- Gold worth evaluation suggests the likelihood of additional draw back because the stronger greenback weighs on the dear steel.

- The brand new Fed Chair nomination has triggered a wave of deeper retracement in gold after a robust rally.

- Gold’s structural assist stays intact as central banks nonetheless purchase, whereas US-Iran stress additionally maintains a safe-haven demand.

Gold costs at the moment are in a pointy correction part after a robust rally earlier in January. The current worth drop is because of a mix of macroeconomic developments, pressured deleveraging, and regulatory responses in key markets. The preliminary trigger was a change in US financial expectations, however the depth of the transfer reveals how weak positioning had change into.

–Are you curious about studying extra about Bitcoin worth prediction? Examine our detailed guide-

The selection of Kevin Warsh as the following Fed Chair has calmed fears of aggressive easing and led buyers to imagine that monetary circumstances will get tighter. This, together with larger US producer inflation, has helped the US greenback and actual yields, weighing on the non-yielding steel within the quick time period.

The drop was exacerbated by systematic promoting, as momentum indicators had remained deeply overbought earlier than the reversal, leaving the market susceptible to fast liquidation as soon as key ranges have been breached.

Developments in China present the extent of volatility. ICBC, Financial institution of China, and China Building Financial institution, amongst different main Chinese language banks, warned treasured metals buyers in public that the markets have been “technically fragile” and urged warning. The Shanghai Gold Change modified its margin necessities and worth limits in response, making it more durable to invest aggressively. These actions present that the federal government is worried that current worth modifications have been pushed extra by leverage and sentiment than by regular end-user demand.

Stress has additionally proven up amongst retail customers. In Kyrgyzstan, residents have reportedly rushed to promote licensed gold bars to the state-owned Kyrgyzaltyn firm after the worldwide hunch. This reveals how shortly conduct can change from hoarding to capital preservation in smaller markets after an enormous drop.

The structural pillars that assist gold stay intact, even after the correction. Central banks are shopping for extra to diversify their reserves. In the meantime, on the geopolitical entrance, tensions between the US and Iran stay excessive, maintaining safe-haven demand alive despite the fact that rhetoric has calmed down within the quick time period.

This correction doesn’t appear like a pattern reversal. It seems extra like a needed reset after an enormous, emotion-driven rise. Gold may stabilize and construct up, however for it to return up shortly, there’ll most likely must be extra macro stress or a transparent pivot in world financial circumstances.

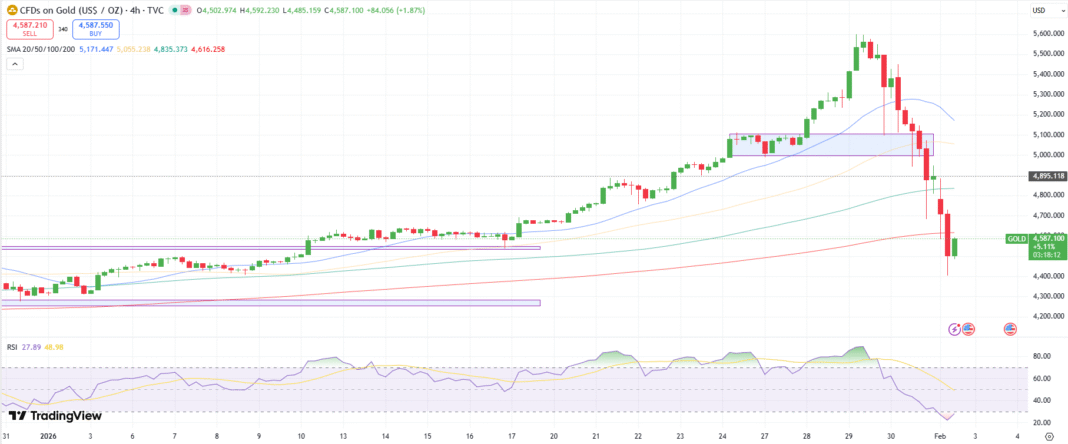

Gold Worth Technical Evaluation: Extra Losses Beneath 200-MA

The 4-hour chart for gold reveals a dismal state of affairs as the value lastly strikes under the 200-period MA close to $4,600 for the primary time since Nov 2025. This means an enduring downtrend with potential for additional losses. Nevertheless, the RSI has hit the oversold zone, suggesting a possible consolidation or pullback earlier than additional draw back.

–Are you curious about studying extra about scalping foreign exchange brokers? Examine our detailed guide-

The dear steel may take a look at the 100-period MA close to $4,835 forward of the $5,000 psychological mark after which the 20-period MA at $5,250. On the flip facet, the gold may break in the present day’s lows of $4,400, which may result in filling the hole at $4,330. Additional draw back may take a look at the $4,000 psychological mark.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you may afford to take the excessive threat of shedding your cash.