- The GBP/USD forecast barely edges decrease regardless of the greenback weak point led by the dovish Fed tone.

- Decrease US yields and broad dollar weak point proceed to place a danger flooring below GBP/USD.

- Pound stays susceptible with rising expectations of a BoE charge minimize subsequent week.

The GBP/USD value is buying and selling decrease close to 1.3365 on Thursday forward of the London session, pressured by a modest rebound within the US greenback following Wednesday’s Federal Reserve assembly. Regardless of the pullback, the draw back stays restricted because the Fed in the end delivered a dovish tone, encouraging traders to promote the dollar into any power.

If you’re excited about automated foreign currency trading, test our detailed guide-

The Fed cuts the speed by 25 bps for the third straight assembly. Nonetheless, the voting break up, with two members favoring a pause and Trump-appointed Stephen Miran requesting a extra substantial transfer, displays the rising division inside the committee.

In Powell’s press convention, he emphasised that policymakers want time to evaluate the affect of the easing on the economic system. In the meantime, the Fed projected just one minimize in 2026, however merchants are speculating on two extra cuts, particularly after Powell flagged the draw back danger to the labor market. The shift in tone triggered a broad greenback sell-off, with the Greenback Index falling to the bottom degree since October 21, whereas the GBP/USD marked a contemporary prime at 1.3391 earlier than falling.

US yields additionally slid after the Fed introduced contemporary Treasury invoice purchases, ranging from December 12, initiating $40 billion program to stabilize liquidity. The sooner-than-expected stability sheet growth plan weighed on the yields, including extra stress on the greenback.

Nonetheless, the GBP outlook stays complicated amid the Financial institution of England’s easing expectations. Markets now value in an 88% chance of a BoE charge minimize subsequent week, following a sequence of softer UK information that alerts easing inflationary stress. The divergence, with the Fed being versatile and the BoE shifting prior to anticipated, is limiting the GBP/USD from extending its rally regardless of greenback weak point.

The broad market sentiment stays cautious because the GBP/USD is left to stability between the dovish Fed and the vulnerability within the pound linked to the BoE. Merchants now await the US preliminary Jobless Claims information due in Thursday’s New York Session for intraday course.

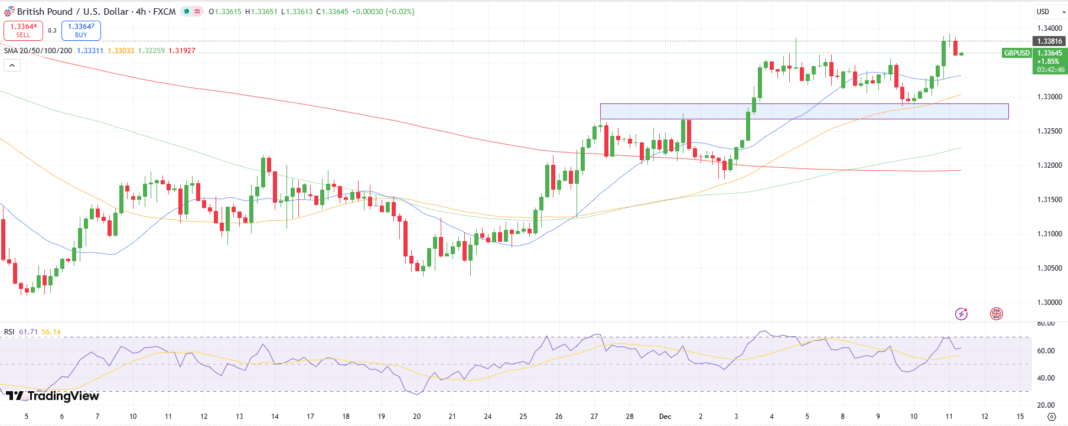

GBP/USD Technical Forecast: Correction Earlier than Bullish Continuation

The GBP/USD 4-hour chart exhibits the value drifting slowly in the direction of the 20-period MA at round 1.3350. The RSI is off the overbought zone however stays steady, indicating a brief choppiness earlier than an upside continuation.

–Are you to be taught extra about foreign exchange choices buying and selling? Test our detailed guide-

Nonetheless, breaching the 20-period MA may push the value additional down in the direction of the 50-period MA at 1.3330, forward of the demand zone round 1.3275. On the upside, at the moment’s prime at 1.3391 stays a key resistance forward of 1.3420.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must take into account whether or not you possibly can afford to take the excessive danger of dropping your cash.