In any case, if you wish to purchase an choice for $50 and you’ve got $100 in your buying and selling account, why shouldn’t you purchase it? You might have the cash to afford it, proper?

The reply isn’t that straightforward. Maybe your market view is unsuitable and your choice expires nugatory.You’ve simply misplaced 50% of your buying and selling capital. Another $50 choice loss and also you’re out of the sport.

Clearly, risking 50% of your capital on one commerce is unsustainable, and to be an choices dealer, and never somebody who makes use of choices to gamble, a much more modest danger per commerce is due.

Though everybody’s reply to how a lot they should commerce choices will likely be completely different primarily based on danger tolerance, technique, accessible capital, and so forth., the reply principally comes all the way down to guess sizing in relation to win price. We’ll get into this in a second.

However past strategic and probabilistic issues about how a lot you may/ought to danger on a commerce, there are particular laws from brokers, exchanges, and governments as to how a lot you could commerce sure choices methods.

So, as at all times and maybe annoyingly, the reply to how a lot capital you could commerce choices is “it relies upon.”

The Primary Necessities

Earlier than we begin evaluating your guess sizing, win-rate, danger tolerance, and so forth, let’s get just a few fundamental statistics straight.

In an effort to make choice trades that require margin, you could have at the very least $2,000 in your buying and selling account.

Most choices methods require margin, so right here’s an inventory of the methods you may make use of with out the usage of margin:

-

Shopping for outright places and calls

-

Promoting coated calls

- Promoting cash-secured places (you want the worth of the underlying must you get assigned)

In an effort to commerce choice spreads or promote uncovered choices, you want a margin account.

That’s your first hurdle. In case your technique entails choice spreads or promoting choices in any respect, you will have the $2,000 required for margin buying and selling in the US.

With lower than $2,000, you’re principally caught shopping for places or calls, as an account that small is unlikely to have the ability to promote coated calls or cash-secured places.

You’ll discover that of the full-time choices merchants you ask, few of them merely purchase choices as their bread-and-butter commerce. It’s tough to be constantly right in regards to the each the path of the market, the magnitude of the transfer, and the timing of the worth transfer to make it a full-time revenue.

Nevertheless, when that’s your solely choice and also you’re dedicated to changing into an choices dealer and constructing your account, it’s a reliable solution to develop your account.

With a small buying and selling account, this may imply that your universe of tradeable property is constrained. You possibly can’t commerce high-priced, or probably even moderately-priced shares.

Nevertheless, you’ll in all probability discover the universe of potential shares to be massive sufficient. This FinViz display screen exhibits that there’s over 400 shares buying and selling between $1 and $10 that commerce over 1,000,000 shares a day and have listed choices. Reducing the vary all the way down to $1 to $5 nonetheless leaves over 200 shares.

Simply for instance, maybe you discovered a name you wish to purchase for $30 and you’ve got a $1,000 buying and selling account. You’re risking 3% of your account per commerce, which is comparatively aggressive, however acceptable when your account measurement is so small.

It is vital to concentrate on low-priced shares to maintain your guess sizing small in proportion to the scale of account, and I’ll present you why…

Your Threat Tolerance: How A lot Ought to You Wager?

As stated, the capital required to have a shot at buying and selling choices in a constantly worthwhile method pertains to your guess sizing. In different phrases, what proportion of your whole buying and selling capital are you risking on the typical commerce?

Whereas there’s no concrete right reply right here, there are blatantly unsuitable solutions which you can arrive at by widespread sense. You shouldn’t danger half of your buying and selling capital on one commerce. Until you’ve discovered some insane arbitrage otherwise you’re breaking the regulation someway, buying and selling edges virtually by no means justify that degree of guess sizing.

Utilizing the Kelly Criterion, we are able to arrive at extra unsuitable solutions, which is able to nudge us within the path of our right reply.

Let’s begin with a easy instance. We’re taking a look at a commerce alternative and we’re evaluating if we wish to take the commerce, and in that case, how a lot we should always guess.

