- The GBP/USD forecast stays bearish beneath 1.3350 as dismal UK CPI weighs on the pound.

- Rising unemployment and downward-trending UK CPI cement the chances of a BoE charge minimize on Thursday.

- The weakening greenback retains pound losses restricted, with eyes on the US CPI knowledge forward.

The British pound plummeted towards the US Greenback on Wednesday following the weaker-than-anticipated UK inflation figures in November. The GBP/USD pair fell by over 0.5% in the direction of the 1.3310 area, defying Tuesday’s good points when the pair briefly went above 1.3450.

–Are you curious about studying extra about copy buying and selling platforms? Examine our detailed guide-

In accordance with the Workplace for Nationwide Statistics, the headline client inflation decreased to three.2% YoY, in comparison with the earlier 3.6% and beneath the market expectations of three.5%. This was the second month-to-month lower, revealing steadily falling worth pressures within the UK. The core inflation additionally slowed to three.2% in comparison with 3.4% within the earlier month. Costs decreased by 0.2% MoM, highlighting the softening development.

The companies inflation, a significant indicator of the Financial institution of England, decreased marginally to 4.4%. Though this degree remains to be properly above the BoE goal, the development has lowered confidence in sustaining the restrictive coverage.

In the meantime, the UK labor market remains to be dropping steam. The UK unemployment charge elevated to five.1%, the best in practically 5 years. Mixed, tame inflation and rising unemployment have raised the chance of a BoE charge minimize.

A restoration within the US Greenback additional weighed on the sterling. The Greenback Index (DXY) regained floor to achieve 98.60 after marking a 10-week low within the earlier week. This was regardless of the blended US employment report, which indicated job progress of 64k in November, however the unemployment charge elevated to 4.6%. Traders largely disregarded the weaker features of the report on account of distortions attributable to the extended authorities shutdown.

Markets are presently anticipating the Fed to keep up charges within the 3.50-3.75% vary in January. The main focus has shifted to the US inflation statistics due on Thursday, which can influence the anticipation of a charge discount within the latter a part of the 12 months.

Shifting forward, GBP/USD is underneath strain within the quick time period as merchants assessment the UK charge expectations. However the wider demerit may very well be confined. Inflation within the UK stays comparatively excessive in comparison with different economies, and the BoE’s easing expectations are extra cautious than these of the Fed. If US inflation slows down and the greenback regains its misplaced momentum, the pound might stabilize even after the current setback.

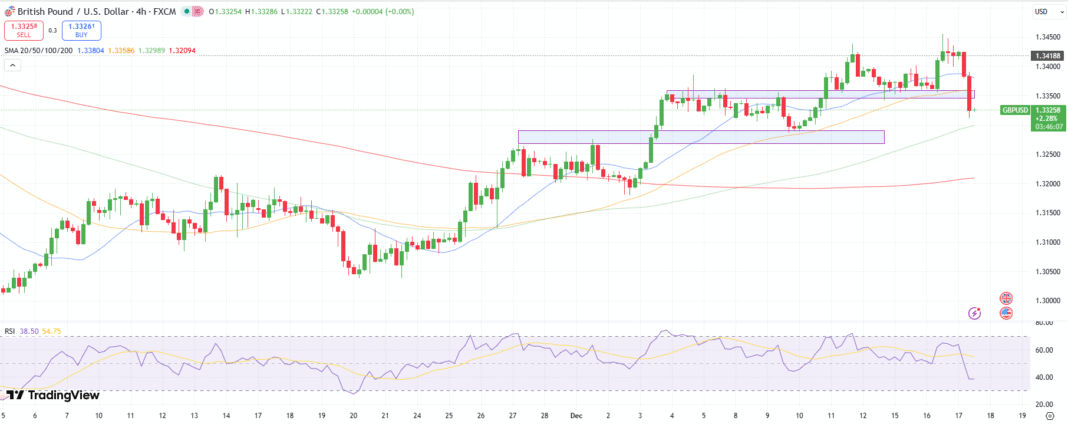

GBP/USD Technical Forecast: Draw back Under 1.3350

The GBP/USD broke beneath the demand zone round 1.3350, marking a recent low at 1.3310 earlier than recovering barely. The value is anticipated to retest the damaged zone earlier than resuming its downward development. Nonetheless, the RSI underneath 40.0, approaching the oversold zone, suggests restricted draw back.

–Are you curious about studying extra about scalping foreign exchange brokers? Examine our detailed guide-

The rapid assist for the pair lies at 1.3300 close to the 100-period MA forward of the following demand zone at 1.3270, after which the 200-period MA close to 1.3200. On the upside, the 1.3350 support-turned-resistance might restrict good points forward of the each day pivot at 1.3378 after which 1.3400.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must contemplate whether or not you may afford to take the excessive threat of dropping your cash.