On this interview with Charlotte McLeod, I stroll by means of what I’m seeing unfold in gold and silver and why, regardless of the bullish long-term backdrop, I’m not satisfied this transfer is able to run uninterrupted. Sure, the situations supporting valuable metals are actual, and sure, costs may nonetheless push a bit increased within the close to time period. However markets don’t transfer in clear, straight traces. From my perspective, gold and silver nonetheless have to work by means of a significant pullback, a needed reset that shakes out late patrons and resets sentiment earlier than the following main alternative develops.

I additionally clarify why defending capital and respecting pattern cycles issues greater than chasing headlines or momentum. There’ll completely be a time to be again in metals, as a result of I imagine gold and silver will transfer dramatically increased from present ranges, however that chance is probably going a 12 months or two away. Till then, endurance, self-discipline, and a willingness to carry money are a part of the method. My focus stays on using tendencies whereas they’re intact, stepping apart when threat will increase, and being ready for the following excessive chance part when the market provides us a transparent sign.

Join my free Investing publication right here

The matters Charlotte and I mentioned embrace:

- 0:00 – Intro

- 0:22 – Gold’s good storm

- 2:39 – Lock in gold earnings

- 5:03 – Inventory market selloff

- 6:54 – Silver to maintain rising?

- 10:05 – Subsequent play is money

- 14:41 – Oil to hit US$45?

- 16:51 – Defending capital

- 19:35 – Outro

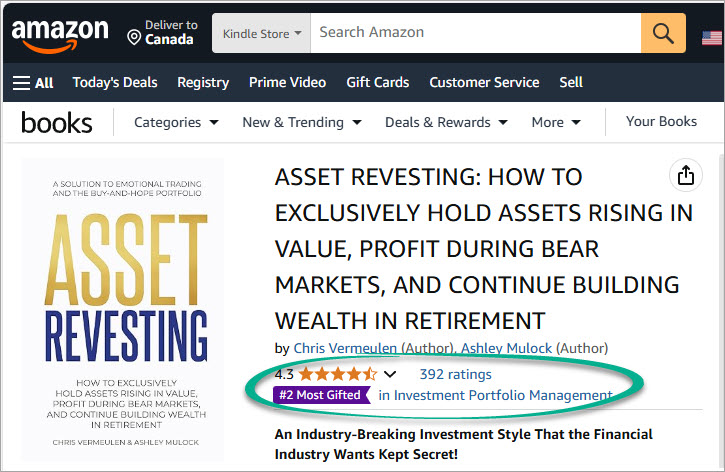

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

MY FREE INDICATORS IN MY BOOKS

Disclaimer: This e mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Change Fee or any state regulator. The content material offered doesn’t represent a suggestion to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to alter with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions might change at any time with out discover. Readers are solely accountable for their very own funding choices. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding choices. Efficiency outcomes referenced might embrace each reside buying and selling information and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t replicate precise buying and selling. No illustration is being made that any account will or is prone to obtain earnings or losses much like these proven. Testimonials and endorsements included on this communication is probably not consultant of all customers’ experiences and usually are not ensures of future efficiency or success. We might obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material offered is normal market commentary and never tailor-made to any particular person’s monetary state of affairs. Previous efficiency isn’t indicative of future outcomes. Investing includes threat, together with the potential lack of capital.