- The EUR/USD outlook stays tender because the greenback surges after a shock decline in jobless claims.

- Considerations in regards to the Eurozone’s progress and falling German yields maintain the bias bearish on EUR/USD.

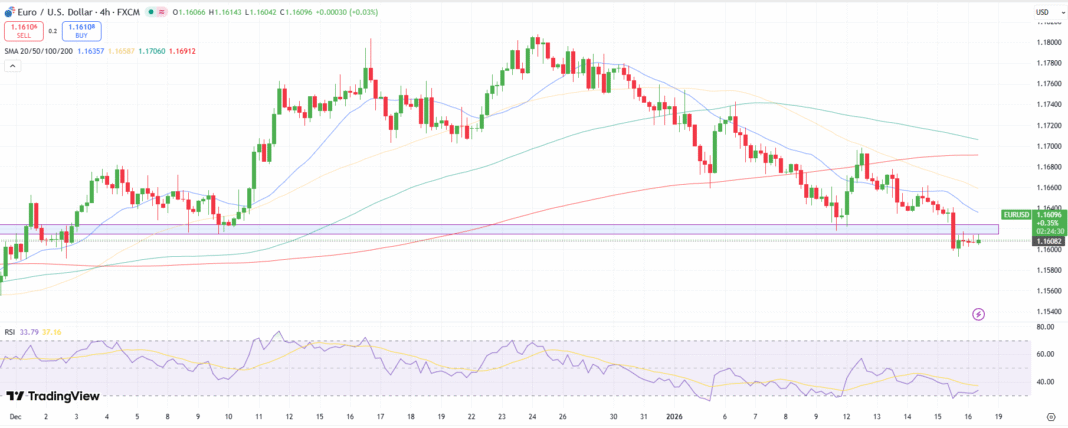

- Technically, a value beneath 1.1635 poses a threat of testing the 1.1550 degree.

EUR/USD is buying and selling with a gentle draw back bias because the greenback pares however largely holds latest positive factors across the 99.30 space on the DXY. Stronger-than-expected US knowledge this week, mixed with an upside shock in Preliminary Jobless Claims, has pushed again expectations for the primary Fed fee lower to June and September from earlier pricing of January and April.

–Are you interested by studying extra about foreign exchange instruments? Verify our detailed guide-

Fed funds futures now assign a few 95% chance that the Fed will maintain charges regular on the late?January assembly, reinforcing carry help for the greenback whereas conserving EUR/USD beneath stress.

The most recent US labor alerts level to still-resilient situations. Preliminary jobless claims dropped to about 198k, lower than the anticipated 215k and the beforehand revised 207k. This reveals that layoffs are nonetheless restricted regardless of strict insurance policies.

That energy, together with worries about sticky inflation, makes it arduous to ease immediately and helps US yields in comparison with the Eurozone. Merchants will take a look at December’s Industrial Manufacturing numbers and feedback from Fed officers, together with Governor Michelle Bowman, to reaffirm that the Fed continues to be affected person and data-dependent.

The structural image on the euro aspect stays softer. The European Central Financial institution is more likely to decrease charges sooner and by greater than the Fed, as progress is slowing and inflation is cooling, giving policymakers extra room to ease. German yields are additionally slowly declining. This reveals divergence between EU and US progress and insurance policies.

Broader threat sentiment is a swing issue however not but euro-supportive. Whereas geopolitical headlines and US political alerts have considerably stabilized threat, EUR/USD stays a risk-sensitive pair. Within the absence of sustained risk-on and with US knowledge outpacing the Eurozone, rallies within the euro are more likely to be offered off, conserving the pair biased decrease within the close to time period.

EUR/USD Technical Outlook: Bearish Momentum

After breaking the demand zone at 1.1610, the EUR/USD value is retracing barely to retest the damaged degree, with restricted upside. The value lies nicely beneath the important thing MAs, indicating a cushion for extra losses.

–Are you interested by studying extra in regards to the finest crypto alternate? Verify our detailed guide-

Nonetheless, the RSI is rising after hitting the oversold area. So long as the worth stays beneath the 20-period MA at 1.1635 and the demand zone, the pair may lose additional to check 1.1550 and 1.1500.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you’ll be able to afford to take the excessive threat of shedding your cash.