By RoboForex Analytical Division

The GBP/USD pair is looking for assist round 1.3062 on Thursday, with traders cautiously positioning themselves forward of right this moment’s pivotal Financial institution of England (BoE) financial coverage assembly. The British foreign money stays underneath stress, buying and selling close to a seven-month low in opposition to the US greenback and at its weakest stage in over two years in opposition to the euro.

Market pricing at the moment implies roughly a one-in-three likelihood of a 25-basis-point charge reduce from the BoE. This uncertainty creates important uneven threat, which means the pound is poised for a pointy transfer in both route as soon as the choice and accompanying assertion are launched.

The pound’s weak point was compounded by the current launch of softer-than-expected UK inflation knowledge, which bolstered expectations for an imminent shift in the direction of coverage easing. A simultaneous world sell-off in fairness markets, significantly within the tech sector, has additional dampened sentiment by lowering urge for food for risk-sensitive belongings akin to sterling.

Including to the headwinds, investor focus is shifting to the UK price range, due for approval later this month. Chancellor Rachel Reeves has signalled the potential for tax rises, a measure that might stifle financial development and doubtlessly immediate the BoE to undertake a extra dovish stance – one other issue weighing on the foreign money.

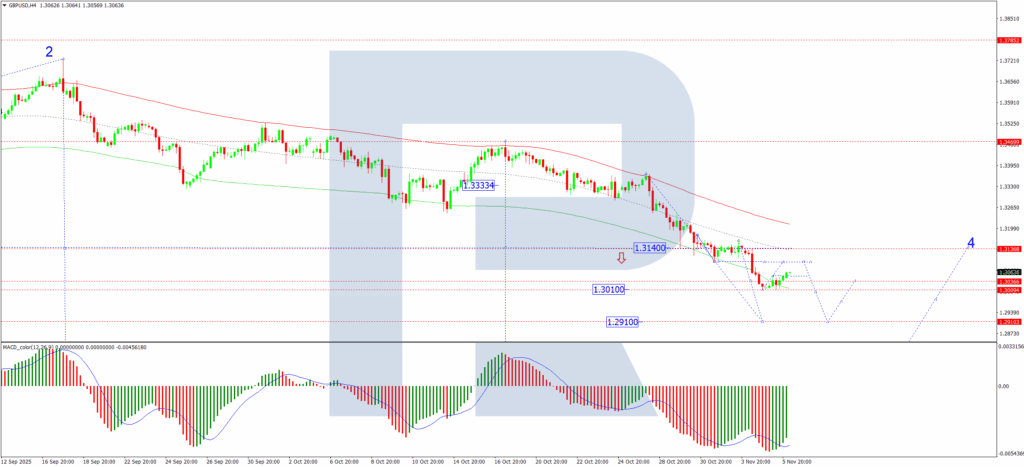

Technical Evaluation: GBP/USD

H4 Chart:

On the H4 chart, GBP/USD broke downwards from a consolidation vary round 1.3140, finishing a bearish wave to 1.3010. We now anticipate a technical correction in the direction of 1.3090. Following this pullback, the first downtrend is predicted to renew, with the subsequent key targets at 1.2910 and, in the end, 1.2811. The MACD indicator helps this bearish outlook. Whereas its sign line is at deeply oversold ranges and has diverged from its histogram, suggesting the potential for a short-term corrective rise, the general construction stays adverse.

H1 Chart:

On the H1 chart, the pair equally broke down from a spread round 1.3157, reaching the 1.3010 goal. A corrective retracement to check 1.3100 from beneath is now anticipated. As soon as this correction is full, the downtrend is more likely to prolong in the direction of no less than 1.2950. The Stochastic oscillator aligns with this view. Its sign line is in overbought territory above 80 and seems poised to show down in the direction of 20, indicating that any near-term energy is probably going corrective earlier than promoting stress reasserts itself.

Conclusion

GBP/USD is stabilising at multi-month lows forward of a high-stakes BoE assembly. The mix of dovish inflation knowledge, a risk-off market temper, and looming fiscal uncertainty has created a profoundly adverse backdrop for sterling. Technically, the trail of least resistance stays downward. Whereas a short-covering bounce again in the direction of 1.3100 is feasible post-decision, the broader pattern suggests additional losses, with key targets at 1.2910 and 1.2811.

Disclaimer:

Any forecasts contained herein are primarily based on the writer’s specific opinion. This evaluation will not be handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes primarily based on buying and selling suggestions and critiques contained herein.

- GBP/USD Hovers Close to Lows as Financial institution of England Determination Looms Nov 6, 2025

- Buyers are switching to risk-off mode. The worth of Bitcoin has fallen beneath $100,000 Nov 5, 2025

- As anticipated, RBA retains the speed at 3.6%. New Zealand greenback hits 7-month low Nov 4, 2025

- EUR/USD Underneath Sustained Stress as Markets Await Key Knowledge Nov 3, 2025

- OPEC+ is predicted to approve one other enhance within the collective oil manufacturing stage. Canada launched a weak GDP report. Nov 3, 2025

- FED and Financial institution of Canada reduce charges. ECB resolution due right this moment Oct 31, 2025

- USD/JPY Hits 9-Month Excessive as Yen Endures Powerful October Oct 31, 2025

- GBP/USD Finds a Flooring at 1.3200 After Fed-Induced Promote-Off Oct 30, 2025

- A Key Day for EUR/USD because the Fed Determination Looms Oct 29, 2025

- The British Index UK100 hit a brand new all-time excessive. The Australian greenback strengthened, reaching a three-week excessive Oct 29, 2025