Choices Delta might be seen as a proportion likelihood that an choice will wind up in-the-money at expiration. Trying on the Delta of a far-out-of-the-money choice is an effective indication of its chance of getting worth at expiration. An choice with lower than a .10 Delta (or lower than a ten% likelihood of being in-the-money) isn’t seen as very prone to be in-the-money at any level and can want a powerful transfer from the underlying to have worth at expiration.

If you promote a credit score unfold with brief deltas round 10, they’ve roughly 90% likelihood to run out nugatory. So theoretically, you will have an opportunity to have a 90% successful ratio.

Right here is the issue: when you will have a 90% likelihood commerce, your danger/reward is horrible – often round 1:9, that means that you simply danger $9 to make $1. Additionally with 90% likelihood trades, your most acquire is often restricted to 8-10%, however your loss might be 100%. Meaning which you can have a 90% successful ratio, and nonetheless lose cash. Additionally take into account the truth that should you win 10% 5 instances in a row after which lose 50%, you aren’t breakeven. You might be truly down 25%.

The danger turns into even greater whenever you promote weekly credit score spreads. With nearer expiration, the Gamma Threat turns into a lot greater and the losses begin to develop actually quick when the underlying goes in opposition to you.

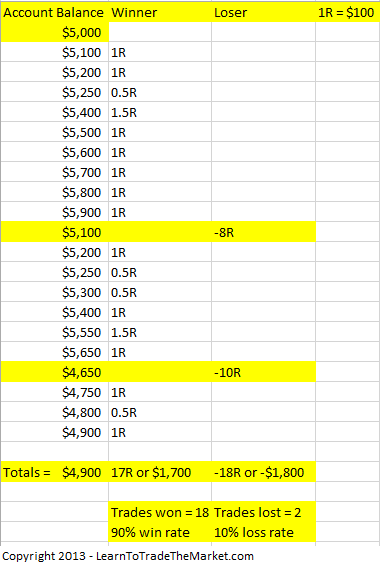

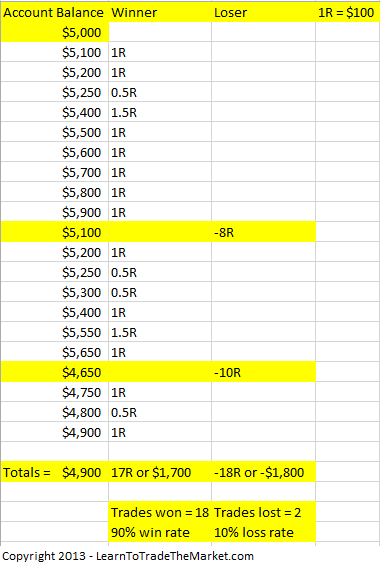

Within the instance picture beneath, we are able to see that even with a 90% successful proportion, a dealer can nonetheless lose cash in the event that they take losses which might be too giant relative to their winners:

It needs to be apparent by now {that a} successful ratio alone would not inform the entire story – in actual fact, it’s fairly meaningless.

Right here is how Karl Domm describes it:

And the bottom line is this: you could possibly win 80-90% of your commerce promoting choices in a bull or sideways market and even presumably in a grind down market. Actually, you could possibly be worthwhile in these markets the place your common winner with extra occurrences outpaces the common loser with the decrease occurrences for an total acquire, however what concerning the crash market?

The final three crashes occurred on August 15,2015; February 5, 2018; and March 2020. That is what your excessive win fee guru doesn’t wish to speak about. They are going to keep away from speaking a couple of crash and so they presumably by no means even skilled the crash or they by no means again examined their system by way of a crash. They won’t even know what’s going to occur in a crash or they’re simply avoiding it altogether on objective.

Does it imply that credit score spreads are a nasty technique? By no means. However contemplating a successful ratio alone to guage a method isn’t a wise factor to do.

On the opposite aspect of the spectrum are merchants who utterly dismiss credit score spreads as a consequence of their horrible danger/reward ratio. Right here is an extract from an article by an choices guru:

The reality is that OTM Credit score Spreads have a excessive likelihood of constructing a revenue. The common Credit score Unfold dealer will face 100% losses on this commerce a number of instances a 12 months whereas attempting to make a modest 5 to 10% a month. What occurs is that ultimately most Credit score Unfold Merchants meet their doomsday. Ultimately, just about all choice merchants who use solely OTM Credit score Spreads wipe out their buying and selling accounts.

Let’s take a look at the “Pc Glitch” of 2010 when the DOW dropped 1000 factors in a matter of minutes. These doing Credit score Spreads on today misplaced on common between 70% and 90% of their portfolio. What occurred is that the volatility rose drastically and the trades moved into that “hazard zone” the place they lose 100% 10 p.c of the time. The Credit score Unfold dealer doesn’t notice that the ten p.c of the time they lose can occur AT ANY TIME. Most individuals suppose that they are going to have 9 wins adopted by 1 loss, however this clearly isn’t how the legislation of likelihood works. It’s not unusual for an OTM Credit score Unfold dealer to face a catastrophic loss on their very first commerce, and as soon as this occurs, there isn’t a solution to get well since a successful commerce will solely carry again 10% on the remaining capital.”

Whereas I agree that credit score spreads are a lot riskier than most merchants consider, the article ignores few vital elements. It’s true that credit score spreads can expertise some very vital losses every so often. However that is the place place sizing comes into play. Personally, I might by no means place greater than 15-20% of my choices account into credit score spreads – except they’re hedged with put debit spreads and/or places.

General, credit score spreads and different excessive likelihood methods can and needs to be a part of a well-diversified choices portfolio, however merchants ought to consider managing the technique and the danger, and never on the successful ratio. Actually, {many professional} merchants take into account a 60% successful ratio wonderful. For instance, Peter Brandt admits that his successful ratio is simply 43% – but his Audited annual ROR is 41.6%. Many methods are designed to have few massive winners and plenty of small losers.

The underside line: the one factor that issues in buying and selling is your total portfolio return. A successful ratio merely would not inform the entire story.

Associated articles: