- GBP/USD worth evaluation stays subdued after easing UK CPI information.

- The pound stays weak amid the Fed’s cautiousness and the BoE’s greater odds of a charge minimize.

- Focus stays on the UK Autumn price range as fiscal issues mount.

The GBP/USD worth evaluation reveals a subdued image on Wednesday regardless of UK inflation easing according to expectations. The main focus of merchants shifted to the chance of Financial institution of England coverage and US macroeconomic information.

-Are you on the lookout for automated buying and selling? Test our detailed guide-

The latest ONS report reveals the headline CPI easing to three.6% YoY in October, down from September’s 3.8%, matching the market estimates. Core CPI slipped to three.4% whereas companies inflation cooled to 4.5% from earlier 4.7%. Inflation stays a priority for the central financial institution, regardless of a gradual disinflationary pattern, which retains coverage expectations intact.

The preliminary response of GBP/USD was muted, edging decrease to 1.3130, extending its decline for a fourth consecutive session. The moderation in inflation information, mixed with weaker labor information and GDP development, is a results of rising fiscal uncertainty. This fuels the expectations of a December charge minimize by the Financial institution of England. With the UK Autumn Finances due subsequent week, merchants are cautious about additional stress on gilt yields and the pound, as it’s reportedly that the federal government might abandon its plan to hike revenue tax. This might widen the fiscal hole to £30 bn. Markets stay unconvinced that Rachel Reeves can preserve a reputable fiscal self-discipline with out deeper cuts.

Throughout the Atlantic, the US greenback stays agency as hopes for a December Fed charge minimize fade, supporting US yields. The CME FedWatch Software now reveals a 49% likelihood of a 25-basis-point charge minimize, down from 67% the earlier week. The latest Fedspeak triggered a cautious tone, as Richmond Fed President Barkin famous that inflation is just not re-accelerating however stays off monitor from the two% goal, underscoring the Fed’s uncertainty. Blended job information, like 232k preliminary jobless claims and a modest discount in jobs within the ADP information, provides complexity to the delayed NFP information for September.

GBP/USD Key Occasions Forward

The PMI information is predicted from each nations on Friday. The figures are unlikely to shift the narrative, as projected numbers are more likely to stay the identical as these from final month. In the meantime, Thursday’s US NFP information might generate volatility within the markets.

The mix of soppy UK information and a resilient greenback makes the GBP/USD weak, with the UK fiscal price range taking middle stage subsequent week.

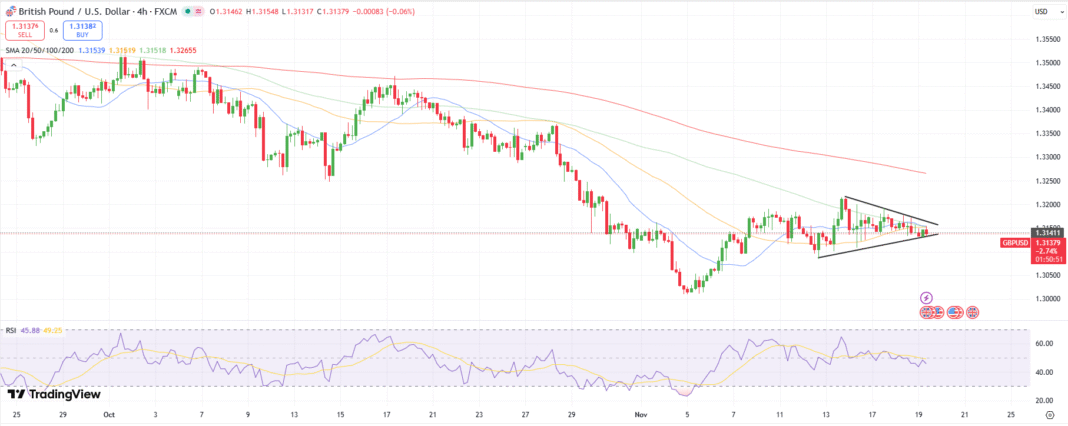

GBP/USD Technical Value Evaluation: Weak Bullish Pennant Sample

The GBP/USD worth wobbles below the important thing MAs, whereas the RSI stays flat below the 50.0 degree. This means a technically weak pound, awaiting a bearish breakout. Nonetheless, the value has fashioned a bullish pennant sample and is staying inside the sample’s trendlines.

-If you’re excited by foreign exchange day buying and selling, then have a learn of our information to getting started-

If the sample works, the value might leap above the cluster of key MAs, breaking the higher trendline to check the numerous degree at 1.3200. However, if the decrease trendline breaks, the pair might proceed its bearish momentum, probably resulting in 1.3100, adopted by 1.3050.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you may afford to take the excessive danger of dropping your cash.