By InvestMacro

Listed below are the newest charts and statistics for the Dedication of Merchants (COT) knowledge revealed by the Commodities Futures Buying and selling Fee (CFTC).

The most recent COT knowledge is up to date by means of Tuesday January thirteenth and exhibits a fast view of how massive market members (for-profit speculators and business merchants) have been positioned within the futures markets. All foreign money positions are in direct relation to the US greenback the place, for instance, a guess for the euro is a guess that the euro will rise versus the greenback whereas a guess towards the euro shall be a guess that the euro will decline versus the greenback.

Weekly Speculator Adjustments led by British Pound

The COT foreign money market speculator bets have been general decrease this week as 5 out of the eleven foreign money markets we cowl had increased positioning and the opposite six markets had decrease speculator contracts.

Main the features for the foreign money markets was the British Pound (5,268 contracts) with Bitcoin (803 contracts), the Brazilian Actual (257 contracts), the Australian Greenback (114 contracts), the US Greenback Index (101 contracts) and additionally displaying constructive weeks.

The currencies seeing declines in speculator bets on the week have been the Japanese Yen (-53,979 contracts), the EuroFX (-30,156 contracts), the New Zealand Greenback (-5,488 contracts), the Mexican Peso (-5,743 contracts), the Swiss Franc (-3,126 contracts) and with the Canadian Greenback (-1,665 contracts) additionally recording decrease bets on the week.

Speculators bets bettering for GBP, MXN and going bearish for JPY

Highlighting the newest foreign money knowledge is the British pound sterling seeing improved sentiment, the Mexican peso with internet contracts above +100,000 positions and the Japanese yen which is shedding speculator contracts.

The British pound sterling which noticed its speculator bets rise for a seventh straight week within the newest up to date knowledge. Over the past seven weeks, there have been +67,951 contracts added to the GBP speculator standing. This has taken the GBP positioning from a extremely bearish -93,221 contracts to this week’s -25,270 contracts, which is the least bearish degree of the final 11 weeks. The British pound sterling positioning has been persistently on the bearish facet, relationship again to July of 2025—a span of 25 weeks. The British pound alternate fee towards the US Greenback has fluctuated since that point and is definitely down by about 300 pips from the July 2025 excessive.

The Mexican peso futures speculator bets dipped this week for the primary time in 4 weeks. Nonetheless, the peso place is strongly bullish on the present second, with the general internet place above the 100,000 contract degree for a fourth straight week and for the fifth outing of the final six weeks. These are presently the best and most bullish ranges for the peso since June of 2024. Within the foreign money market buying and selling, the peso has been on a gradual uptrend since bottoming in February 2025. Since hitting that backside, the peso is up by roughly 20% towards the US greenback and is up by over 2% to begin 2026.

On the opposite finish of the spectrum, the Japanese yen has seen its internet speculator place fall right into a bearish internet standing this week at -45,164 contracts. This was due to an enormous decline on the week of over -53,000 contracts. The sentiment for the Japanese yen has shifted sharply, because the yen bullish place was above +100,000 contracts persistently for 21 weeks final 12 months from March all the best way to July. Since then, there was a gradual decline week to week and month to month that has culminated in a unfavorable bearish place for the yen. The yen futures worth has additionally been on a stark downtrend and is touching the bottom ranges since 2024. Regardless of current rates of interest in Japan rising (which is often a lift for the house foreign money), the yen has been going the alternative means. Giving warning to the yen bulls is the outlook for the brand new prime minister presumably being implementing a dovish coverage and hindering the Financial institution of Japan plans to hike the rate of interest additional.

The Euro speculative place noticed a big discount in bullish bets this week. The change on this week’s speculative place appears to be like like a cool off from a really excessive place, because the euro speculative contracts have now been over +100,000 for seven straight weeks and above the +100,000 internet contract degree in 27 out of the final 31 weeks. Final week marked the best degree (+162,812 internet contracts) for Euro speculative positions since August of 2023. The Euro foreign money worth appears to be in consolidation mode between the 1.1900 degree on the highest facet and the 1.1500 degree on the decrease assist. At present within the month of January, the Euro is down by -1.3% however lately hit its highest degree since 2021 in November on the excessive of 1.1979.

