It’s the previous few days of 2025, after which we kick into 2026, which I consider can be a wild yr for many traders and good for us and our accounts. I contact on a brand new chance for the dear metals sector in the way it may transfer/high, and the actual property market.

Finish-of-year promotion that I cowl through the video!

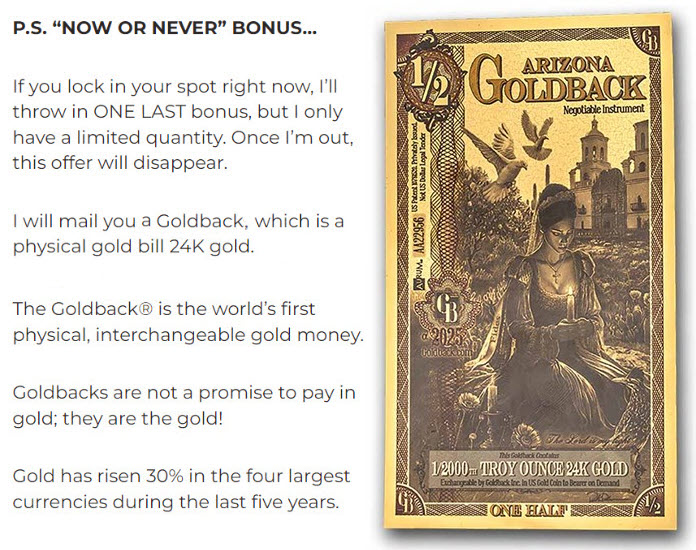

FREE Bodily Gold & Delivery with the ACS Membership

FREE 1 Hour Stay Video Group Name With Chris Vermeulen

My most worthwhile and In style technique, which additionally occurs to have the bottom degree of volatility and portfolio danger, has a particular limited-time supply and bonuses.

ACS (Adaptive Compounding Technique) is the perfect of the perfect.

Our accounts have been hitting new all-time highs.

We additionally had a bonus commerce in a gold ETF for one more fast 15% achieve.

Moreover, we proceed to obtain engaging month-to-month dividend funds, and we’re incomes every day curiosity on any money safely ready on the sidelines for a recent commerce.

NEW YEAR’S OFFER EXPIRES AT MIDNIGHT!

FREE PHYSICAL GOLD + BONUSES BELOW.

TEP (Whole ETF Portfolio Bundle Provide:

Get The Adaptive Compounding Technique (ACS) – Defined right here

Greatest Asset Now (BAN) – Personal the most popular sectors throughout market rallies, together with gold, silver, miners, and uranium shares. We simply closed SLV for a Fast 20% achieve!

The Technical Investor (TTI) – BULL & BEAR MARKET SIGNALS

The present place is hovering round a 17% achieve because it was opened on Might nineteenth 2025, when the brand new bull market cycle began, and plenty of subscribers use 2x ETFs for over 30% return this yr on these indicators.

Able to take management of your future and way of life and take the identical trades I soak up my portfolio utilizing my Asset Revesting methods?

Previous few days to organize for regardless of the markets throw at you in 2026.

Don’t take my phrase for it; see what members saying – READ REVIEWS!

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

Disclaimer:

The content material revealed on this web site, together with weblog posts, movies, analysis articles, and commentary, is meant solely for informational and academic functions and shouldn’t be construed as funding recommendation. Technical Merchants Ltd. and its associates are not registered as funding advisers with the U.S. Securities and Trade Fee or any state securities authority. The data offered is common in nature and is not tailor-made to the funding wants of any particular particular person. Nothing revealed on this website constitutes a advice to purchase, promote, or maintain any specific safety, commodity, or monetary instrument. The views expressed symbolize the opinions of the authors and are topic to alter at any time with out discover. Efficiency outcomes mentioned might embrace stay buying and selling outcomes and/or backtested or hypothetical information. Hypothetical outcomes are inherently restricted and don’t mirror precise buying and selling efficiency. No illustration is made that any account will or is prone to obtain earnings or losses just like these mentioned. Previous efficiency shouldn’t be indicative of future outcomes. All investments contain danger, together with the potential lack of principal. Testimonials and consumer experiences introduced might not be consultant of others and don’t assure future success. Some content material might include affiliate hyperlinks or promotional materials, from which we might earn compensation. This doesn’t affect our content material or editorial independence. By accessing this web site or consuming its content material, you acknowledge that you’re solely accountable for your personal monetary selections and comply with seek the advice of a licensed monetary skilled earlier than performing on any data offered.