sadly this works in reverse. A $50 fall would end in a $5,000 (13%) share loss, however would trigger a 100% choices loss.

Hypothesis

That is the use we’ll be specializing in: choices use in speculating on the path of a number of monetary variables.

One in all these variables might be the share worth, as above, however subtle merchants can use choices to ‘guess’ on different issues comparable to volatility, time decay or the results of earnings (we’ll take a look at these in additional element in a while).

It’s this flexibility that makes choices so common.

Suppose {that a} inventory will fall? An choice commerce might be constructed to take benefit. Or that earnings will trigger a inventory to fall quickly? Once more choices can be utilized.

And even {that a} inventory gained’t transfer very a lot? Properly, there are a number of choices methods that may revenue from this.

Properly revered choices dealer Jared Woodard likes to say that choices are a classy language that can be utilized to specific extra opinions available on the market than every other monetary instrument.

That explains it effectively: there are such a lot of extra methods to revenue utilizing choices.

Widespread Choices Buying and selling Phrases

Beneath are a few of the frequent choices buying and selling phrases that may make it simpler to know choices:

Name choice

The proper to purchase an underlying safety with a specified timeframe

Put Possibility

The proper to purchase an underlying safety with a specified timeframe

Train

Taking over the choice to purchase/promote a name/put choice is named exercising it.

Strike Worth

The ‘specified worth’ at which an safety might be purchased when exercised

Expiry

The final date an choice might be exercised.

Implied Volatity

How a lot a safety’s worth strikes up and down

Within the cash/Out Of The Cash/At The Cash

A name(put) choice the place the strike worth is under(above) the present inventory worth is claimed to be Within the Cash.

A name(put) choice the place the strike worth is above(under) the present inventory worth is claimed to be Out Of the Cash.

An choice the place the strike worth is on the present inventory worth is claimed to be On the Cash.

Debit/Credit score Unfold

Possibility spreads are the mixture of purchased/offered choices traded for a internet value (debit spreads) or credit score (credit score spreads).

Conclusion

Understanding how choices work is significant to have the ability to discover ways to commerce them.

Now that we’ve learnt a few of the fundamentals we will look in additional element at a few of the essential sorts of choices, name and places, and a few choices spreads.

Concerning the Creator: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and recently in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Occasions (of London). He determined to convey this data to a wider viewers and based Epsilon Choices in 2012.

Subscribe to SteadyOptions now and expertise the complete energy of choices buying and selling at your fingertips. Click on the button under to get began!