Bitcoin leads 5-Day Worth Efficiency Adjustments

Forex market worth modifications this week have been led by Bitcoin, which rose by nearly 6%. The Mexican Peso was subsequent with a 1.95% change over the previous 5 days. The US Greenback Index was increased by 0.37%, and the New Zealand Greenback was increased by 0.35%.

On the draw back, the Canadian Greenback was just about unchanged with a 0.02% decline, adopted by the Australian Greenback with a 0.07% lower. Subsequent up, the Japanese Yen was decrease by 0.12%, and the British Pound, in addition to the Brazilian Actual, have been each down by 0.20%. The Swiss Franc fell by 0.29%, adopted by the Euro, which fell an analogous 0.30% over the previous 5 days.

The largest movers over the previous 90 days have been the Mexican Peso, which is up by roughly 5%. The Brazilian Actual is up by nearly 2% over that very same interval, whereas on the draw back, the Japanese Yen has fallen sharply by -6.90% previously 90 days. The New Zealand Greenback is down by -3.69% previously 90 days.

Currencies Information:

Legend: Open Curiosity | Speculators Present Internet Place | Weekly Specs Change | Specs Energy Rating in comparison with final 3-Years (0-100 vary)

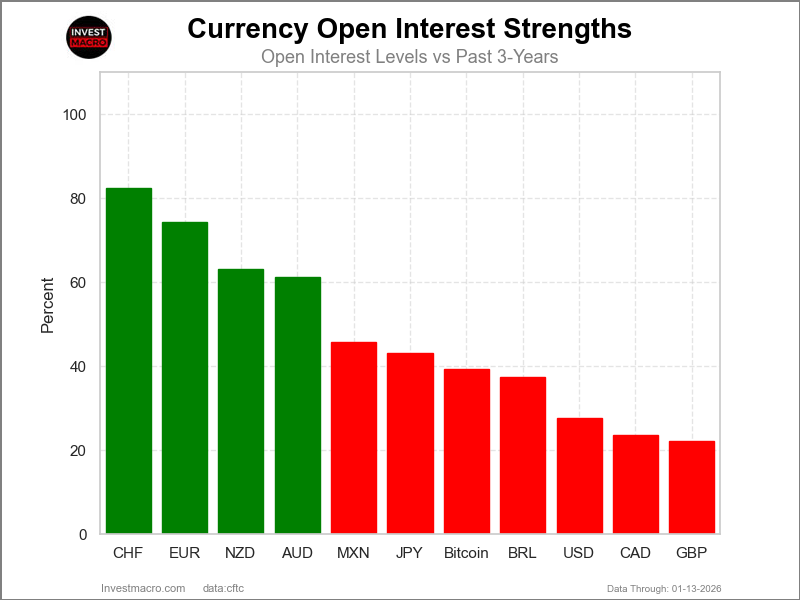

Energy Scores led by Mexican Peso & EuroFX

COT Energy Scores (a normalized measure of Speculator positions over a 3-Yr vary, from 0 to 100 the place above 80 is Excessive-Bullish and under 20 is Excessive-Bearish) confirmed that the Mexican Peso (81 %) and the EuroFX (79 %) lead the foreign money markets this week. The Canadian Greenback (76 %), the Australian Greenback (63 %) and Bitcoin (54 %) are available as the subsequent highest within the weekly energy scores.

On the draw back, the New Zealand Greenback (9 %) and the Swiss Franc (13 %) are available on the lowest energy ranges presently and are in Excessive-Bearish territory (under 20 %). The following lowest energy scores are the British Pound (29 %) and the US Greenback Index (34 %).

