By RoboForex Analytical Division

The EUR/USD pair retreated to 1.1612 on Tuesday, pulling again from a current two-week excessive. The catalyst for the transfer was a big repricing of US rate of interest expectations following weak manufacturing information. The ISM Manufacturing Index confirmed a ninth consecutive month of contraction, with the tempo of decline the quickest in 4 months.

This information solidified market expectations for a Federal Reserve price lower. Futures markets now suggest an 88% likelihood of a 25-basis-point discount at subsequent week’s FOMC assembly.

In associated information, President Donald Trump introduced he has chosen a candidate for the subsequent Fed Chair. Media experiences counsel the main contender is Kevin Hassett, the present head of the White Home Nationwide Financial Council.

Investor consideration is now centered on an upcoming speech by present Chair Jerome Powell later at this time, which can supply additional clues on the Fed’s coverage trajectory.

Technical Evaluation: EUR/USD

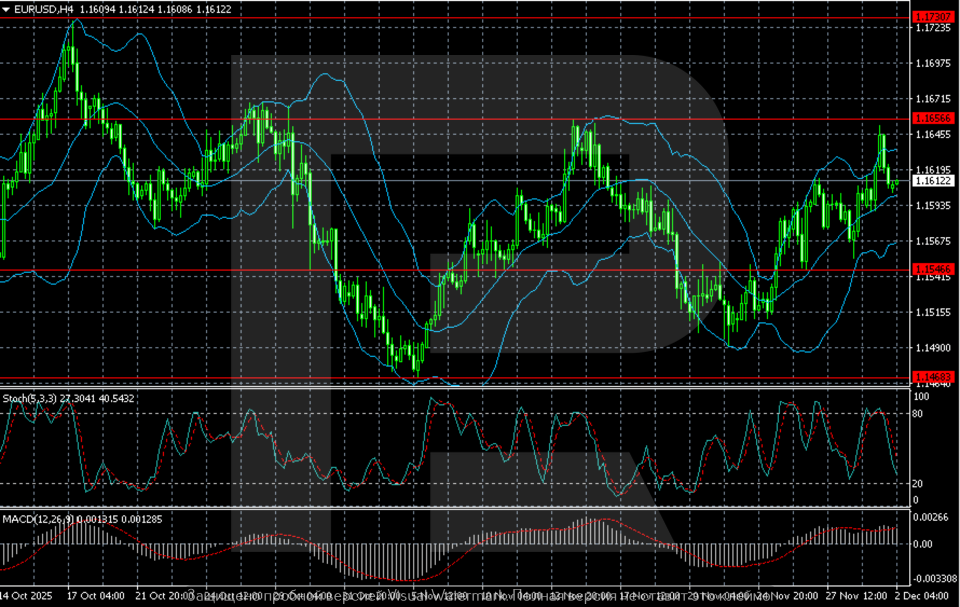

H4 Chart:

On the H4 chart, EUR/USD continues to commerce inside a longtime ascending channel. The pair is presently testing a key resistance zone at 1.1655, the place shopping for momentum has met vital promoting strain. A decisive breakout above this stage would open the trail in the direction of the subsequent main resistance at 1.1730.

The Stochastic Oscillator is rising from the center zone, indicating sustained bullish momentum with out overbought situations. The MACD stays above its zero line, sustaining a steady, albeit weak, purchase sign. Conversely, a break and shut under the important thing assist at 1.1545 would sign a deeper correction, doubtless focusing on the decrease boundary of the present vary close to 1.1468.

H1 Chart:

On the H1 chart, the pair is present process a correction after being rejected from native resistance at 1.1652. Consumers are presently defending the worth above the center Bollinger Band, suggesting short-term bullish management stays intact.

The Stochastic Oscillator is in overbought territory (above 80) and is popping down, pointing to a near-term corrective pullback. Nevertheless, the MACD stays in optimistic territory, supporting the broader upward bias. This technical image suggests a quick downward pause is probably going, with a possible retest of assist within the 1.1600–1.1585 zone. A profitable maintain above this space would enhance the likelihood of a contemporary upward impulse, focusing on a renewed take a look at of 1.1652 and an eventual push in the direction of 1.1700.

Conclusion

EUR/USD stays confidently bid, supported by rising expectations of Fed easing. Whereas a short-term technical correction is underway, the broader construction on each the H4 and H1 charts stays constructive. The important thing for continued upside is a profitable defence of the 1.1600–1.1585 assist zone. A break above 1.1655 can be a big bullish affirmation, whereas a failure to carry assist might set off a deeper pullback in the direction of 1.1545.

Disclaimer:

Any forecasts contained herein are primarily based on the writer’s explicit opinion. This evaluation might not be handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes primarily based on buying and selling suggestions and critiques contained herein.

- EUR/USD Holds Floor Amid Agency Concentrate on Fed Coverage Dec 2, 2025

- Digital belongings underneath strain after PBoC statements. Oil costs leap amid rising geopolitical dangers Dec 2, 2025

- Silver hits an all-time excessive. The US pure fuel costs attain a 2-year peak Dec 1, 2025

- Gold Hits 5-Week Excessive on Dovish Fed Bets Dec 1, 2025

- GBP/USD Rises as Markets Await Essential UK Funds Nov 26, 2025

- The RBNZ lowered the rate of interest to 2.25%. In Australia, inflationary pressures are rising Nov 26, 2025

- EUR/USD Extends Losses as Greenback Power Is Questioned Nov 25, 2025

- Fed officers trace at a December price lower. Hong Kong’s Hold Seng breaks six‑day shedding streak Nov 25, 2025

- Europe’s manufacturing sector continues to wrestle. Oil costs fell under $58 per barrel Nov 24, 2025

- Yen Below Sustained Strain, Igniting Intervention Fears Nov 24, 2025