Swap Arbitrage Alternatives

| Date | Image | Dealer A | Place A | Dealer B | Place B |

Revenue (pips) |

Description |

|---|---|---|---|---|---|---|---|

| 2025-10-23 | XAUUSD |

Moneta Markets (Pty) Ltd |

quick |

Fyntura Restricted |

lengthy |

2.87 | Brief Moneta Markets (Pty) Ltd, Lengthy Fyntura Restricted |

| 2025-10-23 | XAUUSD |

Startrader Monetary Markets Restricted |

quick |

Fyntura Restricted |

lengthy |

2.87 | Brief Startrader Monetary Markets Restricted, Lengthy Fyntura Restricted |

| 2025-10-23 | XAUUSD |

AMarkets LLC |

quick |

Fyntura Restricted |

lengthy |

2.67 | Brief AMarkets LLC, Lengthy Fyntura Restricted |

| 2025-10-23 | BTCUSD |

Startrader Monetary Markets Restricted |

quick |

Duramarkets Restricted |

lengthy |

2.59 | Brief Startrader Monetary Markets Restricted, Lengthy Duramarkets Restricted |

| 2025-10-23 | BTCUSD |

Startrader Monetary Markets Restricted |

quick |

Coinexx Restricted |

lengthy |

2.59 | Brief Startrader Monetary Markets Restricted, Lengthy Coinexx Restricted |

| 2025-10-23 | BTCUSD |

Moneta Markets (Pty) Ltd |

quick |

Duramarkets Restricted |

lengthy |

2.58 | Brief Moneta Markets (Pty) Ltd, Lengthy Duramarkets Restricted |

| 2025-10-23 | BTCUSD |

Moneta Markets (Pty) Ltd |

quick |

Coinexx Restricted |

lengthy |

2.58 | Brief Moneta Markets (Pty) Ltd, Lengthy Coinexx Restricted |

| 2025-10-23 | XAUUSD |

Fyntura Restricted |

lengthy |

Alpari |

quick |

2.19 | Lengthy Fyntura Restricted, Brief Alpari |

| 2025-10-23 | XAUUSD |

Fyntura Restricted |

lengthy |

FXPRO Monetary Companies Ltd |

quick |

0.96 | Lengthy Fyntura Restricted, Brief FXPRO Monetary Companies Ltd |

| 2025-10-23 | XAUUSD |

TW Corp. |

quick |

Fyntura Restricted |

lengthy |

0.95 | Brief TW Corp., Lengthy Fyntura Restricted |

| 2025-10-23 | BTCUSD |

Startrader Monetary Markets Restricted |

quick |

Alpari |

lengthy |

0.90 | Brief Startrader Monetary Markets Restricted, Lengthy Alpari |

| 2025-10-23 | BTCUSD |

Moneta Markets (Pty) Ltd |

quick |

Alpari |

lengthy |

0.90 | Brief Moneta Markets (Pty) Ltd, Lengthy Alpari |

| 2025-10-23 | GBPJPY |

AMarkets LLC |

lengthy |

Fyntura Restricted |

quick |

0.85 | Lengthy AMarkets LLC, Brief Fyntura Restricted |

| 2025-10-23 | GBPJPY |

Fyntura Restricted |

quick |

xChief Ltd |

lengthy |

0.71 | Brief Fyntura Restricted, Lengthy xChief Ltd |

| 2025-10-23 | XAUUSD |

Fyntura Restricted |

lengthy |

Duramarkets Restricted |

quick |

0.67 | Lengthy Fyntura Restricted, Brief Duramarkets Restricted |

| 2025-10-23 | EURJPY |

Fyntura Restricted |

quick |

Duramarkets Restricted |

lengthy |

0.60 | Brief Fyntura Restricted, Lengthy Duramarkets Restricted |

| 2025-10-23 | EURJPY |

Fyntura Restricted |

quick |

Coinexx Restricted |

lengthy |

0.60 | Brief Fyntura Restricted, Lengthy Coinexx Restricted |

| 2025-10-23 | XAUUSD |

Moneta Markets (Pty) Ltd |

quick |

FIBO Group, Ltd |

lengthy |

0.50 | Brief Moneta Markets (Pty) Ltd, Lengthy FIBO Group, Ltd |

| 2025-10-23 | XAUUSD |

Startrader Monetary Markets Restricted |

quick |

FIBO Group, Ltd |

lengthy |

0.50 | Brief Startrader Monetary Markets Restricted, Lengthy FIBO Group, Ltd |

| 2025-10-23 | XAUUSD |

Fyntura Restricted |

lengthy |

xChief Ltd |

quick |

0.49 | Lengthy Fyntura Restricted, Brief xChief Ltd |

What Is Foreign exchange Swap Arbitrage?

In buying and selling, arbitrage merely means discovering and exploiting variations in pricing or knowledge between brokers to make a revenue. When utilized to swaps, foreign exchange swap arbitrage includes figuring out a constructive distinction between the swap charges of two totally different brokers and utilizing that hole to earn a day by day return.

Let’s break it down with an instance.

Suppose Dealer A has a swap price of –5.7 pips on lengthy positions for gold (XAU/USD) and +4.3 pips on quick positions. This implies should you purchase gold and maintain the place in a single day, you’ll pay 5.7 pips per day, whereas should you promote gold and maintain it, you’ll obtain 4.3 pips per day. The distinction between these charges advantages the dealer, not you—a standard state of affairs in foreign currency trading.

Now, think about you examine these charges with Dealer B, which affords –1.6 pips for an extended place on gold and +0.4 pips for a brief place. Individually, each brokers nonetheless construction swaps to their benefit—however look what occurs once you examine them in opposition to one another.

The distinction between Dealer A’s quick swap (+4.3 pips) and Dealer B’s lengthy swap (–1.6 pips) is +2.7 pips.

That’s a swap arbitrage alternative.

By promoting gold with Dealer A and shopping for gold with Dealer B, your positions are completely hedged—which means value actions cancel one another out. You’re not making or dropping cash from gold’s value fluctuations, however you’re incomes 2.7 pips per day from the constructive swap differential so long as the charges maintain.

That’s the essence of foreign exchange swap arbitrage: discovering brokers whose swap price discrepancies allow you to acquire day by day swap earnings with minimal publicity to market route.

The right way to Discover Swap Arbitrage Between Foreign exchange Brokers

To identify swap arbitrage alternatives between foreign exchange brokers, it’s essential monitor every dealer’s swap charges repeatedly and search for constructive variations between their lengthy and quick positions. In easy phrases, you’re looking for a pair of brokers the place the mixed swap (one lengthy, one quick) ends in a web constructive worth — which means you earn curiosity day by day whereas your positions stay hedged.

Nonetheless, doing this manually is much from straightforward. Swap charges may change day by day and never all brokers current their knowledge in the identical format. Some listing swaps in pips, whereas others use base forex, margin forex, and even rate of interest percentages. Earlier than you possibly can precisely examine brokers, you’d must standardize these values, changing all the pieces into a standard unit like pips.

That’s precisely why we constructed our Swap Arbitrage Infrastructure.

This method robotically collects and processes swap knowledge from a number of foreign exchange brokers every single day, converts all values into pips, and calculates potential arbitrage spreads between brokers. The outcomes are then displayed within the desk above, displaying you reside foreign exchange brokers swap arbitrage alternatives ranked from essentially the most worthwhile to the least.

Every worth within the desk represents the day by day revenue in pips you would earn from a given arbitrage setup — making it straightforward to see which alternatives are price your consideration with out the tedious guide work.

Greatest Time for Swap Arbitrage

Timing issues so much in the case of swap arbitrage, however not in the way in which most merchants suppose. Whereas swaps are utilized as soon as per day on the dealer’s rollover time, coming into or closing trades proper round rollover isn’t ultimate — spreads are inclined to widen dramatically throughout these minutes, which may eat into your income and even flip a worthwhile setup right into a loss.

As a substitute, use the interval earlier than rollover to examine the following day’s swap charges. In case you’re already holding an arbitrage place and the up to date swaps present that your constructive distinction will flip damaging, it’s normally finest to shut your place earlier than the brand new charges take impact.

With regards to opening new swap arbitrage positions, goal for occasions when volatility is low however liquidity is excessive — usually throughout overlapping market classes like London–New York. Throughout these intervals, spreads are at their narrowest, serving to you enter positions with minimal price.

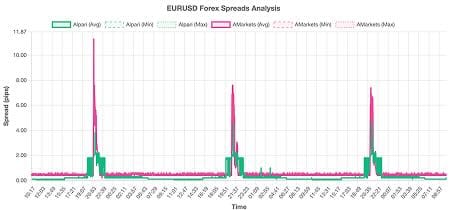

Most brokers apply swaps round 5 p.m. New York time (10 p.m. GMT), although this could fluctuate. If you wish to establish the precise rollover occasions for every dealer, you need to use our Unfold Scanner device — it visually reveals when spreads widen sharply on the chart, revealing every dealer’s rollover window.

