A Wholesome Pattern is Born: FIIs Proceed Shopping for as New Cash Validates Financial institution Nifty’s Energy

On November 13, 2025, the Financial institution Nifty Index Futures market offered a textbook sign that the just lately initiated uptrend is not only a brief short-covering rally, however a wholesome, sustainable transfer with rising conviction. Whereas the amount was modest, Overseas Institutional Traders (FIIs) confirmed their newfound bullish stance, shopping for a internet 973 contracts price ₹196.80 crore.

Nevertheless, the session’s strongest and telling statistic was the small however vital improve in internet Open Curiosity (OI) of 121 contracts. This element transforms the narrative from considered one of easy shopping for to considered one of a brand new, institutionally-backed development taking root.

Decoding the Information: From Reversal to Reloading

This mixture of methodical FII shopping for alongside rising open curiosity is the signature of a wholesome, budding uptrend. Let’s break down the mechanics:

-

The Affirmation of the FII Pivot: That is now the second consecutive occasion of FIIs appearing as internet consumers. Their pivot from a large, entrenched bearish place to a constant purchaser is probably the most important strategic shift out there. It confirms that the institutional “good cash” believes the underside is in and that present costs symbolize worth. The period of relentless promoting stress is decisively over.

-

The Significance of Rising Open Curiosity: That is the important thing that unlocks the whole story. A rise in OI, irrespective of how small, signifies that brand-new contracts have been created. That is profoundly completely different from a rally on falling OI, which merely signifies bears protecting their outdated shorts. A rally on rising OI signifies new cash getting into the market to construct new lengthy positions. It exhibits rising conviction and participation within the new uptrend. On this session, FIIs’ shopping for was sturdy sufficient to soak up all of the sellers who have been closing out outdated positions, with sufficient shopping for energy left over to fulfill new sellers and create new contracts. This can be a signal of a development that’s constructing power, not exhausting itself.

Key Implications for Merchants

-

A Shift from Brief-Overlaying to New Longs: The market is graduating from a panicked reversal rally to a extra steady, accumulation-based uptrend. The first gasoline is not coming from fearful bears shopping for again their shorts, however from assured bulls initiating contemporary longs.

-

An Institutional Ground Beneath the Market: The constant FII shopping for establishes a powerful conceptual flooring of assist for the Financial institution Nifty. It sends a transparent sign that institutional gamers see worth at these ranges and are keen to soak up promoting stress. The market psychology has now fully shifted from “promote the rallies” to “purchase the dips.”

-

Wholesome, Not Frothy: The modest measurement of the FII shopping for can also be a constructive signal. It signifies a methodical, value-based accumulation quite than a panicked, FOMO-driven chase. This implies the rally is being constructed on a strong basis and is much less inclined to a sudden collapse.

-

The Path of Least Resistance is Now Up: With the first sellers having flipped to consumers and new cash validating the development, the trail of least resistance has now clearly shifted to the upside.

Conclusion

Don’t be misled by the small headline numbers. This session’s knowledge supplies a strong X-ray into the market’s enhancing well being. The FIIs have confirmed their bullish pivot, and extra importantly, the rise in Open Curiosity indicators that new, convicted capital is now getting into to assist and construct upon this new uptrend. The Financial institution Nifty has efficiently navigated its bottoming course of, and the information now suggests the start of a wholesome, sustainable new rally.

Financial institution Nifty Nov Futures Open Curiosity Quantity stood at 17.1 lakh, with liquidation of 1.60 Lakh contracts. Moreover, the Enhance in Price of Carry implies that there was a closeure of SHORT positions at the moment.

Financial institution Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 58592 for a transfer in direction of 58831/59070. Bears will get lively under 58114 for a transfer in direction of 57875/57636/57396

Financial institution Nifty Advance Decline Ratio at 03:09 and Financial institution Nifty Rollover Price is @58357 closed above it.

A Bullish Recalibration: Sentiment Improves as Max Ache Drifts Larger to 58,200

The Financial institution Nifty choices market is signaling a transparent and decisive victory for the bulls within the current sentiment battle. The undertone has shifted from a tense stalemate to a state of cautious optimism, with two key items of knowledge confirming this evolution: the Put-Name Ratio (PCR) has strengthened additional to a wholesome 0.93, and extra importantly, the market’s heart of gravity—the Max Ache level—has shifted greater to 58,200. This can be a highly effective indication that the whole buying and selling vary is being recalibrated upwards, with bears in full retreat.

