- The GBP/USD outlook stays mildly subdued amid considerations over the UK’s fiscal state of affairs, because it awaits the discharge of US information.

- The pound sterling slipped decrease because the UK authorities determined to drop the revenue tax fee hikes.

- The Empire State Manufacturing Index and commentary from FOMC and MPC officers will reveal additional coverage cues.

The GBP/USD outlook suggests a weak shopping for momentum, because the pair trades close to 1.3165, with each the pound and the US greenback responding to shifting home and world financial developments.

-Are you in search of automated buying and selling? Examine our detailed guide-

The UK Prime Minister, Keir Starmer, and the Finance Minister, Racheal Reeves, determined to drop the revenue tax rise forward of the November 26 price range, which pressured the pound.

This transfer raises considerations over the UK’s fiscal outlook. The widening price range hole has traders centered on the federal government’s subsequent transfer to sort out it. Markets are pricing in an 80% likelihood of a December reduce by the Financial institution of England, bolstered by comfortable UK information, which additional limits the pound’s upside.

From the US, the greenback holds regular as markets look ahead to the delayed upcoming releases, which had been halted by the federal shutdown. Buyers are listening to non-farm payroll, anticipated on November 20. The info may present a significant sign to the Fed for shaping the near-term financial coverage.

This growth has lowered the likelihood of a Fed reduce in December to 43%, down from 67% final week.

GBP/USD Day by day Key Occasions

The foremost occasions within the day embrace:

- MPC Member Mann Speaks

- US Empire State Manufacturing Index

- FOMC Member Williams Speaks

- FOMC Member Jefferson Speaks

- Development Spending m/m

Markets await the Empire State Manufacturing Index for insights into the manufacturing enterprise exercise in New York. In the meantime, commentary from FOMC members William and Jefferson, in addition to MPC member Mann, is predicted to shed some mild on the coverage path shifting forward.

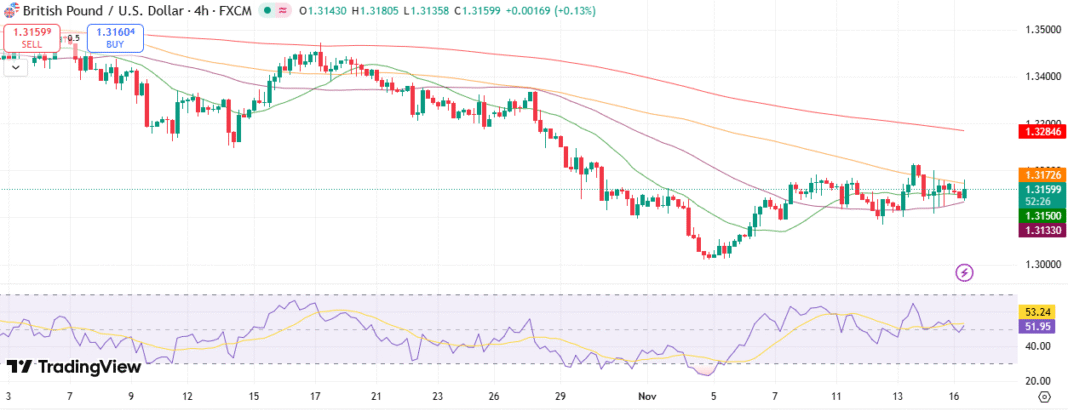

GBP/USD Technical Outlook: Holds Vary-Certain Above 1.3160

The GBP/USD 4-hour chart reveals a range-bound momentum, because it consolidates above 1.3160 after recovering from its day by day lows. The value is above the important thing 50-period MA round 1.3150. Nevertheless, it’s beneath the 100-and 200-period MA, close to 1.3175 and 1.3285, respectively, which caps additional upside regardless of earlier stabilization.

-If you’re eager about foreign exchange day buying and selling, then have a learn of our information to getting started-

The RSI holds close to 52, indicating a impartial to mildly bullish bias. A sustained breach above 1.3175 may prolong the upside. Quite the opposite, a drop beneath 1.3133 may set off additional draw back in direction of November’s lows close to 1.3050.

Help Ranges

Resistance Ranges

-

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to think about whether or not you’ll be able to afford to take the excessive threat of shedding your cash.