By RoboForex Analytical Division

The EUR/USD pair stabilised round 1.1658 on Tuesday, following a interval of volatility over the previous two periods.

Market focus stays firmly on the forthcoming US inflation knowledge, which is anticipated to offer essential readability on the longer term path of Federal Reserve coverage. At present, the market is pricing in two charge cuts this 12 months, with the primary anticipated in June. Nevertheless, any upside shock in inflation might considerably mood expectations for coverage easing.

Supporting a extra dovish outlook was final week’s disappointing Non-Farm Payrolls (NFP) report for December, which revealed weaker-than-expected job development.

Buyers are additionally monitoring developments within the US Supreme Court docket, which is anticipated to rule on the legality of President Donald Trump’s tariff coverage as early as Wednesday.

Earlier this week, the US greenback confronted extra headwinds following stories that Fed Chair Jerome Powell might face scrutiny over his congressional testimony associated to a constructing renovation challenge. This has raised issues, albeit restricted, relating to the perceived independence of the Federal Reserve.

Technical Evaluation: EUR/USD

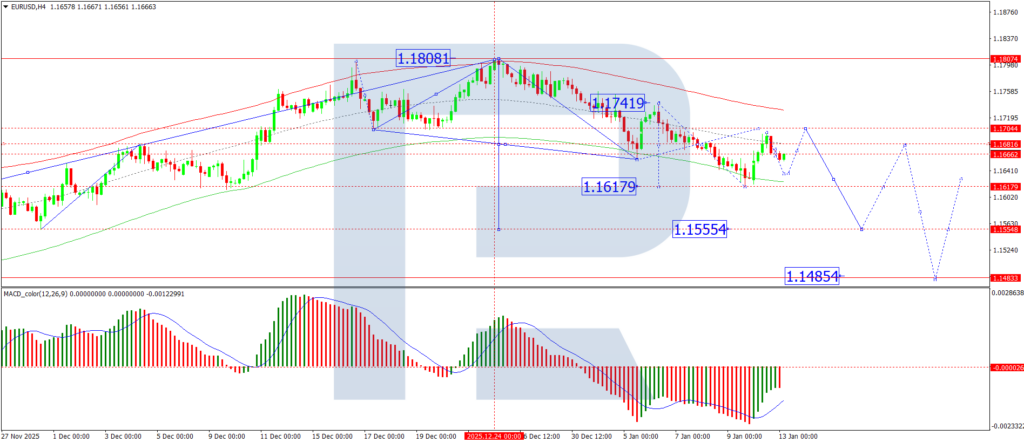

H4 Chart:

On the H4 chart, the pair is forming a corrective retracement inside the context of the second downward impulse. The quick corrective goal stands at 1.1700. As soon as this correction concludes, we anticipate the resumption of the downtrend, with the subsequent bearish goal at 1.1555. This situation is supported by the MACD indicator, whose sign line is beneath zero and pointing decisively downward, reinforcing the continued bearish momentum and potential for additional draw back.

H1 Chart:

On the H1 chart, the market has accomplished a decline to 1.1655 and is now forming an upward corrective impulse in direction of 1.1700. Upon reaching this degree, we count on a renewed wave of promoting stress to emerge. The Stochastic oscillator aligns with this view, as its sign line is at the moment beneath 20 however is popping upward in direction of 80, indicating room for a short-term rebound earlier than the subsequent potential decline.

Conclusion

The EUR/USD pair is in a holding sample forward of key US inflation knowledge, which can doubtless dictate the near-term route of the pair. Whereas the technical construction stays bearish, a corrective bounce in direction of 1.1700 seems doubtless earlier than sellers probably regain management. A stronger-than-expected inflation print might reinforce the greenback’s energy and speed up the transfer in direction of 1.1555.

Disclaimer:

Any forecasts contained herein are based mostly on the writer’s explicit opinion. This evaluation will not be handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes based mostly on buying and selling suggestions and critiques contained herein.

- EUR/USD Awaiting US Inflation Information for Course Jan 13, 2026

- Trump proclaims 25% tariffs on international locations buying and selling with Iran Jan 13, 2026

- USD/JPY Stalls Close to One-Yr Excessive Jan 12, 2026

- Inventory indices and valuable metals proceed to rise Jan 12, 2026

- Week Forward: Will US30 hit 50,000 milestone? Jan 9, 2026

- WTI oil costs rose by greater than 4%. Silver dropped by 5% Jan 9, 2026

- Why Is This the Good Silver Commerce To Make investments In? Jan 8, 2026

- Combined market sentiment amid geopolitical tensions and financial cooling Jan 8, 2026

- Greenback regular forward of U.S. JOLTS, Oil benchmarks sink Jan 7, 2026

- Inventory indices proceed to develop regardless of geopolitics Jan 7, 2026