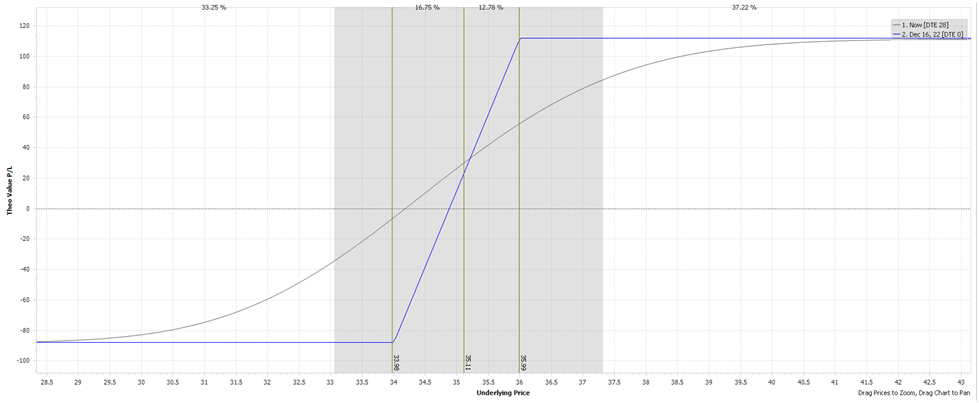

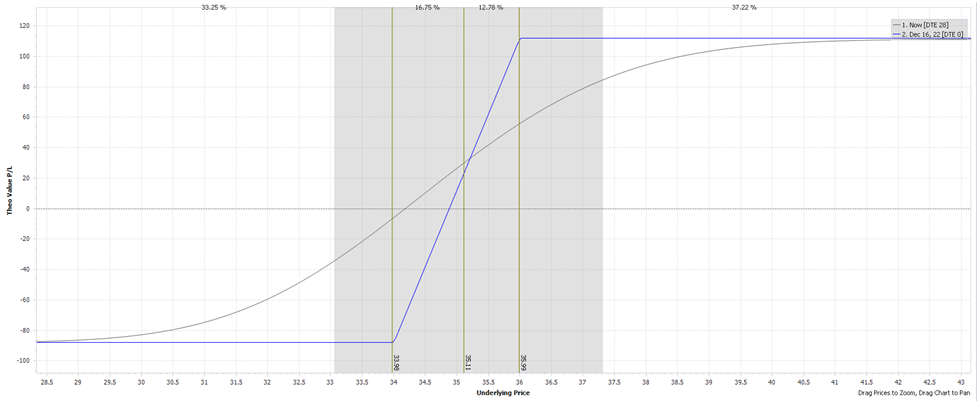

The commerce is a bull name unfold.

-

Max loss is $88

-

Max revenue is $112

-

28 days to expiration

- Implied volatility is 25%

Right here’s the payoff diagram so you will get an thought:

Maybe we predict there’s a forty five% shot that we’ll exit the commerce with our max revenue, and a 55% probability that we’ll get the max loss on this commerce.

We are able to merely enter these numbers right into a Kelly Criterion calculator like this one and discover {that a} Kelly guess right here could be roughly 2% of your buying and selling capital. That sounds fairly affordable, in spite of everything, this edge is fairly small.

However let’s see what occurs once we make the numbers extra dramatic. Utilizing the identical commerce instance, let’s change our assumptions and guess that we’ve a 75% probability of hitting the max revenue.

With these assumptions, the Kelly Criterion says you must guess 55% of your buying and selling capital.

Hopefully you may see how dramatically getting your assumptions unsuitable can harm you. As a result of you may by no means know your true odds available in the market, its crucial that you simply low cost them relative to your degree of uncertainty.

A veteran choices dealer with a database of two,000 trades he’s taken in a selected technique can belief his assumptions way over somebody who’s simply starting to commerce and is usually guessing at their odds.

Trace: a veteran dealer’s historical past will principally by no means inform him to guess even near half of his account on a commerce.

It’s for that reason that the majority merchants who make the most of a guess sizing system just like the Kelly Criterion won’t ever use “full Kelly,” and as an alternative use half, 1 / 4, or perhaps a tenth of full Kelly, relying on their aggression and confidence of their edge.

As you may see, guess sizing in buying and selling can difficult, because it’s one of the important issues to get proper, or at the very least not get unsuitable. It’s at all times higher to err on the aspect of warning and guess lower than your numbers let you know to.

A novice and even lower-intermediate choices dealer is prone to have a whole lot of bother guessing at what they suppose their edge is. They don’t absolutely realize it but, they usually may even query if their edge is concrete sufficient to place into numbers. That’s okay, principally all merchants exist on a spectrum of figuring out their edge is actual, and no one actually is aware of, you simply get extra assured.

On this state of affairs, it’s greatest to maintain your guess sizing small to remain within the recreation. Risking one % of your capital per commerce is usually the quantity prompt by revered buying and selling authors and mentors. In case you’re not sure, follow risking one % or much less per commerce.

What’s Your Technique?

You possibly can craft almost any market view utilizing choices. Past the worth of a inventory going up or down, choices introduce the weather of time and volatility, permitting you to finely craft your place to your actual view.

In case you’re bearish on the following two weeks of worth motion, however bullish for the next month, you should use a calendar unfold. And in the event you suppose volatility is pricey proper now, you can also make the net-short volatility by shopping for a put with round 10 days to expiration to specific your short-term bearish view and promoting a put to specific your intermediate-term bullish view.

The purpose is, choices are an instrument with infinite methods and potentialities. The capital required varies relying on the technique you’re implementing.

Probably the most fundamental distinction is whether or not you’re buying and selling spreads with an outlined max danger or not.

Choices trades with an undefined max danger degree make it tough so that you can plot the worst case situation. In case you don’t know that, it’s exhausting so that you can choose an accurate measurement on your bets. And generally, you may measurement your bets appropriately and nonetheless blow up your account with undefined danger trades. Contemplate the case of OptionSeller.com.

Moreover, many undefined danger methods are the analogical equal to promoting hurricane insurance coverage. Maintain amassing small premiums till the hurricane hits. Did you accumulate sufficient premium to cowl your claims? This can be a very tough query to reply.

Ideas for Undercapitalized Possibility Merchants

-

Undefined-risk methods aren’t solely capital intensive for a small account, however they’re too dangerous for a novice to intermediate dealer to danger blowing up their account with.

-

Attempt to follow lower-priced property. In case you actually wish to commerce SPY, see if you will discover one other massive cap fairness ETF with a cheaper price as an alternative. It will allow you to hold your guess sizing small, or extra surgically handle the variety of contracts you commerce.

-

Generally, with a small account, the “candy spot” is sizing your bets excessive sufficient to develop your account aggressively, however not so excessive that you simply dramatically improve your danger of destroy.

- To be taught to commerce, you could commerce. Academic materials and reflection are important, however not with out actual experiences to drive you. In any other case, it’s all theoretical. That is another excuse to maintain your guess sizing small, it lets you keep within the recreation longer and proceed to be taught.

Abstract

Briefly, with greater than $2,000, you must be capable to use most defined-risk methods on lower-to-moderately priced shares whereas nonetheless protecting your common guess measurement affordable.

With lower than $2,000, you’re just about restricted to purchasing outright choices, though you can also make bets on volatility by shopping for a lengthy straddle, which simply entails shopping for a name and put on the similar worth. As stated earlier, it’s crucial to concentrate on discovering commerce concepts in lower-priced shares.