- The EUR/USD worth evaluation suggests robust bullish momentum, heading in direction of 1.1900 amid broad greenback weak spot.

- Eurozone knowledge remained combined, maintaining the ECB regular as a substitute of supportive.

- Markets eye the FOMC fee resolution and press convention this week as a serious occasion.

The EUR/USD worth is buying and selling greater primarily amid a weaker greenback, not as a result of the Euro space has turned decisively stronger. The pair is up about 0.26% to round 1.1860, whereas the DXY is round 97.00, which is the bottom stage in about 4 months. The motive force is ongoing investor fear about US commerce relations and coverage uncertainty, although some current tensions between the US and the EU have calmed down.

–Are you curious about studying extra about ETF brokers? Test our detailed guide-

The Fed’s resolution on Wednesday is the main occasion this week. The markets anticipate the Fed will preserve charges between 3.50% and three.75%. This might be the primary time charges stayed the identical after three cuts in late 2025 that added as much as 75 bps. The response operate is extra necessary than the speed resolution now that the maintain is generally priced in. Merchants will take note of how Powell communicates about inflation, the job market, and whether or not the committee is open to confirming or pushing again towards expectations for alleviating within the close to future.

Political and institutional danger provides yet one more stage of complexity to USD pricing. The Fed is going through important stress and strange authorized challenges. The markets stay involved about independence optics and coverage credibility. That backdrop might preserve the greenback down till one thing important occurs. Nonetheless, issues might go the opposite means rapidly if the Fed appears united and robust.

The subsequent elements to look at for on the euro aspect are the primary estimates of Eurozone GDP for This autumn and Germany’s HICP for January. The current knowledge is just not all good. The Eurozone companies PMI fell to 51.9. Germany’s companies beat expectations, and manufacturing improved however stayed in contraction. In December, Germany’s industrial manufacturing fell by 0.7%, which was a shock. This makes it tougher to argue for a tighter ECB coverage and retains ECB expectations regular as a substitute of supportive.

Alternatively, the US nonetheless seems to be robust in comparison with different nations, with a powerful December payrolls print of 210k. If the Fed sounds even a bit hawkish, that distinction might come again rapidly.

General, this week is a battle between weak USD sentiment going into the Fed assembly and the likelihood that commerce information or stronger Fed communication will convey again the greenback’s safe-haven bid and restrict EURUSD rallies.

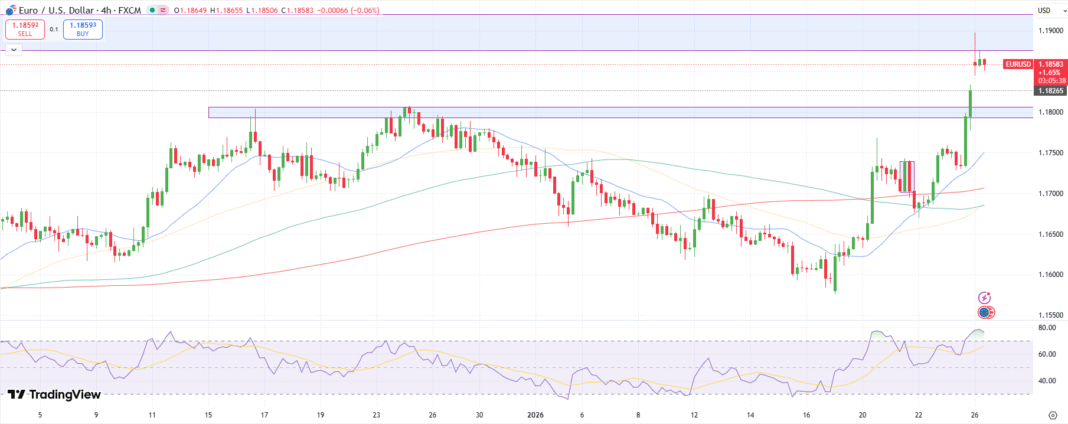

EUR/USD Technical Value Evaluation: Pullback Earlier than Additional Upside

The EUR/USD worth is at present consolidating above the mid-1.1800 stage after reaching a multi-month excessive close to 1.1900 and subsequently bouncing from a powerful provide zone. The pair shaped a bearish pin bar whereas leaving a bullish hole close to 1.1825.

–Are you curious about studying extra about South African foreign exchange brokers? Test our detailed guide-

The RSI signifies an excessive overbought situation, which might result in a pullback to fill the hole at 1.1825 earlier than testing the supply-turned-demand zone close to 1.1800. Nonetheless, the broader pattern stays bullish whereas staying effectively above the important thing MAs. The patrons might intention to pierce the 2025 highs close to 1.1930 to check the psychological mark at 1.2000.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you may afford to take the excessive danger of shedding your cash.