THE END OF FRAGMENTATION

Cristian, monetary companies advanced for many years in vertical silos. Why is that mannequin breaking down now, significantly in FX and buying and selling?

In case you take a look at FX brokers and buying and selling establishments, fragmentation has at all times been a constraint. Buying and selling programs, danger engines, consumer cash, funds, and reporting have been typically dealt with by separate platforms that needed to be stitched collectively.

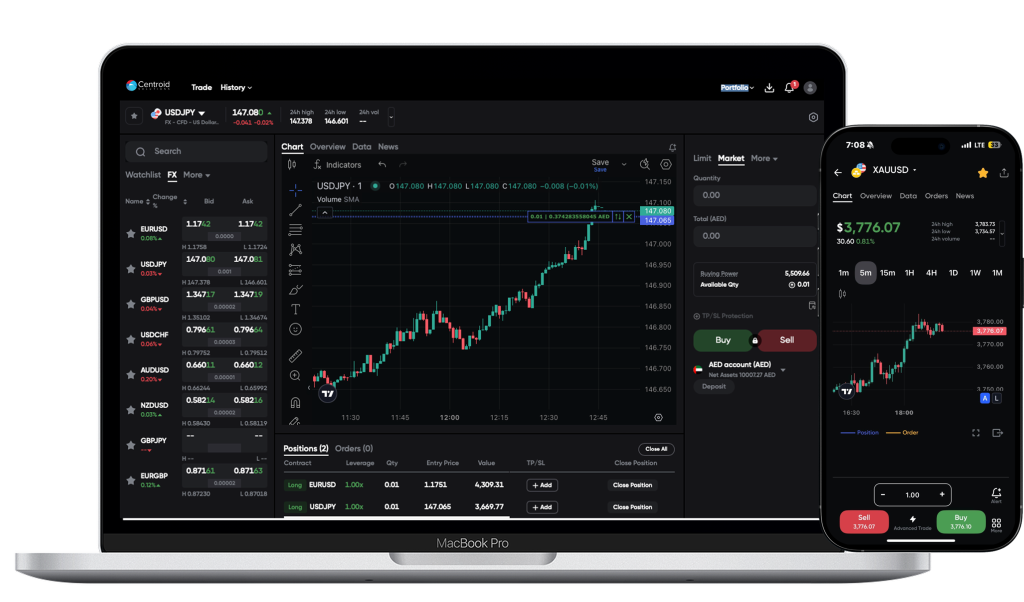

What has modified is not only know-how, however expectation. At this time’s purchasers, whether or not retail or institutional, don’t distinguish between funding, buying and selling, transferring, or managing publicity. They count on a steady, real-time expertise delivered via a single interface.

In FX particularly, the place margin, liquidity, and publicity are continuously transferring, siloed programs merely can not sustain. The business is transferring from product-centric considering to system-centric considering, the place buying and selling, funds, and account buildings function as one.

What’s essential so as to add is that this convergence is felt most strongly on the entrance finish. Purchasers don’t see backend programs, however they instantly really feel friction in onboarding, funding, or navigation. Fragmentation in the end exhibits up as a damaged journey, and that’s the place establishments are dropping purchasers.

We’ve seen this mannequin succeed at scale with platforms like Revolut and Robinhood. Why hasn’t it develop into the norm throughout brokers and banks?

It’s because what folks see is the interface, not the infrastructure beneath. These platforms work as a result of they have been constructed on unified architectures from day one, however simply as importantly, they have been constructed with expertise possession in thoughts.

Most FX brokers and banks function on layered legacy stacks that have been by no means designed for this degree of integration or real-time management. Usually, you will note a buying and selling platform optimized for buying and selling, a bridging engine optimized for execution, a separate pockets or fee system, one other layer for onboarding and compliance, and reporting added on high.

Traditionally, buying and selling platforms have been additionally designed to be reused throughout many brokers with the identical entrance finish. That created scale for distributors, but it surely eliminated differentiation for brokers. If a consumer is sad, they’ll transfer to a different dealer utilizing the identical app, the identical interface, and the identical expertise – simply with a special emblem.

That lack of differentiation creates little or no stickiness, particularly when consumer acquisition prices are excessive. Platforms like Robinhood or eToro succeeded not due to plumbing alone, however as a result of the expertise itself grew to become the product.

WHY CONVERGENCE IS HARDER THAN IT LOOKS

What are the largest structural obstacles FX brokers and banks face when making an attempt to modernize?

The largest problem is that almost all core buying and selling and banking programs have been constructed incrementally, not architected as ecosystems. In FX, brokers are being requested so as to add new asset courses, help extra jurisdictions, supply instantaneous funding and withdrawals, present real-time danger and P&L visibility, and combine with a number of liquidity sources. Banks supporting these flows face comparable stress, typically performing as liquidity suppliers, custodians, or settlement companions, however on infrastructure that prioritizes stability over flexibility.

On the similar time, many establishments are nonetheless locked into platforms the place innovation on the entrance finish is constrained by backend limitations. The plumbing works, but it surely doesn’t assist you to rethink how purchasers are onboarded, engaged, or retained.

The result’s a rising hole between what the market expects and what present programs can realistically ship with out structural change.

Is that this the place establishments typically go unsuitable in digital transformation?

Sure, and it normally comes from assuming there’s a single transformation path for everybody.

Convergence is inevitable, however the way you get there relies on whether or not you’re a dealer, a financial institution, or a hybrid establishment. A dealer targeted on execution and consumer expertise has very totally different priorities from a financial institution offering balance-sheet help or Banking-as-a-Service (BaaS).

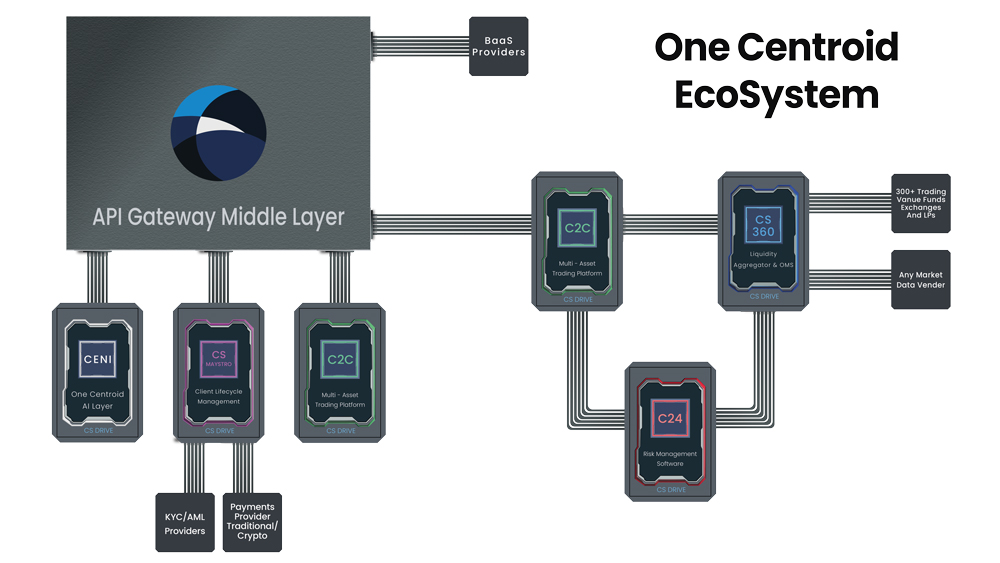

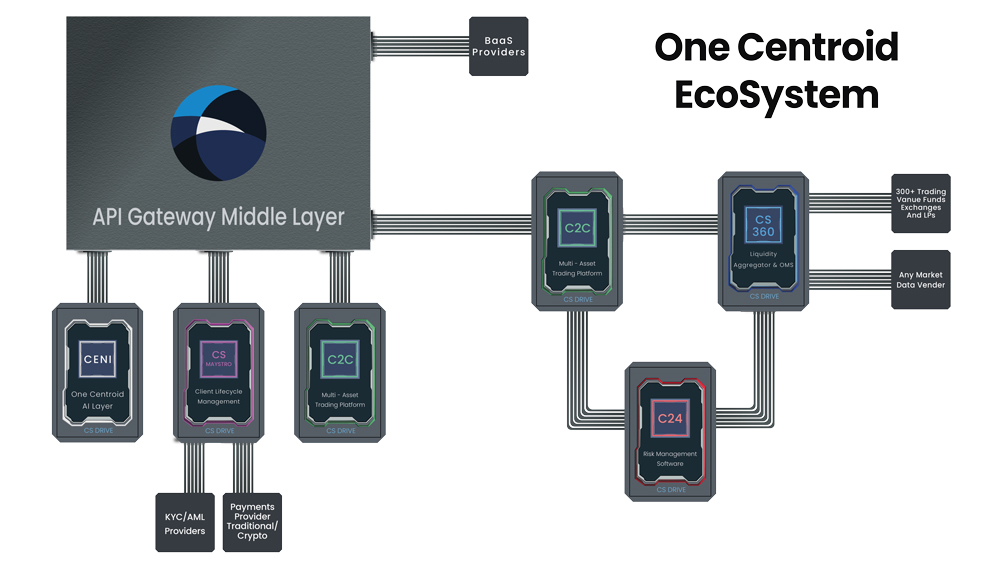

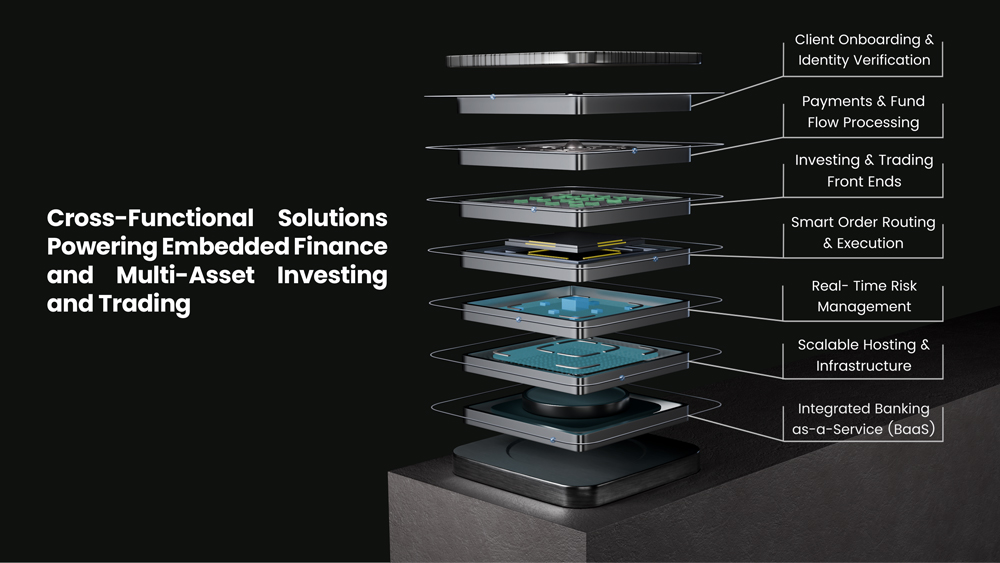

That’s precisely why we designed the One Centroid Ecosystem round a single structure that helps a number of working fashions, whereas leaving expertise design firmly within the palms of the consumer. No two establishments ought to be pressured into the identical entrance finish or the identical journey.

From Market Actuality to Structure

For FX brokers, convergence is just not an summary pattern. Buying and selling platforms more and more sit on the middle of broader monetary journeys, intersecting with funds, wallets, custody, and controlled banking rails.

The problem is just not whether or not these parts ought to join, however how they’ll achieve this with out compromising execution high quality, danger management, or the flexibility to innovate on the product layer.

On the similar time, banks supporting FX circulation as liquidity suppliers, custodians, prime brokers, or BaaS companions face a associated problem: how you can allow innovation round trading-led ecosystems whereas preserving stability on the core.

At Centroid, this led to a foundational design precept behind the One Centroid Ecosystem: one structure, a number of working fashions, and full freedom on the entrance finish.