3-Yr Energy Statistics:

US Greenback Index (34.1 %) vs US Greenback Index earlier week (33.8 %)

EuroFX (79.3 %) vs EuroFX earlier week (90.8 %)

British Pound Sterling (28.9 %) vs British Pound Sterling earlier week (26.6 %)

Japanese Yen (38.3 %) vs Japanese Yen earlier week (53.1 %)

Swiss Franc (13.0 %) vs Swiss Franc earlier week (19.3 %)

Canadian Greenback (76.0 %) vs Canadian Greenback earlier week (76.8 %)

Australian Greenback (62.9 %) vs Australian Greenback earlier week (62.8 %)

New Zealand Greenback (9.1 %) vs New Zealand Greenback earlier week (15.3 %)

Mexican Peso (80.8 %) vs Mexican Peso earlier week (83.9 %)

Brazilian Actual (52.9 %) vs Brazilian Actual earlier week (52.7 %)

Bitcoin (54.2 %) vs Bitcoin earlier week (37.1 %)

Canadian Greenback & Australian Greenback prime the 6-Week Energy Developments

COT Energy Rating Developments (or transfer index, calculates the 6-week modifications in energy scores) confirmed that the Canadian Greenback (53 %) and the Australian Greenback (46 %) lead the previous six weeks traits for the currencies. The US Greenback Index (34 %), the British Pound (23 %) and the EuroFX (9 %) are the subsequent highest constructive movers within the 3-Yr traits knowledge.

The Brazilian Actual (-31 %) leads the draw back pattern scores presently with the Japanese Yen (-22 %), the Swiss Franc (-15 %) and Bitcoin (-11 %) following subsequent with decrease pattern scores.

3-Yr Energy Developments:

US Greenback Index (33.7 %) vs US Greenback Index earlier week (33.8 %)

EuroFX (9.2 %) vs EuroFX earlier week (26.2 %)

British Pound Sterling (23.3 %) vs British Pound Sterling earlier week (26.6 %)

Japanese Yen (-22.4 %) vs Japanese Yen earlier week (-4.9 %)

Swiss Franc (-15.4 %) vs Swiss Franc earlier week (-9.9 %)

Canadian Greenback (53.2 %) vs Canadian Greenback earlier week (54.2 %)

Australian Greenback (45.8 %) vs Australian Greenback earlier week (46.3 %)

New Zealand Greenback (4.9 %) vs New Zealand Greenback earlier week (9.9 %)

Mexican Peso (2.5 %) vs Mexican Peso earlier week (7.5 %)

Brazilian Actual (-31.3 %) vs Brazilian Actual earlier week (-28.5 %)

Bitcoin (-10.6 %) vs Bitcoin earlier week (-13.8 %)

Particular person COT Foreign exchange Markets:

US Greenback Index Futures:

The US Greenback Index massive speculator standing this week recorded a internet place of -3,730 contracts within the knowledge reported by means of Tuesday. This was a weekly advance of 101 contracts from the earlier week which had a complete of -3,831 internet contracts.

The US Greenback Index massive speculator standing this week recorded a internet place of -3,730 contracts within the knowledge reported by means of Tuesday. This was a weekly advance of 101 contracts from the earlier week which had a complete of -3,831 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bearish with a rating of 34.1 %. The commercials are Bullish with a rating of 66.8 % and the small merchants (not proven in chart) are Bearish with a rating of 33.3 %.

Worth Development-Following Mannequin: Weak Uptrend

Our weekly trend-following mannequin classifies the present market worth place as: Weak Uptrend.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 60.0 | 24.0 | 9.9 |

| – % of Open Curiosity Shorts: | 72.5 | 11.4 | 9.9 |

| – Internet Place: | -3,730 | 3,739 | -9 |

| – Gross Longs: | 17,929 | 7,158 | 2,952 |

| – Gross Shorts: | 21,659 | 3,419 | 2,961 |

| – Lengthy to Brief Ratio: | 0.8 to 1 | 2.1 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 34.1 | 66.8 | 33.3 |

| – Energy Index Studying (3 Yr Vary): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 33.7 | -31.8 | -12.3 |

Euro Forex Futures:

The Euro Forex massive speculator standing this week recorded a internet place of 132,656 contracts within the knowledge reported by means of Tuesday. This was a weekly decreasing of -30,156 contracts from the earlier week which had a complete of 162,812 internet contracts.

The Euro Forex massive speculator standing this week recorded a internet place of 132,656 contracts within the knowledge reported by means of Tuesday. This was a weekly decreasing of -30,156 contracts from the earlier week which had a complete of 162,812 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bullish with a rating of 79.3 %. The commercials are Bearish-Excessive with a rating of 20.0 % and the small merchants (not proven in chart) are Bullish with a rating of 73.9 %.

Worth Development-Following Mannequin: Downtrend

Our weekly trend-following mannequin classifies the present market worth place as: Downtrend.

| EURO Forex Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 32.1 | 55.2 | 10.4 |

| – % of Open Curiosity Shorts: | 17.1 | 75.5 | 5.0 |

| – Internet Place: | 132,656 | -179,767 | 47,111 |

| – Gross Longs: | 283,592 | 487,595 | 91,580 |

| – Gross Shorts: | 150,936 | 667,362 | 44,469 |

| – Lengthy to Brief Ratio: | 1.9 to 1 | 0.7 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 79.3 | 20.0 | 73.9 |

| – Energy Index Studying (3 Yr Vary): | Bullish | Bearish-Excessive | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 9.2 | -8.2 | -0.4 |

British Pound Sterling Futures:

The British Pound Sterling massive speculator standing this week recorded a internet place of -25,270 contracts within the knowledge reported by means of Tuesday. This was a weekly raise of 5,268 contracts from the earlier week which had a complete of -30,538 internet contracts.

The British Pound Sterling massive speculator standing this week recorded a internet place of -25,270 contracts within the knowledge reported by means of Tuesday. This was a weekly raise of 5,268 contracts from the earlier week which had a complete of -30,538 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bearish with a rating of 28.9 %. The commercials are Bullish with a rating of 70.2 % and the small merchants (not proven in chart) are Bullish with a rating of 52.6 %.

Worth Development-Following Mannequin: Weak Downtrend

Our weekly trend-following mannequin classifies the present market worth place as: Weak Downtrend.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 38.0 | 46.8 | 13.9 |

| – % of Open Curiosity Shorts: | 50.2 | 34.5 | 14.0 |

| – Internet Place: | -25,270 | 25,504 | -234 |

| – Gross Longs: | 79,003 | 97,243 | 28,832 |

| – Gross Shorts: | 104,273 | 71,739 | 29,066 |

| – Lengthy to Brief Ratio: | 0.8 to 1 | 1.4 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 28.9 | 70.2 | 52.6 |

| – Energy Index Studying (3 Yr Vary): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 23.3 | -24.9 | 22.9 |

Japanese Yen Futures:

The Japanese Yen massive speculator standing this week recorded a internet place of -45,164 contracts within the knowledge reported by means of Tuesday. This was a weekly decline of -53,979 contracts from the earlier week which had a complete of 8,815 internet contracts.

The Japanese Yen massive speculator standing this week recorded a internet place of -45,164 contracts within the knowledge reported by means of Tuesday. This was a weekly decline of -53,979 contracts from the earlier week which had a complete of 8,815 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bearish with a rating of 38.3 %. The commercials are Bullish with a rating of 62.5 % and the small merchants (not proven in chart) are Bearish with a rating of 35.2 %.

Worth Development-Following Mannequin: Downtrend

Our weekly trend-following mannequin classifies the present market worth place as: Downtrend.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 38.0 | 38.8 | 15.1 |

| – % of Open Curiosity Shorts: | 53.3 | 23.3 | 15.3 |

| – Internet Place: | -45,164 | 45,819 | -655 |

| – Gross Longs: | 111,743 | 114,303 | 44,360 |

| – Gross Shorts: | 156,907 | 68,484 | 45,015 |

| – Lengthy to Brief Ratio: | 0.7 to 1 | 1.7 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 38.3 | 62.5 | 35.2 |

| – Energy Index Studying (3 Yr Vary): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | -22.4 | 21.2 | -6.1 |

Swiss Franc Futures:

The Swiss Franc massive speculator standing this week recorded a internet place of -43,392 contracts within the knowledge reported by means of Tuesday. This was a weekly lower of -3,126 contracts from the earlier week which had a complete of -40,266 internet contracts.

The Swiss Franc massive speculator standing this week recorded a internet place of -43,392 contracts within the knowledge reported by means of Tuesday. This was a weekly lower of -3,126 contracts from the earlier week which had a complete of -40,266 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bearish-Excessive with a rating of 13.0 %. The commercials are Bullish with a rating of 76.4 % and the small merchants (not proven in chart) are Bullish with a rating of 62.8 %.

Worth Development-Following Mannequin: Weak Uptrend

Our weekly trend-following mannequin classifies the present market worth place as: Weak Uptrend.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 13.9 | 71.5 | 14.5 |

| – % of Open Curiosity Shorts: | 59.0 | 22.5 | 18.4 |

| – Internet Place: | -43,392 | 47,163 | -3,771 |

| – Gross Longs: | 13,395 | 68,778 | 13,977 |

| – Gross Shorts: | 56,787 | 21,615 | 17,748 |

| – Lengthy to Brief Ratio: | 0.2 to 1 | 3.2 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 13.0 | 76.4 | 62.8 |

| – Energy Index Studying (3 Yr Vary): | Bearish-Excessive | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | -15.4 | 16.8 | -11.5 |

Canadian Greenback Futures:

The Canadian Greenback massive speculator standing this week recorded a internet place of -42,250 contracts within the knowledge reported by means of Tuesday. This was a weekly decline of -1,665 contracts from the earlier week which had a complete of -40,585 internet contracts.

The Canadian Greenback massive speculator standing this week recorded a internet place of -42,250 contracts within the knowledge reported by means of Tuesday. This was a weekly decline of -1,665 contracts from the earlier week which had a complete of -40,585 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bullish with a rating of 76.0 %. The commercials are Bearish with a rating of 30.4 % and the small merchants (not proven in chart) are Bearish with a rating of 35.4 %.

Worth Development-Following Mannequin: Weak Uptrend

Our weekly trend-following mannequin classifies the present market worth place as: Weak Uptrend.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 28.6 | 55.7 | 12.8 |

| – % of Open Curiosity Shorts: | 47.9 | 34.8 | 14.4 |

| – Internet Place: | -42,250 | 45,815 | -3,565 |

| – Gross Longs: | 62,705 | 122,096 | 28,109 |

| – Gross Shorts: | 104,955 | 76,281 | 31,674 |

| – Lengthy to Brief Ratio: | 0.6 to 1 | 1.6 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 76.0 | 30.4 | 35.4 |

| – Energy Index Studying (3 Yr Vary): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 53.2 | -49.9 | 15.5 |

Australian Greenback Futures:

The Australian Greenback massive speculator standing this week recorded a internet place of -18,846 contracts within the knowledge reported by means of Tuesday. This was a weekly advance of 114 contracts from the earlier week which had a complete of -18,960 internet contracts.

The Australian Greenback massive speculator standing this week recorded a internet place of -18,846 contracts within the knowledge reported by means of Tuesday. This was a weekly advance of 114 contracts from the earlier week which had a complete of -18,960 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bullish with a rating of 62.9 %. The commercials are Bearish with a rating of 27.8 % and the small merchants (not proven in chart) are Bullish-Excessive with a rating of 100.0 %.

