A Misleading Surge: FIIs’ Large Shopping for is a Basic Brief-Masking Sign

On the floor, the buying and selling session of November 27, 2025, seemed to be a day of immense bullish power from institutional gamers. The info confirmed Overseas Institutional Traders (FIIs) participating in huge internet shopping for within the Financial institution Nifty Index Futures, buying 4,062 contracts with a major notional worth of ₹844.08 crores. A shopping for determine of this magnitude would usually be interpreted as a strong, high-conviction wager on a sustained market rally.

Nevertheless, this bullish interpretation is totally invalidated by the session’s most important knowledge level: the internet open curiosity (OI) decreased by 914 contracts. That is the unambiguous and textbook signature of a large-scale short-covering operation, not real bullish shopping for.

Decoding the Actual Motivation: It’s About Revenue-Taking, Not New Bets

The connection between value, quantity, and open curiosity is paramount to understanding the market’s true intentions. Right here’s what occurred:

The highly effective shopping for that drove the Financial institution Nifty greater was not the results of FIIs initiating new lengthy positions. As a substitute, it was overwhelmingly dominated by the mechanical, and sure pressured, shopping for required for them to shut out their present quick (bearish) positions. When a dealer covers a brief, they have to purchase again the contracts they beforehand offered. This motion fuels an upward value transfer however, as a result of it closes an present commerce, it reduces the whole variety of open contracts out there, inflicting the OI to fall.

This was not a strategic shift to a bullish view; it was a tactical retreat to lock in earnings on profitable bearish bets.

Key Implications for Merchants:

-

A Hole and Fragile Up-Transfer: A value advance constructed on quick protecting is inherently fragile. It lacks the muse of latest, optimistic capital. Such strikes might be sharp and swift, however they’re usually unsustainable and extremely vulnerable to reversal as soon as the short-covering impulse has been exhausted.

-

The Good Bull Entice: This situation is a traditional bull entice in motion. Retail merchants, seeing the worth surge and the large internet shopping for determine, might be simply lured into chasing the transfer. They danger shopping for at elevated ranges, offering the very exit liquidity that the institutional gamers want to shut out their quick positions profitably.

-

Institutional Sentiment Has Not Turned Bullish: This motion doesn’t imply that FIIs at the moment are optimistic in regards to the banking sector. It’s a profit-taking maneuver. The underlying causes for his or her preliminary bearishness should still be totally intact. It’s extremely possible that they are going to view this value surge as a chance to re-initiate new quick positions at extra favorable, elevated ranges.

Conclusion:

Merchants should not be deceived by the headline shopping for determine. The FII exercise within the Financial institution Nifty on November twenty seventh was not a sign of renewed optimism however an enormous, technically-driven short-covering occasion. The lower in open curiosity is the definitive proof. The prudent strategy is to deal with this upward value transfer with excessive skepticism and to acknowledge that the institutional sentiment has not essentially turned bullish. Any lengthy positions taken on the again of this transfer carry an exceptionally excessive danger of a pointy reversal.

Financial institution Nifty Dec Futures Open Curiosity Quantity stood at 15.3 lakh, with liquidation of 0.64 Lakh contracts. Moreover, the Enhance in Price of Carry implies that there was a closeure of SHORT positions right this moment.

Financial institution Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 59458for a transfer in the direction of 59995/60237. Bears will get lively beneath 59510 for a transfer in the direction of 59268/59025/58783

Financial institution Nifty Advance Decline Ratio at 06:06 and Financial institution Nifty Rollover Price is @58357 closed above it.

A Market Stretched to its Restrict: Warning Abounds as 60,000 Turns into a Fortress

The choices market is flashing important warning indicators, indicating a market stretched to its restrict and ripe for a possible pullback. Regardless of the spot value buying and selling at an elevated 59,737, the underlying knowledge reveals deep-seated warning and a strong build-up of bearish positioning.

The 2 main indicators each level in the direction of underlying weak point. The Put-Name Ratio (PCR) stands at a cautious 1.17. A PCR this excessive confirms that extra Put choices are being held than Calls, a transparent signal of widespread hedging and a rising worry of a draw back transfer. Additional amplifying this concern is the Max Ache degree, which is pegged far beneath the present market at 59,100. This implies that choice writers, who usually have a greater learn in the marketplace, see the next chance of the worth declining in the direction of this degree by expiry to inflict the utmost loss on choice consumers.

This sentiment is visibly etched into the choice chain, which has now shaped a strong and well-defined battleground:

-

Resistance: A colossal wall of Name Open Curiosity has been constructed on the psychological 60,000 strike. This represents a formidable fortress for the bears and the only most vital hurdle for the bulls to beat. A secondary, however nonetheless robust, resistance is seen at 60,500.

-

Help: The instant help is the Put wall at 59,500, with the last word ground of help for the sequence situated on the 59,000 strike, which boasts the best Put OI.

Conclusion:

The market is at present trapped in a high-stakes standoff between the 59,500 help and the 60,000 resistance. Whereas the worth stays excessive, the PCR and Max Ache knowledge strongly recommend the market is susceptible and that the danger is skewed to the draw back. The battle for the 60,000 degree would be the defining theme within the coming periods.

For Positional Merchants, The Financial institution Nifty Futures’ Development Change Stage is At 59617 . Going Lengthy Or Brief Above Or Beneath This Stage Can Assist Them Keep On The Identical Aspect As Establishments, With A Larger Threat-reward Ratio. Intraday Merchants Can Preserve An Eye On 59976 , Which Acts As An Intraday Development Change Stage.

BANK Nifty Intraday Buying and selling Ranges

Purchase Above 59767 Tgt 59889, 60011 and 60132 (BANK Nifty Spot Ranges)

Promote Beneath 59645 Tgt 59523, 59385 and 59166 (BANK Nifty Spot Ranges)

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to intently monitor market actions and make knowledgeable choices primarily based on a well-thought-out buying and selling plan and danger administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be a part of Youtube channel : Click on right here

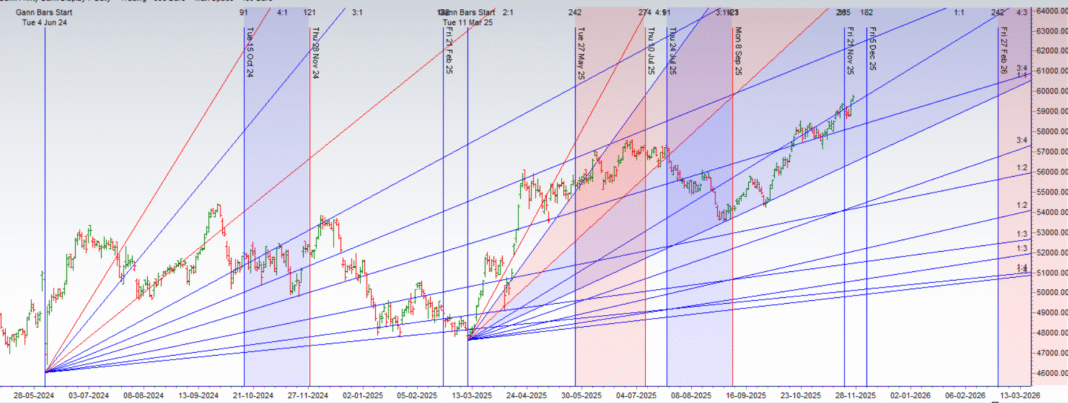

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators