By RoboForex Analytical Division

The EUR/USD pair is declining for a fourth consecutive session, edging nearer to the 1.1532 degree. Investor sentiment stays cautious as markets digest latest commerce developments and await a slew of high-impact financial knowledge.

Over the weekend, the White Home introduced a de-escalation in commerce tensions with China. Beijing has agreed to droop further export restrictions on uncommon earth metals and finish investigations into US semiconductor firms. In return, the US will freeze sure current tariffs and cancel a deliberate 100% tariff hike on Chinese language exports. This determination follows final week’s summit between Donald Trump and Xi Jinping, which aimed to stabilise bilateral relations.

In the meantime, the protracted US authorities shutdown continues to delay the discharge of official key statistics, notably employment knowledge. Of their absence, market individuals will search steering from private-sector indicators due within the coming days, together with the ADP employment report, the ISM Providers PMI, and the College of Michigan Shopper Sentiment Index.

This comes after the Federal Reserve’s anticipated 25-basis-point charge reduce final week. Chair Jerome Powell maintained a cautious stance, emphasising {that a} follow-up reduce in December just isn’t a foregone conclusion – a message that has supplied underlying assist for the US greenback.

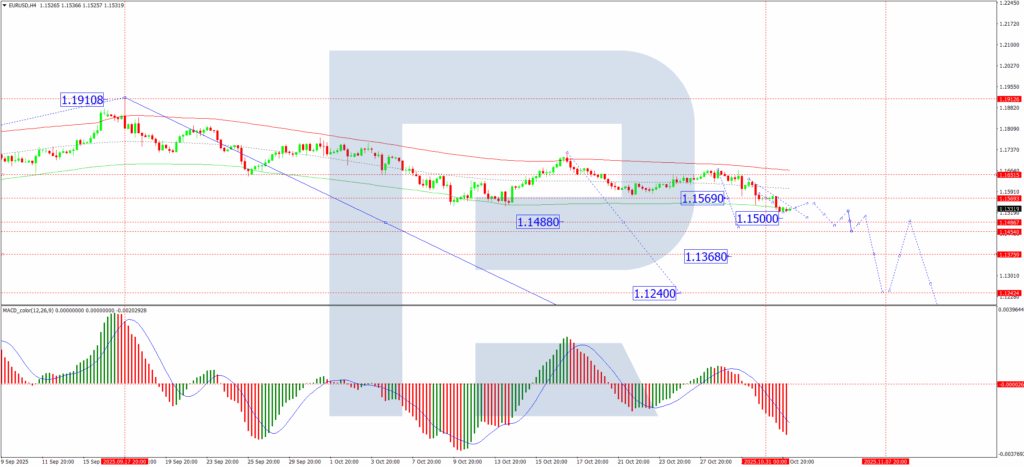

Technical Evaluation: EUR/USD

H4 Chart:

On the H4 chart, EUR/USD fashioned a decent consolidation vary round 1.1569. A subsequent downward breakout accomplished a bearish wave to 1.1521, and the pair is now consolidating above this native low.

A technical rebound to retest 1.1569 from under is a chance. Nonetheless, with bearish momentum nonetheless intact, we anticipate an extra decline in the direction of 1.1500 following any such pullback. The broader goal for this transfer is 1.1488, which is considered as the primary leg of the third and sometimes strongest wave throughout the prevailing downtrend. The MACD indicator confirms this outlook, with its sign line positioned under zero and pointing decisively downward, reflecting sustained promoting stress.

H1 Chart:

On the H1 chart, the pair broke downwards from a consolidation vary round 1.1566, reaching its preliminary goal at 1.1495. As soon as this degree is reached, a corrective bounce in the direction of 1.1533 is probably going earlier than the resumption of the downtrend in the direction of 1.1468.

This state of affairs is supported by the Stochastic oscillator, whose sign line is under 50 and is falling confidently in the direction of the 20 zone, indicating that short-term downward momentum stays dominant.

Conclusion

EUR/USD stays below clear promoting stress, with a de-escalation in US-China commerce tensions and a cautiously hawkish Fed stance offering a supportive backdrop for the US greenback. Technically, the construction is bearish, suggesting that any near-term rebounds are prone to be corrective inside a broader downtrend, with key draw back targets at 1.1488 and 1.1468.

Disclaimer:

Any forecasts contained herein are primarily based on the creator’s specific opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- As anticipated, RBA retains the speed at 3.6%. New Zealand greenback hits 7-month low Nov 4, 2025

- EUR/USD Below Sustained Stress as Markets Await Key Knowledge Nov 3, 2025

- OPEC+ is predicted to approve one other enhance within the collective oil manufacturing degree. Canada launched a weak GDP report. Nov 3, 2025

- FED and Financial institution of Canada reduce charges. ECB determination due in the present day Oct 31, 2025

- USD/JPY Hits 9-Month Excessive as Yen Endures Robust October Oct 31, 2025

- GBP/USD Finds a Ground at 1.3200 After Fed-Induced Promote-Off Oct 30, 2025

- A Key Day for EUR/USD because the Fed Determination Looms Oct 29, 2025

- The British Index UK100 hit a brand new all-time excessive. The Australian greenback strengthened, reaching a three-week excessive Oct 29, 2025

- The US and China representatives reached a preliminary commerce settlement. Saudi Arabia is as soon as once more leaning in the direction of growing oil manufacturing Oct 28, 2025

- Gold Rebounds to 4,000 USD Mark Oct 28, 2025