Worth Development-Following Mannequin: Robust Uptrend

Our weekly trend-following mannequin classifies the present market worth place as: Robust Uptrend.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 36.6 | 45.0 | 17.3 |

| – % of Open Curiosity Shorts: | 44.8 | 46.6 | 7.6 |

| – Internet Place: | -18,846 | -3,610 | 22,456 |

| – Gross Longs: | 83,955 | 103,295 | 39,790 |

| – Gross Shorts: | 102,801 | 106,905 | 17,334 |

| – Lengthy to Brief Ratio: | 0.8 to 1 | 1.0 to 1 | 2.3 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 62.9 | 27.8 | 100.0 |

| – Energy Index Studying (3 Yr Vary): | Bullish | Bearish | Bullish-Excessive |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 45.8 | -44.0 | 22.7 |

New Zealand Greenback Futures:

The New Zealand Greenback massive speculator standing this week recorded a internet place of -48,851 contracts within the knowledge reported by means of Tuesday. This was a weekly discount of -5,488 contracts from the earlier week which had a complete of -43,363 internet contracts.

The New Zealand Greenback massive speculator standing this week recorded a internet place of -48,851 contracts within the knowledge reported by means of Tuesday. This was a weekly discount of -5,488 contracts from the earlier week which had a complete of -43,363 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bearish-Excessive with a rating of 9.1 %. The commercials are Bullish-Excessive with a rating of 89.6 % and the small merchants (not proven in chart) are Bearish with a rating of 45.7 %.

Worth Development-Following Mannequin: Downtrend

Our weekly trend-following mannequin classifies the present market worth place as: Downtrend.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 11.3 | 81.8 | 4.7 |

| – % of Open Curiosity Shorts: | 68.6 | 23.8 | 5.3 |

| – Internet Place: | -48,851 | 49,362 | -511 |

| – Gross Longs: | 9,613 | 69,662 | 4,002 |

| – Gross Shorts: | 58,464 | 20,300 | 4,513 |

| – Lengthy to Brief Ratio: | 0.2 to 1 | 3.4 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 9.1 | 89.6 | 45.7 |

| – Energy Index Studying (3 Yr Vary): | Bearish-Excessive | Bullish-Excessive | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 4.9 | -7.4 | 29.9 |

Mexican Peso Futures:

The Mexican Peso massive speculator standing this week recorded a internet place of 103,558 contracts within the knowledge reported by means of Tuesday. This was a weekly decreasing of -5,743 contracts from the earlier week which had a complete of 109,301 internet contracts.

The Mexican Peso massive speculator standing this week recorded a internet place of 103,558 contracts within the knowledge reported by means of Tuesday. This was a weekly decreasing of -5,743 contracts from the earlier week which had a complete of 109,301 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bullish-Excessive with a rating of 80.8 %. The commercials are Bearish-Excessive with a rating of 19.4 % and the small merchants (not proven in chart) are Bearish with a rating of 48.4 %.

Worth Development-Following Mannequin: Robust Uptrend

Our weekly trend-following mannequin classifies the present market worth place as: Robust Uptrend.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 63.7 | 33.1 | 3.0 |

| – % of Open Curiosity Shorts: | 20.8 | 77.9 | 1.1 |

| – Internet Place: | 103,558 | -108,180 | 4,622 |

| – Gross Longs: | 153,670 | 79,940 | 7,287 |

| – Gross Shorts: | 50,112 | 188,120 | 2,665 |

| – Lengthy to Brief Ratio: | 3.1 to 1 | 0.4 to 1 | 2.7 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 80.8 | 19.4 | 48.4 |

| – Energy Index Studying (3 Yr Vary): | Bullish-Excessive | Bearish-Excessive | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | 2.5 | -2.6 | 1.2 |

Brazilian Actual Futures:

The Brazilian Actual massive speculator standing this week recorded a internet place of 17,874 contracts within the knowledge reported by means of Tuesday. This was a weekly enhance of 257 contracts from the earlier week which had a complete of 17,617 internet contracts.

The Brazilian Actual massive speculator standing this week recorded a internet place of 17,874 contracts within the knowledge reported by means of Tuesday. This was a weekly enhance of 257 contracts from the earlier week which had a complete of 17,617 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bullish with a rating of 52.9 %. The commercials are Bearish with a rating of 46.3 % and the small merchants (not proven in chart) are Bearish with a rating of 38.5 %.

Worth Development-Following Mannequin: Weak Downtrend

Our weekly trend-following mannequin classifies the present market worth place as: Weak Downtrend.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 66.3 | 27.5 | 5.1 |

| – % of Open Curiosity Shorts: | 43.7 | 54.1 | 1.1 |

| – Internet Place: | 17,874 | -21,003 | 3,129 |

| – Gross Longs: | 52,400 | 21,753 | 4,017 |

| – Gross Shorts: | 34,526 | 42,756 | 888 |

| – Lengthy to Brief Ratio: | 1.5 to 1 | 0.5 to 1 | 4.5 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 52.9 | 46.3 | 38.5 |

| – Energy Index Studying (3 Yr Vary): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | -31.3 | 30.7 | -0.2 |

Bitcoin Futures:

The Bitcoin massive speculator standing this week recorded a internet place of 69 contracts within the knowledge reported by means of Tuesday. This was a weekly enhance of 803 contracts from the earlier week which had a complete of -734 internet contracts.

The Bitcoin massive speculator standing this week recorded a internet place of 69 contracts within the knowledge reported by means of Tuesday. This was a weekly enhance of 803 contracts from the earlier week which had a complete of -734 internet contracts.

This week’s present energy rating (the dealer positioning vary over the previous three years, measured from 0 to 100) exhibits the speculators are presently Bullish with a rating of 54.2 %. The commercials are Bullish with a rating of 53.6 % and the small merchants (not proven in chart) are Bearish with a rating of 40.7 %.

Worth Development-Following Mannequin: Downtrend

Our weekly trend-following mannequin classifies the present market worth place as: Downtrend.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – % of Open Curiosity Longs: | 80.2 | 5.3 | 5.0 |

| – % of Open Curiosity Shorts: | 79.9 | 5.8 | 4.8 |

| – Internet Place: | 69 | -134 | 65 |

| – Gross Longs: | 19,118 | 1,257 | 1,204 |

| – Gross Shorts: | 19,049 | 1,391 | 1,139 |

| – Lengthy to Brief Ratio: | 1.0 to 1 | 0.9 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – Energy Index Rating (3 Yr Vary Pct): | 54.2 | 53.6 | 40.7 |

| – Energy Index Studying (3 Yr Vary): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Energy Index: | -10.6 | 10.2 | 2.1 |

Article By InvestMacro – Obtain our weekly COT E-newsletter

*COT Report: The COT knowledge, launched weekly to the general public every Friday, is up to date by means of the newest Tuesday (knowledge is 3 days outdated) and exhibits a fast view of how massive speculators or non-commercials (for-profit merchants) have been positioned within the futures markets.

The CFTC categorizes dealer positions based on business hedgers (merchants who use futures contracts for hedging as a part of the enterprise), non-commercials (massive merchants who speculate to comprehend buying and selling earnings) and nonreportable merchants (often small merchants/speculators) in addition to their open curiosity (contracts open out there at time of reporting). See CFTC standards right here.

- COT Metals Charts: Weekly Speculator Adjustments led by Gold Jan 18, 2026

- COT Bonds Charts: Speculator Bets led by 10-Yr Bonds & 5-Yr Bonds Jan 18, 2026

- COT Vitality Charts: Speculator Bets led by Bloomberg Commodity Index & WTI Crude Oil Jan 18, 2026

- COT Delicate Commodities Charts: Speculator Bets led by Soybean Oil & Soybean Meal Jan 18, 2026

- USD/JPY Slips because the Yen Reacts to a Wave of Market Information Jan 16, 2026

- Oil tumbles 5%. Tech rally pushes US shares increased Jan 16, 2026

- GBP/USD Secure: Sentiment Shifts in Favour of Sterling Jan 15, 2026

- Pure Gasoline costs plunge over 10%. Revenue-taking noticed in treasured metals. Jan 15, 2026

- Markets gripped by geopolitics, uncertainty & Trump Jan 14, 2026

- Gold Units New Highs, With Additional Good points Forward Jan 14, 2026