A Excessive-Conviction Bull Run: FIIs Unleash Main Shopping for as New Capital Floods into Financial institution Nifty

On January 6, 2026, the Financial institution Nifty Index Futures market despatched its strongest bullish sign of the brand new yr, indicating a major acceleration within the prevailing uptrend. International Institutional Traders (FIIs) threw their full weight behind the rally, shopping for a considerable 3,360 contracts price ₹608 crore in a formidable show of institutional conviction.

Much more important than the shopping for itself was the highly effective underlying market dynamic it revealed: the web Open Curiosity (OI) surged by 1,160 contracts. That is the definitive, textbook signature of a wholesome, vibrant, and sustainable bull pattern that’s attracting new capital and broadening its participation.

Decoding the Information: The Mechanics of a Highly effective Bull Market

The mix of huge institutional shopping for alongside a robust enlargement in open curiosity is the traditional hallmark of a high-conviction market pattern.

-

FIIs: The Driving Drive of the Rally: This was not a modest or tentative motion; it was a significant allocation of capital to the lengthy aspect. This proactive and aggressive accumulation demonstrates a robust institutional perception that the market has important additional upside. By performing as the first engine of the rally, FIIs are creating a strong “institutional bid” underneath the market, which basically alters its psychology and offers a robust basis of assist. The message is evident: main gamers are shopping for with conviction.

-

The Open Curiosity Affirmation: A Development with Deep Roots: That is probably the most essential piece of the evaluation that validates your entire bullish thesis. A rally on falling OI is weak, as it’s fueled by outdated bears exiting. A rally on rising OI, as seen right here, is an indication of immense well being and energy. It proves that new, assured capital is flowing into the market.

The FIIs’ huge purchase order was so highly effective that it simply absorbed all of the day’s profit-takers (which might have brought about OI to lower) and nonetheless had sufficient demand to satisfy a wave of latest sellers, forging 1,160 brand-new, lively contracts. It is a signal of a strong, liquid market the place bullish conviction is so sturdy that it’s attracting and overwhelming all opposing forces.

Key Implications for the Market

-

A Wholesome, Sustainable Development: The rally is constructed on probably the most stable basis attainable: new lengthy positions initiated by the market’s strongest gamers. This makes the pattern much more sturdy and resilient than a easy short-squeeze.

-

The “Purchase the Dip” Setting is in Full Drive: With FIIs constantly and aggressively accumulating, the strategic crucial is evident. Any interval of weak spot or intraday dip is extremely more likely to be met with sturdy institutional shopping for, making it a shopping for alternative, not a motive for concern.

-

The Path of Least Resistance is Unequivocally Up: The highly effective twin engines of institutional shopping for and broadening market participation have created a formidable tailwind. Combating this pattern is now an try to struggle the market’s main, institutional-led momentum.

-

Potential for Development Acceleration: One of these high-conviction information usually precedes a interval of pattern acceleration, as increasingly more individuals are drawn into the rally, including to the momentum.

Conclusion

That is an A+ grade, bullish sign. The FIIs have supplied highly effective and unambiguous management, and the sturdy development in Open Curiosity is the market’s definitive stamp of approval. The Financial institution Nifty is not in a tentative restoration; it has entered a wholesome, increasing, and high-conviction bull section, with all of the underlying dynamics now firmly in place for a sustained transfer to increased ranges.

Final Evaluation may be learn right here

The Financial institution Nifty continues its highly effective advance, with bulls firmly accountable for the pattern’s momentum. Nevertheless, this spectacular rally has now arrived at a second of maximum cyclical significance and potential peril. Two main astrological occasions are converging, one in all which—Bayer Rule 19—is a traditionally potent sign for market tops. This celestial warning creates a high-stakes atmosphere the place the highly effective uptrend is now confronting a pre-calculated, main reversal level.

1. The Astrological Crimson Flag: A Confluence of Extremes

Immediately’s session is dominated by two highly effective timing indicators that command a dealer’s utmost respect:

-

Bayer Rule 19 (The “Prime” Sign): This particular and highly effective rule states that important market tops are sometimes shaped when Venus, in its geocentric place, makes a conjunction with the Solar. With Venus on the coronary heart of this facet, your directive to look at the monetary giants HDFC Financial institution and ICICI Financial institution is the important thing. They’re the market’s “Venusian” bellwethers. Their energy or weak spot right this moment would be the final “inform” of whether or not the market can defy this historic topping sign.

-

Mercury at Most Distance from the Solar: This secondary facet provides to the theme of extremity. When Mercury reaches its furthest level, it usually correlates with some extent of most optimism or pessimism out there—a second when a pattern is stretched to its restrict and is ripe for a reversal.

2. The Decisive Inside Management: The Verdict from HDFC and ICICI

The destiny of right this moment’s pattern rests squarely on the shoulders of the personal banking leaders.

-

If HDFC Financial institution and ICICI Financial institution present continued energy and management, it may sign that the market’s underlying bullish momentum is highly effective sufficient to soak up the cyclical reversal vitality.

-

Nevertheless, if these key shares start to falter, lag, or present indicators of distribution, it could be the primary and most important affirmation that the bearish energy of the Venus facet is taking maintain and a significant reversal is starting.

3. The Definitive Battleground: The 59,959 Line within the Sand

This highly effective confluence of a robust pattern and a significant reversal sign has created a brand new, high-stakes battlefield. It is going to be outlined by a single, crucial assist zone, and the market’s response right here would be the remaining verdict.

-

The Bullish Continuation Case: So long as the bulls can efficiently defend the crucial 59,959 assist stage, the bullish narrative stays intact. A profitable maintain would sign that the market is weathering the cyclical storm and is able to use its momentum to launch the subsequent leg of the rally, focusing on 60,450 and 60,942.

-

The Bearish Reversal Case: Nevertheless, a decisive break and failure to take care of the 59,900-59,959 zone could be a significant technical failure. It could verify that the historic topping sign is in impact, inviting a strong wave of revenue reserving and focusing on a swift decline in the direction of 59,470 and a extra important fall to 58,893.

Conclusion

The Financial institution Nifty is in a uncommon and highly effective state of battle. A confirmed uptrend at an all-time excessive is now going through a potent, traditionally validated sign for a significant high. The whole session is a battle between momentum and cycles. The value motion at 59,959 will present the definitive clue as to which drive will dictate the market’s subsequent main 700+ level transfer. Watch the personal banks with excessive focus.

Financial institution Nifty Dec Futures Open Curiosity Quantity stood at 14.3 lakh, with addition of 0.99 Lakh contracts. Moreover, the Enhance in Price of Carry implies that there was a closuer of SHORT positions right this moment.

Financial institution Nifty Advance Decline Ratio at 06:08 and Financial institution Nifty Rollover Price is @59525 closed above it.

The Financial institution Nifty choices market is signaling a strong bullish breakout, with bulls decisively conquering a significant psychological milestone. A really sturdy Put-Name Ratio (PCR) of 1.11 has pushed the market firmly right into a bullish sentiment zone. This excessive ratio, pushed by aggressive put writing, signifies that merchants have minimal concern of a decline and have constructed a formidable assist construction beneath the index.

Probably the most crucial growth is the spot value buying and selling at 60,118, considerably above each the Max Ache level of 59,900 and, extra importantly, the colossal open curiosity wall on the 60,000 strike. This isn’t merely a rally; it’s a main technical and psychological victory for the bulls. This breakout places the huge variety of name sellers who have been defending the 60,000 stage underneath immense strain, forcing them to cowl their brief positions. This “brief squeeze” can now act as a strong gasoline, accelerating the rally even increased.

The market’s battleground has been basically redrawn by this highly effective transfer:

-

Resistance: The subsequent main resistance is now positioned at 60,500, the place the subsequent important focus of name writers is positioned. The final word ceiling for this collection seems to be at 61,000.

-

Help: The previous resistance fortress at 60,000 has now decisively flipped to turn into the brand new main assist ground. An in depth under this stage could be required to negate the bullish breakout. The 59,500 strike, which holds a large wall of places, now acts as the last word assist.

In conclusion, the stalemate is definitively damaged. The bulls are in absolute command, having conquered a significant resistance stage. The market has now entered a “blue-sky” section the place the trail of least resistance is firmly upwards, so long as the bulls can defend the brand new 60,000 assist ground.

For Positional Merchants, The Financial institution Nifty Futures’ Development Change Stage is At 60012. Going Lengthy Or Quick Above Or Under This Stage Can Assist Them Keep On The Similar Aspect As Establishments, With A Larger Threat-reward Ratio. Intraday Merchants Can Hold An Eye On 60340 , Which Acts As An Intraday Development Change Stage.

Financial institution Nifty Spot – Intraday Technical Setup

Market Remark: The index is presently buying and selling inside an outlined vary. Merchants ought to watch the next pivot zones for potential directional strikes:

-

Energy (Upside): If the index sustains above 60166, it signifies bullish momentum. The quick resistance ranges to look at are 60323, 60496 and 60729.

-

Weak spot (Draw back): Promoting strain is more likely to intensify if the index breaks under 59950. On this situation, the subsequent assist zones are 59858, 59565 and 59400.

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to intently monitor market actions and make knowledgeable choices primarily based on a well-thought-out buying and selling plan and danger administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be a part of Youtube channel : Click on right here

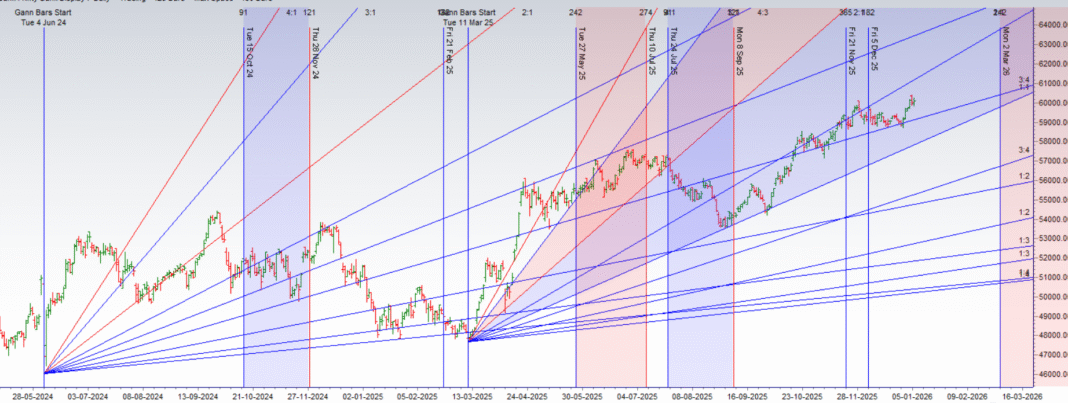

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators