- The GBP/USD forecast edges decrease as threat sentiment deteriorates, resulting in elevated flows to the safe-haven greenback.

- Pound’s draw back stays restricted amid Cautious BoE and accommodative Fed.

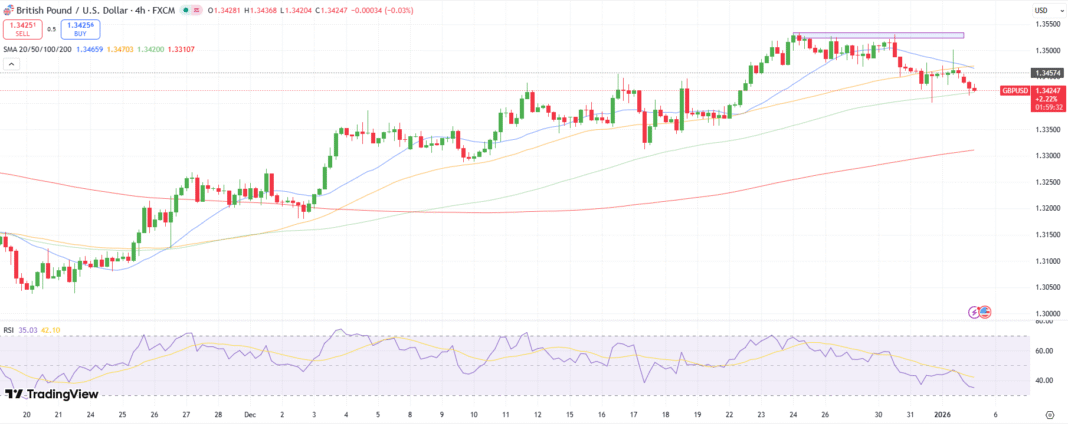

- Technically, 100-MA holds from additional losses, however bearish stress stays intact.

After a quick bearish hole, GBP/USD started the brand new week cautiously, barely falling beneath the mid-1.3400s. Though the motion suggests a resurgence of demand for US {dollars}, there was little promoting stress to date. The market’s uncertainty, slightly than an obvious change in course, is highlighted by the pair’s continued maintain above final week’s lows.

–Are you curious about studying extra about foreign exchange indicators? Verify our detailed guide-

One short-term issue has been geopolitics. Some buyers are turning again to the greenback as a defensive asset as a result of ongoing battle in Ukraine, the unrest within the Center East, and the latest US army motion in Venezuela. GBP/USD is underneath short-term stress as a result of greenback index’s continued restoration from multi-month lows. However demand for protected havens by itself hasn’t been sturdy sufficient to pressure a broader repricing, significantly with US charge expectations nonetheless tilted towards easing.

The first counterweight to the power of the greenback stays the outlook for rates of interest. With no less than another transfer later within the 12 months nonetheless priced in, markets are nonetheless debating whether or not the Fed will make its first minimize as early as March. Any concrete proof of a slowing US labor market would assist that idea and restrict future greenback positive factors, significantly when in comparison with currencies the place central banks appear extra hesitant to ease.

Within the UK, the relative repricing of Financial institution of England expectations continues to assist the pound. Though the December charge minimize by the BoE to three.75% was broadly anticipated, the shut 5-4 vote cut up drew discover. Traders have been compelled to decrease their expectations for swift follow-up cuts, because it indicated continued concern concerning the persistence of inflation. Though UK development stays muted, this variation has supplied sterling with some assist.

From a broader perspective, the US greenback’s decline, slightly than the pound’s outright power, was the primary driver of the pound rally final 12 months. Sterling underperformed a number of different main currencies in 2025, regardless of the cable rising by greater than 6%. That is vital for 2026 as a result of it implies that extra upside will want assist tailor-made to the UK slightly than only a weaker greenback.

The UK fundamentals state of affairs isn’t solely clear. Progress stays modest, the labor market is regularly opening up, and inflation has cooled extra rapidly than anticipated. When taken as a complete, these components enable the BoE to additional decrease charges if circumstances worsen. Nevertheless, political unpredictability and monetary fragility are nonetheless unresolved dangers that would rapidly reappear if gilt markets grow to be unstable.

The GBP/USD value is at the moment near a crucial zone. Whereas 1.30 continues to find out whether or not pullbacks stay corrective or preliminary reversal, the 1.35 space stays a definite barrier that has persistently capped rallies. The cable is more likely to stay range-bound, with course decided extra by the greenback than by home UK momentum, till future US labor information prompts a clearer repricing of charge expectations.

GBP/USD Technical Forecast: 100-MA holding losses

The GBP/USD draw back discovered a robust assist close to the 100-period MA round 1.3420. Nevertheless, a Friday’s bearish pin bar and a bearish crossover of 20- and 50-period MAs reveal a constructing bearish stress. Solely shifting above the 20-period MA, close to 1.3455, might alleviate the bearish stress and result in a take a look at of the provision zone close to 1.3550.

–Are you curious about studying extra about subsequent cryptocurrency to blow up? Verify our detailed guide-

However, breaking beneath the 10-period MA might set off a deeper correction to a swing low of December, with confluence on the 200-period MA close to 1.3300. The RSI beneath 50.0 additionally helps the bearish narrative.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must contemplate whether or not you’ll be able to afford to take the excessive threat of shedding your cash.