- The GBP/USD weekly forecast turns strongly bullish because the greenback loses traction amid geopolitics.

- The upbeat UK CPI, retail gross sales, and PMI information offered satisfactory assist to the pair.

- Markets await the FOMC fee resolution and press convention subsequent week.

GBPUSD ended final week with sterling fundamentals enhancing, however value motion nonetheless leaned closely on USD headline danger and US fee expectations.

Within the UK, inflation re-accelerated as CPI rose 3.4% YoY in December (from 3.2%), which generally reduces the market’s confidence in fast BoE easing and helped GBP on the day by lifting front-end UK yields. Exercise and demand information additionally stunned positively: UK retail gross sales rose 0.4% MoM in December (versus expectations for a fall), including to indicators of a pickup and supporting sterling sentiment, even when the FX follow-through was at instances modest.

–Are you interested by studying extra about ETF brokers? Verify our detailed guide-

The UK flash PMI set added to the constructive tone by signalling continued enlargement in private-sector exercise, reinforcing the concept the UK economic system is just not rolling over into the BoE’s subsequent selections.

On the US aspect, “good” information didn’t translate right into a stronger greenback as a result of geopolitics dominated. The US economic system’s momentum was confirmed as Q3 2025 GDP was revised as much as a 4.4% annualized tempo, and enterprise surveys stayed expansionary with the S&P International flash PMIs displaying manufacturing at 51.9 and composite at 52.8 in January.

On the identical time, tensions between the US and Europe over Greenland added to volatility within the danger premium. Trump stated he would impose 10% tariffs on eight European nations beneath strain from Greenland. Later, he additionally stated {that a} “framework” had been talked about after assembly with NATO Secretary Basic Mark Rutte. Denmark and Greenland each said that their sovereignty is just not negotiable. That blend made the markets jumpy and damage regular demand for the USD.

Within the subsequent week, there gained’t be any huge UK releases, so the tape will lead. So, GBPUSD ought to principally commerce like a Fed-week USD cross, reacting to modifications in US yield expectations and any new geopolitical or tariff information.

If the Fed is hawkish, the USD could be stronger than the enhancing information pulse of the GBP. Conversely, if the Fed stays balanced and yields fall, the GBP can maintain up higher than its friends, given final week’s hotter CPI and stronger exercise alerts.

–Are you interested by studying extra about South African foreign exchange brokers? Verify our detailed guide-

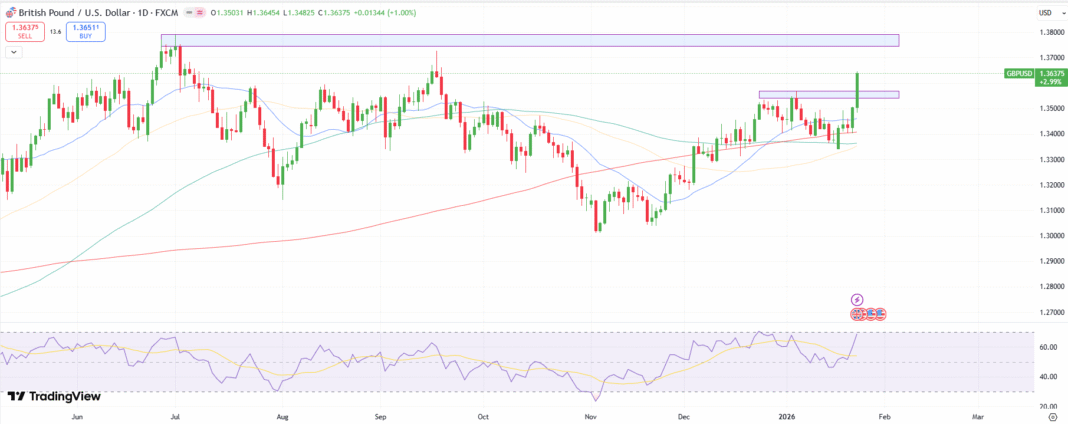

GBP/USD Weekly Technical Forecast: Bullish Above 1.3565

The GBPUSD every day chart reveals a powerful bullish candle piercing the 1.3565 resistance degree, adopted by the 1.3600 psychological mark. Nevertheless, the RSI approaching the overbought area signifies a possible pullback to the 1.3565 space earlier than an upside continuation.

The upside goal for the pair lies at 1.3700, forward of 1.3750. On the draw back, if the value breaks and stays under the 1.3565 degree may collect additional promoting strain and drag in the direction of 1.3500.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you possibly can afford to take the excessive danger of dropping your cash.