By RoboForex Analytical Division

The GBP/USD pair prolonged its positive factors, reaching 1.3189, as traders await particulars of the UK finances, to be offered immediately, 26 November. All consideration is on Chancellor Rachel Reeves and her technique to shut the fiscal deficit whereas adhering to the federal government’s self-imposed budgetary guidelines. This problem requires discovering tens of billions of kilos in financial savings or income. Market volatility has been stoked by experiences suggesting the federal government might keep away from fast tax will increase.

The fiscal backdrop is deteriorating. In response to media experiences, the Workplace for Price range Accountability (OBR) is getting ready to decrease its progress forecasts for 2026 and past. This revision may widen the finances deficit by £20–30 billion, intensifying the long-term stress for tax rises.

Current macroeconomic knowledge underscores the financial system’s fragility. Public sector borrowing stays at report highs exterior of the pandemic interval, enterprise exercise is slowing, retail gross sales have contracted sharply, and shopper confidence is waning.

Amid this weak financial panorama, October’s inflation studying fell to three.6%, solidifying expectations for financial coverage easing. Markets are actually pricing in an 80% likelihood of a 25-basis-point price minimize from the Financial institution of England in December.

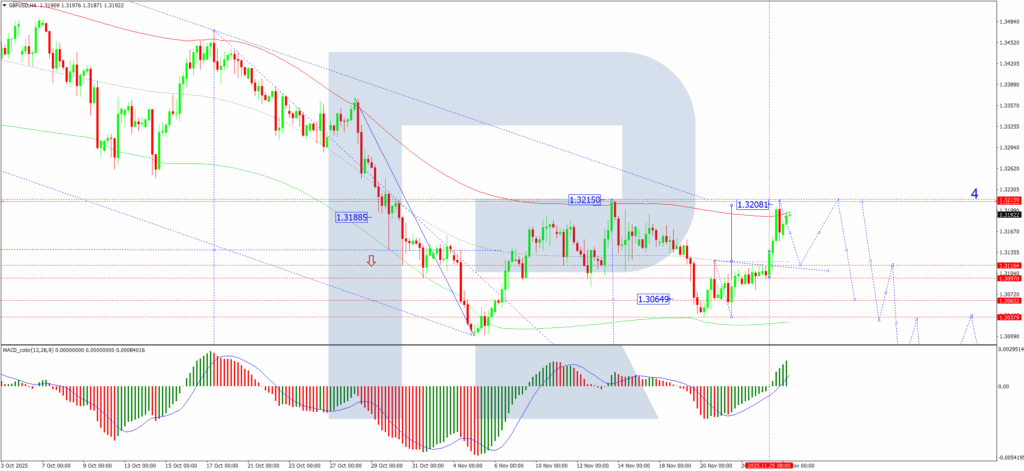

Technical Evaluation: GBP/USD

H4 Chart:

On the H4 chart, GBP/USD broke decisively above 1.3116, finishing a corrective wave construction to 1.3210. We now anticipate a pullback to retest the 1.3116 stage from above. Following this retest, a remaining leg of the correction may push the pair in direction of 1.3215.

As soon as this corrective section is full, the first downtrend is predicted to renew. The subsequent key goal for the next wave of promoting is at 1.2911. The MACD indicator helps this view; its sign line is above zero and pointing upwards, confirming the present corrective power is probably going a prelude to a brand new downtrend.

H1 Chart:

On the H1 chart, the pair broke upwards from a pronounced consolidation vary round 1.3123, reaching its preliminary goal at 1.3210. A decline to retest 1.3123 is now anticipated. This needs to be adopted by a remaining upward thrust to 1.3215, at which level the corrective potential is more likely to be exhausted.

We then forecast the beginning of a fifth and usually highly effective wave of decline, concentrating on 1.2911. The Stochastic oscillator confirms this situation. Its sign line is in overbought territory above 80 and is popping downwards, signalling that the present upward momentum is shedding steam.

Conclusion

The pound’s power is fragile, pushed by finances hypothesis relatively than a shift in fundamentals. The pre-budget rally is seen as a corrective bounce inside a broader bearish pattern. Technically, the pair is approaching a vital resistance zone close to 1.3215. We anticipate this stage will cap positive factors and current a promoting alternative, paving the way in which for a resumption of the downtrend with an preliminary goal at 1.2911. The finances particulars and the BoE’s subsequent December assembly might be key determinants of the pound’s medium-term course.

Disclaimer:

Any forecasts contained herein are based mostly on the creator’s explicit opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes based mostly on buying and selling suggestions and evaluations contained herein.

- GBP/USD Rises as Markets Await Essential UK Price range Nov 26, 2025

- The RBNZ lowered the rate of interest to 2.25%. In Australia, inflationary pressures are growing Nov 26, 2025

- EUR/USD Extends Losses as Greenback Power Is Questioned Nov 25, 2025

- Fed officers trace at a December price minimize. Hong Kong’s Hold Seng breaks six‑day shedding streak Nov 25, 2025

- Europe’s manufacturing sector continues to battle. Oil costs fell under $58 per barrel Nov 24, 2025

- Yen Below Sustained Strain, Igniting Intervention Fears Nov 24, 2025

- Issues concerning the synthetic intelligence sector triggered a worldwide promote‑off of belongings Nov 21, 2025

- Gold Treads Water Amid Combined Alerts Nov 21, 2025

- The PBOC stored rates of interest unchanged as anticipated. Nvidia’s report beat projections and eased considerations about AI investments Nov 20, 2025

- GBP/USD Weakens Quickly Amid Dovish Information and Exterior Pressures Nov 20, 2025