Candlestick patterns are a good way to find out commerce entry factors. And most significantly, they work.

The Triple Strike sample is a uncommon however extraordinarily efficient Japanese candlestick mixture. The sample works on any timeframe.

It may be used as a sign to search out an entry level on the weekly chart, or as a scalping entry on the M1 timeframe. I want hourly (H1) charts.

Sample identification guidelines Triple Strike

We’re searching for 3 consecutive strike bars in numerous instructions.

- An Ascending Impression Bar is a bar whose closing worth is larger than the excessive of the earlier bar.

- Downward Impression Bar – a bar whose closing worth is decrease than the low of the earlier bar.

A further affirmation is the growing measurement of the bars.

Logics

The logical rationalization for this sample is ache. Basically, merchants are being deceived twice. Earlier than a really robust transfer, the market likes to knock out the stop-losses of small gamers.

Buying and selling system

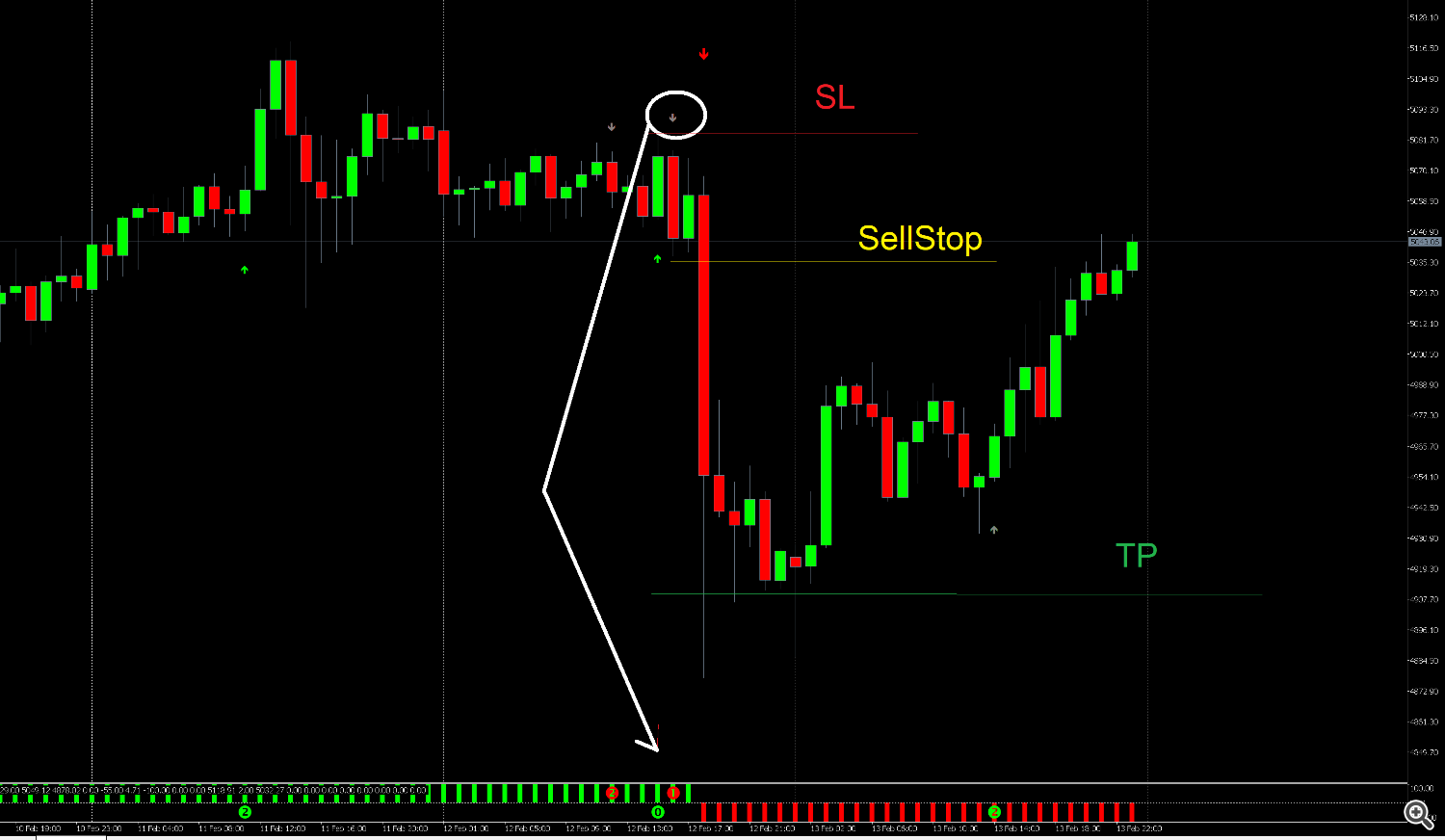

- To verify an entry, use a breakout of the excessive or low of the final bar within the sample. This is not crucial, because the sample itself may be very robust.

- Set cease loss on the most (for gross sales) of the sample.

- Take revenue must be a a number of of cease loss, from 0.5 to three, relying on choice.

Within the screenshot under, I used the AceTrend indicator to establish the sample. It mechanically attracts the Triple Strike sample and marks it as #1.

The sample is so robust that it typically initiates a pattern reversal!

Candlestick patterns actually work!

In case you nonetheless do not consider it, this is an instance of my actual automated buying and selling utilizing candlestick patterns:https://www.mql5.com/en/indicators/2339244

Abstract: Why the Triple Strike Works and How one can Use It in Your Buying and selling

The Triple Strike sample is not only a random mixture of candlesticks, however a mirrored image of market psychology, the place a stronger participant (or the market itself) “shakes out” the group earlier than triggering a momentum wave. To summarize, there are 5 key explanation why this sample deserves a spot in your buying and selling arsenal:

-

Excessive reliability as a result of “double deception”.

Not like easy candlestick formations, the Triple Strike forces merchants to make errors twice in a row. The primary strike bar catches some, the second catches others. By the point the third bar types, there’s minimal liquidity (stop-losses) left out there earlier than the actual transfer, making it a extremely correct harbinger of a reversal or a robust pattern continuation. -

Versatility of timeframes.

You talked about that you simply want H1, however the fantastic thing about the sample is its scalability. Discovering a Triple Strike on M1 is simply as efficient as on Weekly. The principle rule is: the upper the timeframe, the stronger the motion will likely be, however the much less continuously the sign will happen. -

Straightforward identification.

You do not want a heavy arsenal of indicators. Whereas utilizing instruments like AceTrend accelerates the search, the sample is definitely noticed with the bare eye: three bars, every successive bar closing past the earlier one, making a “three-steps-of-violence” impact earlier than the breakout. -

Clear danger administration.

The sample offers crystal-clear ranges for capital safety. Cease-loss orders are positioned past the sample’s excessive, and take-profit orders, that are multiples of the danger (from 0.5 to three), assist you to flexibly regulate the technique to your buying and selling type—whether or not conservative scalping or aggressive swing buying and selling. -

Power of pattern reversal.

A “triple strike” typically happens at key assist/resistance zones or at pattern tops/bottoms. In case you see this sample on an hourly chart close to a robust stage, you’ll be able to safely contemplate it an early signal of a worldwide pattern reversal.

Abstract for a dealer:

Do not chase the variety of indicators. The “Triple Strike” is a uncommon sight on the chart, however when it does seem, the market appears to be shouting its intentions at you. Add it to your guidelines, all the time wait till the third bar closes, and keep in mind: your objective is not to time the transfer, however to enter it after the market has “knocked out” all weak gamers. The self-discipline of getting into this sample pays off with a excessive likelihood of a profitable commerce.