BANKS AS FINTECH ENABLERS: PARALLEL INFRASTRUCTURE BY DESIGN

How does this structure work in follow for banks that help brokers and fintechs?

For banks, the strategic query is never how you can rebuild their total digital stack. It’s how you can allow innovation with out destabilizing the core.

Many banks are transferring towards a fintech-enablement mannequin, offering regulated banking, custody, and settlement rails to fintechs, brokers, and client platforms via Banking-as-a-Service (BaaS). In that context, system alternative is neither sensible nor mandatory.

When a financial institution acts as a fintech enabler, the target is isolation and management. You need innovation on the edge with out contaminating the core, whereas nonetheless permitting fintechs to construct differentiated consumer journeys.

How does this ‘parallel mannequin’ appear like contained in the One Centroid Ecosystem?

Beneath the One Centroid Ecosystem, banks deploy a parallel, fashionable infrastructure layer particularly for fintech applications.

A brand new core banking occasion, devoted to fintech exercise, runs alongside the financial institution’s present core. It communicates with legacy programs the place required, consumes and distributes companies through true BaaS, and operates independently from retail and company banking.

This ensures fintech progress doesn’t introduce operational or regulatory danger into core banking operations, whereas nonetheless permitting fintechs and brokers to innovate freely on the utility layer.

The place does consumer onboarding and compliance sit inside this mannequin?

On the middle sits CS Maystro, our multi-tenant Shopper Lifecycle Administration platform. CS Maystro handles digital onboarding, KYC/AML, and compliance workflows, integrates fee suppliers and multi-currency pockets companies, and helps limitless fintechs in remoted tenants.

What’s vital is that every fintech or dealer can outline its personal onboarding logic and buyer journey, whereas the financial institution retains centralized oversight and reporting. Compliance turns into a shared framework, not a constraint on expertise.

How are buying and selling, execution, and danger dealt with?

Every fintech or dealer receives a devoted occasion of Centroid’s C2C buying and selling platform backend, giving them full management over merchandise, asset courses, and charge buildings.

Execution and danger are centralized via CS 360, our unified OMS and liquidity engine. This enables establishments to scale fintech exercise whereas preserving income seize, compliance, and management – with out forcing everybody into the identical entrance finish or consumer expertise.

BROKERS, SUPER-APPS, AND DIGITAL-FIRST PLAYERS: THE ECOSYSTEM IS THE PLATFORM

How does this differ for FX brokers, neo-brokers, and super-apps operating their very own consumer expertise?

The fact could be very totally different. Brokers and digital-first platforms are instantly chargeable for the end-to-end consumer expertise. For them, convergence can’t be bolted on. Operating fragmented programs with a generic entrance finish creates churn. Purchasers examine experiences, not simply spreads or product lists. That’s the reason these establishments want unified onboarding, funding, buying and selling, and account buildings, seamless fund mobility, constant compliance, real-time visibility, and a single knowledge layer.

Simply as importantly, they want the flexibility to construct their very own entrance ends, publish apps underneath their very own model, and constantly evolve the expertise. Constructing entrance ends at the moment is just not prohibitively costly. What issues is having an API stack that doesn’t restrict creativity.

Centroid’s C2C platform was constructed with this in thoughts, providing a complete API layer for purchasers who wish to construct from scratch, in addition to white-labeled entrance ends for many who need pace to market.

EXPERIENCE AS THE SOURCE OF STICKINESS

The place is actual aggressive differentiation shifting in at the moment’s buying and selling and fintech platforms?

What we see throughout the business is that backend plumbing, whereas important, is now not the place worth is created. It has develop into a commodity.

The true differentiation – and the true stickiness – comes from how establishments design their consumer journeys, how they maintain customers inside their app, and the way they flip infrastructure into engagement.

Brokers make investments closely in consumer acquisition. If the expertise is generic, these purchasers are misplaced shortly to opponents utilizing the identical platforms. If the expertise is differentiated, intuitive, and constantly evolving, the app turns into the consumer’s monetary residence.

That’s the transformation Centroid is enabling.