By RoboForex Analytical Division

USD/JPY is right down to 156.73 on Monday. The Japanese yen had earlier dropped to its lowest ranges in virtually two weeks after a landslide victory for Japan’s ruling Liberal Democratic Celebration in early elections to the decrease home of parliament. The coalition is led by Prime Minister Sanae Takaichi. Nevertheless, demand for the yen returned shortly after.

Takaichi’s coalition received 352 of 465 seats within the Home of Representatives, in response to NHK. On the similar time, the Liberal Democratic Celebration of Japan itself secured a majority of 316 seats. The vote’s final result offered the prime minister with a transparent mandate to implement an expansive fiscal coverage.

Markets regarded the outcome as a sign in favour of a softer funds line and attainable tax breaks. This elevated stress on the yen and Japanese authorities bonds amid fears of an increase within the debt burden. On the similar time, the outcomes supported expectations of extra beneficial dynamics for the inventory market.

A extra conservative home agenda is now anticipated to advance, together with stricter immigration insurance policies and land possession guidelines. All this provides uncertainty to the evaluation of medium-term penalties for the financial system and monetary markets.

Technical Evaluation

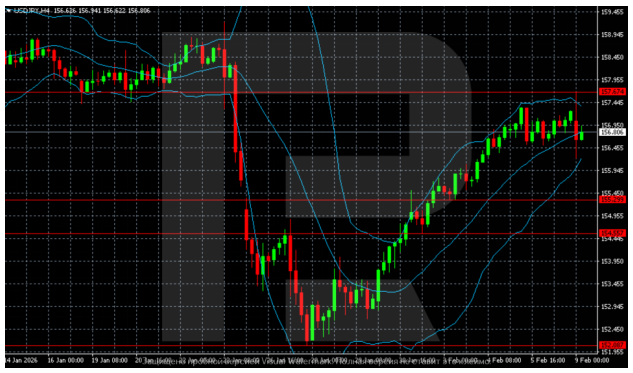

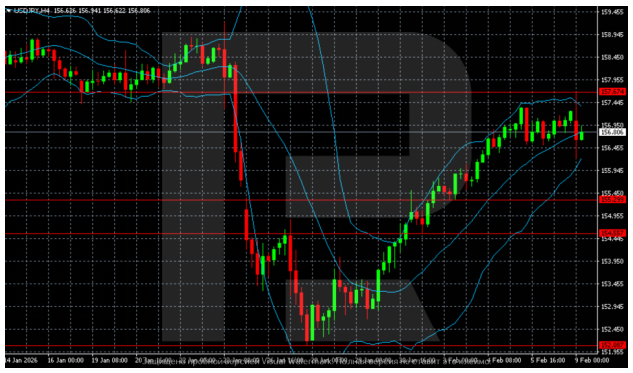

On the H4 chart for USD/JPY, following a pointy decline on the finish of January, a neighborhood backside fashioned within the 152.00-152.20 zone, from which the pair started to get well. This impulsive progress was accompanied by motion alongside the higher border of the Bollinger Bands. The value is now buying and selling beneath latest highs and consolidating within the 155.80-157.70 vary. Volatility has decreased, and the construction stays corrective. Nevertheless, momentum weakened, and the market has entered a pause part underneath resistance.

The H1 chart reveals the event of lateral dynamics after progress, with the worth hovering across the Bollinger Bands’ midline, and no new momentum forming. Promoting stress shortly cancelled makes an attempt to maneuver greater to 157.40-157.70, whereas assist holds within the 155.50-155.80 area. The near-term trajectory seems impartial, with a steadiness between correction and makes an attempt to proceed the restoration.

Conclusion

In abstract, USD/JPY is present process a corrective pullback because the market digests the political implications of Japan’s election final result. Whereas the landslide victory initially weakened the yen on expectations of expansive fiscal coverage, a technical pause has adopted. The pair is now consolidating, caught between the basic stress from anticipated greater Japanese debt (bearish for JPY) and technical resistance. The near-term trajectory will rely upon whether or not this consolidation results in a continuation of the restoration or a deeper correction, with readability on the brand new authorities’s fiscal measures serving as the subsequent main catalyst.

Disclaimer

Any forecasts contained herein are primarily based on the creator’s explicit opinion. This evaluation might not be handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- USD/JPY Reacts to Political Information: Finances Line Will Be Tender Feb 9, 2026

- Purchaser curiosity has returned to inventory indices. Bitcoin has returned to the $70,000 mark Feb 9, 2026

- COT Metals Charts: Speculators drop Gold Bets for fifth time in 6 Weeks Feb 8, 2026

- COT Bonds Charts: Speculator Bets led by SOFR 1-Months, SOFR 3-Months & Extremely 10-Yr Bonds Feb 8, 2026

- COT Vitality Charts: Weekly Speculator Bets led by WTI Crude & Brent Oil Feb 8, 2026

- COT Tender Commodities Charts: Sugar Speculator Bets hit All-Time File Low Feb 8, 2026

- Bitcoin has dropped beneath $70,000. The Financial institution of Mexico held its charge at 7% Feb 6, 2026

- Gold Closes with a Decline for the Second Week in a Row: Fewer Dangers Feb 6, 2026

- The British Index has hit a brand new all-time excessive. Silver has plummeted by 16% Feb 5, 2026

- GBP/USD Beneath Native Strain: Concentrate on Financial institution of England Indicators Feb 5, 2026