On this February 2026 dialogue, I sat down with Craig Hemke from Sprott Cash to stroll via what’s actually been occurring in gold, silver, and the broader inventory market after an especially emotional 2025.

Each gold and silver skilled highly effective, euphoric rallies to new highs, adopted by sharp and quick pullbacks that caught quite a lot of traders off guard. On this video, I break down whether or not that silver transfer might have marked a significant prime, and why gold may nonetheless have the technical construction to push a lot increased, even towards the $6,000 stage, whereas silver struggles to maintain tempo.

We dig into the charts, Fibonacci extensions, sentiment extremes, and momentum shifts that matter proper now. I clarify what the worth motion is telling us, how I’m occupied with trimming versus holding, and why asset rotation turns into important after parabolic strikes. This isn’t about predictions, it’s about letting worth information choices and understanding the place danger and alternative could also be shifting subsequent in treasured metals.

Join my free Investing e-newsletter right here

The matters Ben and I mentioned embrace:

- 00:00 – February outlook begins

- 01:56 – Finest asset proper now

- 03:21 – Inventory market pattern overview

- 04:10 – Gold’s measured transfer sample

- 05:38 – Silver’s euphoric section ends

- 06:36 – Is the highest in?

- 10:38 – Gold’s longer-term power

- 14:45 – Silver worth resistance zones

- 17:43 – Gold to $6,000?

- 20:11 – Technique: rotate, don’t maintain endlessly

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

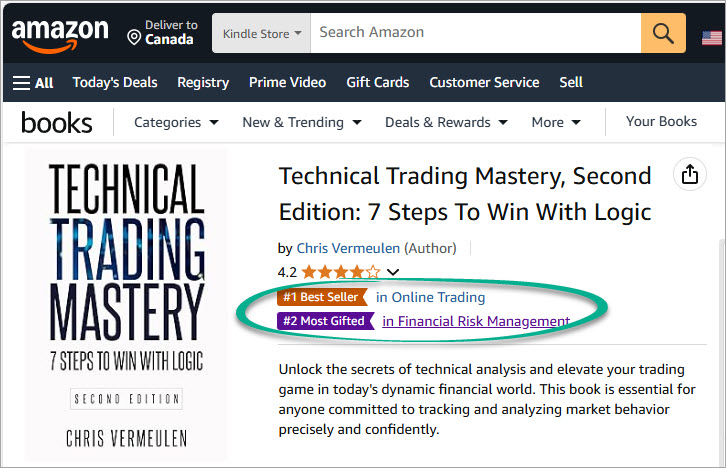

MY FREE INDICATORS IN MY BOOKS

Disclaimer: This e mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Alternate Fee or any state regulator. The content material offered doesn’t represent a suggestion to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to vary with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions might change at any time with out discover. Readers are solely liable for their very own funding choices. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding choices. Efficiency outcomes referenced might embrace each reside buying and selling information and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t replicate precise buying and selling. No illustration is being made that any account will or is prone to obtain income or losses much like these proven. Testimonials and endorsements included on this communication will not be consultant of all customers’ experiences and aren’t ensures of future efficiency or success. We might obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material offered is common market commentary and never tailor-made to any particular person’s monetary scenario. Previous efficiency just isn’t indicative of future outcomes. Investing entails danger, together with the potential lack of capital.