It’s additionally price noting that Wednesdays are distinctive within the foreign exchange world. That’s when the triple swap is utilized to account for weekend curiosity The triple swap makes Wednesday arbitrage alternatives notably profitable, because you’re successfully locking in three days of swap with out worrying about price modifications till after the weekend.

Briefly, profitable swap arbitrage isn’t nearly discovering the correct brokers — it’s about executing on the proper time, when spreads are tight and swap circumstances are working in your favor.

The right way to Use a Swap-Free Account for Arbitrage

One other attention-grabbing method to foreign exchange swap arbitrage is utilizing a swap-free (Islamic) account on one aspect of your setup. With this technique, you open a place in a swap-free account—the place you don’t pay or earn any swap—after which open the alternative place with one other dealer that provides constructive swap charges on that very same pair.

The concept is straightforward: by combining a swap-free account with an everyday account, you take away the damaging swap price on one aspect whereas nonetheless accumulating the constructive swap from the opposite.

Nonetheless, there are a number of vital issues to remember earlier than utilizing this technique.

First, swap-free accounts are primarily designed for Muslim merchants, as paying or receiving curiosity (riba) is prohibited underneath Sharia regulation. Some brokers do enable non-Muslim merchants to open swap-free accounts, however this relies fully on the dealer’s insurance policies.

Second—and that is essential—swap-free accounts aren’t swap-free ceaselessly. Most brokers apply an administrative price after a sure variety of days to offset the lacking swap fees. This era can vary from simply someday to two weeks, relying on the dealer. As soon as that interval ends, the executive price can considerably scale back (and even erase) your arbitrage revenue.

So, should you plan to make use of a swap-free account for arbitrage, be sure you perceive precisely how your dealer handles these charges and the way lengthy positions can stay really swap-free.

In case you’d prefer to dive deeper into this subject, I’ve written a full article explaining swap-free (Islamic) accounts and itemizing brokers that provide them—you possibly can test it out [here].

When utilizing a swap-free account for arbitrage, it’s additionally vital to select essentially the most favorable constructive swap for the opposite aspect of the commerce. For the reason that swap-free aspect earns nothing, your revenue potential relies upon fully on how excessive the constructive swap is out of your second dealer.

For instance, let’s say the lengthy swap price on gold (XAU/USD) is constructive, however varies by dealer:

- Dealer A: +1.5 pips

- Dealer B: +2.0 pips

- Dealer C: +2.5 pips

On this case, Dealer C clearly affords the perfect situation in your swap arbitrage setup. To search out such alternatives, head over to our Swap Scanner and type the constructive swap price column (whether or not quick or lengthy) from highest to lowest — the brokers on the high will provide you with the perfect outcomes for this technique.

Will Foreign exchange Brokers Enable You to Arbitrage Swaps?

Right here’s the reality: most foreign exchange brokers don’t like swap arbitrage — and plenty of explicitly prohibit it of their phrases of service.

The reason being easy. Swap arbitrage doesn’t generate buying and selling quantity or publicity threat, that are the principle methods brokers make cash. As a substitute, it includes holding offsetting positions throughout two brokers to earn day by day swap variations with just about no market threat. From a dealer’s perspective, that’s what they name “poisonous circulation.”

That is very true for B-Guide brokers — those that take the alternative aspect of your trades slightly than passing them to liquidity suppliers. When a dealer runs a swap arbitrage technique, the dealer finally ends up paying swaps with none probability of recovering these prices by unfold or value motion, which immediately hurts their backside line.

Even A-Guide or hybrid brokers, who go trades to exterior liquidity suppliers, may flag or limit accounts that present unnatural buying and selling conduct — for instance, holding completely hedged positions with minimal buying and selling exercise. Some brokers may quietly widen your spreads, scale back leverage, and even cancel swap funds in the event that they detect arbitrage-like exercise.

Briefly, whereas foreign exchange swap arbitrage just isn’t unlawful, it’s not welcomed by most brokers. The secret is to grasp every dealer’s coverage and learn their phrases rigorously. Some brokers tolerate it so long as it doesn’t abuse their liquidity or methods, whereas others will instantly classify such buying and selling as a violation.

In case you plan to interact in swap arbitrage, it’s good to:

- Use brokers with clear swap insurance policies, ideally these explicitly stating that holding long-term positions is allowed.

- Diversify throughout a number of brokers as a substitute of counting on only one.

- Maintain positions average and buying and selling exercise pure to keep away from drawing pointless consideration.

Swap arbitrage could be a highly effective technique — however like all edge in buying and selling, the way you handle your relationships with brokers issues simply as a lot as the mathematics behind the swaps.