The Narrative of a Wholesome PCR (0.93)

The continued rise of the PCR to a near-neutral 0.93 confirms that the concern of a big decline has all however evaporated. This enchancment is pushed by a wholesome market dynamic the place put writers, assured that the underside is in, are aggressively promoting places and creating a powerful security internet underneath the market. Concurrently, the unwinding of outdated bearish hedges continues. That is not only a market recovering from concern; it’s a market actively constructing a bullish-to-neutral basis, the place individuals are extra targeted on potential upside than draw back threat.

The Essential Shift: Max Ache Strikes to 58,200

Essentially the most vital improvement is the upward drift of the Max Ache stage from 58,000 to 58,200. This isn’t a trivial change. Max Ache represents the purpose of most monetary loss for choice consumers and is the worth stage that exerts the strongest magnetic pull on the index as expiry approaches. The truth that this stage has shifted greater signifies that the key choice writers (the “good cash”) have adjusted their very own expectations. They not see 58,000 because the almost certainly expiry level; they’re now constructing positions that counsel a brand new, greater equilibrium. This can be a sturdy vote of confidence out there’s stability and underlying power.

Defining the New Battleground: Assist and Resistance Ranges

This recalibration redraws the market’s key battle traces, turning former resistance ranges into new assist flooring.

-

Final Resistance: The key fortress of Name OI stays on the 58,500 strike. That is now the first and most formidable ceiling that the bulls want to overcome to unleash a brand new trending transfer.

-

Instant Resistance / Pivot: The brand new Max Ache stage of 58,200 is now the quick pivot. It would act as a magnet, but additionally as a degree of rivalry the place each name and put writers are lively.

-

Main Assist: The earlier battleground of 58,000 has now decisively reworked into a significant assist stage. What was as soon as a ceiling is now a flooring, strengthened by a large variety of put writers. This can be a basic signal of a wholesome uptrend.

-

Final Assist: The ultimate line of protection stays sturdy at 57,500, holding a big wall of Put OI. A take a look at of this stage is now thought of a low-probability occasion given the improved sentiment.

Conclusion

The Financial institution Nifty has efficiently accomplished its bullish transition. The technical and nostalgic proof now overwhelmingly favors the bulls. The concern has been purged, and the market’s complete construction has been reset to the next stage. Whereas the immense OI positions nonetheless counsel a range-bound setting, that vary has shifted definitively greater. The almost certainly state of affairs is a interval of consolidation across the new 58,200 pivot, because the market builds vitality for an eventual try and problem the key resistance at 58,500. The danger of a big decline has diminished dramatically.

For Positional Merchants, The Financial institution Nifty Futures’ Pattern Change Stage is At 58326. Going Lengthy Or Brief Above Or Under This Stage Can Assist Them Keep On The Identical Facet As Establishments, With A Larger Danger-reward Ratio. Intraday Merchants Can Preserve An Eye On 58618, Which Acts As An Intraday Pattern Change Stage.

BANK Nifty Intraday Buying and selling Ranges

Purchase Above 58352 Tgt 58566, 58729 and 58945 (BANK Nifty Spot Ranges)

Promote Under 58150 Tgt 58008, 57850 and 57700 (BANK Nifty Spot Ranges)

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable choices based mostly on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

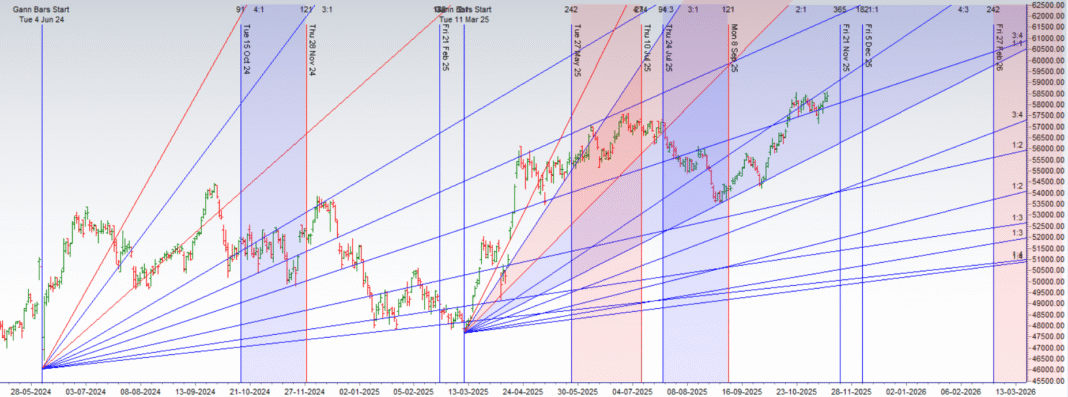

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators

Associated